1. Bitcoin Market

From April 26 to May 2, 2025, the specific trends of Bitcoin are as follows:

April 26: In the previous trading day, the price rose from $93,500 to $95,586, then fluctuated around $95,000, showing signs of weakening momentum as the intraday volatility gradually narrowed. The market then experienced a pullback, with prices falling to $94,583, $94,339, and $94,001, eventually stabilizing around $94,320.

April 27: After briefly rising to an intraday high of $95,172, the price encountered resistance and failed to stabilize, subsequently retreating to $93,815. The market entered a tug-of-war phase, exhibiting narrow fluctuations with prices oscillating between $94,261, $93,762, $94,140, and $93,823, lacking clear directional guidance.

April 28: Bulls made a short-term effort, pushing the price up to $94,395, maintaining that level for a while. However, the market then faced significant selling pressure, breaking below the key support level of $93,500, hitting a low of $92,933. A rapid rebound followed, with prices rising to $94,872 and then to an intraday high of $95,512. In the closing phase, bullish momentum weakened, and the price retreated to the $94,500 area, later further dropping to $93,603.

April 29: After consolidating around $93,621, Bitcoin's price began to rebound, rising to $94,892, and after a brief pullback, it attacked $95,328 again. The overall trend showed a fluctuating upward movement, with prices rebounding after a drop to $94,258, subsequently reaching $95,068, $95,235, and $95,466, maintaining fluctuations near $95,000.

April 30: Bitcoin's price began to pull back from an intraday high of $95,444, fluctuating down to $93,937 before stabilizing and gradually climbing to $95,078. After a brief pullback to $94,622, the price rose again, reaching $95,158. However, the market then changed abruptly, experiencing a rapid decline, with prices plummeting to $93,376, forming a cliff-like drop. Subsequently, market sentiment gradually recovered, with prices returning to the upward channel, rising to around $94,000, and entering a consolidation phase within that range.

May 1: Bitcoin briefly dipped to $93,803 in the morning but quickly stabilized and initiated a rebound. The price exhibited a fluctuating upward pattern, breaking through the key short-term resistance levels of $95,000, $96,000, and $97,000, reaching $94,943 and $96,315, reflecting a gradual warming of bullish sentiment. Ultimately, driven by bullish momentum, the intraday high reached $97,436, marking a new high for the week and indicating strengthened market buying power.

May 2: After maintaining consolidation above $97,000 for a while, Bitcoin faced selling pressure from above and began to retreat. During this period, there was intense competition between bulls and bears, with prices briefly pulling back to around $96,245 for support, then rising again to $97,149, but failing to sustain the breakthrough momentum, subsequently facing pressure and retreating again. As of the time of writing, Bitcoin was priced at $96,825, overall in a high-level consolidation phase, with short-term attention still needed on the gains and losses around the $97,000 level and the sustainability of bullish momentum.

Summary

This week, Bitcoin maintained an overall upward trend, exhibiting a strong fluctuating pattern. During this period, it repeatedly tested the key resistance zones of $95,500 and $97,000, successfully breaking through and reaching a high of $97,436, setting a new peak for the phase. The overall trend showed wide fluctuations upward, with market volatility significantly increasing and capital sentiment becoming more active.

The weekly low was a pullback to $92,933, testing the effectiveness of the lower support range. The price quickly rebounded, confirming that $93,500 and $94,000 formed a solid short-term support zone, becoming the core area for bullish defense. On May 1, Bitcoin broke through the $97,000 mark, reaching the peak of this round of rebound, but there remains strong resistance above $97,500, forming a major resistance level in the short term.

In terms of market sentiment, risk appetite has significantly rebounded, overall liquidity has improved, and capital activity has increased, with trading volume moderately expanding, indicating a stronger willingness for outside capital to enter. If the macro environment remains stable and prices can effectively stabilize above $97,000, Bitcoin is expected to open further upward space, challenging $98,500 and the psychological round number of $100,000.

Bitcoin Price Trends (2025/04/26-2025/05/02)

2. Market Dynamics and Macroeconomic Background

Capital Flow

1. Centralized Exchange BTC Supply Hits 7-Year Low

As of April 26, the total supply of Bitcoin in CEX dropped to 2.488 million BTC, the lowest level since October 2018. Although there was a brief replenishment of 40,000 BTC over the weekend (rising to 2.492 million BTC), the overall supply remains at a historical low, indicating that market participants are transferring BTC to cold wallets or holding for the long term, signaling a long-term bullish outlook.

2. Whale Ratio Decreases, Retail Activity Increases

According to CryptoQuant data, the Whale Ratio on exchanges has decreased from 0.512 on April 17 to 0.36 on April 27, indicating a significant reduction in the proportion of large transfers (>100 BTC) among exchange transactions.

At the same time, on-chain data shows an increase in the number of active UTXOs and small address (1 BTC) activity, suggesting that retail trading is becoming more frequent and is gradually dominating short-term market fluctuations.

3. Bitcoin ETF Records Largest Weekly Net Inflow, Institutions Drive Rebound

On April 26, as Bitcoin's price rebounded to $95,800, the U.S. spot Bitcoin ETF experienced its largest single-week net inflow since Trump's inauguration. According to data from Santiment and Trader T, the total net inflow last week reached $3.033 billion, with a trading volume of $19 billion. The rapid pace of this capital inflow may be related to the recovery of basis trading, driving the total net inflow for April to approximately $2.26 billion, reversing the previous trend of capital outflow.

