Original Title: "The Crypto Business Insights of Trump's Second Son"

Original Author: Bright, Foresight News

At the time of Token2049 Dubai, the Trump family is making moves again.

On the evening of April 29, The National reported that Eric Trump, Executive Vice President of the Trump Organization, revealed that the Trump Organization will collaborate with London-listed company Dar Global to launch a $1 billion development project in Dubai, which will include a Trump-branded hotel, residential units, and a club. The building will be located at the entrance of Sheikh Zayed Road in downtown Dubai and is expected to be completed within five years. The project will accept cryptocurrency payments. This is not the first property in the Trump family's Middle Eastern business portfolio, but it is the first building directly linked to cryptocurrency by Eric Trump, the second son of Trump.

On April 30, The Block reported that Trump Media & Technology Group plans to launch a utility token for Truth Social. This token will be integrated into the Truth digital wallet, initially used for paying Truth+ subscription fees, with future expansion to other products and services within the Truth Social ecosystem.

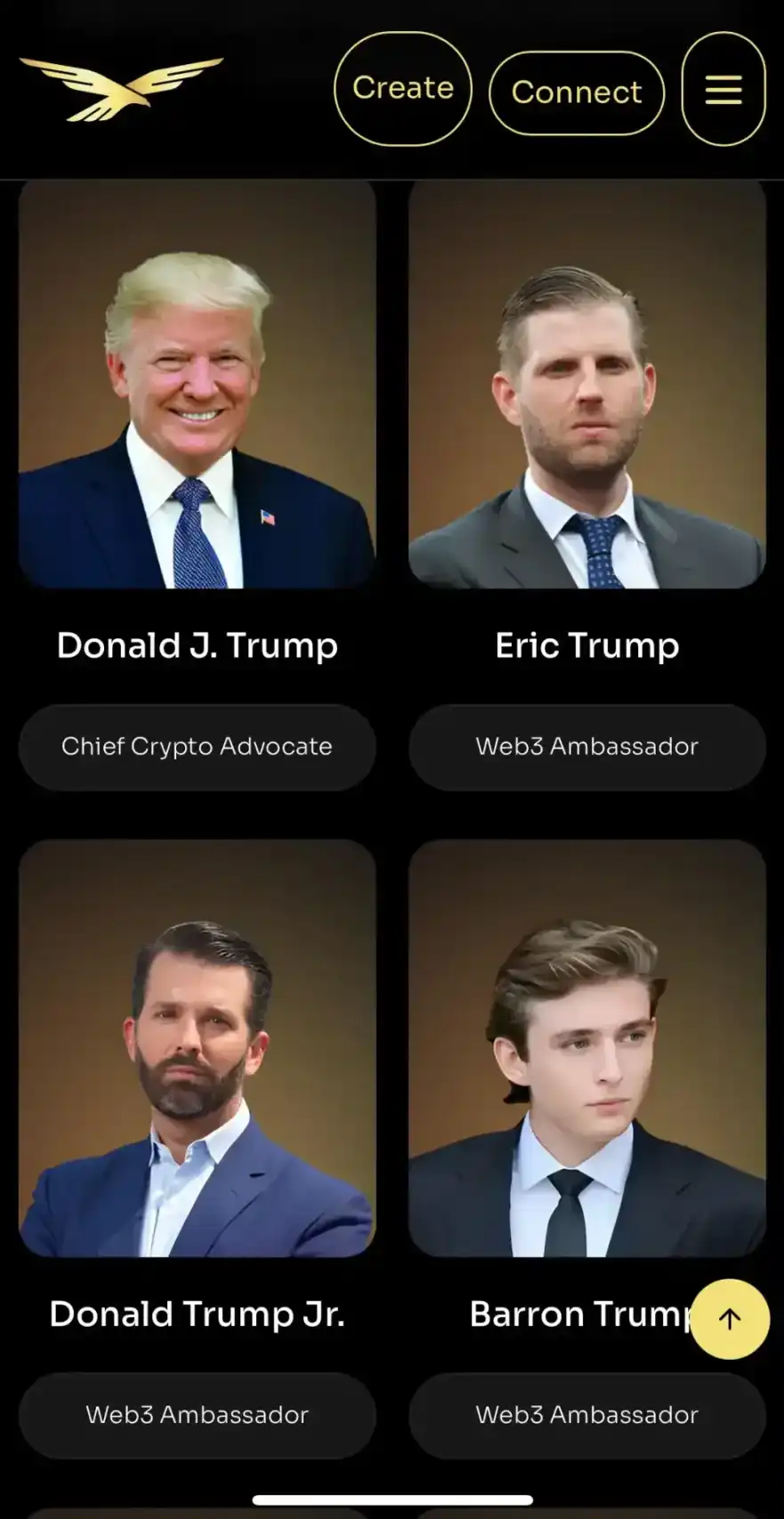

The Trump family, which has tasted great success in the crypto space through political influence, continues to expand its crypto portfolio. Eric Trump appears to be the "vanguard" of the Trump family in the crypto realm.

A Smooth Sailing Crypto Career

In 2006, Eric Trump graduated from Georgetown University with a degree in finance and management. That same year, he joined the Trump Organization as Executive Vice President of Development and Acquisitions. In 2012, Forbes named Eric Trump one of the "30 Under 30" in real estate. When Trump first took office as President of the United States in 2017, he retained ownership of the Trump Organization while handing over control of the vast business empire to his eldest son Donald Jr. and second son Eric. Without any scandalous twists, Eric Trump has diligently worked for the Trump family. Now, as Executive Vice President of the Trump Organization, Eric Trump continues to make appearances for the crypto-betting Trump family.

