Original Title: Inside Movement's Token-Dump Scandal: Secret Contracts, Shadow Advisers and Hidden Middlemen

Original Author: Sam Kessler, CoinDesk

Original Translation: Aki Chen, Wu Says Blockchain

It is reported that the Layer 2 blockchain project Movement Labs is investigating a market-making agreement suspected of fraud. An arrangement originally intended to facilitate the smooth listing of the MOVE cryptocurrency token has ultimately evolved into a market-shaking sell-off scandal. The agreement allegedly transferred control of 66 million MOVE tokens to a vaguely identified intermediary, Rentech, without the project team being fully informed. Rentech simultaneously acted as both a "Web3Port subsidiary" and a "foundation agent" in the agreement, suspected of engaging in self-dealing. This arrangement directly triggered a sell-off of tokens worth $38 million the day after the MOVE token was listed, leading to a significant price drop and resulting in Binance imposing a ban.

Despite internal opposition to the agreement, senior management pushed for its signing, raising serious concerns about governance failure, lack of due diligence, and conflicts of interest. Currently, several executives and legal advisors are under scrutiny, and the project's governance structure and collaboration mechanisms are being comprehensively questioned. This crisis reveals deep flaws in Movement's institutional design, risk control, and compliance capabilities, which may have long-term impacts on its future reputation and ecosystem development.

MOVE Token Plummets Immediately After Launch, Movement Labs Allegedly Misled into Signing High-Risk Agreement

According to internal documents reviewed by CoinDesk, the blockchain project behind the MOVE cryptocurrency token, Movement Labs, is conducting an internal investigation into a controversial financial agreement. This agreement may have granted primary control of the token market to a single entity without the project team being fully aware, causing structural imbalance.

The agreement directly led to a concentrated sell-off of 66 million MOVE tokens the day after they were listed on exchanges on December 9, 2025, triggering a cliff-like drop in token price and raising widespread questions in the market about "insider trading" and benefit transfer. Notably, the MOVE project received public endorsement from the Trump-backed crypto venture fund World Liberty Financial, adding political and industry significance to the event.

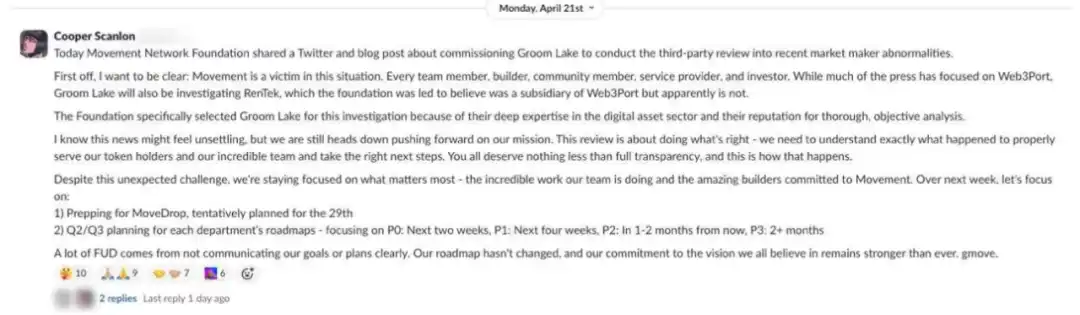

Cooper Scanlon, co-founder of Movement Labs, stated in an internal Slack announcement on April 21 that the team is investigating a key issue: how more than 5% of MOVE tokens originally reserved for the market maker Web3Port were transferred to an intermediary named Rentech.

It is claimed that the Movement Foundation was initially told that Rentech was a subsidiary of Web3Port; however, investigations have shown this to be untrue. Rentech has denied any misleading behavior.

Rentech Unilaterally Controls Nearly Half of Circulating Supply, MOVE Token Circulation Structure Imbalanced

According to an internal memorandum from the Movement Foundation, the agreement signed between Movement and Rentech lent approximately half of the total circulating supply of MOVE tokens to this single counterparty. This arrangement gave Rentech an unusually significant market influence at the initial listing of the token.

Several industry experts interviewed pointed out that this centralized structure severely deviates from the decentralized distribution principles typically pursued by crypto projects, making it easy to manipulate token prices or achieve unilateral arbitrage.

