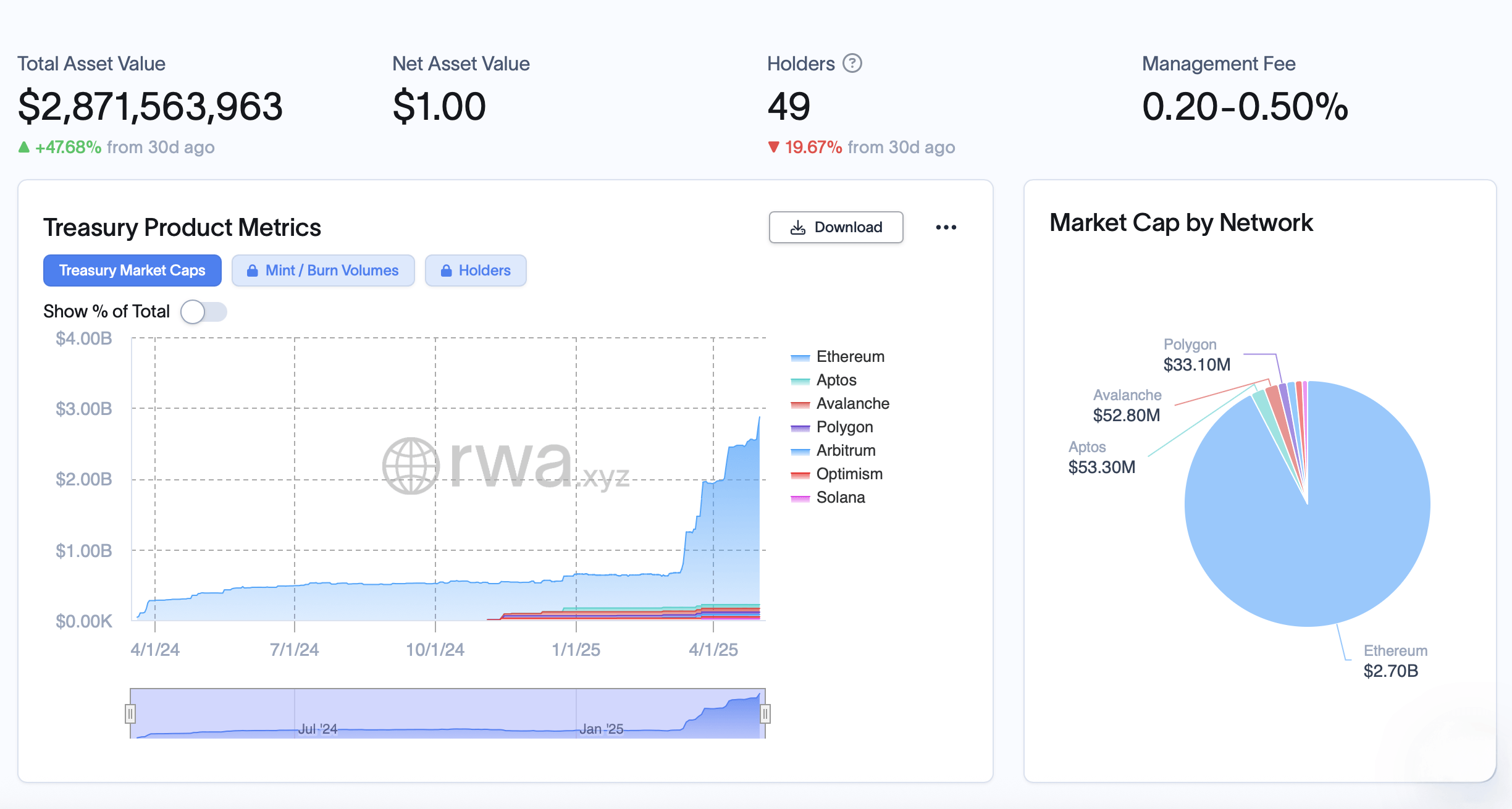

The Blackrock USD Institutional Digital Liquidity Fund (BUIDL), powered by Securitize, captured the lion’s share of inflows, ballooning its market cap by a hefty $402 million. Rwa.xyz metrics indicate that in a mere 15 days, BUIDL vaulted from $2.469 billion to a commanding $2.871 billion.