From the 2024 Abu Dhabi Bitcoin MENA to the 2025 Token2049 Dubai, Eric Trump has accumulated titles from various crypto companies in less than a year. Not only does he serve as an ambassador for World Liberty Financial, which is directly related to his interests, and as Chief Strategy Officer at the new Bitcoin mining company American Bitcoin, but he has also been hired as an advisor by several well-known crypto companies, including Japan's "MicroStrategy" Metaplanet.

In fact, becoming an advisor to crypto giants is just a routine matter for Eric Trump, who is backed by the Trump family. With the aura of "my dad is the president," Eric Trump can easily arrange a conversation with Michael Saylor at Mar-a-Lago. What truly draws public attention is Eric Trump's "extremely close" attitude towards cryptocurrency.

Eric Trump stated in an interview with CNBC, "You will find that cryptocurrency is faster, more pragmatic, more transparent, and much cheaper." Unlike Donald Trump, who is seated in the presidential chair, Eric Trump is seen as the "gloved hand" directly implementing Trump's business will without too many restrictions. He has repeatedly advocated for crypto in social media and public speeches, claiming that "Bitcoin is one of the greatest stores of value" and that "now is a good time to bet on cryptocurrency."

"Now, I know almost everyone in this industry to some extent," Eric Trump said. "A few years ago, I fell in love with this industry and then dove right in."

Mutual Pursuit of Interests

However, Eric Trump, who comes from a family of businessmen, has inherited the style of a speculator. Behind his "fervent endorsements" may lie the Trump family's further plans to rake in money.

In the traditional financial sector, the influence of the U.S. president is still constrained by a relatively complete legal system and financial institutions, with the intricate forces of Wall Street also exerting significant influence on the White House. In 2022, about two years after Trump's first term ended, two subsidiaries of the Trump Organization were found guilty of multiple charges by a New York jury, including tax fraud, falsifying business records, and conspiracy. All 17 charges were ruled guilty just three weeks after Trump announced his candidacy for the 2024 election. Additionally, a Florida bank named Capital One immediately closed over 300 bank accounts belonging to the Trump Organization following the January 6, 2021, Capitol riot.