This week's ETF inflow details:

April 28: +$591 million

April 29: +$172 million

April 30: -$56.3 million (slight outflow)

May 1: +$71 million

Overall, despite a slight net outflow on April 30, the overall capital trend still points to net inflows, reflecting the market's relatively optimistic expectations for Bitcoin's mid-term trend. If this trend continues, it may continue to provide downward support and mid-term upward momentum for Bitcoin's price.

Technical Indicator Analysis

1. Relative Strength Index (RSI 14)

According to Investing.com data, as of May 2, 2025, Bitcoin's 14-day Relative Strength Index (RSI) is 63.36. This value is in the bullish zone (50–70) and has not yet entered the overbought zone (>70), but it shows that bullish momentum is dominant in the market.

The current RSI is in the mid-high range, indicating that buying momentum still dominates, but it also suggests that there are signs of upward fatigue in prices. If the RSI continues to approach or even break through 70, attention should be paid to potential short-term pullback risks.

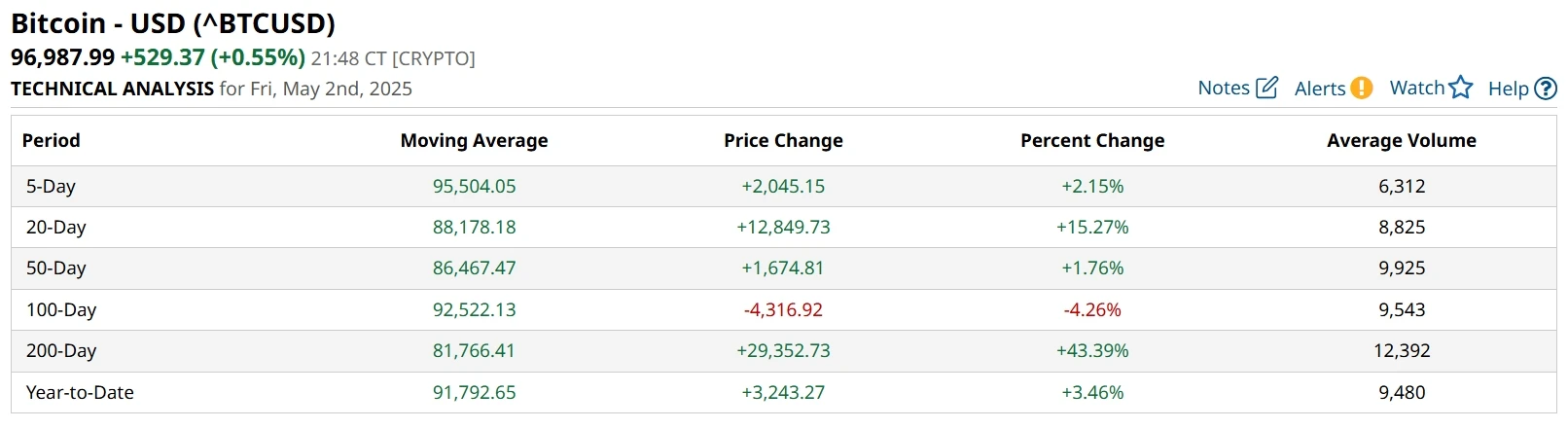

2. Moving Averages (MA): Clear Trend Structure, Bullish Pattern Not Broken

50-day Moving Average (MA50): $86,467.47

200-day Moving Average (MA200): $81,766.41

Current Price (Market Price): Approximately $96,800 (above both moving averages)

Technical Structure: Golden Cross Pattern

The current MA50 has steadily crossed above the MA200, forming a typical "Golden Cross" pattern, which is usually seen as a confirmation of a medium to long-term bullish signal. This structure enhances market expectations for continued upward movement.

The current price is significantly above the MA50 and MA200, confirming the continuation of the medium to long-term upward trend. The MA arrangement shows a typical bullish structure (short-term > medium-term > long-term), indicating that the market has not yet experienced structural damage. However, as prices have significantly deviated from the moving averages in the short term, there is some mean reversion pressure, and the market may face technical pullbacks or consolidation.

50-day SMA, 200-day SMA Data Image

3. Key Support and Resistance Levels

Support Levels: The main support range for Bitcoin currently lies between $93,500 and $94,000, which is an important pullback defense line in the short term. If the price falls back to this area, it is expected to attract some bullish buying, potentially forming a technical rebound.

Resistance Levels: The initial resistance levels above are concentrated around $97,000 and $97,500. If the price can effectively break through and stabilize above $97,500, it is expected to open further upward space, testing the psychological round number of $100,000.

Market Sentiment Analysis

1. Market Optimism Rebounds, Capital Liquidity Increases

This week, market optimism has significantly rebounded, with multiple on-chain and sentiment indicators improving in sync, reflecting a gradual recovery of investor confidence:

The Bitcoin Bull-Bear Market Cycle Indicator rose to 60 on April 28, marking a three-week high; data from CryptoQuant analyst Julio Moreno indicates that the liquidity of stablecoins and Bitcoin on exchanges has risen simultaneously, suggesting that capital is flowing back into risk assets.

