TL;DR

Oracles are one of the cornerstones of the blockchain world, and the core competitiveness of oracle projects is mainly reflected in the following four aspects: comprehensiveness and credibility of data acquisition, exclusive data acquisition and value capture, security and decentralization of verification mechanisms, and transmission efficiency and network robustness.

By 2030, the overall market size of the oracle sector is expected to be between $13.8 billion and $23.1 billion.

Chainlink is the absolute leader in the oracle sector, with a rich data source and extensive project collaborations; Pyth has advantages in transmission speed and financial data acquisition; Redstone is currently the only oracle with both Push and Pull pricing methods.

In the future, oracles will no longer overly rely on providing pricing services for DeFi projects, and RWA is expected to become a strong second growth curve for the oracle sector.

DePIN, AI, and DeSci businesses have the opportunity to combine with oracle data services in the future, becoming new drivers for oracle revenue growth, allowing industry growth from 2 to N.

Introduction

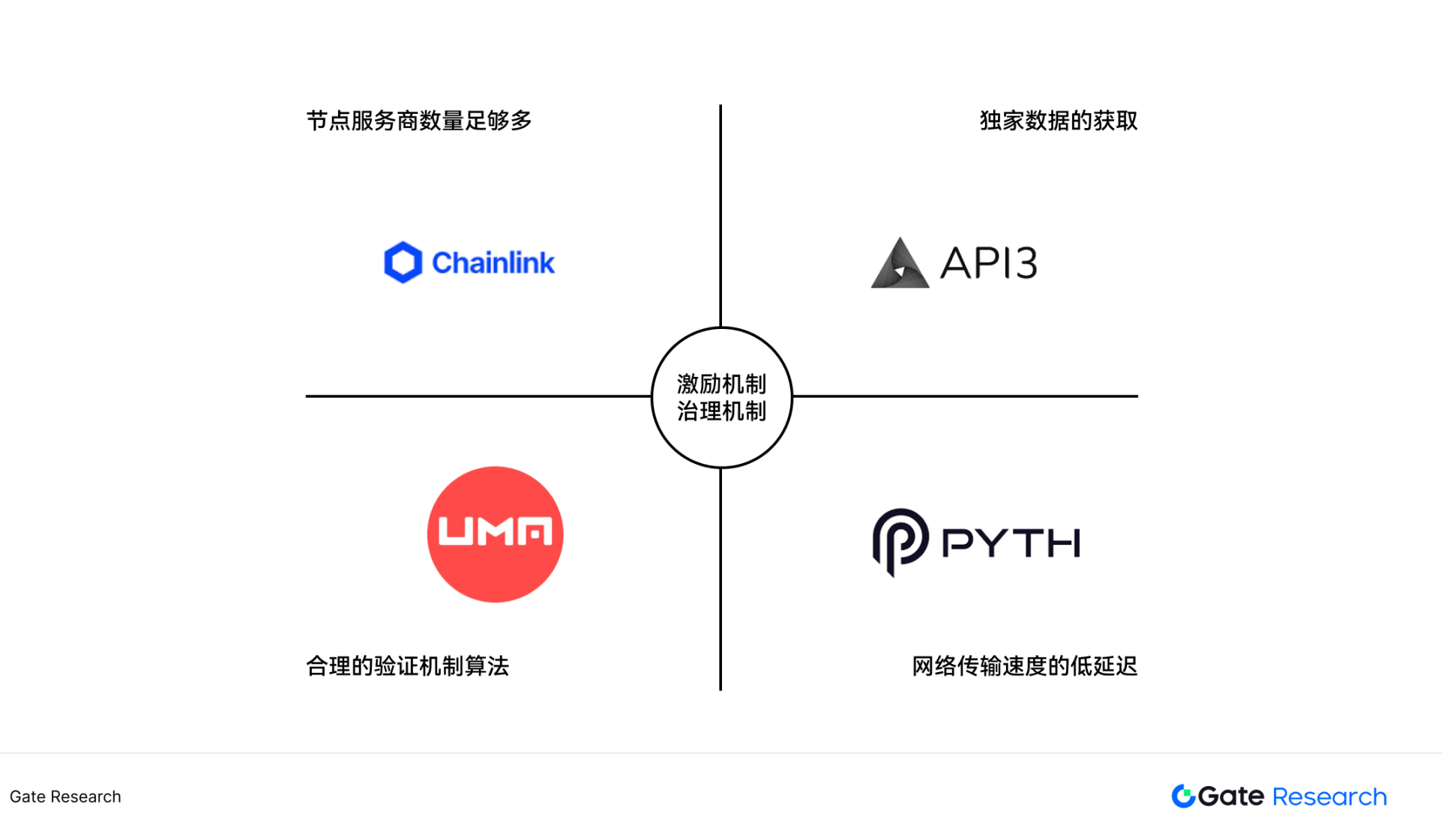

Oracles are a service mechanism in blockchain systems used to bring off-chain data into smart contracts, making them one of the cornerstones of the blockchain world. From a first-principles perspective, the core competitiveness of oracle projects is mainly reflected in the following four aspects: comprehensiveness and credibility of data acquisition, exclusive data acquisition and value capture, security and decentralization of verification mechanisms, and transmission efficiency and network robustness.

Figure 1: Oracle Competitiveness Model

Competitiveness One: Comprehensiveness and Credibility of Data Acquisition

In short, a complete oracle platform needs to have enough node service providers to offer a large amount of data for verification. Taking the Chainlink project as an example, there are currently over 100 data providers for Chainlink, including well-known data platforms like Arkham, Coin Metrics, and Coingecko. Multiple data providers can reduce the risk of single points of failure. Additionally, these data platforms enjoy a high reputation in the industry, and the data they provide has been rigorously verified, ensuring accuracy and reliability.

Competitiveness Two: Exclusive Data Acquisition and Value Capture

From the perspective of the DeFi sector, the types of data that oracles can provide are generally similar, with differences in highly structured indicators such as the Pi Cycle. Some oracles can find data providers for these indicators, while others cannot. Exclusive data is a significant growth point for oracle development, as more and more private data can be transmitted point-to-point through oracles.

Competitiveness Three: Security and Decentralization of Verification Mechanisms

The verification mechanism is the core of oracles, with different projects employing diverse aggregation algorithms (such as median, reputation weight, time-weighted average, etc.) to adapt to specific data types and scenario requirements.

Competitiveness Four: Transmission Efficiency and Network Robustness

After addressing issues related to the quantity, quality, and verification of data sources, the last important step is data transmission. Since the primary application scenario for oracles is DeFi, they need to ensure real-time data transmission to guarantee the accuracy of transaction prices. Additionally, oracles must maintain real-time data transmission even during fluctuations in the blockchain network.

In summary, oracles primarily play a role in the integration, verification, and transmission of data. Beyond the technical dimension, the long-term development of oracle projects also relies on mechanism design, especially a reasonable token incentive mechanism that can effectively drive node participation and ecosystem growth. These elements together form the competitiveness model of oracles.

The importance of oracles to the DeFi sector is self-evident, as lending protocols, staking protocols, and derivatives exchanges require extensive interaction with oracles to obtain real-time asset data. Among them, lending protocols are the main users of oracle data services, needing to obtain real-time market prices of collateral assets to calculate collateral ratios and trigger liquidations. For example, leading lending protocols like Aave, Compound, and Kamino already have significant asset management scales, and directly obtaining prices from a single exchange via API can easily lead to data centralization risks, so they generally use oracle pricing services.

However, the application potential of oracles extends far beyond financial transaction data. Theoretically, various types of off-chain data, such as real estate price data, sensor data, and biomolecular data, can be uploaded to the chain through oracles to trigger transactions of their corresponding assets. This indicates that there are multiple sub-directions within the oracle sector that are in potential rapid growth stages.

To gain a more comprehensive understanding of the oracle sector, this article will analyze its development history, market size, core projects, second growth curve, and specialized oracles.

1. Development History of Oracles

Before 2014

Augur is a decentralized prediction market that allows users to bet digital assets on the outcomes of real-world events. The demand for oracles began to emerge. Vitalik was an advisor for this project.

2015-2016 Phase

Ethereum co-founder Vitalik Buterin proposed the concept of oracles, emphasizing their key role in enabling smart contracts to access external data. In 2015, Oraclize (now known as Provable) launched the first decentralized oracle service, supporting Ethereum smart contracts in obtaining external data. The Ethereum mainnet was launched the same year.

2017-2018 Phase

The Chainlink project was established in 2017, proposing the concept of a decentralized oracle network (DON) aimed at solving single point of failure issues. Decentralized finance (DeFi) had not yet exploded, and the demand for oracles was mainly focused on simple data calls.

2019-2021 Phase

The DeFi Summer arrived in 2020, with oracles serving as the core external data providers for DeFi, offering pricing services for decentralized applications. Due to the explosion in demand, oracle projects beyond Chainlink, such as Band Protocol and Tellor, were launched, marking the initial emergence of competitive dynamics.

2022-2023 Phase

The DeFi market entered an adjustment period, but the oracle sector continued to innovate. Cross-chain interoperability and modular blockchains became industry trends, with oracle services expanding to multi-chain and multi-scenario applications. Chainlink launched the Cross-Chain Interoperability Protocol (CCIP), supporting cross-chain data transmission and smart contract interactions. Pyth Network (an oracle focused on financial data) went live on the mainnet, attracting participation from several traditional financial institutions.

2024-2025 Phase

Oracle services will expand from DeFi to areas such as gaming, NFTs, and insurance. DePIN applications will begin to create more demand for IoT oracles. AI will combine with oracles to explore new scenarios for automated execution of smart contracts.

Figure 2: Timeline of Oracle Development

2. Market Size of the Oracle Sector

Due to the current lack of authoritative predictive data specifically targeting the future growth of the oracle sector, this article attempts to indirectly infer the potential market size of oracles through the growth of its service target—the DeFi sector.

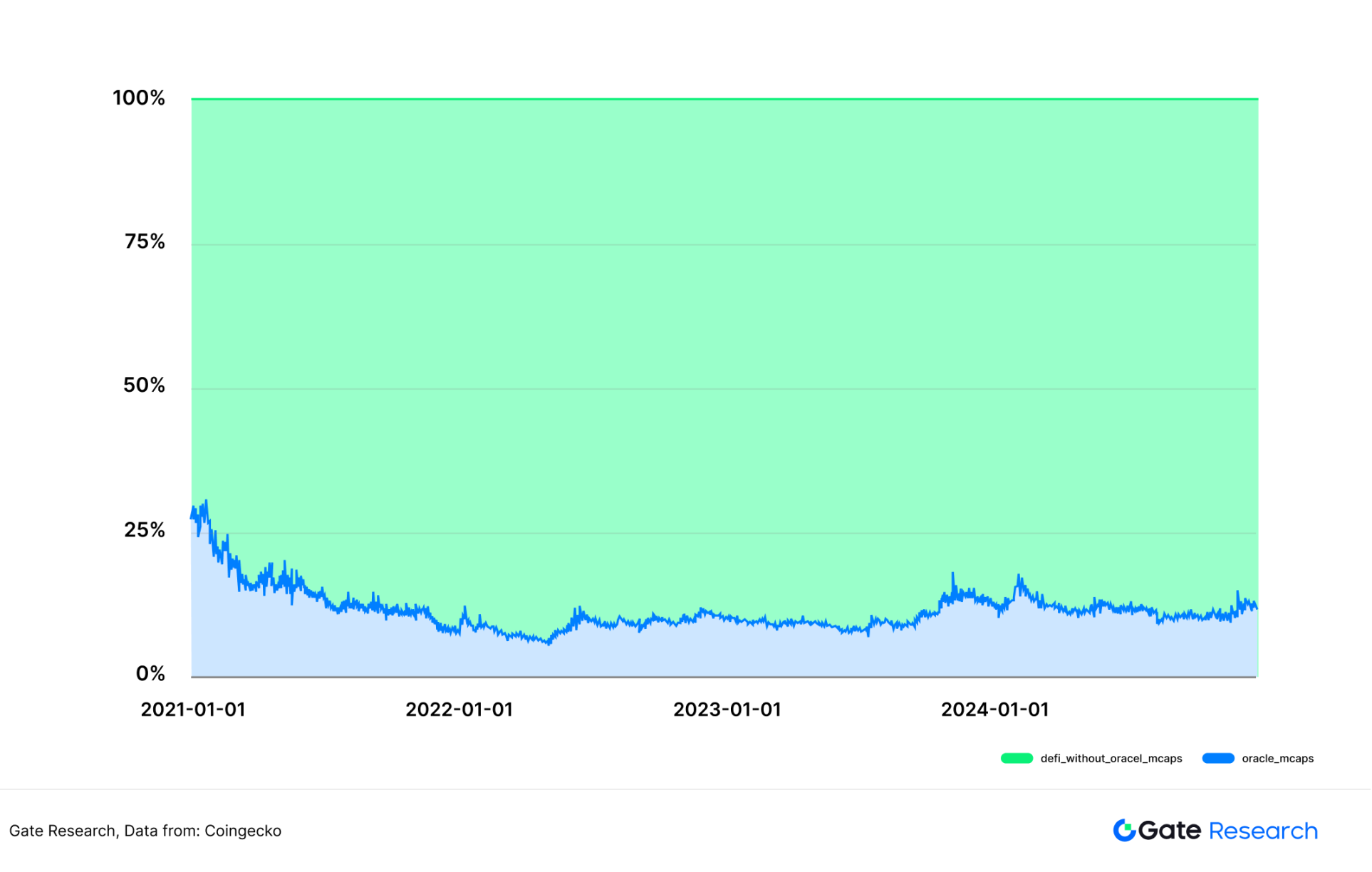

From historical data, as of the end of 2024, the total market capitalization of oracle projects is $10.55 billion, accounting for 11.8% of the total DeFi market capitalization ($91.268 billion). Compared to early 2021, when the market capitalization of oracles once accounted for over 25% of DeFi, this proportion has significantly decreased. The core reason for this change is that new models like re-staking have expanded the boundaries of the DeFi industry, but compared to other inherent DeFi sub-sectors, the "necessity" of oracles remains solid.

