ALPACA (almost) ends its wicked life.

Written by: Deep Tide TechFlow

In recent days, the soon-to-be delisted "Alpaca Coin" $ALPACA has been active in the market spotlight, stirring up over $10 billion in total trading volume with a circulating market cap of $30 million.

On April 24, Binance announced that it would delist four tokens, including Alpaca Finance ($ALPACA), on May 2.

The news of "delisting from Binance" is typically a huge negative for projects—delisting means reduced liquidity, shrinking trading volume, and token prices often plummet or even become stagnant.

However, after the delisting announcement, $ALPACA experienced a drop of about 30% in a short time (based on Binance spot trading), but within three days, the price skyrocketed nearly 12 times, soaring from $0.029 to a peak of $0.3477. Meanwhile, the open interest (OI) for $ALPACA far exceeded its token market cap by several times, and the long-short battle around $ALPACA began to resemble a "meat grinder" market.

Accelerated fee settlement, intensified long-short battle

Subsequently, Binance adjusted the funding rate rules, shortening the cap rate cycle to settle once every hour (up to 2%), further intensifying the fierce long-short battle. Long positions not only profited from pushing the price up but could also continuously "eat" high funding rates, with longs "eating and taking" over several days, as the price of $ALPACA continued to engage in high-level trading for nearly four days.

With an hourly settlement of -2% in fees, a short seller holding a position for one day would lose at least 48% of their principal under 1x leverage. Yet, even with such high rates, funds continued to pour in to short the asset.