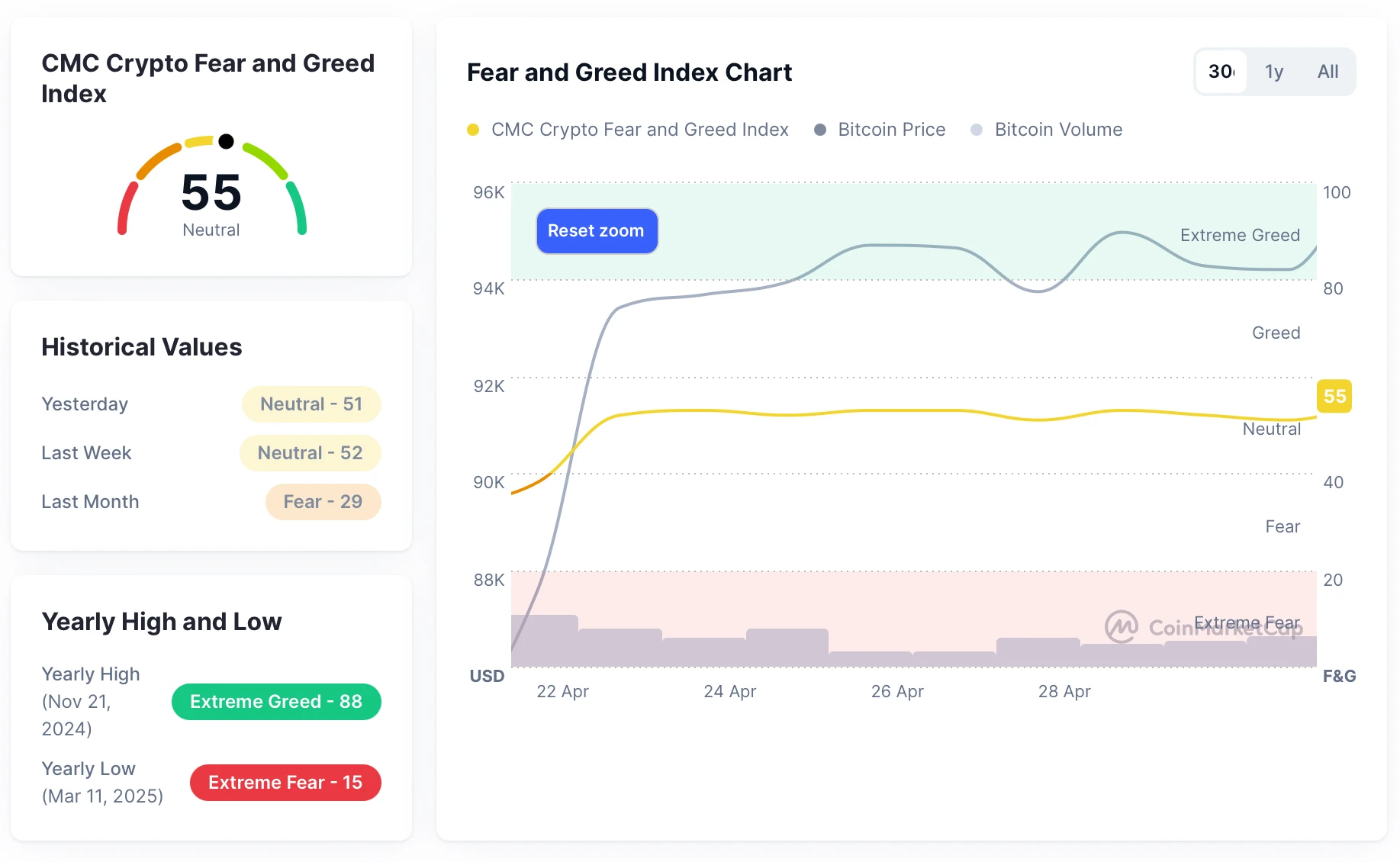

2. Key Sentiment Indicator (Fear and Greed Index)

According to CoinMarketCap data, as of May 2, the Fear and Greed Index stands at 55, in the "neutral" zone. The index showed a stable trend this week: April 26: 53 (neutral); April 27: 53 (neutral); April 28: 51 (neutral); April 29: 53 (neutral); April 30: 52 (neutral); May 1: 51 (neutral).

The index fluctuated between 51 and 55, reflecting stable market sentiment, with investors neither overly panicking nor exhibiting irrational greed; the index's small fluctuations indicate that investors are taking a wait-and-see approach amid recent price fluctuations, with confidence gradually recovering but not becoming noticeably aggressive; sentiment has not entered greed, suggesting that there is still upward space in the market and it has not overheated.

Fear and Greed Index Data Image

Macroeconomic Background

1. Renewed Economic and Trade Tensions Between the U.S. and Europe, Major Adjustments to Global Tax Policies May Be Ahead

The European Union is considering amending its 15% minimum corporate tax law to ease tensions with a potential new U.S. government. This law, which took effect in 2023, aims to align with a global unified tax system under the G20 framework, but U.S. officials are concerned that their domestic companies will be constrained by EU rules. If implemented, this move could signal a regression in the coordination of multinational tax policies, further affecting cross-border capital flows and corporate hedging behaviors.

2. Trump’s Policy Expectations Reshape Geopolitical and Trade Landscape

Trump has recently made several statements, reiterating that he will not easily lift tariffs on China and emphasizing the need for "substantial concessions" from China; he is also actively involved in mediating the Russia-Ukraine situation and promoting a rare earth agreement for Ukraine. If peace is achieved, the energy and military-industrial chains may benefit. Additionally, he plans to alleviate pressure from auto tariffs and strengthen domestic manufacturing, which could trigger a global supply chain readjustment.