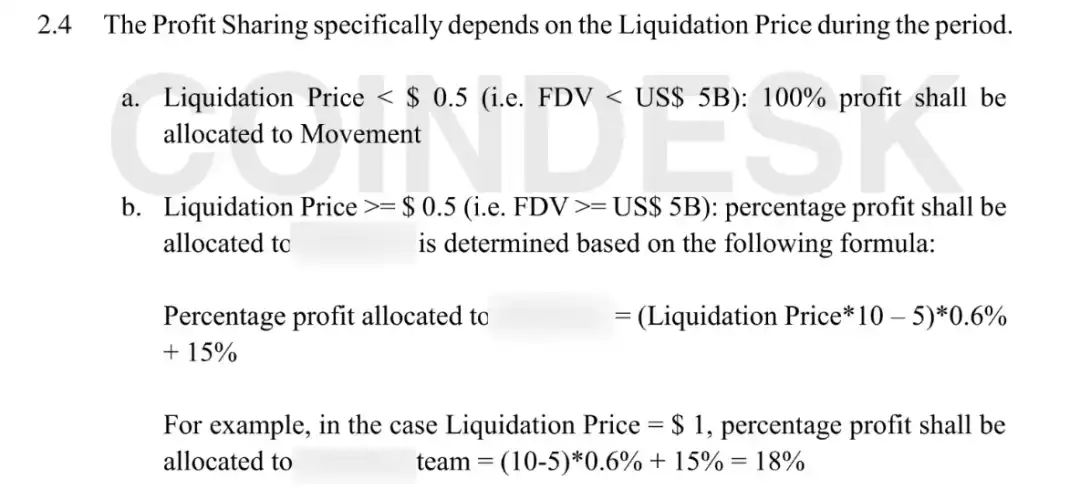

Zaki Manian, a veteran founder in the crypto industry, noted after reviewing the contract version obtained by CoinDesk that certain terms included in the agreement essentially set clear incentives for "artificially inflating the fully diluted valuation (FDV) of MOVE tokens to over $5 billion before profiting from selling to retail investors."

He stated, "Even the mere presence of such discussions in written documents is shocking." This comment further intensified external doubts about the motives and ethical boundaries of the Rentech agreement.

In theory, market makers are hired by project teams to provide liquidity services for newly listed tokens, with the responsibility of buying and selling using funds provided by the project team to maintain price stability and market depth. However, in practice, this role also carries the risk of abuse.

Once regulatory oversight is absent or agreements are opaque, market makers can become tools for insiders to manipulate the market and quietly transfer large token holdings, making it difficult for outsiders to detect, thereby severely harming the interests of ordinary investors and market fairness.

Contract Exposure Reveals Crypto Gray Area: How Public Projects Become Tools for a Few to Profit in a Regulatory Vacuum

A series of contract documents obtained by CoinDesk reveal a little-known gray area in the crypto industry: in an environment lacking effective regulation and legal transparency, blockchain projects originally intended for the public can easily be exploited as vehicles for a few behind-the-scenes operators to profit.

The content of these agreements shows that if project teams neglect structural design and compliance oversight, so-called "decentralized" projects can be completely privatized by a few operators through unequal terms, deviating from their original fair and open intentions.

In the crypto market, rumors of manipulation and abuse surrounding market-making mechanisms have long been prevalent, but specific details of related operations, contract structures, and benefit arrangements are rarely made public. For this reason, the internal contracts and agreement details disclosed in the Movement Labs incident provide a rare window into observing the black box of Web3 project operations and the gray areas of market making, refocusing the industry on the fundamental yet often overlooked principle of "transparency."

The market-making contract reviewed by CoinDesk shows that Rentech appeared in the transaction with the Movement Foundation in two capacities: on one hand as an agent of the Movement Foundation, and on the other hand as a subsidiary of Web3Port signing the agreement. This structure potentially allowed Rentech to occupy a "brokerage dominance" position in the transaction, theoretically enabling it to set transaction terms independently and profit from information asymmetry.

The market-making agreement reached between Movement and Rentech ultimately opened a sell-off channel for a group of wallets associated with Web3Port. This Chinese financial institution claims to have served MyShell, GoPlus Security, and the crypto fund World Liberty Financial associated with Donald Trump. These wallets quickly liquidated tokens worth approximately $38 million the day after the MOVE token was launched on exchanges, causing significant market volatility and leading to concentrated doubts about the motives and legitimacy of the agreement itself.