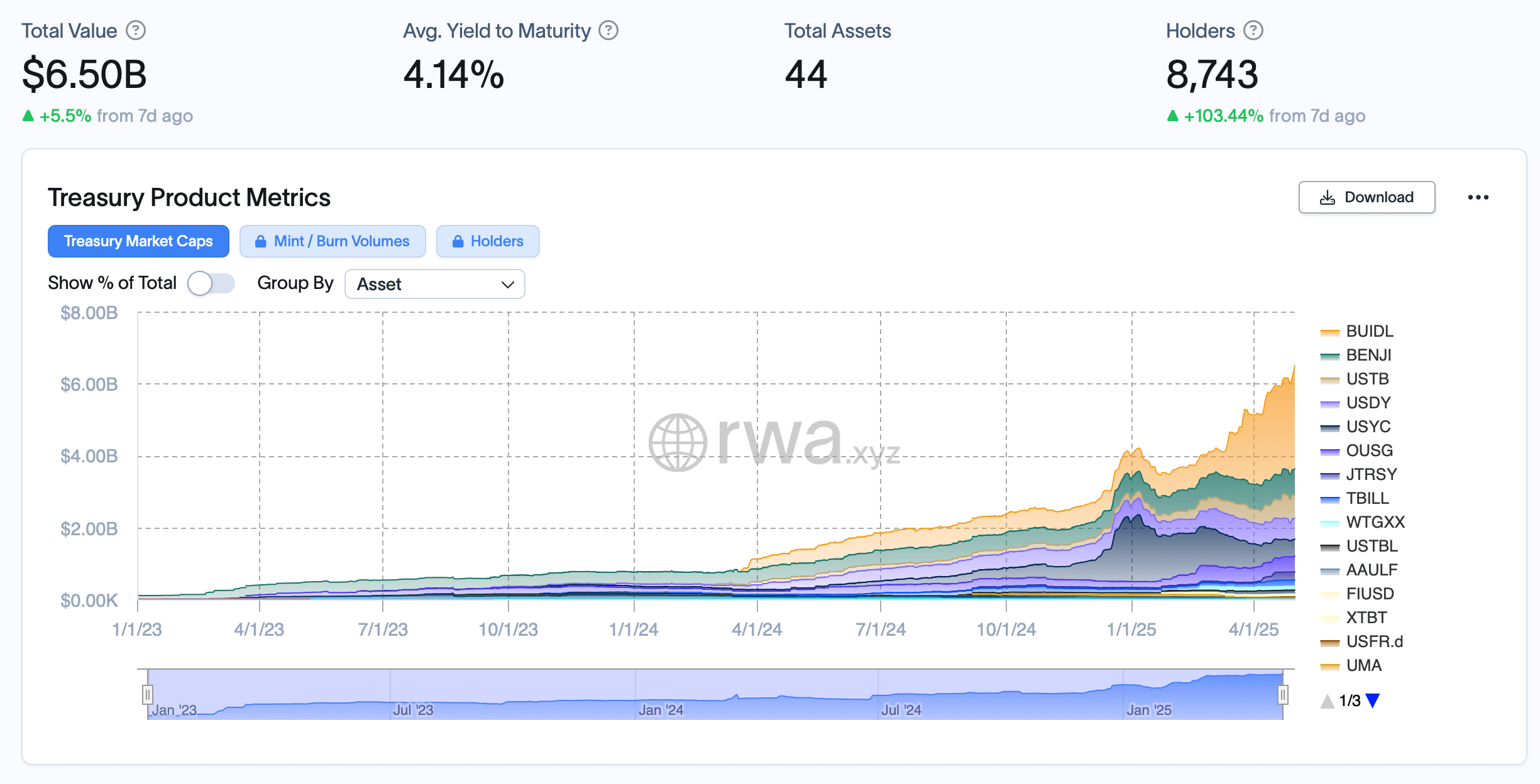

Source: Rwa.xyz metrics

Not to be outdone, Franklin Templeton’s Onchain U.S. Government Money Fund (BENJI) climbed from $702 million to $716.84 million—a tidy $14.84 million uptick. Meanwhile, the race for third place took a twist: Ondo’s USDY fund, previously holding the bronze, yielded its spot to Superstate’s Short Duration U.S. Government Securities Fund (USTB).

Out of the $2.871 billion BUIDL, $2.7 billion is issued on Ethereum. Source: Rwa.xyz metrics

Superstate’s USTB made waves, jumping from $502.30 million to a formidable $651.51 million market cap. Together with BUIDL, these two titans accounted for a whopping $551.21 million of the sector’s $560 million total growth since April 17. Meanwhile, Ondo’s USDY stumbled in the rankings, slipping to fourth place with $581.20 million after shedding $4.7 million.

Unwilling to let the theatrics pass it by, Circle’s USYC secured its spot among the top five with $468.68 million, easing back from its earlier standing of $525.17 million. Among the 44 tokenized Treasury bond offerings, the mean yield to maturity settled at 4.14% according to rwa.xyz stats. During the past week, the count of cryptocurrency holders of these tokenized Treasury instruments climbed by 103.44%, reaching a total of 8,743 holders.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。