Figure 3: Changes in Oracle Market Capitalization as a Percentage of DeFi Market Capitalization from 2021 to 2024

Data: Coingecko

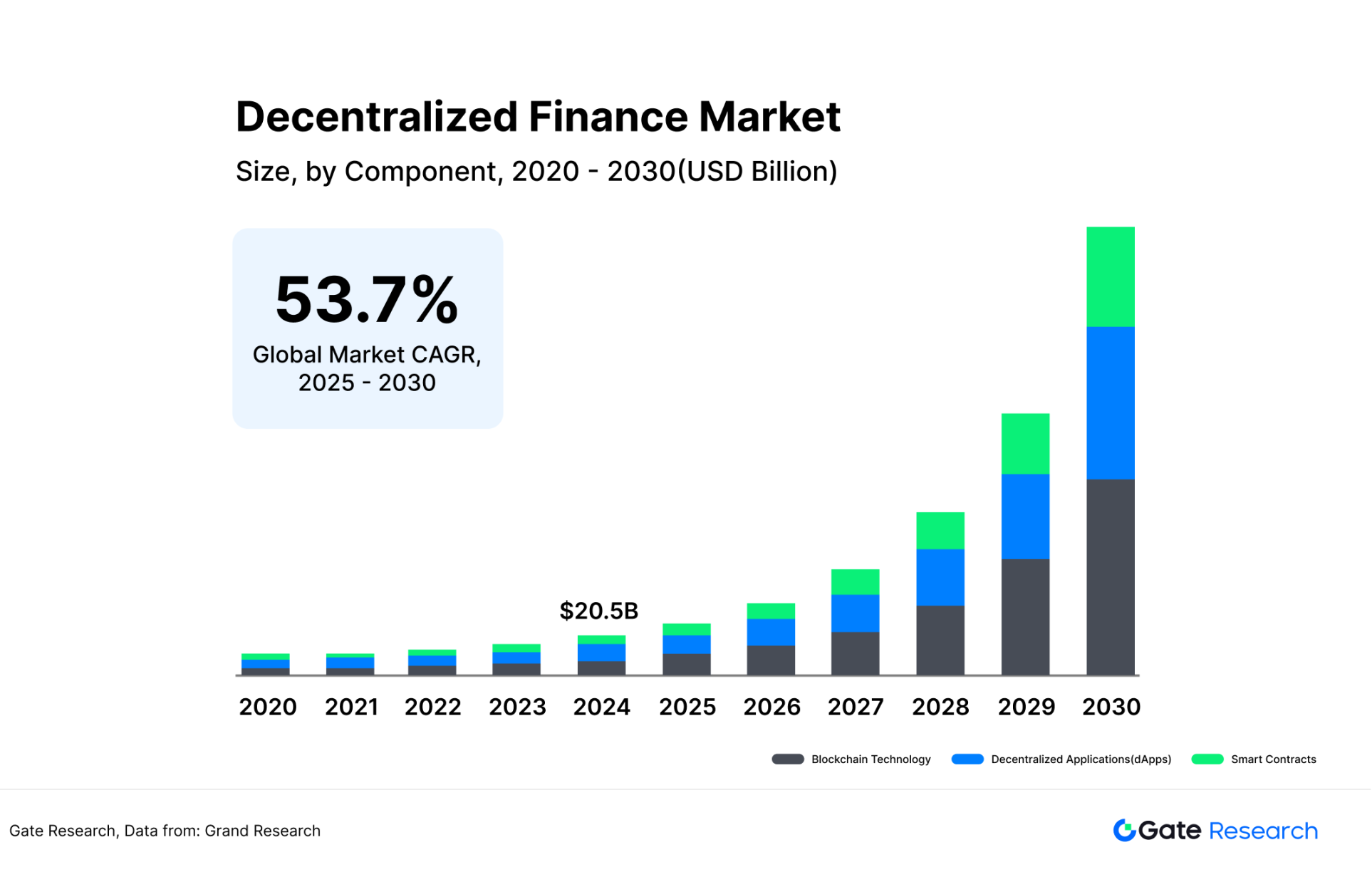

Based on Grand View Research's forecast for the DeFi market (with a compound annual growth rate of about 53% from 2025 to 2030, reaching a market capitalization of $231 billion by 2030), this article introduces two hypothetical scenarios—"stable proportion" and "declining proportion"—to estimate the market space for oracles:

● Optimistic Scenario: If the oracle market size can maintain 10% of the DeFi market size, it will reach $23.1 billion by 2030.

● Neutral Scenario: If the oracle market size remains at 6-8% of the DeFi market size, it will be $13.8-18.4 billion by 2030.

This predictive model calculates the potential market capitalization of oracles using the "market capitalization proportion × total DeFi market capitalization" method, reflecting both its dependence on DeFi growth and the gradually slowing independent growth rate of the oracle industry relative to DeFi.