3. Cryptocurrency Policies Becoming Increasingly Political, Regulatory Outlook Full of Uncertainty

As connections between the Trump family and the cryptocurrency industry gradually come to light (such as the WLFI project team meeting with Zhao Changpeng in Abu Dhabi), the independence of the U.S. SEC's regulation is widely questioned. Forbes reports that if the SEC shows favoritism towards politically related projects, it could trigger systemic concerns about the credibility of digital asset regulation among the public.

If the new SEC Chairman Paul Atkins fails to find a balance between political pressure and industry reform, it may weaken the U.S.'s dominant position in global cryptocurrency policy-making.

Moreover, the recent large-scale transfer of $2.4 billion in on-chain funds related to Trump’s official MEME coin project due to a dinner event also demonstrates the significant impact of the "politics + crypto" narrative on market sentiment.

4. Domestic Inflation and Monetary Policy in the U.S. Back in Focus

Trump has publicly criticized the Federal Reserve again, claiming "he is more insightful than the Fed Chairman" and suggesting that he will have more control over monetary policy. Meanwhile, the U.S. Senate has just rejected a proposal to limit Trump's tariff authority, indicating that the balance of power between the Federal Reserve and the Treasury may be further weakened in the future.

If Trump regains power, his policy combination of deregulation, expansive fiscal policy, and high tariffs may once again catalyze volatility in market risk assets, including cryptocurrencies like Bitcoin, which are increasingly seen as safe-haven assets.

3. Hash Rate Changes

From April 26 to May 2, 2025, the Bitcoin network hash rate exhibited fluctuations, as detailed below:

On April 26, the hash rate quickly rose from 877.58 EH/s to 944.31 EH/s, briefly maintained that level before entering a decline, dropping to 883.05 EH/s, 813.18 EH/s, and finally retreating to 777.38 EH/s. On April 27, continuing the downward trend from the previous day, the hash rate further touched a low of 693.46 EH/s, then recovered upward, returning to 877.72 EH/s. On April 28, the hash rate fluctuated around 850 EH/s, first pulling back to 806.74 EH/s before rebounding to 881.14 EH/s, and then continuing to rise to 884.67 EH/s. On April 29, the hash rate fluctuated upward, peaking at 962.47 EH/s, then maintaining a high range of 900–950 EH/s, reaching a high of 954.34 EH/s again in the evening. On April 30, the Bitcoin network hash rate retreated from its high, dropping to a low of 796.17 EH/s, then briefly rising to 840.03 EH/s, followed by another drop to 782.83 EH/s, overall showing a fluctuating trend. In the closing phase of the day, the hash rate gradually rose and ultimately climbed to 833.00 EH/s, indicating a slight recovery in miners' participation in the network. On May 1, the hash rate continued the upward trend from the previous day, further climbing to 910.27 EH/s. It maintained around 900 EH/s for a while, then retreated to 794.24 EH/s, before rising again to 846.00 EH/s. On May 2, the hash rate continued to rise, reaching 872.20 EH/s.

In summary, this week, the Bitcoin network hash rate exhibited an overall upward trend, although there were significant short-term pullbacks, the duration of high operation time was extended, indicating that miners have a strong capacity for sustained hash rate investment at the current price range. If the hash rate remains high, it is expected to impact future block production rates and difficulty adjustments.

Bitcoin Network Hash Rate Data

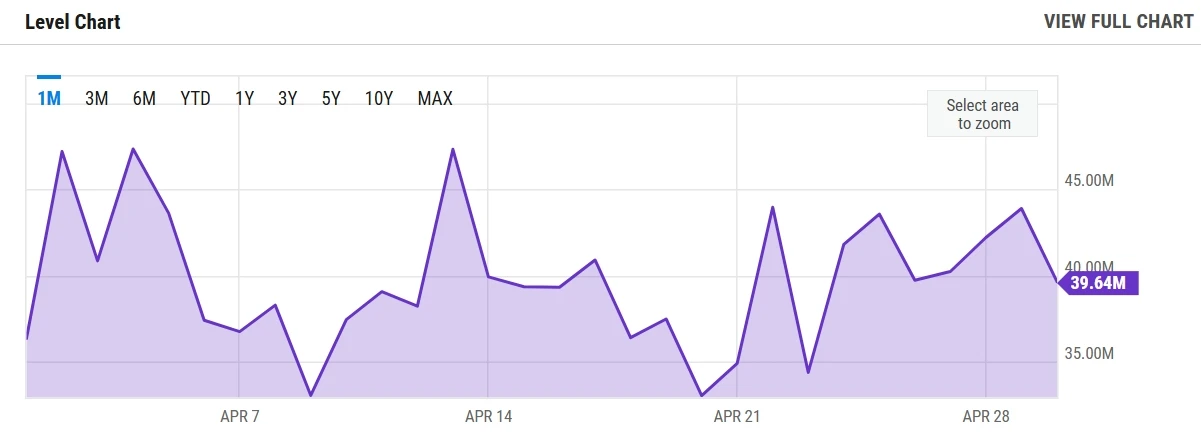

4. Mining Revenue

According to YCharts data, the total daily revenue of Bitcoin miners (including block rewards and transaction fees) for this week is as follows: April 26: $39.72 million; April 27: $40.23 million; April 28: $42.21 million; April 29: $43.90 million; April 30: $39.64 million. From the trend, the average daily revenue of miners this week remained stable between $39 million and $44 million.

