Today's homework is not very difficult, and there aren't any significant events in the macro field. After all, we just passed through the "crisis" of GDP. Trump is just shifting the blame to Biden, and the market is clear about who the real creator of the crisis is. Next up is tomorrow's non-farm payroll data, where employment may show a decline, and the market expects the unemployment rate to remain consistent with last month. Personally, I think the probability of an increase in the unemployment rate is quite high, though I may not be right.

The rise in U.S. stocks and Bitcoin is partly due to the stabilization of macro sentiment, as there is no recession. Additionally, during the earnings season, both Meta and Microsoft's reports were good, which stimulated the rise in risk markets. Therefore, overall investor sentiment today is quite positive. However, Amazon's earnings report was released before the U.S. stock market closed, and it wasn't very good, which may have some impact on the market, though these are all short-term effects.

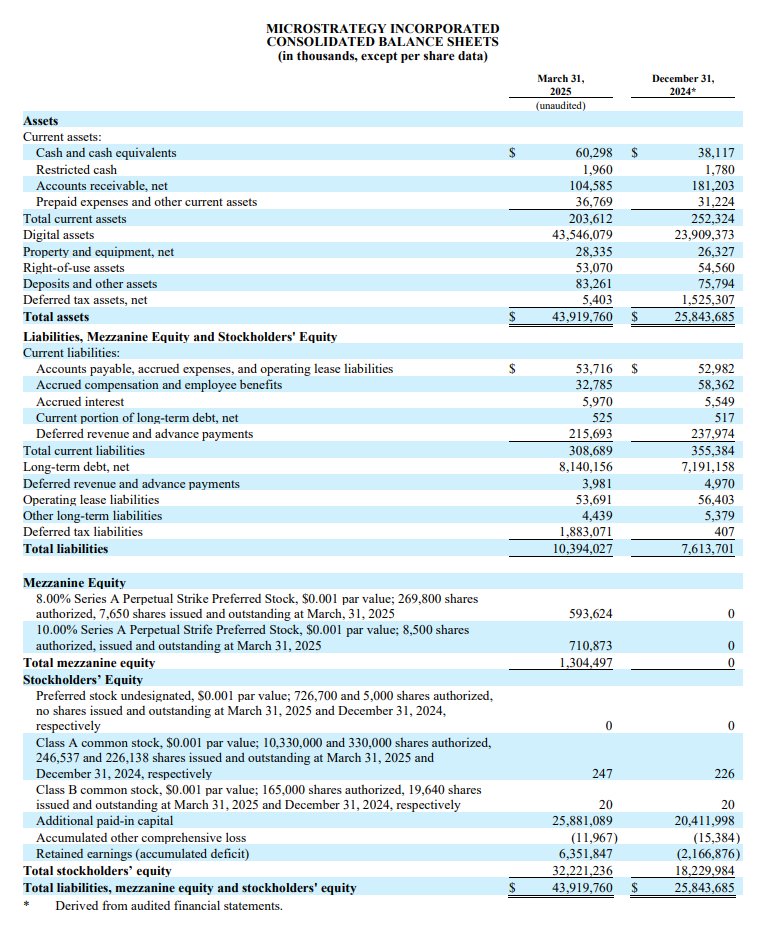

Just before I went to sleep, $MSTR also released its earnings report, which was somewhat dismal as expected. Even according to the latest FASB accounting standards (in fact, MSTR has long used non-fair value accounting, so there isn't much difference), MSTR lost $5.9 billion in the first quarter of 2025 compared to the fourth quarter of 2024, mainly due to the decline in $BTC prices.

However, if we calculate based on the current price, MSTR's profit exceeds $8 billion. As for its software business, I think not many people are interested; more interest is likely in its financing capabilities. In the first quarter of 2025, MSTR raised $7.7 billion, but in April 2025 alone, MSTR raised $2.3 billion, which means it raised a total of $10 billion in the first four months and announced a new ATM plan.

At the same time, it redeemed about $1.05 billion of convertible bonds maturing in 2027, converting all of them into shares, with no need to repay the principal. This means that there is no need to worry about any risk issues for MSTR until 2028.

