El Salvador’s commitment to bitcoin remains steadfast despite pledges made to the International Monetary Fund (IMF) to curb crypto purchases. Speaking during an interview with Bloomberg News at the Web Summit in Rio de Janeiro on Tuesday, Economy Minister Maria Luisa Hayem affirmed that the country is still acquiring the digital asset. Hayem stated when asked directly whether the administration was maintaining its bitcoin acquisition policy:

There’s a commitment of President Bukele to keep accumulating assets as a way to do precisely that.

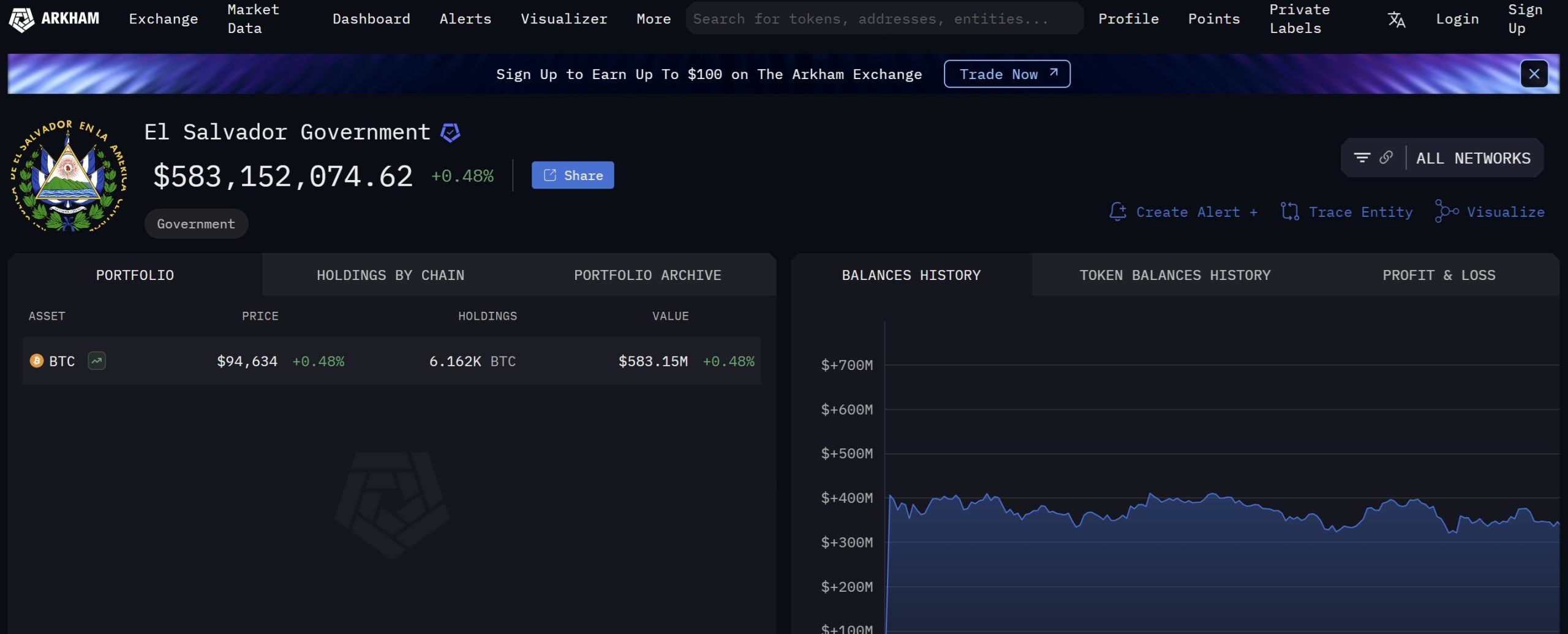

According to Arkham Intelligence, the Salvadoran government currently holds 6.162K BTC valued at over $583 million as of this writing and has been accumulating at a pace of 1 BTC per day.

Arkham’s data on El Salvador’s bitcoin stash. Source: Arkham Intelligence.

In late 2024, the Central American nation secured a $1.4 billion loan from the IMF, which required it to tighten fiscal policies and scale back its bitcoin-related activities. President Nayib Bukele’s decision to adopt bitcoin as legal tender in 2021 had alienated many institutional creditors and triggered credit rating downgrades. As part of the loan agreement, El Salvador also agreed to make bitcoin acceptance optional for businesses—an effort to reassure global financial markets.

However, government actions suggest that crypto remains central to Bukele’s strategy. Hayem emphasized: “Bitcoin keeps being an important project. There is an asset accumulation that we’re seeing from the government perspective, from the private sector perspective.” El Salvador’s compliance with the IMF’s bitcoin non-purchasing clause has been under renewed scrutiny after the Fund reiterated during its 2025 spring meetings that the country continues to honor its commitment. Rodrigo Valdes, the IMF’s Western Hemisphere Director, confirmed there’s been no new bitcoin accumulation, a key condition of the $1.4 billion credit deal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。