Crypto ETFs finished in positive territory, with spot bitcoin products drawing $674.91 million and ethereum‑linked counterparts bringing in $20.10 million, according to sosovalue.com stats. Within the bitcoin cohort, Blackrock’s IBIT single‑handedly captured the entire influx.

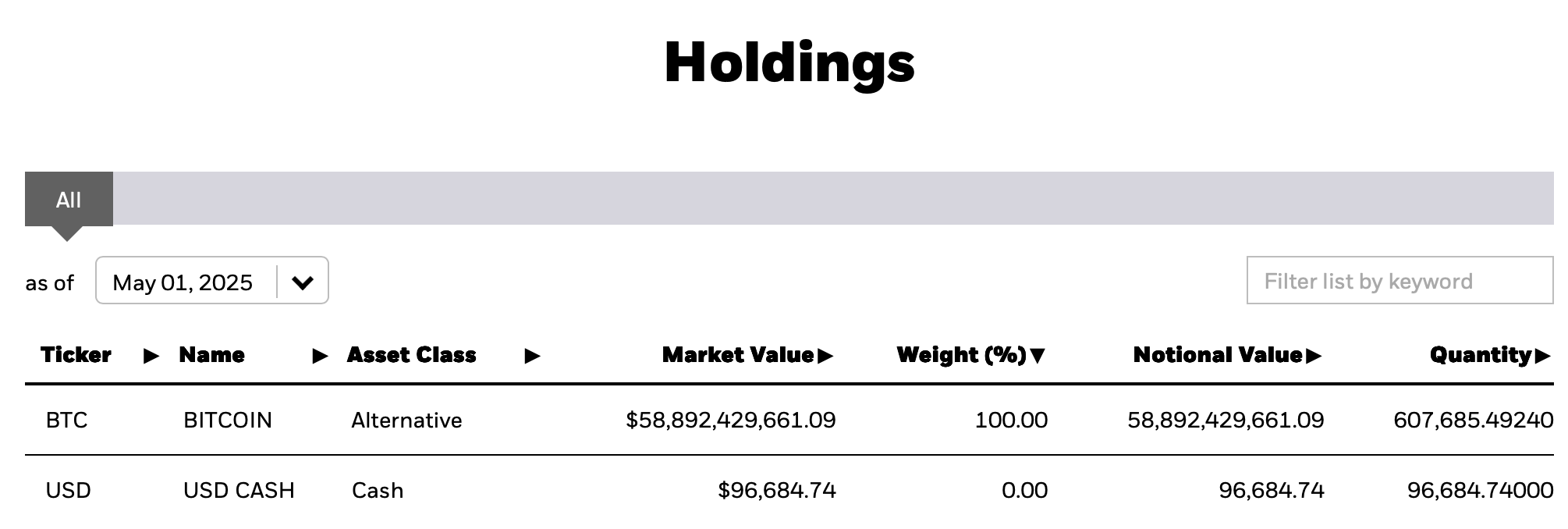

Blackrock’s IBIT now holds more than 600,000 BTC.

The other 11 spot bitcoin vehicles ended the day flat. Friday’s $674.91 million allocation lifted IBIT’s trove to 607,685.49 bitcoin, valued at about $58.5 billion. Since Jan. 11, 2024, the dozen funds have welcomed $40.24 billion in net inflows.

Ethereum ETFs echoed that pattern: the $20.10 million addition flowed exclusively into Blackrock’s ETHA. The remaining eight instruments showed neither gains nor outflows. From their debut in July 2024 to date, the group has logged a net $2.51 billion inflow.

Collectively, the nine ether funds now command $6.4 billion in ether, equal to 2.87 % of the asset’s market cap. The 12 spot bitcoin ETFs control $113.15 billion in bitcoin, representing 5.87% of the currency’s total valuation. Blackrock’s IBIT safeguards roughly 51.71 % of that bitcoin cache.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。