In the previous article, the Crypto Salad team delved into the core concepts of stablecoins and systematically analyzed the operational mechanisms and application scenarios of mainstream stablecoins in the current market. It is evident from the analysis that the stablecoin sector holds immense growth potential. However, the technological innovation of stablecoins acts as a double-edged sword; while it has broad development prospects, its potential risks cannot be overlooked. According to the "2024 Global Crypto Crime Report" released by the on-chain analysis firm Chainalysis, the total amount of illegal transactions completed through stablecoins reached as high as $40 billion from 2022 to 2023. Among these, 70% of crypto fraud activities and over 80% of sanction evasion transactions involved stablecoins.

Therefore, to balance innovation and risk, global regulatory agencies are accelerating the construction of a systematic regulatory framework for stablecoins: the United States is continuously advancing the legislative process of the "Stablecoin Transparency Act" (STABLE Act), while the Hong Kong Monetary Authority has passed the "Stablecoin Ordinance" and established a "Stablecoin Sandbox" regulatory mechanism. This dynamic balance of technological neutrality and risk prevention is shaping the next stage of stablecoin development paradigms and signifies that the stablecoin industry is evolving from a phase of reckless growth to one of compliance.

What risks do stablecoins face, and why is regulation necessary?

Which countries and regions currently have regulatory frameworks for stablecoins?

What are the specific contents of the regulatory framework? What are the entry barriers and compliance requirements for the stablecoin industry?

In the long term, how will the continuous improvement of the regulatory framework impact the future development of the stablecoin industry?

The Crypto Salad team has been deeply involved in the cryptocurrency industry for many years and possesses rich experience in handling complex cross-border compliance issues in the cryptocurrency sector. In this article, we will combine relevant industry research and the practical experience of the Crypto Salad team to clarify and answer the above questions from a professional legal perspective.

What risks do stablecoins face, and why is regulation necessary?

Why is the regulatory framework for stablecoins so important? Currently, there are two main risks in the stablecoin industry:

- Intrinsic Risks of Stablecoins

The value stability of stablecoins is not an absolute guarantee; rather, it is built on a balance of market consensus and trust mechanisms. The core logic is that the relative stability of stablecoins does not stem from the intrinsic value of reserve assets but relies on the continuous trust of holders in the issuer's ability to fulfill obligations. This trust is essentially a "consensus-driven value balance"—when the majority of market participants trade and transfer based on the expectation of stablecoin value stability, the risk of significant price fluctuations is suppressed by the consensus itself.

However, once the foundation of trust shows cracks, the stability of stablecoins will quickly collapse. For example, in cases of insufficient reserve assets or misappropriation of funds, when the market perceives such risks, the consensus mechanism among stablecoin holders may rapidly reverse or collapse. This is manifested in panic selling by stablecoin holders, which can lead to a de-pegging of the coin's value, and the market panic triggered by this de-pegging can further stimulate a wave of selling, ultimately forming a self-reinforcing negative feedback loop—commonly referred to as the "death spiral." In extreme cases, the collapse of a single stablecoin can trigger a series of chain reactions in the cryptocurrency market, ultimately becoming a black swan event for the overall market.

The transmission mechanism of this systemic risk was fully validated in the 2022 Luna-UST incident. As a representative of algorithmic stablecoins, UST relied on a complex algorithmic mechanism with Luna tokens to maintain its peg to the US dollar. However, when a liquidity crisis erupted in the market, the inherent flaws in the algorithmic design were maliciously exploited and continuously amplified. At the same time, the lack of transparency of UST further led to a rapid spread of the trust crisis, ultimately resulting in a collapse of its value. This incident not only caused nearly $40 billion in market value evaporation but also triggered a chain reaction in the crypto market, fully exposing the intrinsic risks inherent in stablecoins that lack regulatory constraints.

- External Risks of Stablecoins

The anonymity and cross-border liquidity of stablecoins certainly provide significant convenience and advantages, but these characteristics also make them highly susceptible to being exploited by black and gray markets and criminal activities. Without effective regulation, especially if the anti-money laundering (AML) and counter-terrorism financing (CFT) compliance requirements for stablecoins are unclear, stablecoins could easily become a hidden channel for illegal fund flows, thereby posing a threat to the security of the financial system.

Overview of Stablecoin Regulatory Frameworks in the U.S. and Hong Kong

In recent years, the development of global stablecoin regulatory frameworks has shown a trend of rapid advancement. Countries or regions such as Hong Kong, the United States, Singapore, the European Union, and the United Arab Emirates are all quickly pushing forward and gradually implementing relevant laws and regulations.