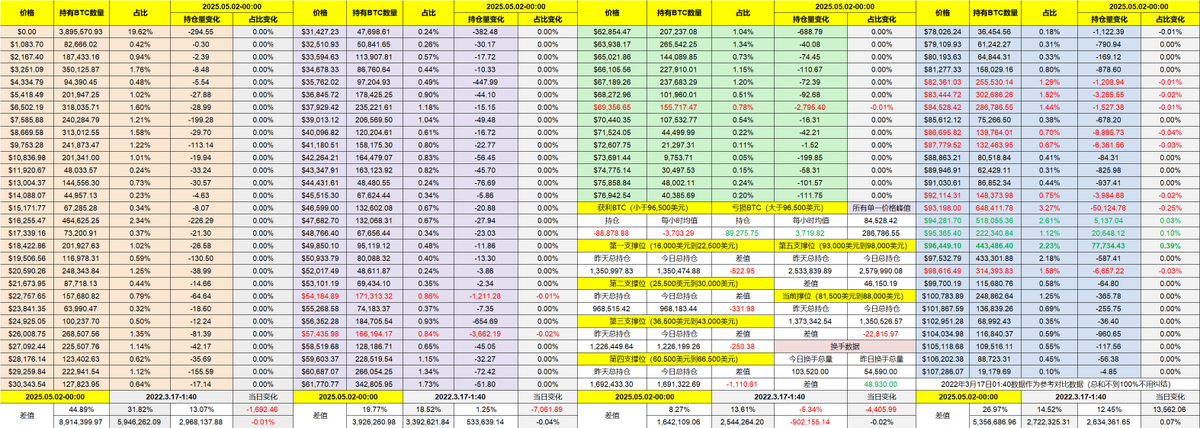

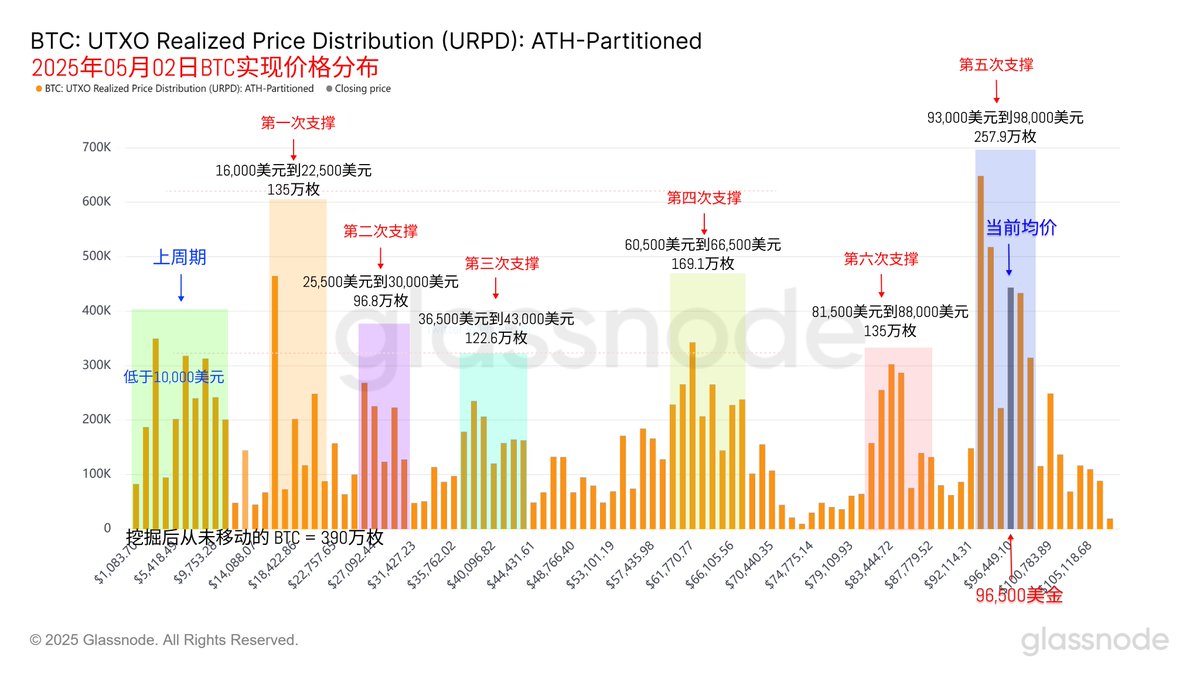

Looking at Bitcoin's data, the turnover in the last 24 hours has increased, but it is still within a reasonable range. Considering some pressure from GDP, this turnover rate is actually quite low. The data shows that recent profit-taking investors are the main force exiting, while earlier investors are still waiting, which is completely consistent with the data we've seen recently.

From a support perspective, the stable range remains between $93,000 and $98,000. The price increase has not led to higher trading volumes, so the essence of liquidity has not changed. The rise is likely driven by the momentum from the earnings season in the U.S. stock market, and tomorrow's non-farm payroll data may be the more significant short-term influence.

Additionally, the support level between $81,000 and $88,000 continues to be damaged, with a large transfer of held BTC. If tomorrow's non-farm payroll data is good, there is a possibility of breaking through $98,000.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。