From the perspective of unit hash rate revenue, the current Bitcoin "hash price" is approximately $50.14 per PH/s, having rebounded to a relatively high level over the past month. This reflects that, under the combined effect of Bitcoin price rebound and slowing hash rate growth, the marginal revenue per unit hash rate for miners has improved.

According to The Block's data, the total revenue of Bitcoin miners in April 2025 was approximately $1.15 billion, slightly down from $1.22 billion in March and $1.24 billion in February. The decline was mainly due to the prolonged low Bitcoin price before April 20, which led to insufficient trading activity and put pressure on miners' revenue for most of the time. It was not until the price rebounded above $90,000 in late April that revenue began to recover. If Bitcoin's market continues to rise in May and successfully breaks through with increased volume, miners' monthly earnings are expected to see a phase rebound, thereby improving the current operating environment.

Daily Revenue Data of Bitcoin Miners

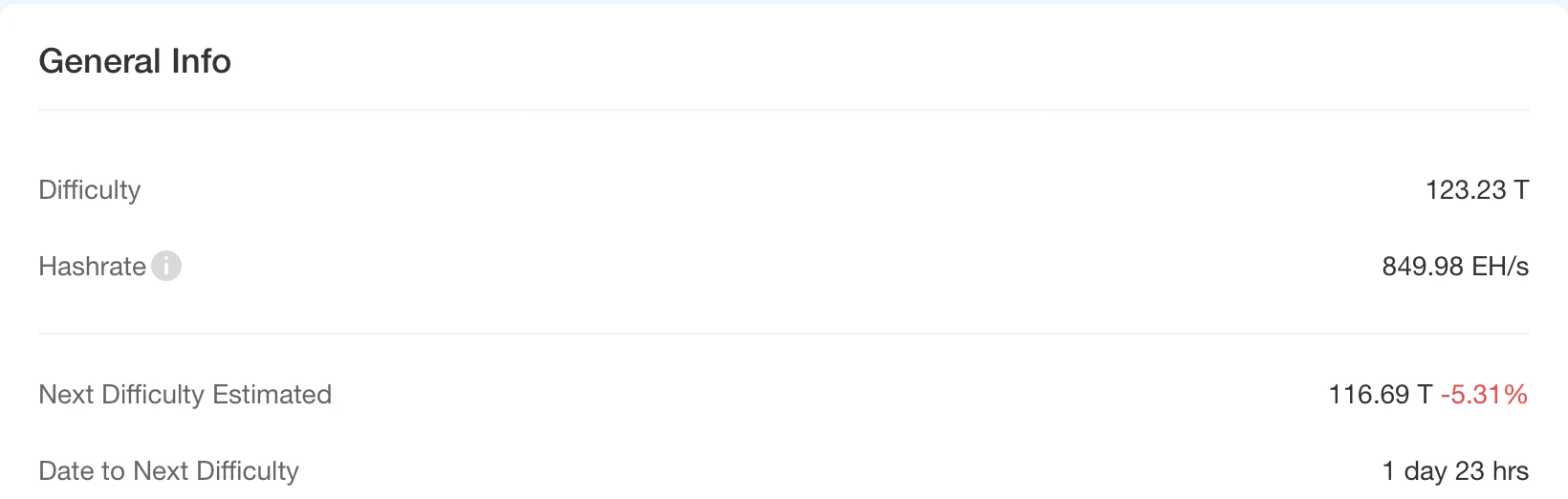

5. Energy Costs and Mining Efficiency

According to CloverPool data, as of May 2, 2025, the total network hash rate of Bitcoin was 849.98 EH/s, and the current mining difficulty was 123.23 T. The next difficulty adjustment is expected to occur on May 4, with an anticipated decrease of 5.31%, bringing the difficulty down to 116.69 T. This trend indicates that, against the backdrop of short-term stabilization in Bitcoin prices, some less efficient and higher-cost mining machines are gradually exiting the market, leading to a slowdown or even slight retreat in overall network hash rate growth. The difficulty reduction will alleviate the mining pressure on remaining miners to some extent, thereby improving miners' profitability in the short term.

According to the latest model calculations from MacroMicro, as of April 30, 2025, the unit production cost of Bitcoin was approximately $90,809.30, while the spot price on that day was $94,207.31, resulting in a mining cost-to-price ratio of 0.96. This ratio is slightly below 1, indicating that most miners are still in a slightly profitable range, and the overall industry profit is in a stage of moderate recovery. If Bitcoin prices continue to rise, miners' profit margins will expand accordingly, and the industry's profitability is expected to continue improving, thereby attracting more efficient hash rate into the market and driving hash rate and difficulty upward again.

In summary, the slowdown in overall network hash rate growth and the expected difficulty reduction together constitute the current operational logic of Bitcoin mining: short-term profit recovery is beginning to show, but whether it can maintain a healthy state in the long term still depends on Bitcoin price trends and the update process of high-efficiency equipment.