Overall, the current stablecoin regulatory frameworks in various countries mainly revolve around the following three major directions:

Entry Barriers for Issuers: Clearly define the qualification requirements for stablecoin issuers to ensure they possess sufficient capital strength, risk management capabilities, and industry experience.

Mechanisms for Value Stability and Maintenance of Reserve Assets: Require issuers to maintain sufficient reserve assets for stablecoins and ensure transparency and compliance through regular disclosures and independent audits.

Compliance in Circulation: Focus on strengthening the anti-money laundering (AML) and "know your customer" (KYC) mechanisms for stablecoins to prevent them from being used for illegal fund flows.

Next, this article will focus on Hong Kong and the United States, analyzing their latest stablecoin regulatory frameworks in depth and discussing the following dimensions: regulatory processes, normative documents, regulatory agencies, and the core contents of the regulatory frameworks.

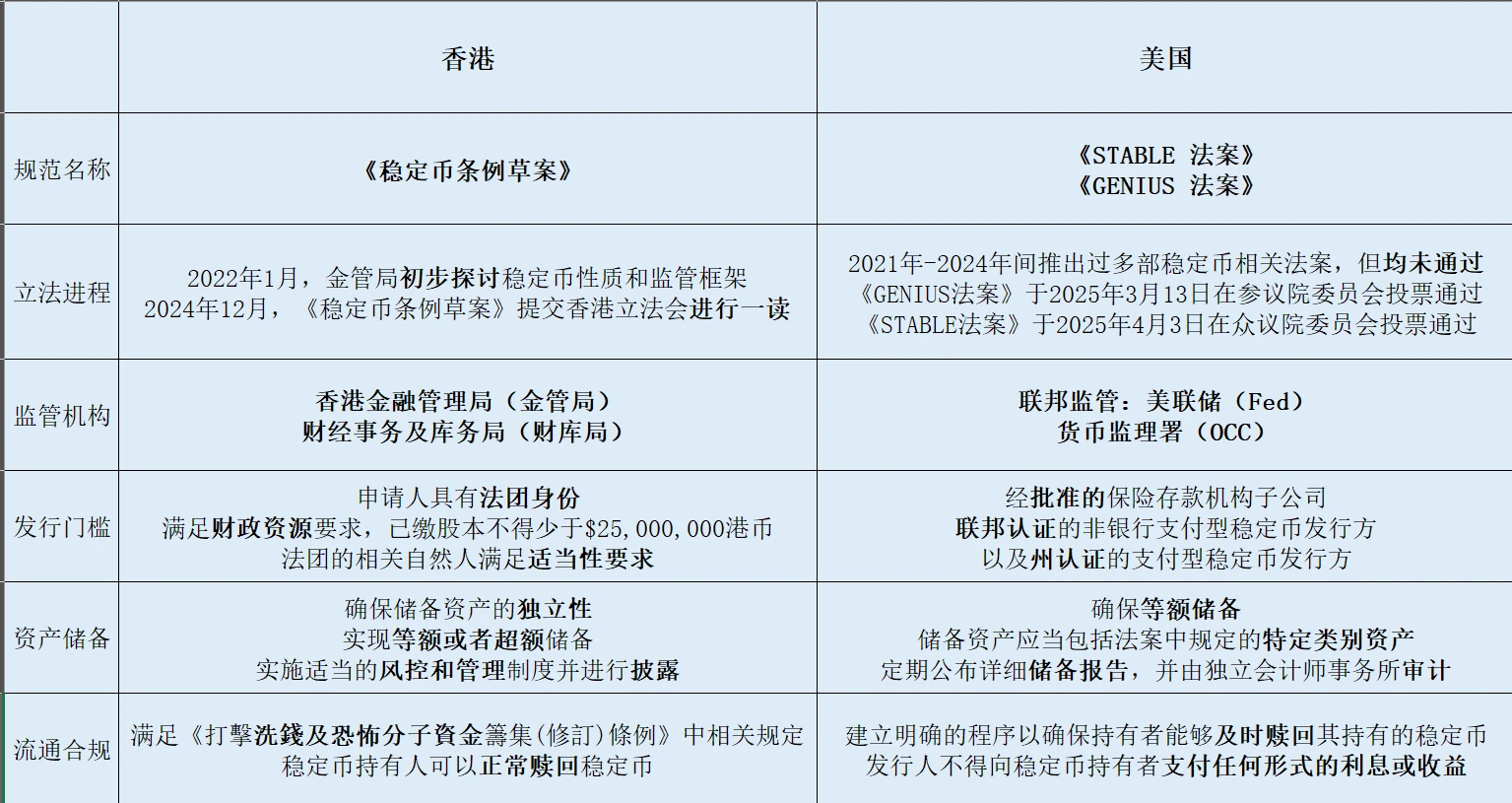

(The above image is a comparative summary table of the stablecoin regulatory frameworks in the U.S. and Hong Kong)