Figure 4: Grand View Research's Forecasted DeFi Market Size

3. Major Projects in the Oracle Sector

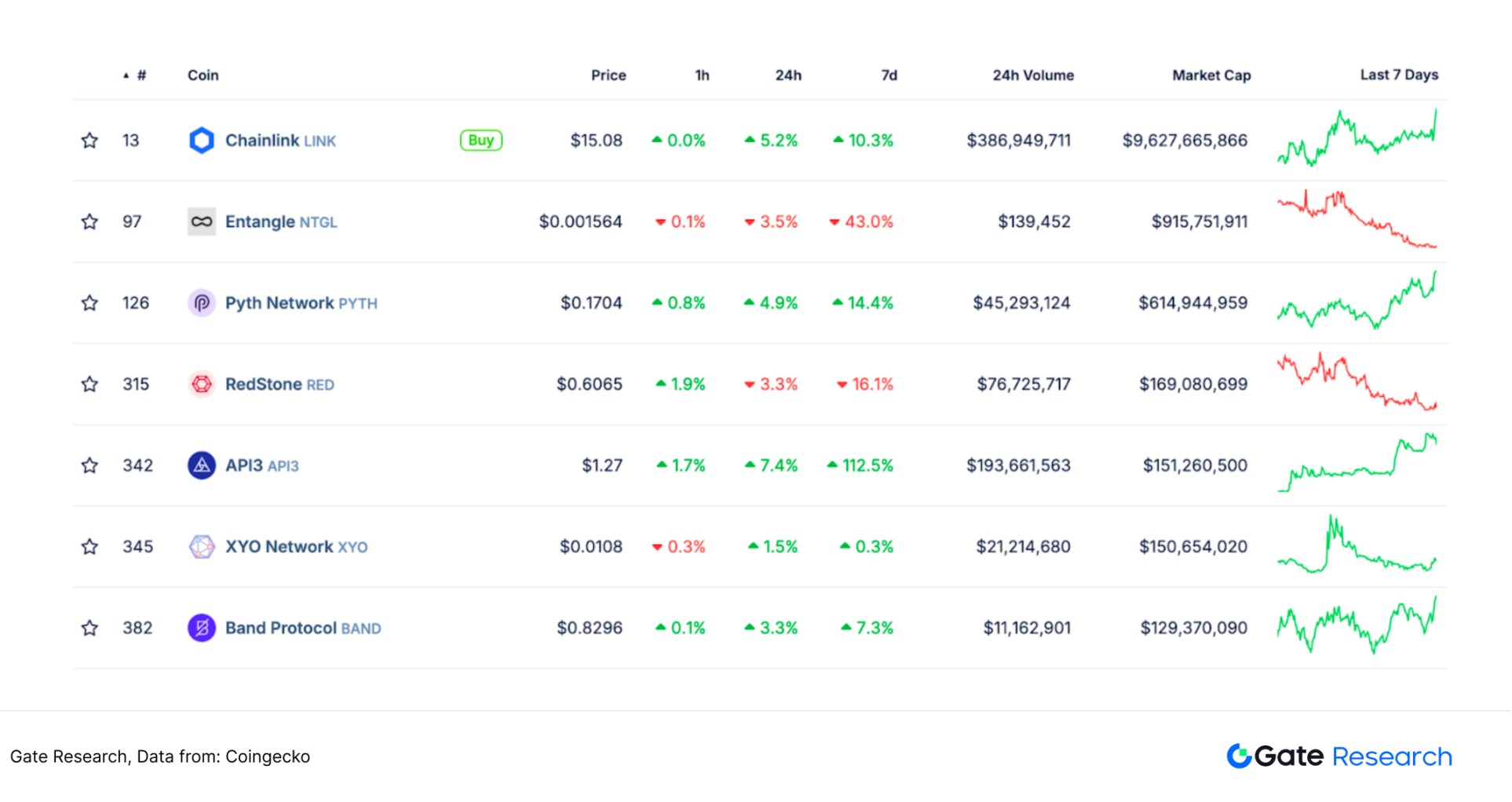

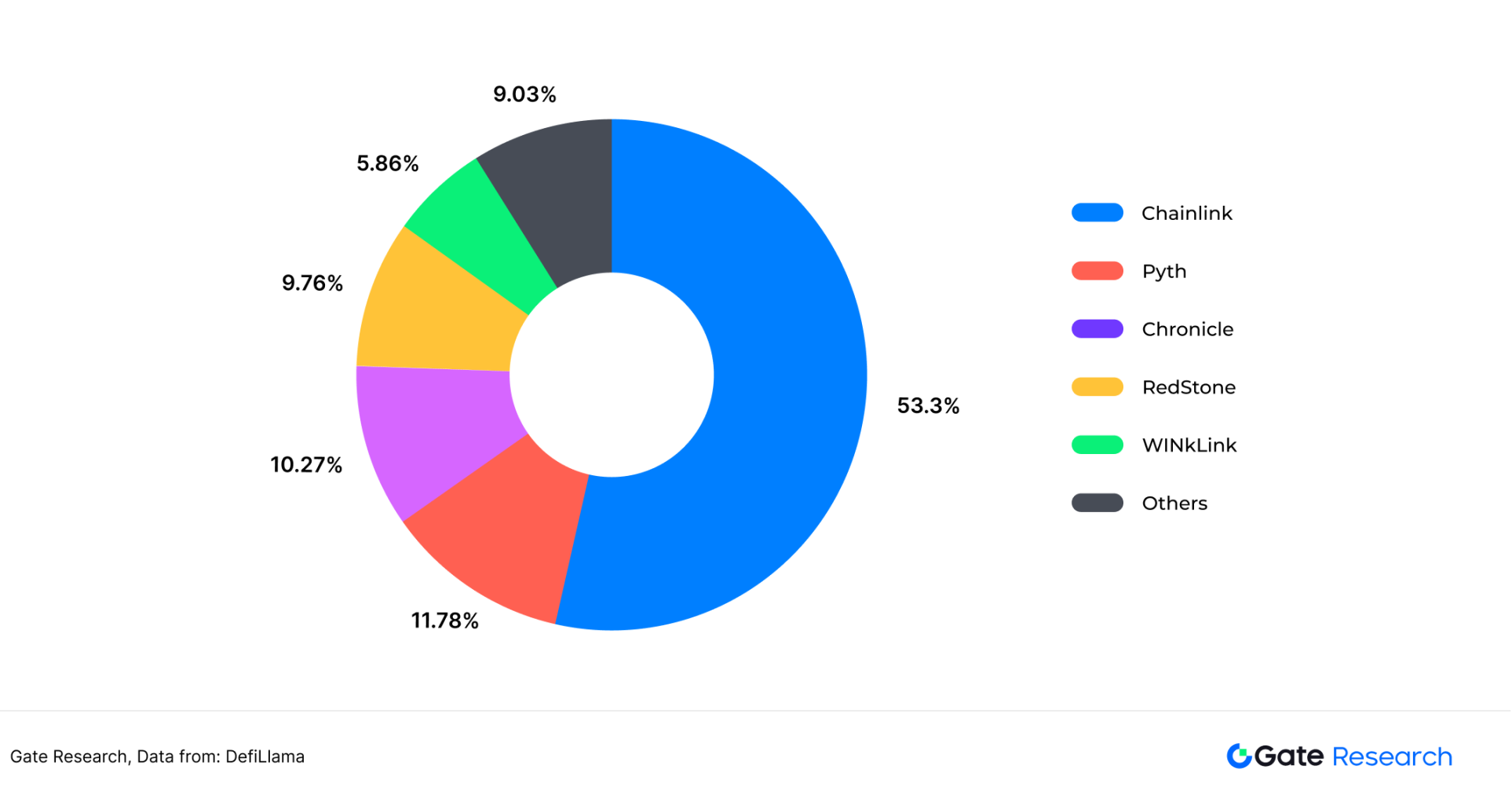

Currently, the landscape of the oracle industry can be described as dominated by one player. In terms of token market capitalization and TVS (Total Value Secured), Chainlink is the absolute leader in this sector. As of March 2025, the TVS of the Chainlink project is $31 billion, accounting for 53.3% of the total TVS of the entire oracle sector, while its token market capitalization is $9.6 billion, accounting for 76.9% of the total market capitalization of the oracle sector. Beyond Chainlink, projects like Pyth Network, UMA, and API3 also occupy a place in the oracle sector due to their advantages in low latency, verification mechanisms, and data acquisition.

Figure 5: Token Market Capitalization of Major Oracle Projects

Figure 6: DefiLlama Data on TVS (Total Value Secured) of Major Oracle Projects

Figure 7: Comparison of Major Projects in the Oracle Sector

Note: TVL and total token market capitalization data are from March 2025.

3.1 Chainlink

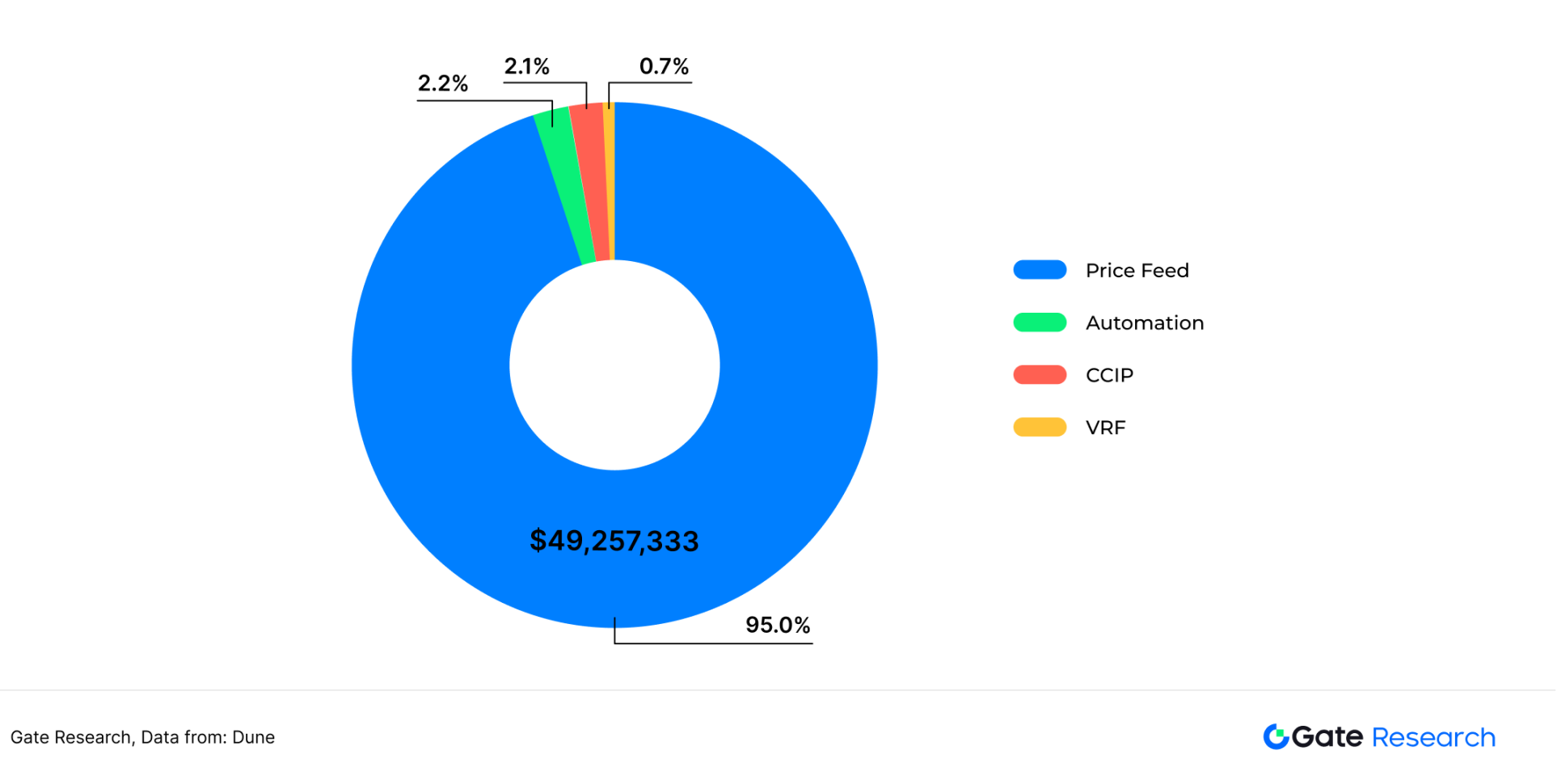

Chainlink is the absolute leader in the oracle sector, established in 2017, and is one of the earliest oracle projects. Chainlink provides services such as data feeds, automation, verifiable random functions (VRF), and cross-chain operations (CCIP). In 2024, in terms of revenue composition, the income from data feed services accounted for the highest proportion of the project's revenue, making up 95% of cumulative income, with DeFi protocols as its main service users; the income from the other three types of services totaled 5%. The income from automation services and cross-chain services each accounted for 2%, while revenue from random number generation services was less than 1%.【4】

Figure 8: Revenue Breakdown of Chainlink Project in 2024

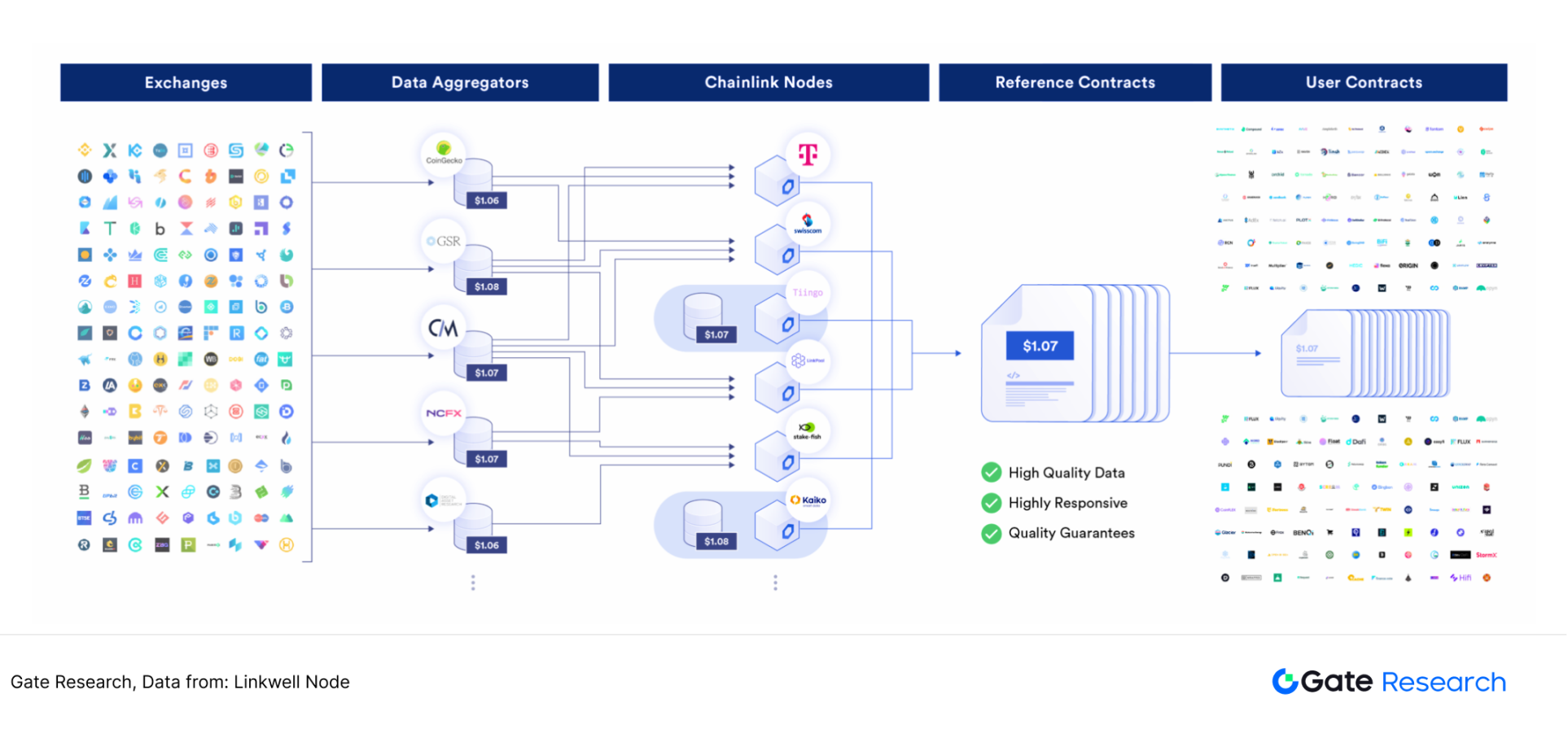

3.1.1 Chainlink Data Feed Services

Data feeds are one of the most traditional services of oracles. As one of the earliest decentralized oracle projects, Chainlink's data feed service does not directly obtain prices from third-party APIs but instead acquires data through data nodes. For example, when the Aave lending platform retrieves the real-time price of ETH/USDT, a user's on-chain transaction request triggers a smart contract that calls Chainlink's oracle service to obtain the latest price data. Chainlink oracles do not source information from a single data source; instead, they gather data from multiple high-quality data aggregators (such as CoinMarketCap and CoinGecko) through several independent nodes, which aggregate and clean the data locally before submitting it to the chain.

