U.S. Stock Market First Quarter GDP Range and Market Reaction Expectations

I see many friends asking about GDP data today. I remember writing an article about it before, but I can't find it, so I'll rewrite it.

Beijing time Wednesday at 20:30 is when the U.S. first quarter GDP will be announced. Last Friday, the market expectation was still 0.4%, but today, as I checked, the market expectation has dropped to 0.3%. So, what GDP data would be favorable for market sentiment, and what would be unfavorable?

I'll share my own judgment, which only represents my personal opinion and may not be correct, so please do not take it as financial advice.

Very favorable: This is very difficult, meaning it exceeds or is not lower than the GDP of the fourth quarter of 2024, which means the GDP data should not be lower than 2.4%. If such data is released, there would be almost no need to consider the issue of a U.S. economic recession, but the current expectation is even below this threshold.

Relatively favorable: If the GDP data can be above 1%, it indicates that the U.S. economy is maintaining low-speed growth. Although the difference compared to the previous value is significant, it can still make the market believe in the possibility of a soft landing for the U.S. economy, and this low-speed growth may not even exert inflationary pressure.

Slightly favorable: If the GDP data is below 1% but greater than or equal to market expectations, then although the optimistic state of the U.S. economy is low, it still falls within the category of low-speed growth. However, investors' confidence in a soft landing may be insufficient, and tariffs may still be needed to adjust sentiment.

Bull-bear game: If the GDP data is below expectations but still greater than zero, it is a positive number. Although this is not favorable for market sentiment, it has not yet entered a pessimistic state. If Trump implements new policies or the Federal Reserve takes early interest rate cuts, it could still help market sentiment.

Unfavorable: If the GDP data is below zero, it is certainly below expectations, but above -1%. In this case, the market is likely to start entering a trading recession phase, which is not good news for investors. For example, if the U.S. stock market falls today, it is very likely that investors are taking risk-averse actions. In this situation, the Federal Reserve may indeed start cutting interest rates in June to try to curb the recession.

Very unfavorable: The higher the negative value, the greater the impact on market sentiment, leading to increased panic among investors. Unless the White House or the Federal Reserve comes out to reassure the market, expectations of a recession may intensify. In this case, the Federal Reserve is very likely to directly enter the interest rate cut phase to remedy the situation.

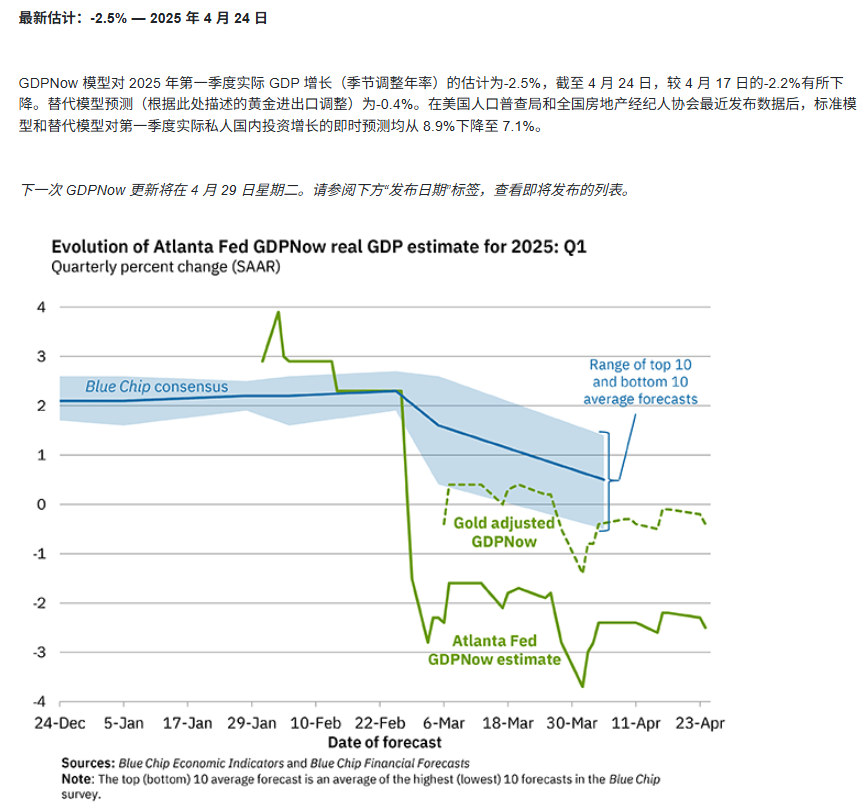

PS: Currently, GDPNow gives a data estimate of -2.5%. This data was from last Thursday, and an updated version will be released early Wednesday morning Beijing time. Even excluding gold imports, the U.S. first quarter GDP expectation is -0.4%.

All of the above content is my personal opinion and may not be correct. It does not necessarily mean that I believe a negative outlook will lead to a significant market drop; everything depends on the market's reaction. Additionally, there is no need to question the final GDP data, whether high or low, as it is beyond our control. As long as the Federal Reserve and the White House believe in it, that is sufficient.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。