(1) Hong Kong

1. Regulatory Process

January 2022:

The Hong Kong Monetary Authority (hereinafter referred to as "HKMA") released the "Discussion Paper on Crypto Assets and Stablecoins," beginning initial discussions on the nature of stablecoins and related regulatory frameworks.

December 2023:

The HKMA and the Financial Services and the Treasury Bureau (hereinafter referred to as "FSTB") jointly released the "Legislative Proposal Consultation Document for Implementing a Regulatory Regime for Stablecoin Issuers in Hong Kong," proposing a specific draft of the stablecoin regulatory framework, focusing on regulating issuers and protecting holders.

March to July 2024:

The HKMA launched the "Stablecoin Sandbox" program, introducing a sandbox for stablecoin issuers, with companies like Round Coin Technology and JD Coin Chain becoming the first participants in this "sandbox."

December 2024:

On December 6, 2024, the Hong Kong government published the "Stablecoin Ordinance Draft" in the Gazette (hereinafter referred to as the "Stablecoin Ordinance") and submitted it to the Hong Kong Legislative Council for a first reading on December 18.

According to Hong Kong's legislative process, the bill must complete the three-reading process in the Legislative Council—first reading, second reading, and third reading—before becoming formal law. Essentially, this involves three stages of reading and deliberation of the bill. Therefore, the "Stablecoin Ordinance" must also complete this process before being officially signed into law, with optimistic estimates suggesting it may be completed within 2025.

2. Legal Texts and Corresponding Regulatory Agencies

The core normative document of Hong Kong's stablecoin regulatory framework is the "Stablecoin Ordinance" published in December 2024, and the regulatory system for stablecoins in Hong Kong is primarily overseen by the aforementioned HKMA and FSTB.

3. Regulatory Framework and Main Contents

a. Definition of Stablecoins

First, the "Stablecoin Ordinance" clarifies the broad definition of "stablecoins." Article 3 of the "Stablecoin Ordinance" stipulates that stablecoins must possess the following characteristics:

They are a form of unit of account or storage of economic value;

They serve as a medium of exchange accepted by the public, usable for purchasing goods or services, settling debts, or making investments;

They are deployed on a distributed ledger system and can be transferred, bought, sold, and stored electronically;

They reference a single asset or a basket of assets to maintain stable value.

It is important to note that Hong Kong's "Stablecoin Ordinance" does not regulate all broadly defined stablecoins but specifically governs "designated stablecoins" that meet certain conditions. Article 4 of the "Stablecoin Ordinance" explicitly states that stablecoins that maintain value stability solely by referencing one or more official currencies are the "designated stablecoins" regulated by this ordinance.

b. Regulated Activities Related to Stablecoins

After clarifying the concepts of stablecoins and designated stablecoins, Article 5 of the "Stablecoin Ordinance" specifies the stablecoin-related activities that are regulated by this ordinance and require licensing, such as:

Issuing designated stablecoins within Hong Kong;

Issuing designated stablecoins pegged to the Hong Kong dollar in countries or regions outside Hong Kong;

Actively promoting stablecoin-related activities to the public.

c. Entry Barriers for Issuers

To engage in regulated stablecoin-related activities, one must obtain the corresponding stablecoin issuance license under the regulatory framework of the "Stablecoin Ordinance." The entry conditions for obtaining this license include, but are not limited to, the following points:

First, the license applicant must have corporate status, either as a company established in Hong Kong or as a banking institution established outside Hong Kong.

Second, the license applicant must meet basic financial resource requirements to fulfill its obligations. Specifically, the paid-up capital of the license applicant must not be less than HKD 25,000,000.

Finally, the relevant natural persons such as shareholders, directors, controlling persons, and executives of the license applicant must also meet the corresponding suitability requirements in the "Stablecoin Ordinance," which will not be discussed here.

d. Mechanisms for Value Stability and Maintenance of Reserve Assets

Regarding the management of reserve assets for designated stablecoins, the "Designated Stablecoin" stipulates the following:

First, licensees must ensure that the reserve asset portfolio of designated stablecoins is strictly separated from other assets to ensure the independence of the reserve assets.

