Blackrock Powers Inflow Into Bitcoin ETFs as Ether ETFs Hold Momentum With Third Day of Inflows

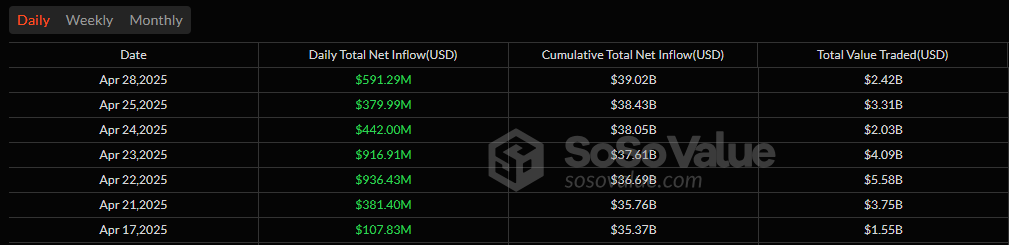

Investor confidence in crypto exchange-traded funds (ETFs) showed no signs of slowing as Monday, April 28, brought another wave of strong inflows, despite notable fund withdrawals. Bitcoin ETFs tallied a $591 million net inflow, marking their 7th straight day in the green.

The day was dominated by Blackrock’s IBIT, which saw a jaw-dropping $970.93 million pour in. That singular inflow helped counterbalance hefty outflows from other funds, including Ark 21Shares’ ARKB ($226.30 million), Fidelity’s FBTC ($86.87 million), and Grayscale’s GBTC ($42.66 million). Bitwise’s BITB and Vaneck’s HODL also posted red figures with $21.13 million and $2.68 million withdrawn, respectively.

Still, the bullish tone prevailed. Bitcoin ETF trading volume hit $2.42 billion for the day, and net assets climbed to $109.30 billion.

Source: Sosovalue

Ether ETFs, meanwhile, quietly kept their momentum alive. Monday marked the 3rd straight day of inflows, adding $64.12 million to the space. Blackrock’s ETHA was the lone inflow source, attracting $67.47 million. Bitwise’s ETHW trimmed the gains slightly with a $3.35 million outflow.

Trading volume for ether ETFs hit $266.32 million, and net assets rose to $6.20 billion, an encouraging signal as ETH products begin to catch their stride. Both bitcoin and ether ETFs now enter the week with strong tailwinds, reinforcing the narrative that institutional appetite for crypto remains strong, resilient, and broadening.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。