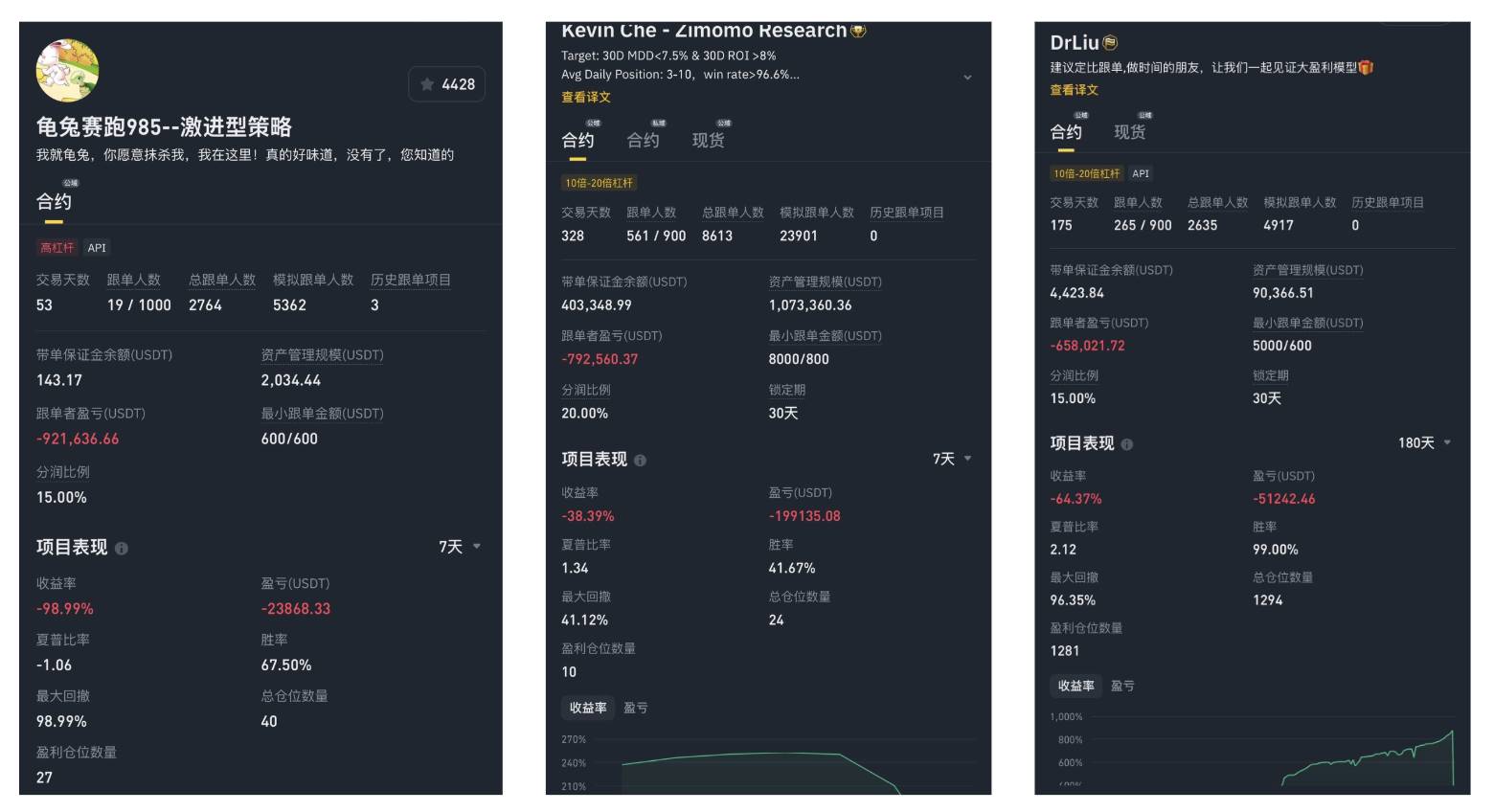

In the midst of this fierce battle, some noticed that certain traders with million-dollar positions were consistently shorting $ALPACA at high leverage, ultimately leading to the liquidation of millions of dollars in funds from their followers.

On April 29, Binance raised the maximum contract rate for $ALPACA to ±4%. For short sellers, this increase in the cap rate would double the cost of shorting, but instead of deterring shorts, the price of $ALPACA unexpectedly plummeted from $0.27 to around $0.067.

There are no absolute trading rules

As trading volume and attention gradually shift, the story of $ALPACA may come to a close.

Looking back at this billion-dollar farce, in some ways, $ALPACA has become a kind of meme—drawing significant attention from the negative impact of delisting, allowing the principle of "black and red are still red" to be fully realized in price fluctuations. At the same time, in a similar environment (top-tier exchanges), its relatively low circulating market cap (at one point less than $4 million) and highly controlled chips, combined with wide price fluctuations that continuously stimulate players' nerves, even the image of "alpaca" is linked to the meme.

However, while the image may be cute, for those truly involved in the battle, these days can only be described as "bloody."

With negative news leading to frenzied price increases and "short squeeze" news resulting in smooth declines, the complex price movements of $ALPACA have overturned the usual "sell the news" logic, also disrupting many people's positions.

Clearly, the boundaries between "good news" and "bad news" have become increasingly blurred, and the previously singular judgment logic is gradually becoming unsuitable for the ever-evolving market. Instead, violent manipulation that plays with human nature is rampant, with continuously refreshing liquidation data gradually occupying the market center. Describing this evolutionary direction as "barbaric growth" may be quite fitting.

However, things have dual aspects; while some feel confused, others feel excited. This farce is not necessarily a bad thing for everyone. For many participants seeking price volatility and possessing exceptional skills, the way the alpaca has moved could even represent a long-awaited opportunity to make big profits.

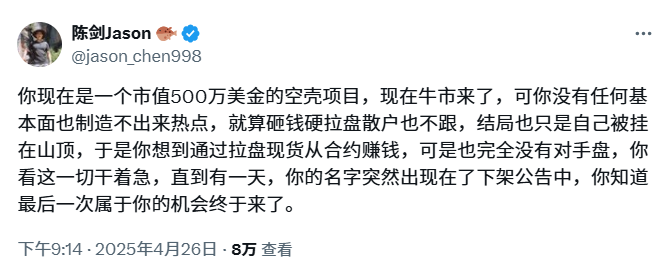

There are also voices suggesting that the traders using followers' funds to short without regard for costs are essentially hunting retail investors' capital, akin to the saying in a movie: "The gentry's money is returned in full, while the common people's money is split three to seven." The truth of these claims is hard to judge at the moment, but it is certain that even if the reality is not so dark, the ultimate winners in this manipulation will not be ordinary users.

In the absence of adequate regulatory measures, $ALPACA may not be the last instance of wild manipulation in this market.

As of the completion of this writing, the price of $ALPACA is still experiencing violent fluctuations, and there may be more exciting "performances" before the official delisting.

In the tumultuous price battle, it is difficult for naive participants to find a safe haven. Under the hunting of attention and liquidity, perhaps the best strategy for retail investors is to watch less and act more. Those who see big news and abnormal price movements and think "opportunity has come" are not just retail investors, but also the long-awaited project parties.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。