Second, at all times, the market value of the reserve asset portfolio for designated stablecoins must be greater than or equal to the circulating nominal value of the stablecoins, thereby achieving equal or excess reserves.

Finally, licensees must implement appropriate risk control policies and management systems for reserve assets and timely disclose to the public the management policies, risk assessments, composition and market value, and results of regular audits of their reserve assets in a timely and complete manner.

e. Compliance Requirements in Circulation

First, the "Stablecoin Ordinance" clearly stipulates that licensees must establish a dedicated risk management system that complies with the relevant provisions of the "Anti-Money Laundering and Counter-Terrorism Financing (Amendment) Ordinance" enacted in 2022, and prevent money laundering or terrorism financing activities related to their designated stablecoin activities.

Second, each holder of a designated stablecoin must have the right to redeem that stablecoin, and the issuance of designated stablecoins must not impose any excessively harsh conditions that restrict the redemption of the stablecoin, nor charge unreasonable fees related to redemption.

f. Hong Kong Stablecoin Sandbox

Alongside the introduction of the Stablecoin Ordinance, the Hong Kong Monetary Authority has also established a corresponding "Stablecoin Sandbox" mechanism aimed at providing a testing environment and compliance support for relevant stablecoin issuers. Currently, several stablecoin issuers that have passed the initial approval by the HKMA are already in this sandbox, including Round Coin Technology, JD, and Standard Chartered Bank. These issuers are expected to become the first entities in Hong Kong to issue compliant stablecoins.

Although the "Stablecoin Sandbox" mechanism was launched last year and began testing, the relevant entities have not yet formally completed the issuance of stablecoins. The Crypto Salad team has learned that these stablecoin issuers in the sandbox may officially launch stablecoin products that comply with Hong Kong's regulatory requirements in 2025.

(2) United States

1. Regulatory Process and Normative Documents

To understand the current stablecoin regulatory framework in the United States, the two core normative documents are the "Guiding and Establishing National Innovation for U.S. Stablecoins Act" (hereinafter referred to as the "GENIUS Act") and the "Stablecoin Transparency and Accountability for a Better Ledger Economy Act" (hereinafter referred to as the "STABLE Act").

The GENIUS Act was proposed by Senator Bill Hagerty and has received support from several senators. The act was passed in the Senate on March 13, 2025, with a vote of 18 in favor and 6 against. The STABLE Act was proposed by U.S. Representatives Bryan Steil and French Hill and was passed by the House Financial Services Committee on April 3, 2025, with a vote of 32 in favor and 17 against.

According to the U.S. legislative process, the STABLE Act, which has been reviewed and passed by the House Financial Services Committee, will be submitted to the Senate or the House for full session debate. The bill must receive a majority vote in both the Senate and the House and reach a consensus before being signed into law by the President.

It is important to note that these two acts are not mutually exclusive or opposing. On the contrary, the STABLE Act is positioned as an improvement and continuation of the GENIUS Act. Bryan Steil, the chairman of the House Digital Assets Subcommittee, informed reporters that "after a new round of review, the STABLE Act will align well with the Senate's GENIUS Act, which was achieved after several rounds of draft revisions in both the House and Senate with technical assistance from the SEC and CFTC. In fact, there is a 20% difference between the two acts, and these differences are merely textual, not significant or substantive."

2. Corresponding Regulatory Agencies

As of now, the regulation of stablecoins in the United States remains fragmented, lacking a unified federal framework to regulate the issuance and operation of stablecoins. This regulatory ambiguity has led to overlapping jurisdictions among federal agencies, while inconsistencies between state laws further complicate regulation.

Currently, the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) hold primary regulatory authority over the stablecoin market. The SEC believes that many stablecoins structurally resemble money market mutual funds and therefore argues that they should be subject to securities regulations.

However, on June 28, 2024, the U.S. District Court for the District of Columbia ruled in favor of Binance, rejecting the SEC's claim that the stablecoin BUSD is a security. BUSD is issued in partnership with Paxos and is regulated by the New York State Department of Financial Services (NYDFS). This ruling is consistent with previous judicial decisions regarding stablecoins, further emphasizing that stablecoins like BUSD and USDC—because they are pegged to fiat currency at a 1:1 ratio—do not inherently meet the definition of investment contracts under SEC jurisdiction.