Subsequently, Chainlink's aggregation contract filters and performs a weighted average on the data reported by all nodes to derive a final on-chain price for smart contract calls. In this process, the oracle nodes consist of independent operators such as LinkPool, ChainLayer, and Mycelium. After using this price data, the Aave platform pays the Chainlink network with $LINK tokens as service fees through a smart contract.【5】

Figure 9: Chainlink Data Feed Service Flowchart

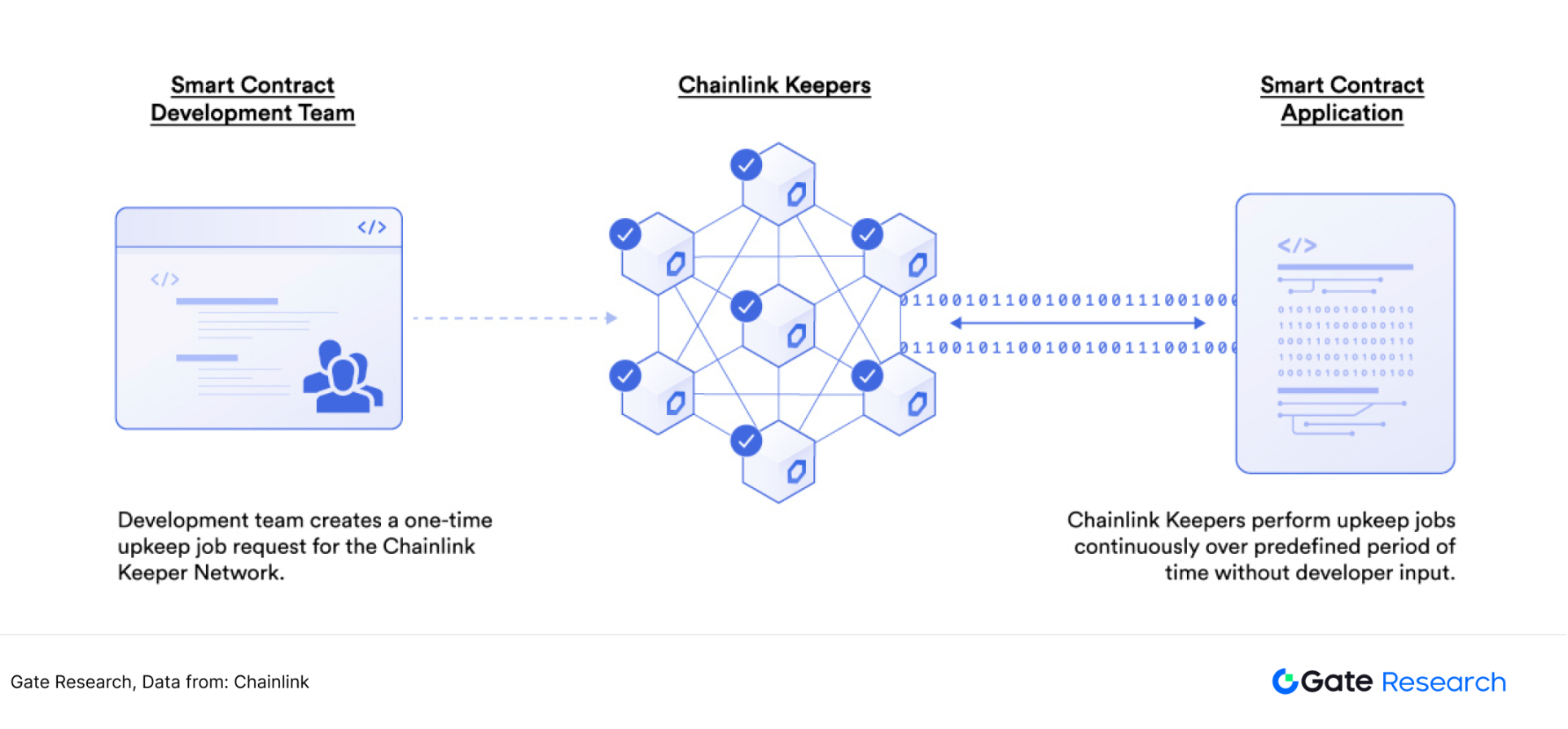

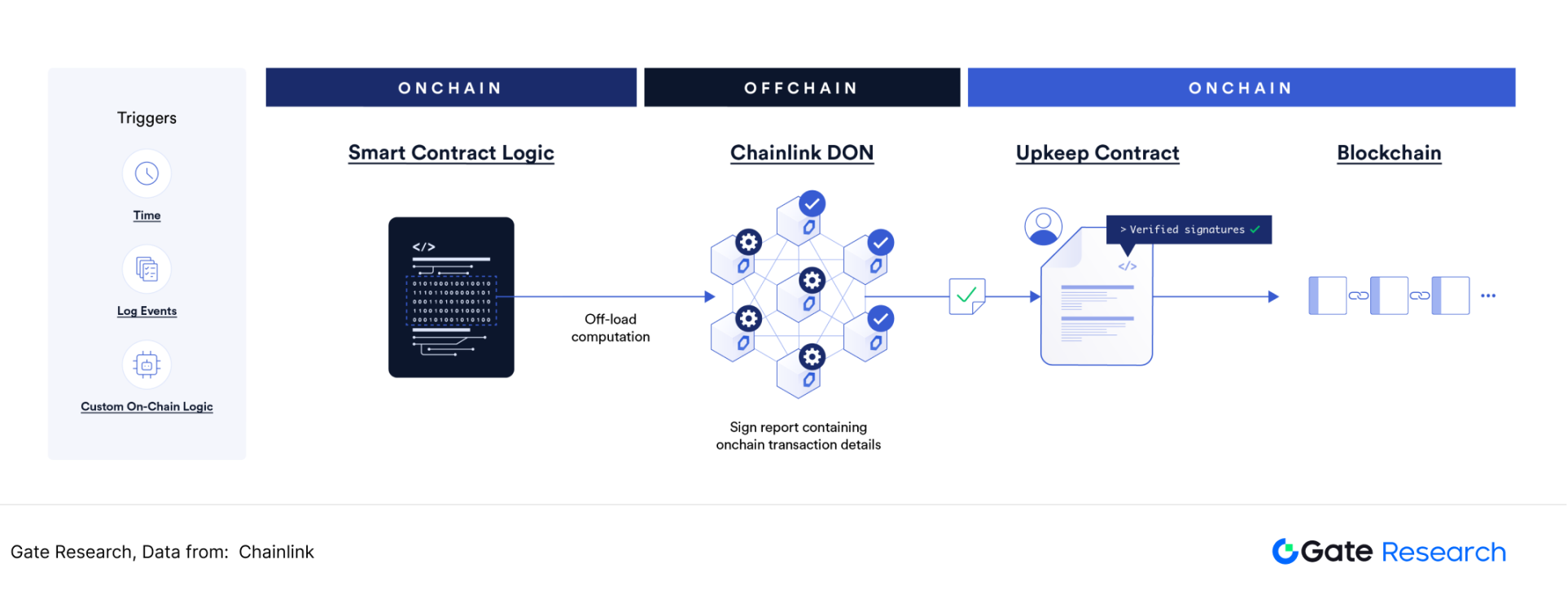

3.1.2 Chainlink Automation

Automation is another important revenue-generating business for the Chainlink project. In 2021, Chainlink launched the Keeper transaction automation service. A Keeper is an externally owned account (EOA) that can trigger smart contracts to execute based on predefined conditions under certain economic incentives. Keepers use off-chain computation to execute the same smart contract functions as on-chain. Once the function returns true, Keepers initiate an on-chain transaction to call the on-chain smart contract function. In practical applications, Keepers can be used to automatically execute operations triggered by specific events, such as minting NFTs, rebalancing liquidity supply, yield aggregation, and loan repayments. Keepers were also the most important product of the Chainlink project during the Automation 1.0 era.【6】

Figure 10: Workflow of Chainlink Keeper

In 2024, Chainlink launched Automation 2.0. Automation 2.0 introduced cryptographic consensus into decentralized off-chain computation, transferring the expensive computational verification from the blockchain network to the off-chain network. Developers can improve the runtime of their dApps, reduce costs, and simplify user experience. The savings in gas fees and improvements in computational performance will encourage more developers to choose Chainlink's Automation 2.0 solution.【7】

Figure 11: Workflow of Chainlink Automation 2.0

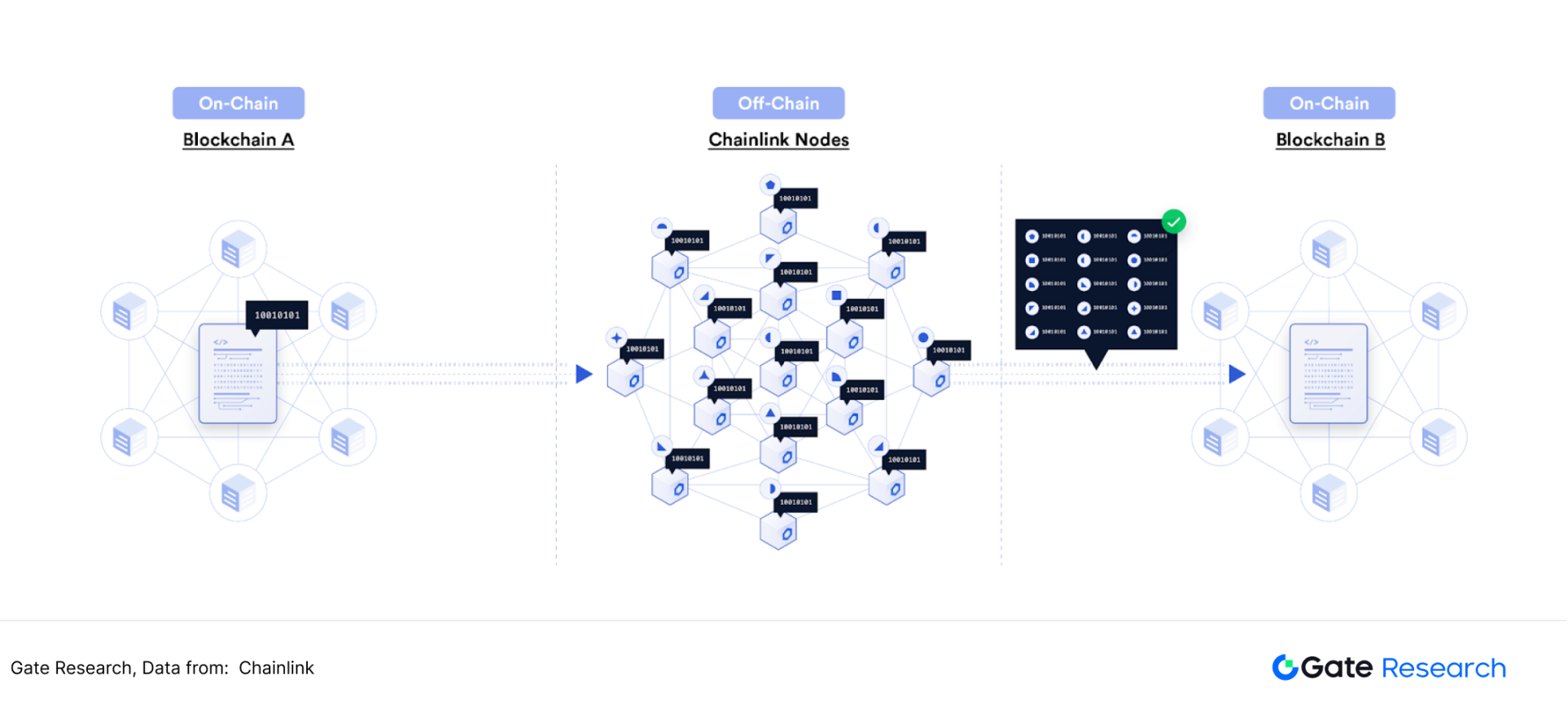

3.1.3 Chainlink Cross-Chain Protocol

In 2021, Chainlink released the Cross-Chain Interoperability Protocol (CCIP), a new open-source standard for cross-chain protocols. This protocol provides smart contract developers with a general infrastructure with computational capabilities, enabling the transmission of data and smart contract instructions across various blockchain networks. CCIP will become the underlying protocol for various cross-chain services, including Chainlink's programmable token bridge, allowing users to securely and efficiently transfer tokens to any blockchain network with scalability.

For example, if a user wants to transfer 1,000 USDT assets from Sui to Solana, the key point is that the cross-chain bridge must verify that the user actually owns 1,000 USDT on the Sui chain. The Chainlink network, with its large and decentralized node network, has a strong advantage in cross-chain verification and data relaying, making it well-suited for such high-security requirement cross-chain scenarios.

