The company’s net loss included a $5.9 billion unrealized loss on its bitcoin holdings under new fair value accounting rules adopted in 2025. Despite this, Strategy (Nasdaq: MSTR) emphasized progress in its bitcoin strategy, achieving a 13.7% year-to-date “ BTC Yield” and a $5.8 billion “ BTC Gain.” It holds 553,555 bitcoin, acquired at an average cost of $68,459 each, and raised its 2025 BTC Yield target from 15% to 25%.

CEO Phong Le highlighted the $21 billion ATM offering’s role in adding 301,335 bitcoin to its balance sheet while boosting its stock price by 50% during the quarter.

“With over 70 public companies worldwide now adopting a Bitcoin treasury standard, we are proud to be at the forefront in pioneering this space,” Le said. Strategy CFO Andrew Kang noted the adoption of fair value accounting lifted retained earnings by $12.7 billion but acknowledged Q1’s unrealized loss due to Bitcoin’s quarter-end price of $82,445.

Strategy raised $7.7 billion in net proceeds during Q1 through stock sales, convertible notes, and preferred stock offerings. It also increased authorized shares of Class A common stock to 10.3 billion to facilitate equity raises.

The firm’s operating expenses surged 1,976% year-over-year to $6 billion, driven by bitcoin-related accounting changes. Meanwhile, Strategy’s software revenue fell 3.6% year-over-year to $111.1 million, though subscription services grew 61.6%. Cash reserves rose to $60.3 million, up $22.2 million from December 2024, the earnings report discloses.

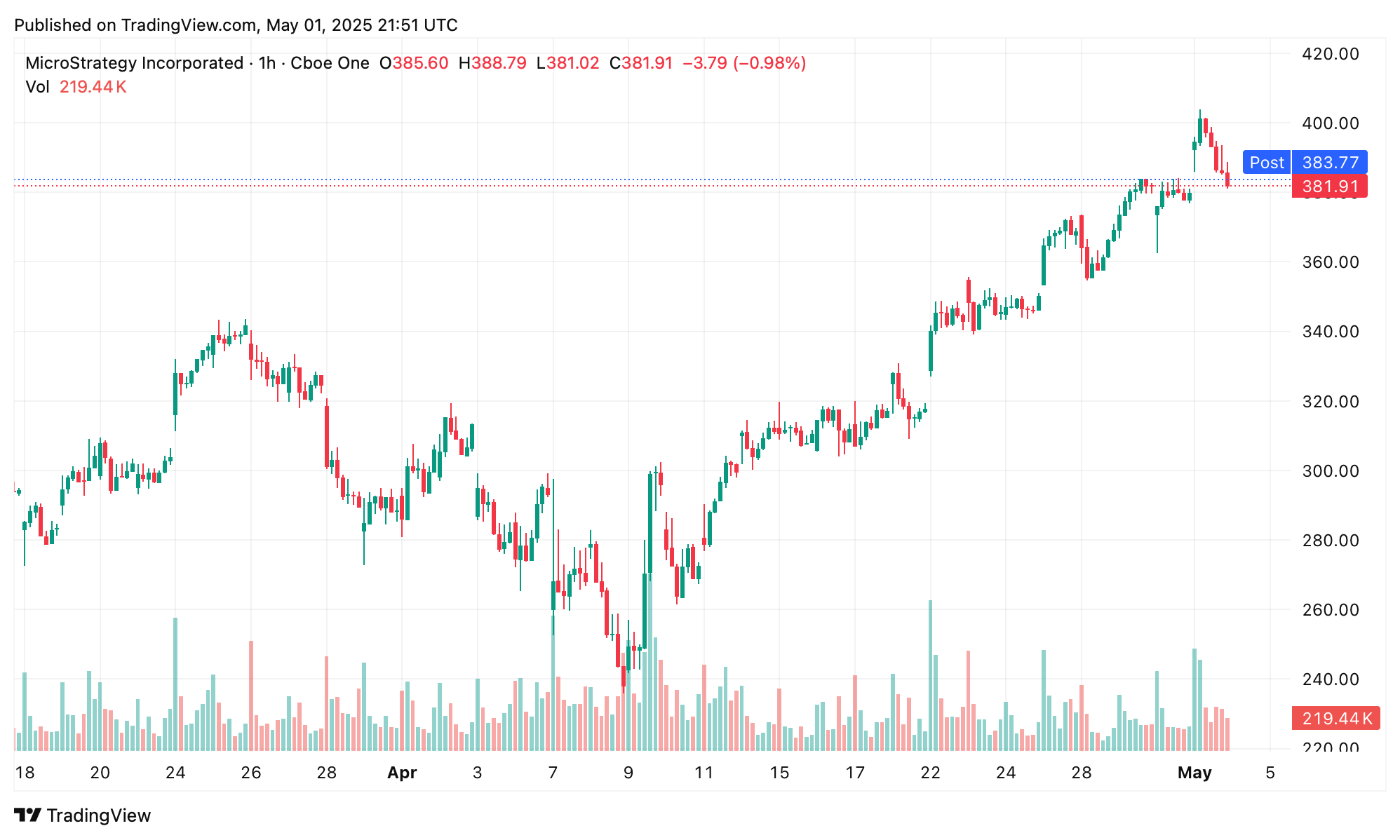

The company’s Q1 2025 financial results cautioned that bitcoin price volatility, regulatory shifts, and liquidity risks could impact future results. It holds bitcoin worth $43.5 billion at quarter-end, with a current market value of approximately $96,619 per bitcoin as of Thursday, May 1, 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。