On the other hand, the CFTC classifies some stablecoins as commodities and regulates them accordingly. CFTC Chairman Rostin Behnam stated in 2023 that "stablecoins are a commodity, and unless Congress explicitly designates them as other types of assets, we must regulate this market." For example, the CFTC imposed a $41 million fine on Tether for violating sanctions trading regulations.

In summary, the lack of a unified legal framework not only complicates compliance for stablecoin issuers but may also pose financial stability risks to investors. Therefore, some argue that incorporating stablecoins into a regulatory framework similar to that of banks could help reduce systemic risks associated with stablecoins while providing clearer compliance guidance for the market.

The GENIUS Act and the STABLE Act, to some extent, clarify the previously complex and chaotic regulatory framework. Specifically, issuers of stablecoins exceeding $10 billion will be regulated at the federal level. The Federal Reserve (Fed) will oversee deposit-taking institutions, while the Office of the Comptroller of the Currency (OCC) will regulate non-bank issuers. At the same time, state regulatory agencies will be allowed to oversee issuers of stablecoins with a market value below $10 billion. Thus, these two acts establish a parallel structure of federal and state regulatory systems, aiming to provide a more comprehensive and systematic regulatory model for the U.S. stablecoin industry.

3. Regulatory Framework and Main Contents

Next, we will analyze the latest provisions of the STABLE Act in detail.

a. Definition of Stablecoins

The act stipulates that payment stablecoins regulated by this law must possess the following characteristics:

A digital asset intended to be used as a means of payment or settlement;

Valued in national currency;

The issuer is obligated to redeem, exchange, or repurchase at a fixed monetary value;

Not national currency, nor a security issued by an investment company.

b. Entry Barriers for Issuers

Only "Permitted Payment Stablecoin Issuers" can issue stablecoins, which include:

Approved subsidiaries of insured deposit institutions;

Federally certified non-bank payment stablecoin issuers;

And state-certified payment stablecoin issuers;

c. Mechanisms for Value Stability and Maintenance of Reserve Assets

Issuers must ensure that reserve assets cover 100% of the total outstanding liquid stablecoins (i.e., 1:1 backing), and the reserve assets should include the following categories:

U.S. dollar cash;

Deposits at Federal Reserve Banks;

Demand deposits at insured deposit institutions;

Short-term U.S. Treasury securities maturing within 93 days;

Overnight repurchase agreements that meet specific conditions;

Money market funds investing in the above assets.

Additionally, issuers must publicly release detailed reports on the composition of reserves monthly, which should be audited by an independent registered accounting firm. Furthermore, the report must include written assurances from the company's Chief Executive Officer (CEO) and Chief Financial Officer (CFO) to ensure the accuracy and completeness of the information.

Finally, issuers must comply with capital adequacy, liquidity management, and risk management requirements set by the primary federal stablecoin regulatory agencies. The scope of risk management covers key areas such as operational risk, compliance risk, information technology risk, and cybersecurity risk.

d. Compliance in Circulation

First, issuers should publicly disclose the redemption policies for stablecoins and establish clear procedures to ensure that holders can timely redeem their stablecoins.

Second, issuers must not pay any form of interest or yield to stablecoin holders to avoid potential conflicts of interest and market distortions.

Crypto Salad Interpretation

The Crypto Salad team analyzes that the accelerated construction of stablecoin regulatory frameworks by major global economies actually reveals the core value of stablecoins across different dimensions:

First, as an indispensable key infrastructure in the digital asset market, stablecoins are rapidly breaking through the boundaries of on-chain ecosystems and deeply embedding themselves in the operational aspects of the traditional financial system and the real economy, thereby achieving a deep integration of on-chain and off-chain value systems.

Second, at this critical juncture of deep adjustment in the global financial landscape and the accelerating trend of de-dollarization, stablecoins will play an increasingly crucial role in the international monetary and financial system, becoming an important strategic tool for countries to maintain monetary sovereignty and financial security.

Finally, as the regulatory mechanisms for stablecoins in various countries continue to optimize, the stablecoin industry will inevitably enter a new stage of balanced development between regulation and innovation. This requires stablecoin issuers to further enhance their compliance capabilities within the regulatory framework while providing institutional space for exploring new business paradigms. The future development of the stablecoin industry will seek new growth momentum and value creation points within the global financial regulatory system through technological iteration and institutional adaptation.

Special Statement: This represents the personal views of the author of this article and does not constitute legal advice or opinions on specific matters.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。