Figure 12: Flowchart of Chainlink Asset Cross-Chain Implementation

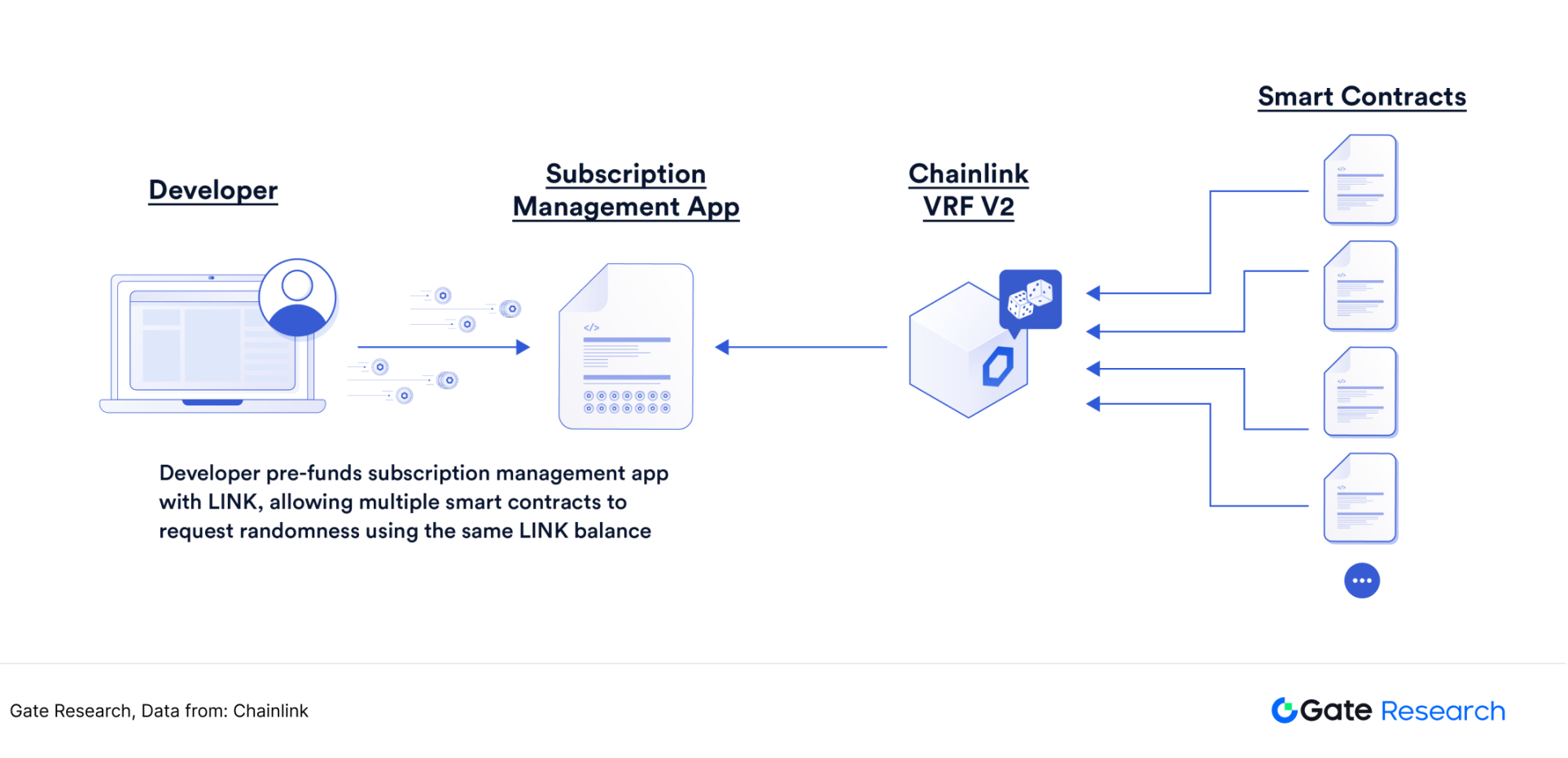

3.1.4 Chainlink Verifiable Random Function

A verifiable random function is a cryptographic function that generates pseudo-random numbers based on data input and attaches a proof that anyone can verify. Chainlink VRF uses Goldberg's verifiable random function (VRF). Chainlink VRF generates one or more random numbers for each random number request and attaches a cryptographic proof of the random number. This proof is published on-chain and verified on-chain, and only after verification is the random number used. Chainlink VRF has covered multiple blockchain networks, including Ethereum, Polygon, and BSC. In February 2022, VRF V2 was officially launched, representing a new upgraded version of VRF with stronger performance and higher security.

Figure 13: Interaction of Chainlink Verifiable Random Function with Smart Contracts

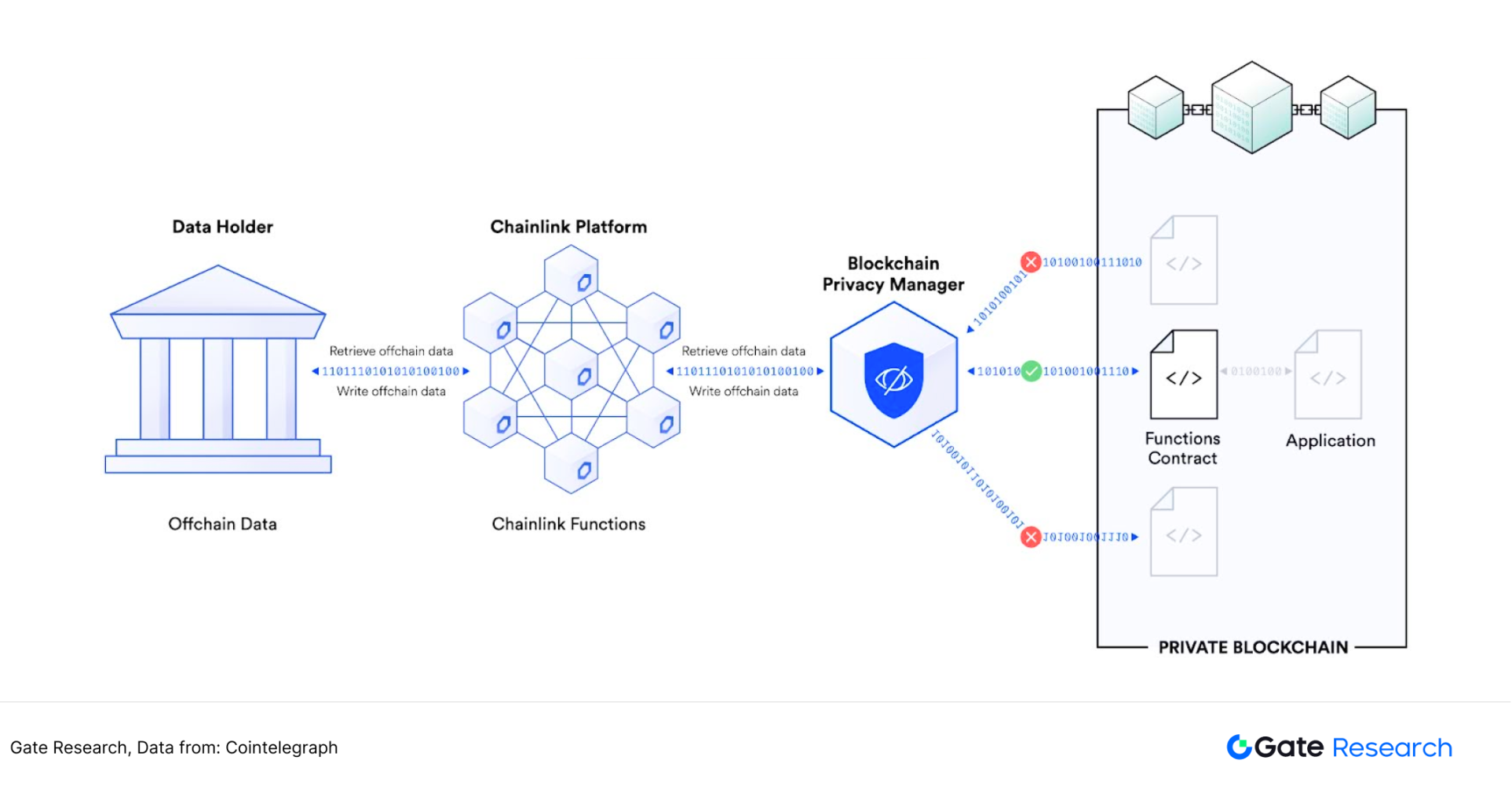

3.1.5 Chainlink Enterprise Privacy Data Services

As one of the earliest oracle projects, Chainlink has formed a strong moat in its data feed business, and the expansion of other services has not stagnated. There has been significant growth in automation, cross-chain protocols, and verifiable random numbers. Additionally, there are many enterprises that require point-to-point transmission of privacy data. To meet this demand, numerous startups focus on privacy data, employing methods such as multi-party secure computation (MPC), zero-knowledge proofs, homomorphic encryption (HE), trusted execution environments (TEE), and federated learning. Chainlink's robust verification network can ensure the security and timeliness of privacy data transmission.

Chainlink can provide enterprises with opportunities to sell data and API services to the blockchain environment, enabling various functions such as uploading privacy data to the chain, computing contract logic off-chain, and trading privacy data on-chain. In November 2024, Chainlink announced the completion of a pilot program with the Society for Worldwide Interbank Financial Telecommunication (SWIFT) and Swiss banking giant UBS. This pilot project tested tokenized fund settlements among parties, including interactions between traditional financial systems and the digital economy without using cryptocurrencies.【8】

Figure 14: Flowchart of Chainlink Privacy Data On-Chain Process

3.2 Pyth Network

Compared to predecessors in the oracle sector like Chronicle, Chainlink, and WINkLink, Pyth Network only completed its project launch in 2021. Oracles are a key component of the grand narrative of the high-performance Solana public chain, supporting not only on-chain transactions but also narratives such as DePIN, AI, and low-latency payments. Pyth Network is also a project heavily supported by the Solana Foundation. The fast price update frequency is one of Pyth's important labels.

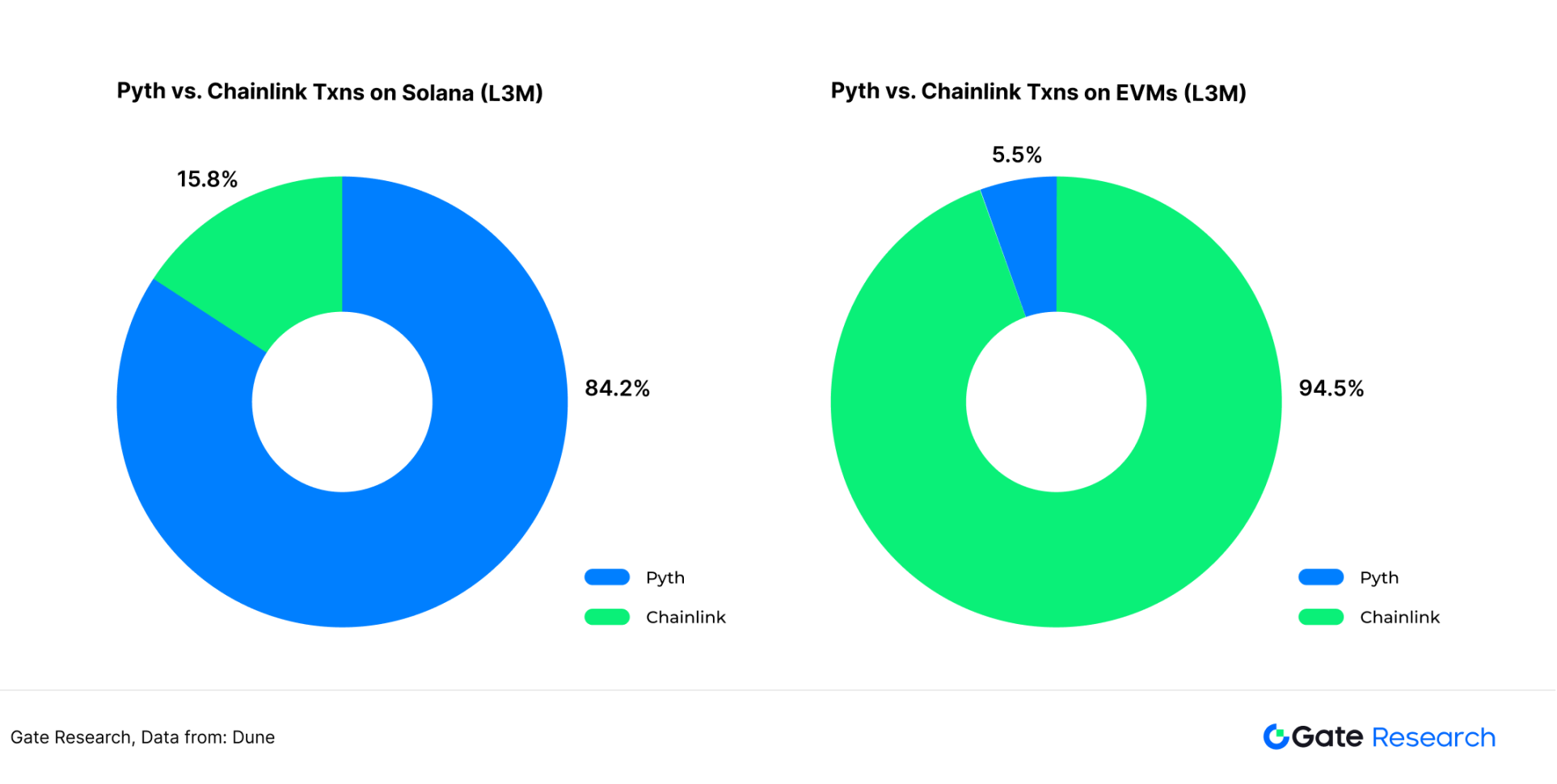

Pyth Network supports a total of 65 public chains, second only to Redstone, making it one of the oracles with the most public chain support. However, its main data feed services still occur on the Solana chain. According to Dune data analysis, both Chainlink and Pyth have established certain barriers in their interactions on Ethereum and Solana, making it difficult for each to expand market share on the other's public chain.