Binance Bans Market-Making Accounts for "Improper Behavior," Movement Urgently Launches Token Buyback

As the incident escalated, the mainstream exchange Binance has banned the involved market-making accounts, citing "improper behavior." Meanwhile, the Movement project team urgently announced the launch of a token buyback plan in an attempt to stabilize market sentiment and regain community trust.

Similar to employee stock option mechanisms in startups, most crypto projects set lock-up periods during token distribution to limit core teams, investors, and early participants from selling large holdings during the initial trading phase of the project.

This mechanism is intended to protect market stability and prevent insiders from profiting early by leveraging information advantages. However, in the Movement incident, the liquidity arrangements that bypassed lock-up restrictions are at the core of external doubts.

Binance's ban on the involved accounts quickly sparked associations within the community, with many observers believing this could imply that internal personnel of the Movement project had privately reached an agreement with Web3Port to circumvent normal lock-up mechanisms and sell tokens early.

In response to this doubt, Movement denied any violation of transfer arrangements with third parties. However, the information chaos and contract structure flaws exposed by the incident still make the impression of "insider trading" difficult to completely eliminate.

Star Layer 2 Project Mired in Controversy, Multiple Parties Blame Each Other Behind Rentech Agreement

Movement is an Ethereum scaling Layer 2 network built on Facebook's open-source language Move, which has rapidly become one of the most discussed emerging projects in the crypto industry in recent years due to technological innovation and capital support.

The project was co-founded by two 22-year-old dropouts from Vanderbilt University, Rushi Manche and Cooper Scanlon, who raised $38 million and were included in the Trump-backed World Liberty Financial crypto investment portfolio. In January 2025, Reuters reported that Movement Labs was about to complete a new funding round of up to $100 million, potentially reaching a valuation of $3 billion.

However, there are clear divisions within the project regarding the controversial market-making agreement with Rentech. CoinDesk interviewed more than a dozen sources familiar with the project (most requested anonymity), who provided various contradictory accounts.

Galen Law-Kun, the owner of Rentech, denied any misleading behavior and stated that the transaction structure was designed in coordination with Movement Foundation's General Counsel YK Pek. However, internal memorandums and communication records reviewed by CoinDesk show that Pek initially held strong opposition to the agreement and denied involvement in the establishment process of Rentech.

Movement Labs co-founder Scanlon stated in an internal Slack message, "Movement is the victim in this incident." This statement also indicates that the project team is attempting to shift responsibility to external operators.

According to four anonymous sources familiar with the internal investigation's progress, Movement is focusing on reviewing the role of its co-founder Rushi Manche in the Rentech agreement. It is claimed that Manche was the one who initially forwarded the agreement to the internal team and promoted the collaboration within the organization.

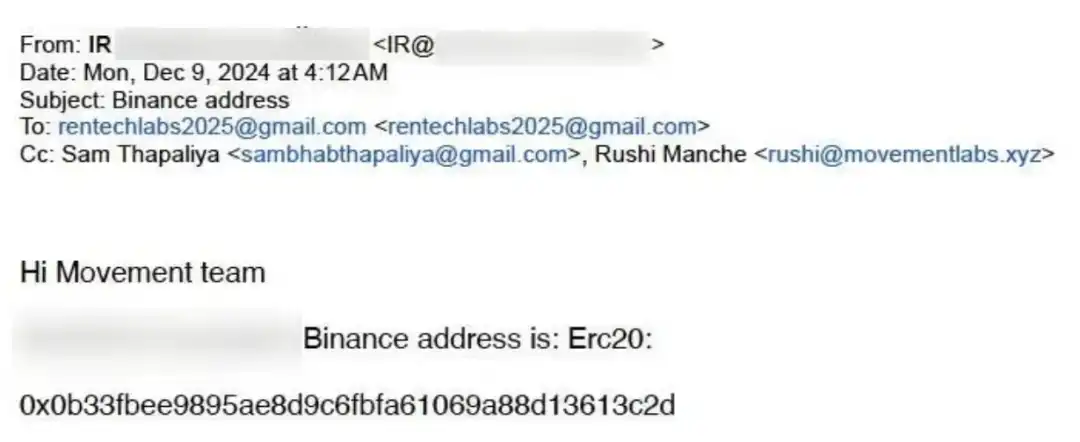

Also under investigation is Sam Thapaliya—founder of the crypto payment protocol Zebec and a business partner of Rentech's owner Galen Law-Kun. Although Thapaliya does not hold an official position at Movement, he has long participated in core affairs as an "informal advisor," and his specific influence in this incident has also become a key focus of the project's internal audit.