As a result, before Trump returns to the White House, the Trump Organization announced a new ethical plan that would limit Trump's involvement in management decisions and other business matters during his presidential term. Eric Trump publicly stated that the Trump Organization "might be the most restricted company on Earth."

In contrast, the cryptocurrency sector, which operates on the edge of regulation and has ample liquidity, has become a favorite of the Trump family. Just the two meme coins, Trump and Melania, have added billions of dollars to the family's paper wealth. The Trump family has chosen to forgo directly profiting from the intricate forces of Wall Street and instead has entered the crypto space under the guise of protecting financial innovation and being crypto liberators. Eric Trump has publicly stated that his entry into the cryptocurrency field is not a financial gamble but a form of resistance. This move began with what he calls an "industry war." He stated that banks are closing accounts, the U.S. Securities and Exchange Commission is cracking down on trading platforms, and cryptocurrency users are being "deprived of bank accounts" simply for holding cryptocurrency.

However, during Trump's second presidential term, the U.S. crypto sector has indeed been shedding its shackles. The SEC and the Commodity Futures Trading Commission (CFTC) had previously conducted very strict reviews of crypto trading platforms and projects, but since Trump took office, the U.S. has made significant strides in crypto regulation, including the repeal of the "Defi broker rule," the withdrawal of the lawsuit against XRP, and the release of the Silk Road founder, among others.

It can be said that in the U.S. political arena, where power and money are intertwined, the Trump family, with the sharp vision of a businessman, has chosen the easiest path to wealth.

The Legendary Reverse "Endorser"

However, Eric Trump's three high-profile endorsements in 2025 have formed a bizarre causal chain with the market's significant downturn:

On February 3, Eric posted on X platform, "In my opinion, now is a good time to increase your position in $ETH. You can thank me later." At that time, Ethereum's price hovered around $2900, and market sentiment was slightly optimistic due to the Trump family's World Liberty Financial (WLFI) project. However, within 48 hours after the endorsement, the price of ETH plummeted to $2000, a drop of over 30%. On-chain data shows that WLFI transferred approximately $300 million worth of crypto assets to Coinbase Prime on the day of the endorsement, including 66,000 ETH.

On February 25, when Bitcoin's price rebounded to around $89,000, Eric spoke again, advising investors to "buy BTC on dips; long-term holding is key." The next day, Bitcoin's price suddenly dropped to $78,258, with a single-day decline of 12%. Analysis from Lookonchain showed that WLFI sold approximately 12,000 BTC (about $1 billion) around the time of the endorsement, coinciding with a peak in market selling pressure.

On March 2, after the Trump administration announced the possibility of exploring crypto assets as national reserves, Eric quickly followed up, calling for "long-term holding of cryptocurrency; the future is decentralized." Even the tweet announcing the national reserves on Trump's X account that day was closely related to Eric. However, the next day, after Ethereum surged, it crashed again by 17.5%, with a weekly decline expanding to 30%, hitting a low of $1410. On-chain analysts found that WLFI sold a total of 86,000 ETH (about $235 million) during this period, with a significant price difference between their holding cost ($3354) and market price ($1550), exposing their "buy high, sell low" awkward situation. On X, the topic NeverTrustEric (never trust Eric) briefly surpassed #Bitcoin in popularity, and community members began to spontaneously compile the "Eric Endorsement Index" as a warning signal for market risk.

In a short time, WLFI became the target of market criticism, with paper losses exceeding hundreds of millions of dollars, and was questioned for using derivatives to hedge profits off-market. WLFI's business model was also criticized again—WLFI had raised $550 million through the issuance of governance tokens, but token holders only had voting rights without profit-sharing rights, with the official website clearly stating that "purchasing tokens should not be for profit." "This is essentially a capital game that does not hold investors accountable," commented the crypto compliance agency Chainalysis, "a political family using regulatory gray areas to turn social media influence into financial harvesting tools."

However, this does not affect the continued construction of the Trump Tower in Dubai. Eric Trump knows that the crypto world needs the political influence of the Trump family, and he will continue to sell it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。