【9】

Figure 15: Number of Data Feed Service Transactions for Pyth and Chainlink on Ethereum and Solana

3.2.1 Pyth Network Data Feed Services

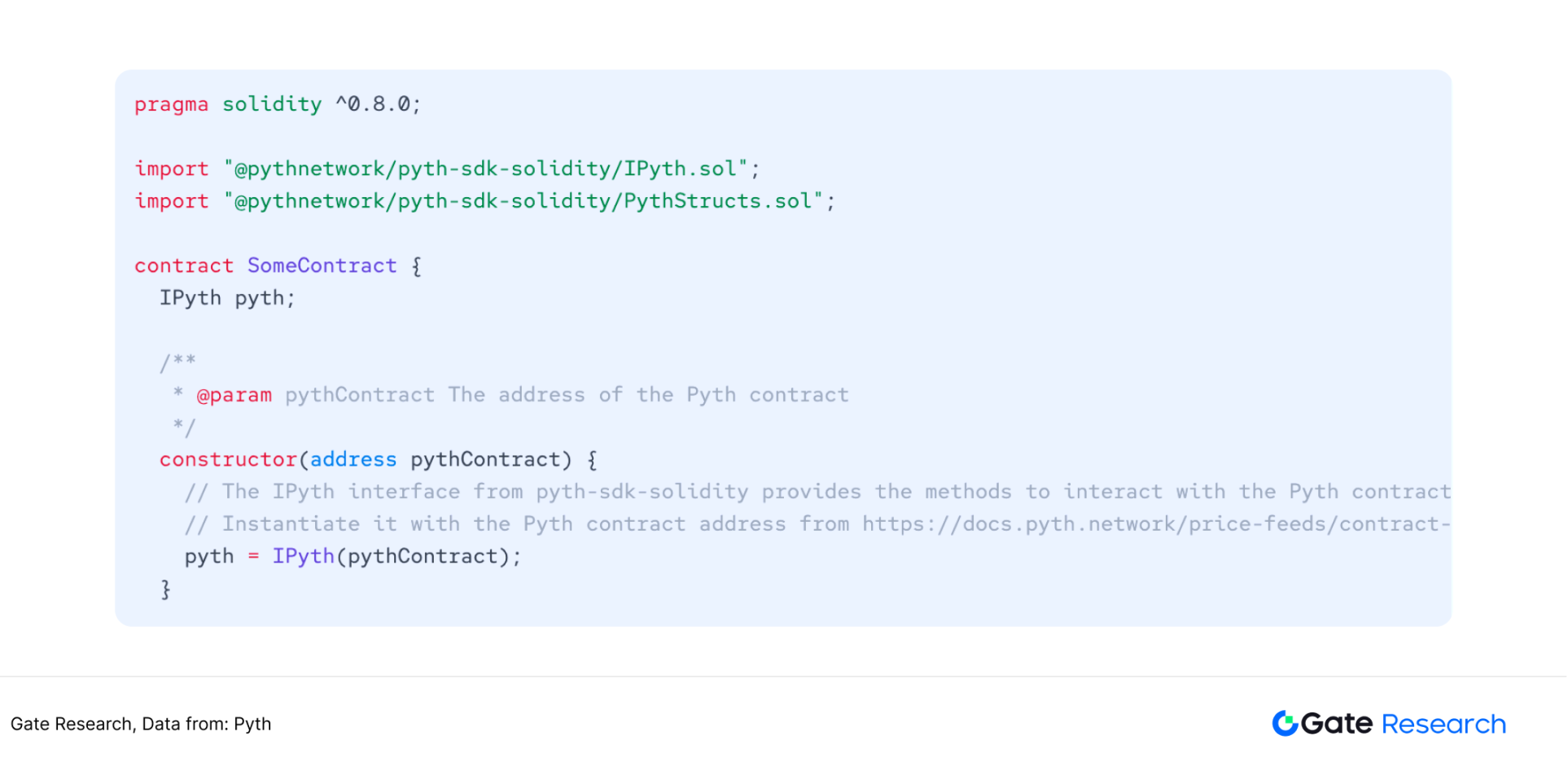

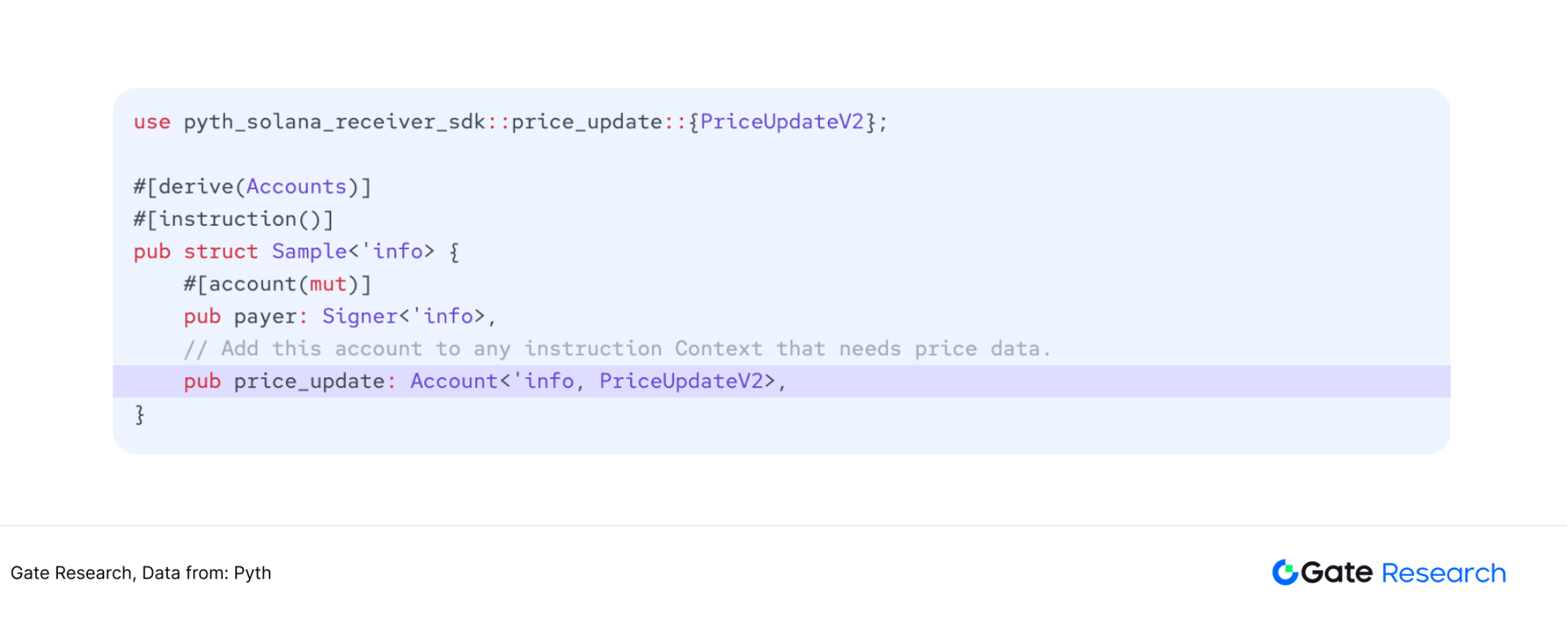

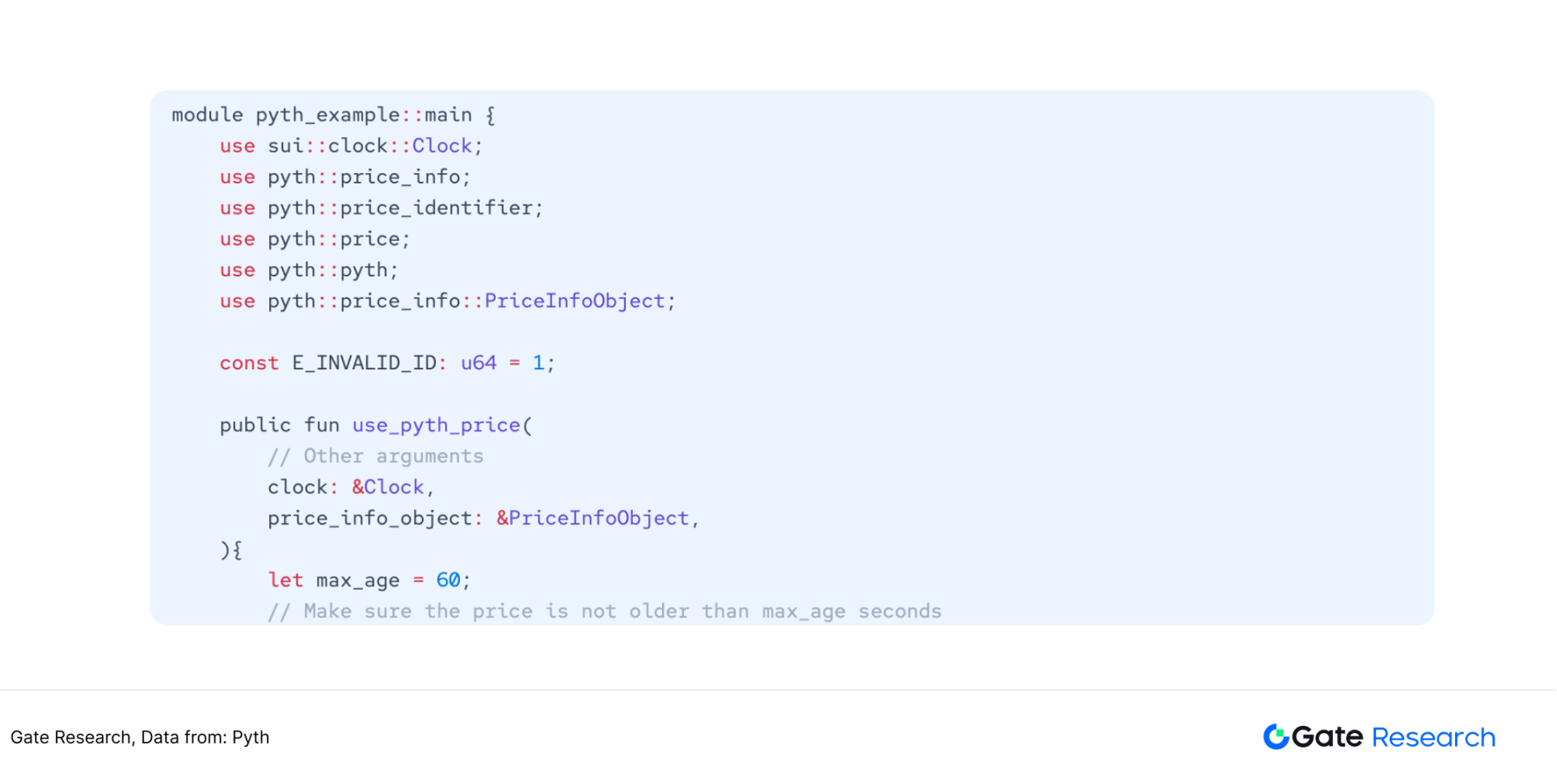

From the oracle competitiveness model mentioned in the introduction, the competitiveness of Pyth's data feed services mainly lies in its low latency and exclusivity. Pyth does not set up node service providers for its data feeds; several financial institutions, including Wintermute and Flowdesk, serve as primary data suppliers for Pyth. Pyth's data feed services provide corresponding SDKs for different types of public chains, such as EVM chains, Solana, and Sui. Once users install the SDK, they can call (import) Pyth's data feed services. 【10】

Figure 16: Calling Pyth Data Feed Service in Solidity Development Environment after Installing SDK on EVM Chain

Figure 17: Calling Pyth Data Feed Service in Rust Development Environment after Installing SDK on Solana

Figure 18: Calling Pyth Data Feed Service in Move Development Environment after Installing SDK on Sui

3.2.2 Pyth Network Random Number Generation Service

Pyth Entropy is the random number generation product launched by Pyth Network. The principle of generating random numbers is similar to Chainlink's random number generation service. Generating random numbers with Pyth Entropy can be accomplished in just a few lines of code. Users of the service need to call the requestWithCallback method of the IEntropy contract, which requires users to pay fees in Gas Tokens, with different fees on each chain. By constructing a callback function, the contract can obtain the random number generated by the entropy contract.