Initial Rejection Followed by Signing, Movement Bypasses Caution Mechanisms to Accept High-Risk Agreement, Governance Structure Questioned

Despite initially rejecting a high-risk market-making agreement with Rentech, Movement ultimately signed a revised version of the agreement that bore a similar structure, relying on a verbal guarantee from an intermediary with almost no public track record.

This decision highlights the shortcomings in the current governance structure of the crypto industry. According to common practice, to avoid securities regulatory risks, crypto projects typically split operations into two entities: one managed by a non-profit foundation responsible for token management and community resource allocation, and another for-profit development company responsible for underlying technology development. Movement Labs serves as the development entity, while the Movement Foundation handles token affairs.

However, internal communications reviewed by CoinDesk show that the structure, which was supposed to operate independently, effectively failed in the Movement case. Co-founder Rushi Manche, although nominally an employee of Movement Labs, played a leading role in key affairs of the non-profit foundation. This overlap in functions undermined the checks and balances that the dual-entity mechanism was supposed to provide to prevent compliance risks.

On March 28, 2025, co-founder Rushi Manche sent a draft market-making agreement to the Movement Foundation via Telegram, stating that the contract "needs to be signed as soon as possible."

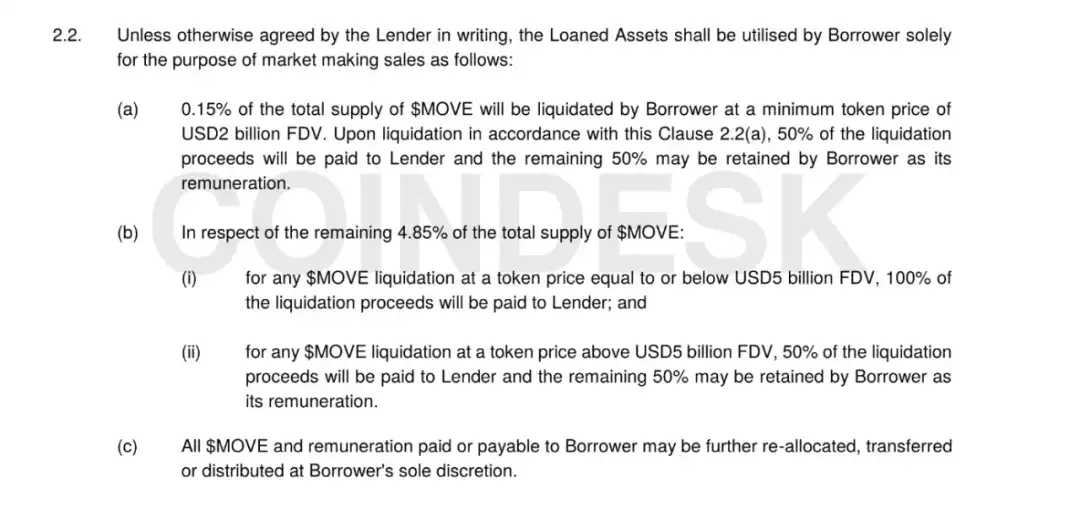

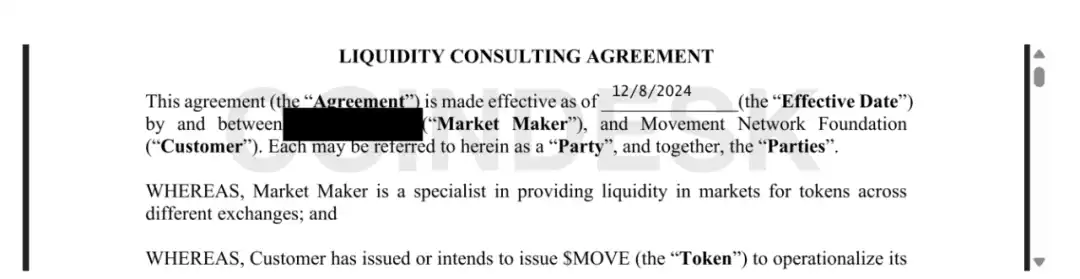

On November 27, 2024, Rentech proposed a draft market-making agreement to Movement, which included lending up to 5% of the total amount of MOVE tokens to Rentech. According to the contract, Rentech was the borrower, and Movement was the lender. However, this agreement was ultimately not signed.