Bitcoin Mining Difficulty Data

6. Policy and Regulatory News

Swiss Central Bank President Again Rejects Calls to Increase Bitcoin Holdings, Says "Does Not Meet High Standards for Reserve Currency"

On April 26, Swiss National Bank President Martin Schlegel stated on Friday: "The market liquidity of cryptocurrencies during crises will be questioned, and their high volatility is also a significant risk for long-term value preservation. In short, it can be said that cryptocurrencies currently do not meet our high requirements for reserve currencies." He made this statement in response to a proposal from the advocacy group Bitcoin Initiative to increase Bitcoin holdings. The organization’s research indicated that if 1% had been invested in Bitcoin in 2015, the overall return for the Swiss National Bank would have nearly doubled, with only a slight increase in volatility.

El Salvador's Bitcoin Strategy Continues to Advance, Bypassing IMF Restrictions

To secure a $1.4 billion loan from the International Monetary Fund (IMF), the El Salvador government previously promised that the finance department would no longer increase Bitcoin holdings and announced the cancellation of Bitcoin as a mandatory payment and tax method starting May 1. However, on April 28, the El Salvador Bitcoin Office posted on the X platform, stating that it would "continue to add one Bitcoin to the strategic reserve every day." As of April 30, the office had added 32 Bitcoins in April, bringing the total holdings to over 6,160 Bitcoins, valued at approximately $584 million. Analysts point out that El Salvador is technically bypassing the IMF's restrictions on the "finance department" through this office, continuing to advance President Bukele's national Bitcoin strategy.

Arizona House Passes Bitcoin Reserve Bill, Promoting Establishment of Cryptocurrency Reserves

On April 29, the Arizona House passed two bills that may allow the state to establish reserves using Bitcoin or other cryptocurrencies. In the third reading of Senate Bill 1025 (SB1025) on April 28, 31 legislators voted in favor, while 25 opposed. Another similar bill, SB1373, passed with 37 votes in favor and 19 against. These approvals bring these bills closer to being signed into law than similar initiatives in any other U.S. state. Meanwhile, President Trump signed an executive order in March proposing the establishment of a "strategic Bitcoin reserve" and "digital asset reserves."

Related Image

Nigerian Government Passes Law Recognizing Bitcoin as Security

On May 1, it was reported that Nigerian President Tinubu signed the Investment and Securities Act 2025 last month, officially classifying Bitcoin and other digital assets as securities. This marks the first official recognition of Bitcoin's legal status by Nigerian regulators.

The new law will grant the Nigerian Securities and Exchange Commission (SEC) regulatory authority over virtual asset service providers (VASPs), digital asset operators (DAOPs), and digital asset exchanges (DAEs). The law also imposes strict penalties against Ponzi schemes, with violators facing fines of at least 20 million naira (approximately $12,430) and up to 10 years in prison.

7. Mining News

U.S. Secretary of Commerce: The U.S. Will Vigorously Promote Domestic Bitcoin Mining Development

On April 29, it was reported by BitcoinMagazine that U.S. Secretary of Commerce Howard Lutnick stated that the U.S. will "fully promote the development of the Bitcoin mining industry domestically."

Related Image

Cambridge University Research: Bitcoin Mining is Shifting to Sustainable Energy

On April 29, it was reported that the latest research report from the Cambridge Centre for Alternative Finance (CCAF) shows that the sustainable energy usage rate in the Bitcoin mining industry has risen to 52.4%, significantly up from 37.6% in 2022. The report indicates that natural gas (38.2%) has replaced coal (8.9%) as the largest single energy source, with coal usage dropping sharply from 36.6% in 2022. The data also shows that North America dominates global mining activities, with the U.S. accounting for 75.4% and Canada for 7.1%. This research is based on a survey of 49 mining companies across 23 countries, covering 48% of global mining activities, estimating Bitcoin's annual electricity consumption at 138 terawatt-hours, approximately 0.5% of global electricity usage.

8. Bitcoin News

Global Corporate and National Bitcoin Holdings (This Week's Statistics)

1. El Salvador Continues to Accumulate Bitcoin, Holdings Reach 6,159 Coins

According to a statement from the El Salvador Bitcoin Office on April 27, the country's national strategic reserve added 1 Bitcoin, bringing the total holdings to 6,159.18 coins, continuing the "one coin per day" accumulation plan.

2. Strategy Accumulates 15,355 Bitcoins in a Week, Total Holdings Exceed 550,000 Coins

On April 28, it was reported that Strategy purchased 15,355 BTC for approximately $1.42 billion between April 21 and 27, at an average price of about $92,737. As of April 28, the total holdings reached 553,555 BTC, with a total investment of about $37.9 billion.

3. Japanese Brand ANAP Purchases 35 More Bitcoins, Holdings Exceed 50 Coins

On April 30, Japanese fashion brand ANAP announced the purchase of 35 more Bitcoins, bringing its total holdings to 51.6579 coins, continuing to advance its Bitcoin asset allocation strategy.

4. Australia's Monochrome Bitcoin ETF Holdings Rise to 345 Coins

As of April 29, Monochrome's spot Bitcoin ETF (IBTC) held 345 BTC, valued at approximately $50.96 million, indicating continued investor optimism towards Bitcoin assets.

5. BlackRock Accumulates Over 25,000 Bitcoins in a Week, Total Holdings Exceed 600,000 Coins

According to tracking data from Lookonchain, BlackRock's IBIT ETF increased its holdings by 25,430 BTC over the past seven days, valued at approximately $2.37 billion. As of April 30, total holdings reached 601,209 BTC, with a total market value of about $56.11 billion.