Figure 19: Calling Pyth Entropy in Solidity Development Environment after Installing SDK on EVM Chain

3.2.3 Pyth Network Express Relay Service

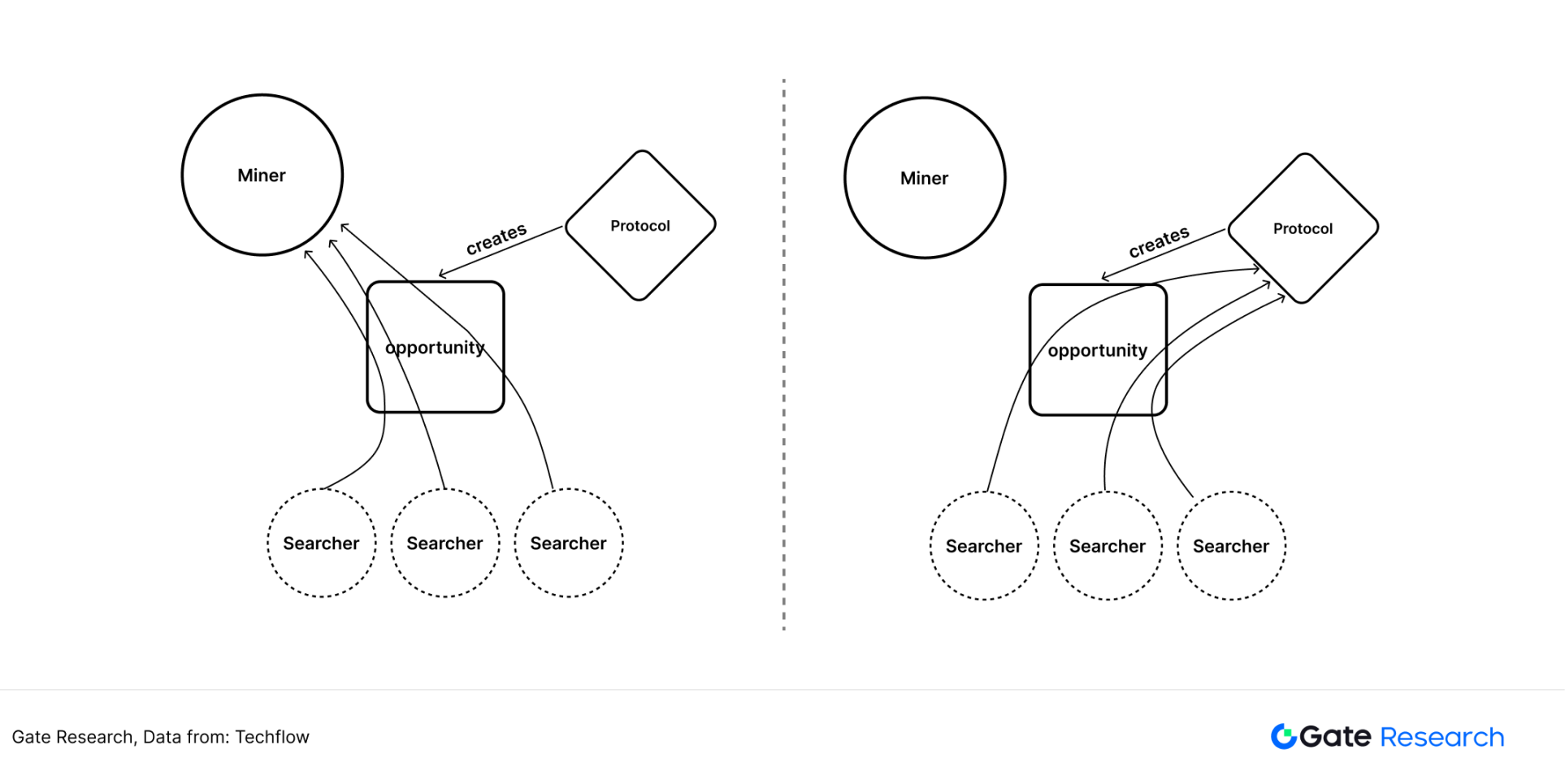

The Express Relay service is the latest product launched by the Pyth team in July 2024, aimed at eliminating on-chain MEV (Maximum Extractable Value). MEV itself is a controversial topic, specifically referring to certain nodes arbitraging through transaction ordering on-chain, especially on low TPS public chains like Ethereum, where arbitrage is easier. Public chains have different attitudes towards MEV; some choose to tolerate it, while others try to minimize the arbitrage profits from transaction ordering.

To understand the significance of Express Relay, consider an example from the Solana network. Memecoin trading on the Solana chain is a type of transaction that requires very high timeliness, as a token may experience a price fluctuation of over 10% within seconds. Therefore, if traders use the Orca protocol for trading, they need to pay a certain percentage of tips to on-chain nodes like Helius and Galaxy to prioritize processing their transactions. With Express Relay, the Solana network adds a relay that allows users to search and bid for priority processing of transactions, with the highest bidder getting their transaction processed first. The bidding profits will go to protocol layers like Orca, rather than nodes like Helius, maximizing the benefits for DeFi protocols. 【11】

Figure 20: Illustration from the article "Eliminating MEV: Understanding Pyth Network's New Product Express Relay"

Express Relay is not only an important product launched by Pyth Network; it also plays a role in supporting decentralized finance protocols on the Solana chain, such as Orca, Jupiter, and Kamino. By eliminating MEV, it returns profits to the protocol layer. The increase in revenue will encourage more DeFi developers to choose the Solana ecosystem.

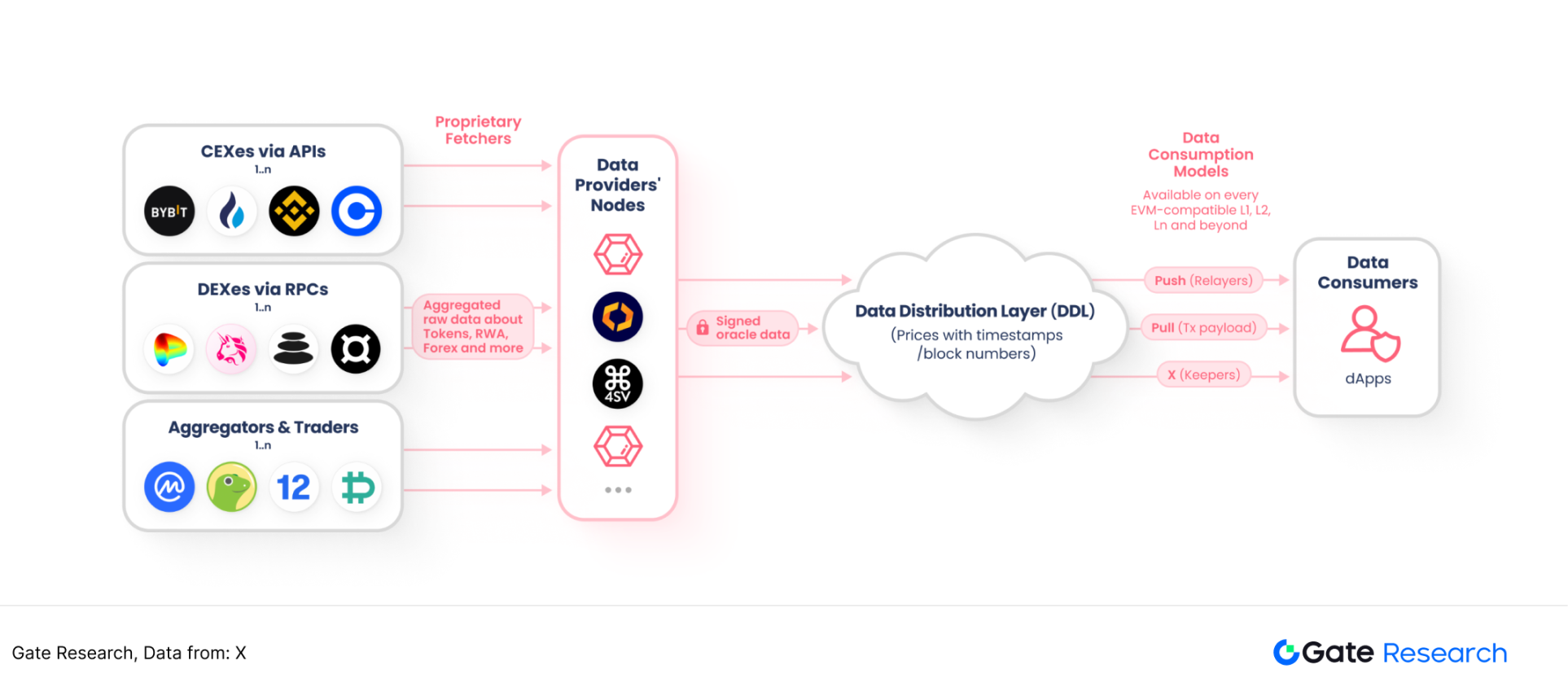

3.3 Redstone

Chainlink and Pyth occupy core positions in the Ethereum and Solana ecosystems, respectively, forming their distinct ecological labels. However, there are currently some oracles in the market that do not take sides between Ethereum and Solana but instead provide services to as many public chains as possible. Redstone is a representative of such oracles, having completed integration with over 70 public chains, making it the oracle project with the most integrated public chains.

Redstone's products include both push and pull models, as well as a new field of AI oracles. The push and pull models are the two most commonly used methods for obtaining data by oracles. Chainlink uses the push model, where data operators push off-chain data onto the chain, which is fast but may lead to errors without a robust verification mechanism. Pyth, on the other hand, uses the pull model, which is relatively flexible, allowing data to be pulled when needed; however, it suffers from unstable data updates. Redstone is currently the only data supplier that employs both Push and Pull models simultaneously. 【12】