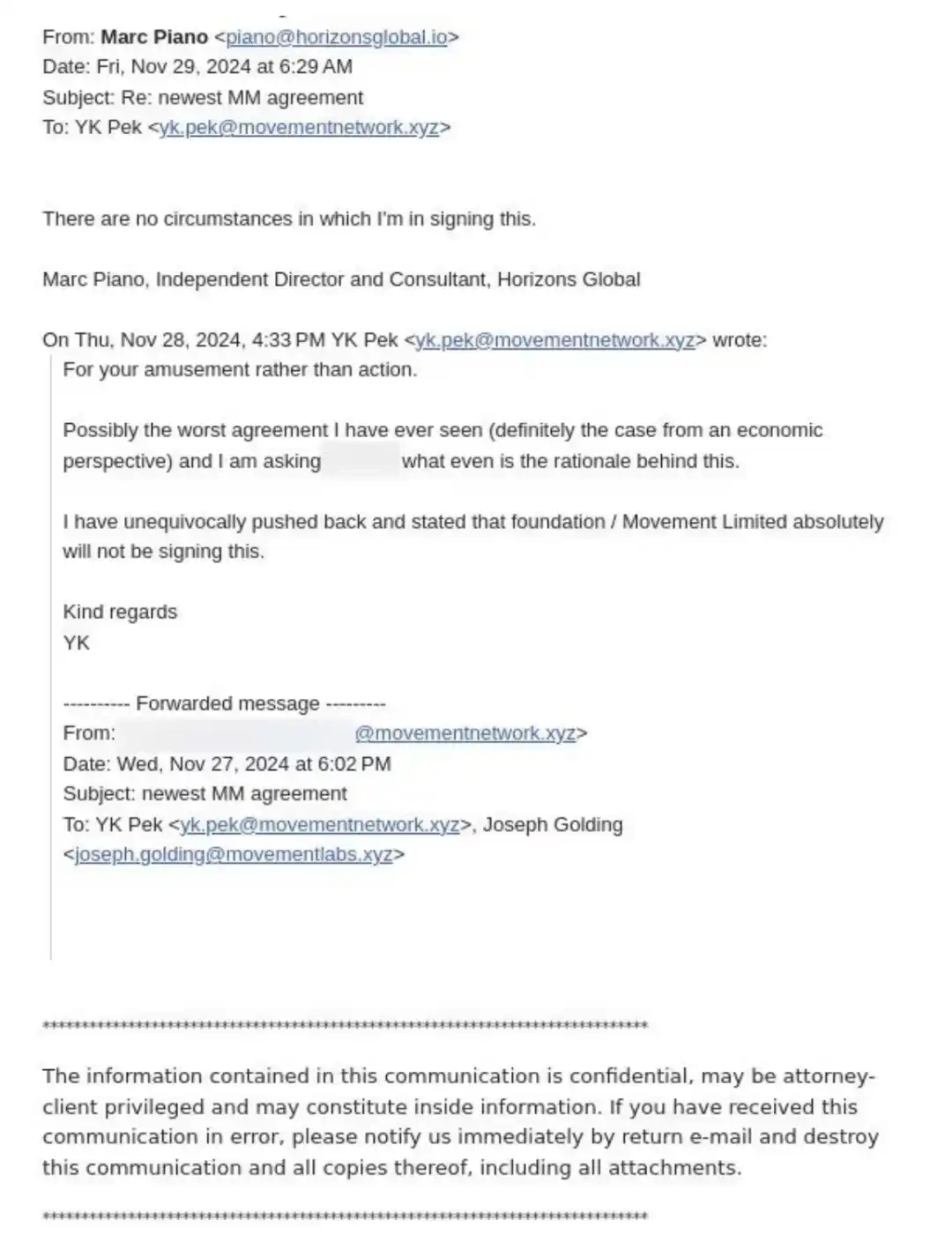

Rentech, a company with almost no public background or on-chain records, immediately raised alarms within the foundation with its large token lending request. Movement Foundation's legal advisor YK Pek stated in an email that the document "might be the worst agreement I've ever seen." He further pointed out in another memorandum that if executed, the agreement would effectively transfer substantial control of the MOVE market to an ambiguously identified external entity.