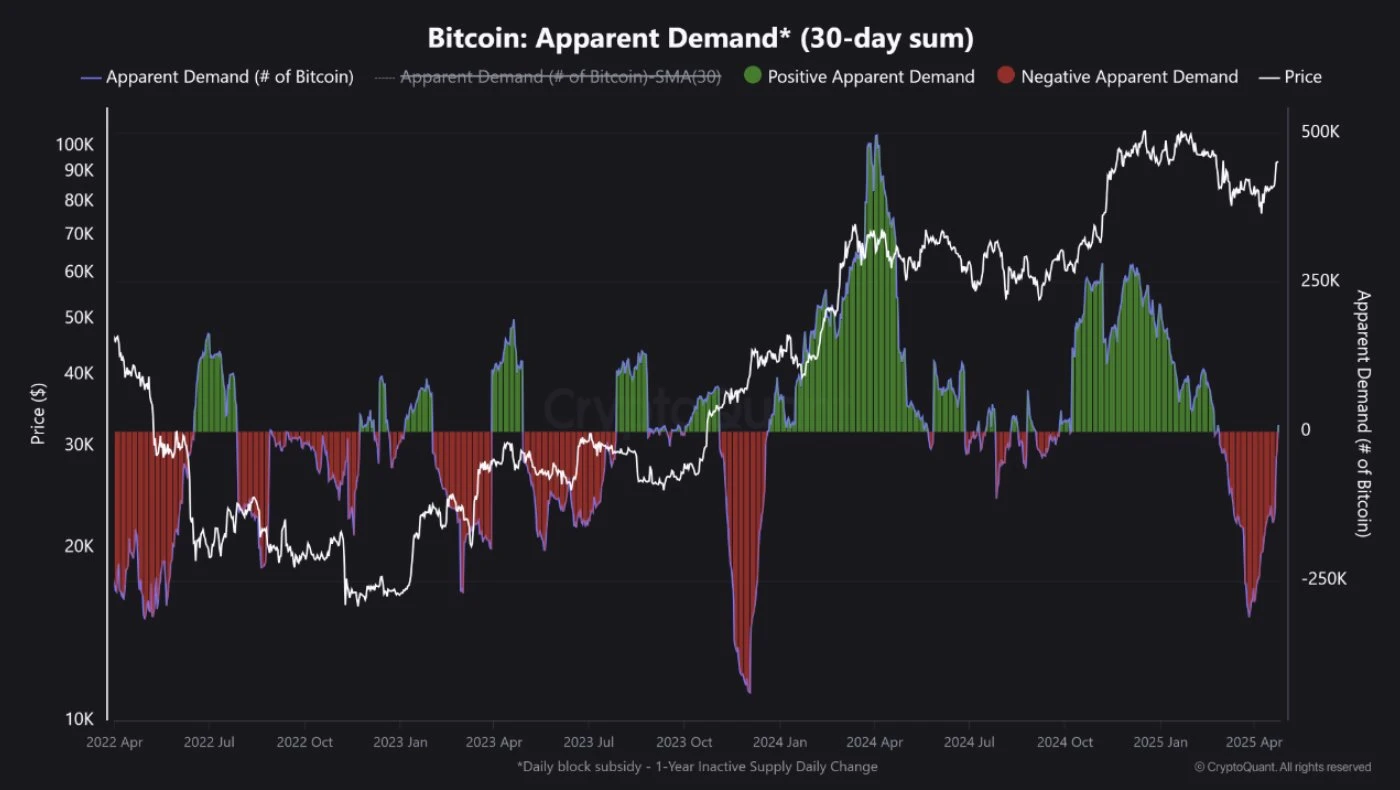

CryptoQuant Analyst: Demand Indicators Show Dormant Funds Are Flowing Back into Bitcoin

On April 26, CryptoQuant analyst ITTech stated that apparent demand indicators show a significant rebound in Bitcoin buying interest. The strong rebound from extreme negative values (below -200,000 BTC) indicates that previously dormant funds are flowing back in.

Related Image

Bitcoin Core Developer Proposes Abolishing "Satoshi" Unit and Removing Decimal Points, Sparking Community Controversy

On April 27, as the Bitcoin community was busy optimizing user experience, launching custodial solutions, lobbying regulators, and courting institutions, core developer and Synonym CEO John Carvalho proposed a simpler solution: abolishing the "satoshi" unit and removing decimal points to lower the cognitive barrier for newcomers. In a BIP proposal in December 2024, he suggested directly defining the 100 million "satoshis" that make up one Bitcoin as "Bitcoin," meaning that a transaction currently displayed as 0.00010000 BTC would show as 10,000 BTC in the new system, fundamentally reshaping the measurement of "Bitcoin millionaires."

This move quickly sparked controversy. Opponents mocked it with the "pizza theory": if each slice of pizza is called a "whole," one would need to order eight at once to satisfy demand, satirizing the absurdity brought by unit inflation. More community members expressed concern that if the total supply were "inflated" from 21 million to 21 billion, it would undermine the core narrative of Bitcoin's scarcity. However, Carvalho's proposal may be quietly gaining traction. On April 25, he posted on the X platform, stating: "Although still a minority, more and more people are beginning to accept the idea of calling the smallest unit of Bitcoin 'Bitcoin' and removing the decimal point."

CryptoQuant Analyst: Demand Indicators Show Dormant Funds Are Flowing Back into Bitcoin

On April 27, CryptoQuant analyst ITTech stated that apparent demand indicators show a significant rebound in Bitcoin buying interest. The strong rebound from extreme negative values (below -200,000 BTC) indicates that previously dormant funds are flowing back in.