Additionally, Marc Piano, a director registered in the British Virgin Islands, also refused to sign the agreement. These various objections indicate that there was a clear awareness of the risks associated with the agreement within Movement, yet the subsequent processes failed to prevent the agreement from being implemented in a modified form, further exposing governance failures.

One particularly striking clause in the contract stipulated that once the fully diluted valuation (FDV) of MOVE tokens exceeded $5 billion, Rentech could begin liquidating its held tokens and share the resulting profits with the Movement Foundation on a 50:50 basis.

Veteran crypto industry expert Zaki Manian pointed out that this structure effectively created a "distorted incentive mechanism," encouraging the market maker to artificially inflate the price of MOVE to concentrate sell-offs of their large holdings when the valuation was inflated, thus extracting profits. This design not only deviated from the original intention of market-making to serve price stability but could also directly harm the interests of retail investors.

Although the Movement Foundation initially refused to sign the high-risk market-making agreement, negotiations with Rentech did not cease. According to three informed sources interviewed by CoinDesk and the legal documents reviewed, Rentech subsequently claimed to the foundation that it was a subsidiary of the Chinese market-making institution Web3Port and proactively offered to provide $60 million in collateral, thereby increasing the appeal of the agreement.

Under these conditions, the Movement Foundation accepted a revised version of the agreement on December 8, 2025. This version made modifications to some key terms, removing one of the most controversial provisions—namely, the right for Web3Port to sue the Movement Foundation for compensation if the MOVE token failed to launch on a specific exchange.

Although the agreement was adjusted in form, this compromise decision indicated that the foundation relaxed its risk prevention stance in the face of multiple pressures and incentives, ultimately laying the groundwork for subsequent events.

On December 8, 2025, the Movement Foundation officially signed the revised market-making agreement with Rentech. Although Rentech was explicitly labeled as "Web3Port" in the agreement (the name has been redacted in some documents), its identity as the borrower remained unchanged, while the foundation continued to be the lender.

Notably, the primary drafter of the agreement was YK Pek, the foundation's legal advisor, who had previously expressed strong opposition to the initial version of the agreement. Although some of the most controversial clauses were removed in the revision, the core structure remained unchanged: Web3Port could still borrow 5% of the total supply of MOVE tokens and sell them in certain ways to realize profits.

Further technical information revealed the intentionality behind the operations of the agreement—the domain "web3portrentech.io," registered under the email of Rentech's director, was only registered on the day the agreement was signed.

Was the Agreement Already "Executed in Advance"? Web3Port and "Movement" Secretly Signed a Contract, and the Foundation Only Learned Later

According to three insiders close to the event, the Movement Foundation was unaware that Web3Port had signed a similar cooperation agreement with the nominal "Movement" weeks before the formal agreement was signed on December 8, 2025.

This "preliminary agreement" not only bypassed the foundation's formal processes but also circumvented the necessary compliance reviews and governance mechanisms.

According to a contract dated November 25, 2025, obtained by CoinDesk, Web3Port had already signed a highly similar market-making agreement with Rentech before the Movement Foundation officially signed. In this agreement, Rentech was designated as the lender, and Web3Port as the borrower, with Rentech directly referred to as the representative of "Movement" in the document.

This "shadow agreement" almost replicated the content of the original proposal that the foundation later rejected, indicating that some key arrangements had already been implemented through informal channels without the foundation's approval process. This finding confirms the existence of multiple "power channels" within the project.

The early agreement signed on November 25 was structurally highly consistent with the contract rejected on November 27, with core terms still clearly allowing the market maker to execute liquidation operations when the price of MOVE tokens reached a specific threshold.

This setting is viewed by industry insiders like Zaki Manian as a core mechanism with "high manipulation risk"—that is, artificially pushing the price to meet the threshold and then concentrating sell-offs to extract profits. This indicates that even in the superficially modified subsequent versions, some key stakeholders behind the project were still promoting a path of built-in arbitrage incentives, without substantively eliminating fundamental risks.

"Shadow Co-founder"? Behind-the-Scenes Manipulators Emerge, Zebec Founder Accused of Deep Involvement in Agreement Structure Design

Several insiders close to the Movement project have revealed to CoinDesk that there is much speculation about the true orchestrators behind the Rentech agreement. The agreement, believed to have directly led to the large-scale sell-off of MOVE tokens in December and the ensuing public outcry, was initially circulated internally by co-founder Rushi Manche and pushed into the decision-making process by him.