10x Research: Bitcoin May Break $100,000 After Short-Term Consolidation

On April 28, 10x Research released an analysis report stating that although the resistance level of $94,000-$95,000 will continue to limit Bitcoin's upward momentum in the short term, two reversal indicators have turned bearish, and the stochastic indicator has risen to 95%, suggesting short-term downside risks. However, analysts believe this only represents a short-term consolidation phase before breaking through $100,000.

Standard Chartered: Bitcoin Expected to Break $120,000 in Q2

On April 28, it was reported by The Block that Geoffrey Kendrick, global head of digital asset research at Standard Chartered, stated in a recent report that Bitcoin is expected to reach approximately $120,000 in the second quarter of 2025 and maintain its target price of $200,000 by the end of 2025. Kendrick believes now is the time to buy Bitcoin, with multiple indicators supporting price increases, including U.S. investors seeking non-U.S. assets, continued accumulation by "whale" investors, and a shift of ETF funds from gold to Bitcoin as a safe haven. He emphasized that Bitcoin, due to its decentralized nature, is more effective than gold in hedging risks in the current financial system.

Presto Research Director: Bitcoin Expected to Rise to $210,000 by the End of 2025

On April 28, it was reported by Cointelegraph that Peter Chung, research director at quantitative trading firm Presto, reiterated his prediction that Bitcoin will rise to $210,000 by the end of 2025.

Chung stated that global liquidity expansion is the main driving force behind his long-term bullish outlook on Bitcoin. He also acknowledged that this year's market environment has not been as ideal as expected, especially with challenges in the macroeconomic situation and market reactions.

However, he described the recent market pullback as a healthy adjustment, believing it lays a more solid foundation for Bitcoin's advancement as a mainstream financial asset. He stated: "Looking back, I think this is actually a healthy correction that paves the way for Bitcoin to be re-priced as a mainstream asset."

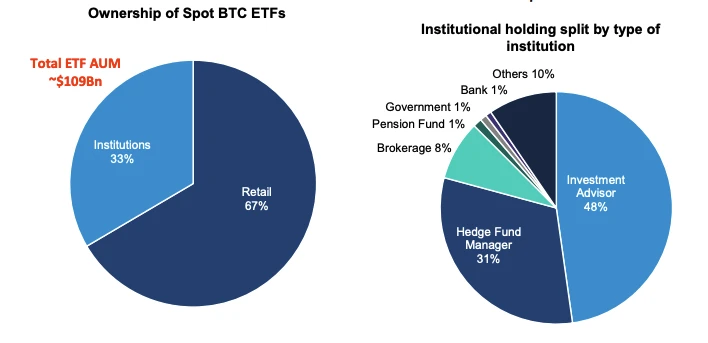

Bernstein: Expecting Bitcoin Prices to Reach New Highs with Corporate Accumulation and ETF Fund Inflows

On April 29, it was reported that this year's Bitcoin price narrative has fluctuated between "gold" and "Nasdaq" correlations, but Bernstein analysts believe that the short-term correlation is misleading. The exhaustion of retail selling, corporate accumulation, and ETF fund inflows are the key indicators that may drive "supply tightening" to new price highs. Last week, Twenty One Capital announced an initial accumulation of 42,000 BTC (approximately $4 billion), joining the ranks of companies like Strategy. Currently, about 80 companies collectively hold 700,000 BTC, accounting for 3.4% of the total supply. The U.S. spot Bitcoin ETF saw a net inflow of $3 billion last week, a five-month high, with total holdings accounting for 5.5% of Bitcoin's circulating supply. The institutional share rose from 20% in September last year to 33%, with 48% held by investment advisors, reflecting asset allocation demand. Combined with corporate holdings, institutional capital now controls 9% of BTC's supply. If the U.S. government implements a strategic reserve, it may trigger sovereign nations to compete in accumulating Bitcoin. The balance of BTC on exchanges has dropped from 16% at the end of 2023 to 13%, but some assets have only shifted to ETF custodians.

Bernstein analysts estimate that Bitcoin will reach approximately $200,000 at the peak of the cycle by the end of 2025, $500,000 by the end of 2029, and $1 million by the end of 2033, with intermittent bear markets occurring in between.

Related Image

Trump Crypto Committee Executive Director: Countries Are Engaged in a "Space Race" Style Bitcoin Accumulation, the U.S. Views Bitcoin as Digital Gold

On April 30, it was reported that Bo Hines, executive director of the Trump Crypto Committee, stated that countries are engaged in a competition for Bitcoin accumulation similar to a "space race." We view Bitcoin as digital gold.

CZ: Multiple Countries Consulting on Establishing Cryptocurrency Reserves, Bitcoin ETF Leading the Current Cycle

On April 30, it was reported that Zhao Changpeng (CZ) recently stated that he is consulting for several countries outside of Europe on how to establish cryptocurrency reserves like the U.S. He noted that Europe is currently not part of this discussion. CZ explained his reasons for investing in the X platform, emphasizing that "free currency" needs to be based on "freedom of speech." Regarding the current market, he believes that ETFs are the main driving force of this cycle, with Bitcoin being dominant. Although Ethereum's performance is not as prominent as Bitcoin's, he expects Bitcoin's success to eventually drive other cryptocurrencies and emphasized that "we are still in the early stages."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。