According to Blockworks, Manche was temporarily suspended last week due to his involvement in the agreement. Manche himself responded that during the selection of market makers, MVMT Labs always relied on the foundation team and several advisors for advice and assistance, "but it now appears that at least one foundation member represented the interests of both parties to the agreement, which has become a key focus of our current investigation."

Meanwhile, another key figure, Sam Thapaliya, has also drawn significant attention. Thapaliya is the founder of the crypto payment protocol Zebec and a long-time advisor to Manche and co-founder Scanlon. He was copied on multiple emails exchanged between Web3Port and Movement and appeared alongside Rentech and Manche in important communications.

This clue strengthens suspicions that Thapaliya may have played a "behind-the-scenes operator" role in the design of the Rentech structure—he may not merely be an advisor but rather a "shadow co-founder" who leads the agreement's architecture and deeply intervenes in decision-making.

Several Movement employees have revealed that Zebec founder Sam Thapaliya may play a role within the project that exceeds his advisory status. Some referred to him as "Rushi's close advisor, a sort of shadow third co-founder," and pointed out, "Rushi has always been secretive about this relationship; we usually only hear his name occasionally."

Another employee stated, "Many times we have reached an agreement on a matter, but at the last moment, there will always be changes, and at such times, we usually know that it might be Sam's opinion."

According to three witnesses, Thapaliya was present at Movement's office in San Francisco on the day the MOVE token was launched to the public. CoinDesk also reviewed several Telegram screenshots showing that co-founder Scanlon had commissioned Thapaliya to assist in screening the MOVE airdrop list—this is a highly sensitive part of the project's community token distribution mechanism.

Such arrangements further deepened the impression among some team members that Thapaliya's actual influence in the project was much deeper and more covert than his public identity suggested. In response to CoinDesk, Thapaliya stated that he met Manche and Scanlon during his university years and has since participated in the project as an external advisor, but he "does not hold shares in Movement Labs, has not received tokens from the Movement Foundation, and has no decision-making power."

Who is Rentech? A Mysterious Intermediary with Complicated Entanglements, Founders and Legal Advisors Blame Each Other

At the center of the MOVE token controversy is Rentech, founded by Galen Law-Kun—who is a business partner of Zebec founder Sam Thapaliya. Law-Kun told CoinDesk that Rentech is a subsidiary of his Singapore-registered financial services company Autonomy, aimed at building financing bridges between crypto projects and Asian family offices.

Law-Kun claimed that Movement Foundation's General Counsel YK Pek not only assisted in establishing Autonomy SG but also served as the legal counsel for Rentech (or its affiliated companies). He further stated that although Pek strongly opposed the Rentech agreement internally, he had actually assisted in designing Rentech's structure and participated in drafting the initial version of the market-making agreement, "the content of which was almost identical to the contract version he later formally drafted for the foundation."

However, CoinDesk's investigation did not find direct evidence of Pek holding a position at Autonomy or drafting any contracts related to Rentech in that capacity.

In response, Pek stated, "I have never been, nor am I the legal counsel for Galen or any of his entities." He explained that a corporate secretarial service company he co-founded did provide secretarial services for two companies under Galen, but these companies are not Rentech, and they both reported "no assets" in their 2025 annual review.

Pek further stated that he had spent two hours in 2024 reviewing a consulting agreement between Galen and a certain project, and had only provided free advice on the FTX case deadline and NDA documents. "I completely do not understand why Galen would claim I am his general counsel; it confuses and unsettles me."

Pek also pointed out that the legal teams of Movement Foundation and Movement Labs learned about the lawyer GS Legal hired by Rentech through co-founder Rushi Manche.

In Galen's account, Pek was introduced as "Autonomy's legal counsel" to ten different projects and never denied this title; regarding GS Legal's involvement, "it was merely a formal process completed at Movement's request."

After the incident broke out, Movement Labs co-founder Cooper Scanlon emphasized in an internal Slack announcement that the company had hired an external auditing firm, Groom Lake, to conduct an independent third-party investigation into the irregularities in the recent market-making arrangements. He reiterated, "Movement is the victim in this incident."

This series of mutual denials and accusations exposes the complex interpersonal and legal relationships behind Rentech, further pushing the MOVE controversy from a market event into the core vortex of a trust crisis and governance breakdown.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。