Figure 21: Redstone Service Process Design

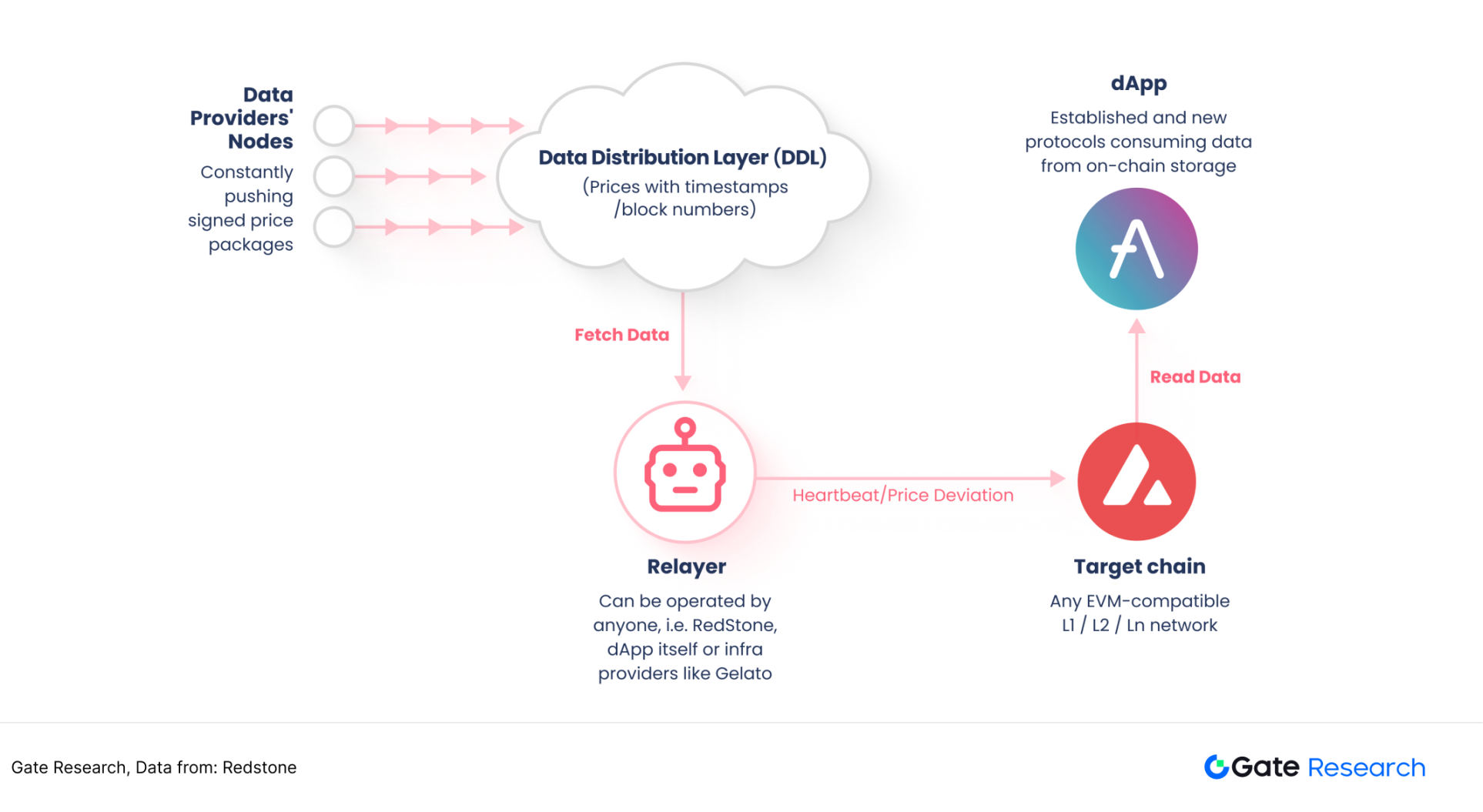

3.3.1 Redstone Push Model

The push model consists of two main parts. The first part is the off-chain relay, responsible for pushing data onto the chain in a customized manner through environmental variables. The second part is the on-chain contract, which stores prices and retrieves them through familiar interfaces (such as Chainlink Aggregator).

The off-chain relay is an innovative design, as previous oracle projects did not include this processing layer. The relay operates as a service based on environmental variables in a customizable manner. It regularly checks a defined set of conditions and pushes prices when those conditions are met. Currently implemented conditions include time conditions and price deviation conditions. This design facilitates DApps on the chain, allowing them to call oracle services only when certain conditions are met, achieving customization and automation of data feed services. 【13】

Figure 22: Push Model Workflow

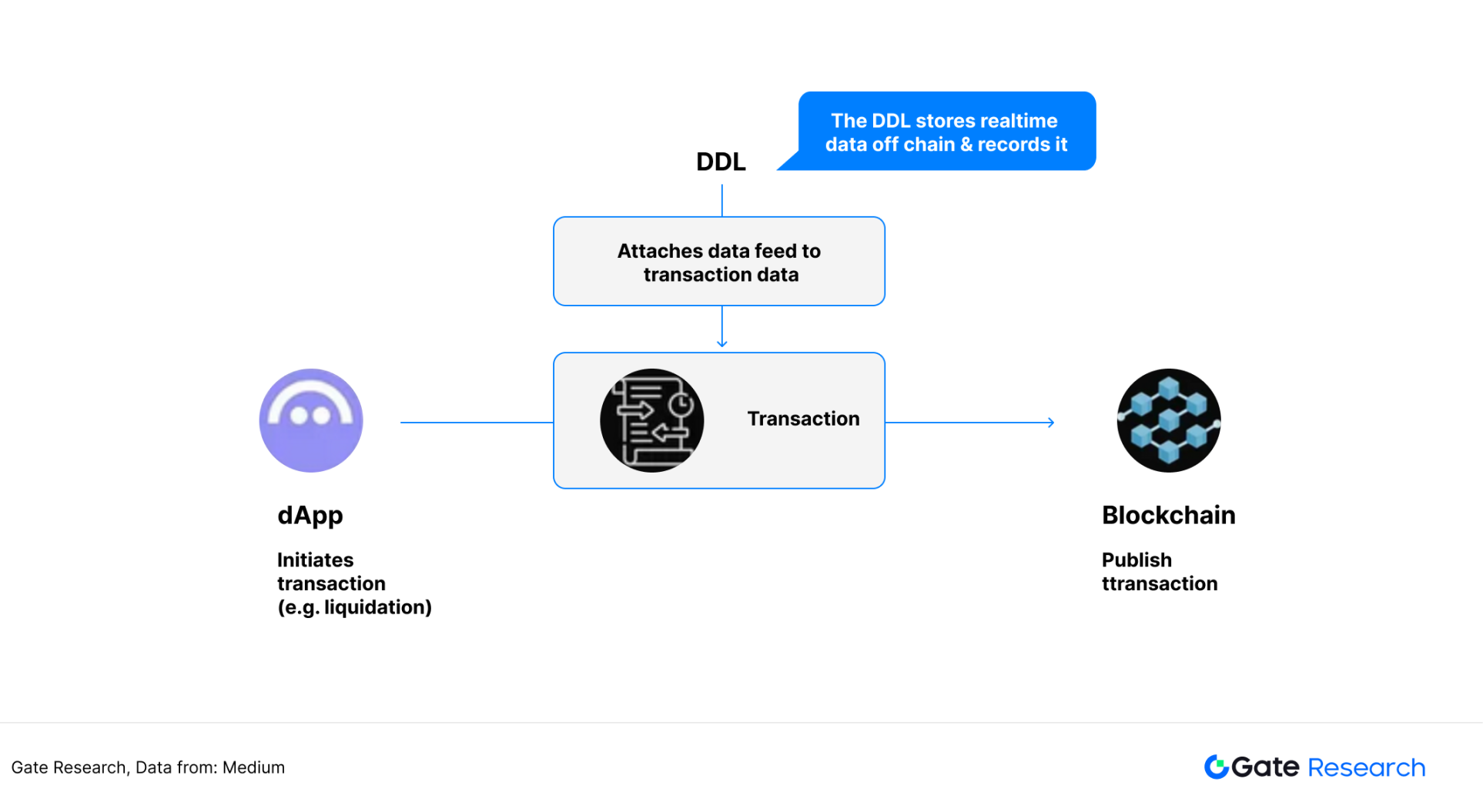

3.3.2 Redstone Pull Model

On-chain smart contracts actively call the oracle interface when they need data, requesting the latest off-chain data from Redstone, rather than continuously receiving data pushes in advance. Redstone's Pull model injects data directly into user transactions, maximizing gas efficiency while simplifying dApp data access. 【14】

Figure 23: Pull Model Workflow

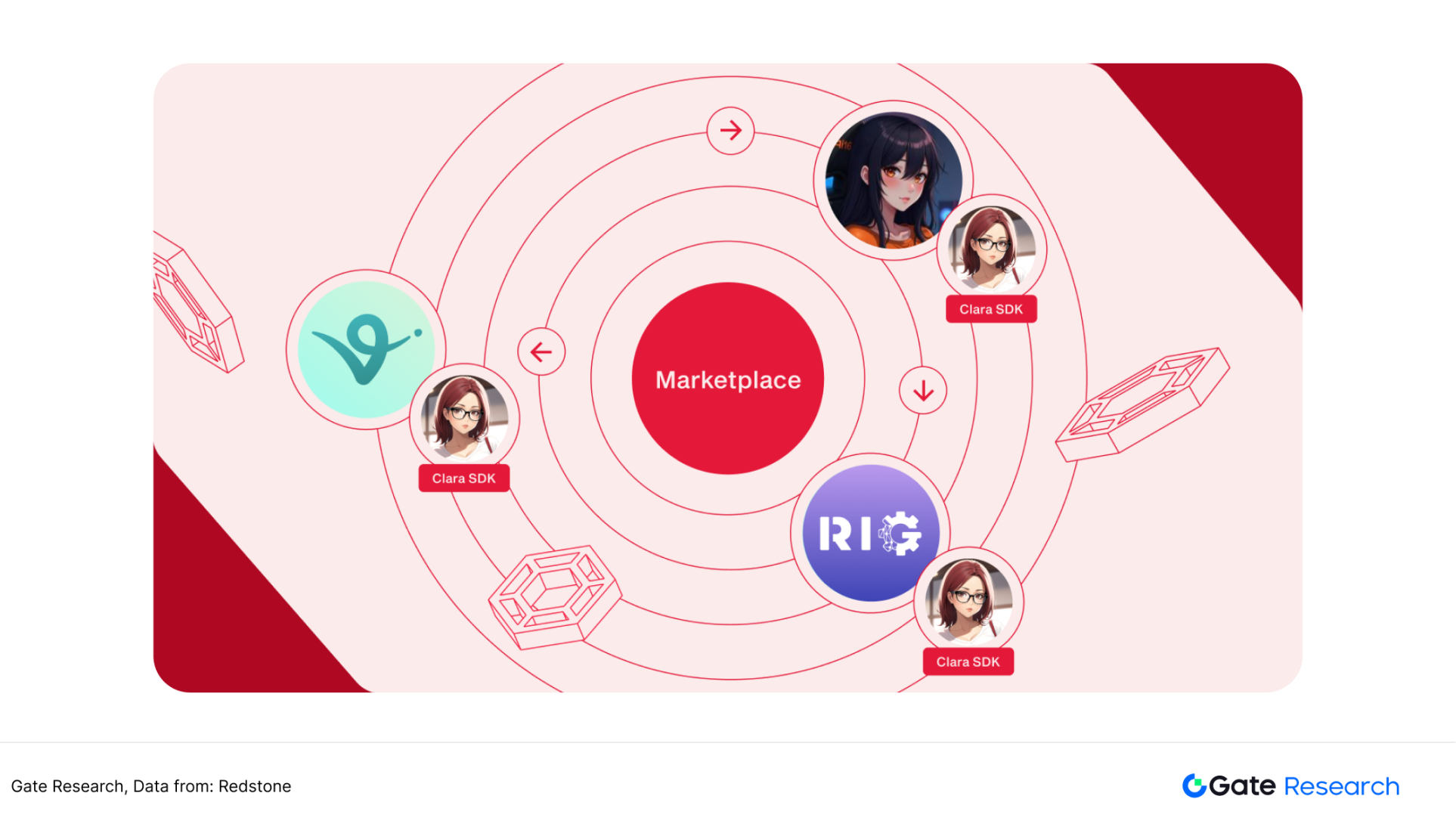

3.3.3 Redstone AI Oracle Architecture CLARA

CLARA is a blockchain communication layer framework launched by Redstone, aimed at achieving seamless communication between agents. The CLARA agent protocol consists of three key components: the market module, CLARA SDK, and framework plugins. The market module coordinates relationships between various agents and is responsible for key processes such as verification and transactions. The CLARA SDK is a developer toolkit that allows developers to easily connect to the CLARA network. Framework plugins integrate the CLARA communication architecture with mainstream AI agent architectures like Eliza, providing interfaces to make it a communication layer for mainstream AI agent architectures. In the future, Redstone will also launch multiple AI-related oracle services, leading the industry in its exploration of AI. 【15】

Figure 24: CLARA Can Interact with Multiple Mainstream AI Agent Architectures

4. RWA Opens the Second Growth Curve for the Oracle Sector

As the "data bridge" of the DeFi ecosystem, oracles are deeply integrated with the rapid growth of the industry through core functions such as price feeds and cross-chain settlements. However, as the penetration rate of the DeFi market approaches saturation, the limitations of over-reliance on a single scenario are becoming increasingly apparent—protocol revenues are easily impacted by market fluctuations, and technological iteration homogenization weakens long-term value capture. Unlike DeFi, which mainly provides price feeds, the demand for oracles in RWA is more complex, encompassing both asset valuation and real-time tracking and on-chain synchronization of physical asset statuses, making it a new battlefield for extending oracle capabilities. Building a "second curve" in the RWA scenario is expected to unlock a billion-dollar incremental market with trusted off-chain data keys.

4.1 Growing Demand for RWA Price Feed Services, Oracles Become Beneficiaries

The integration of traditional finance and crypto technology is one of the biggest narratives of 2024, featuring Bitcoin ETFs like IBIT that actively embrace traditional channels and traditional assets like U.S. Treasury bonds that are actively brought on-chain, such as BUIDL. For cryptocurrency investors, real-world assets serve as a favorable tool to hedge on-chain risks. Real-time feedback on off-chain asset prices requires the use of oracles as a bridge between on-chain and off-chain, allowing investors to monitor the net value changes of their total assets in real-time.

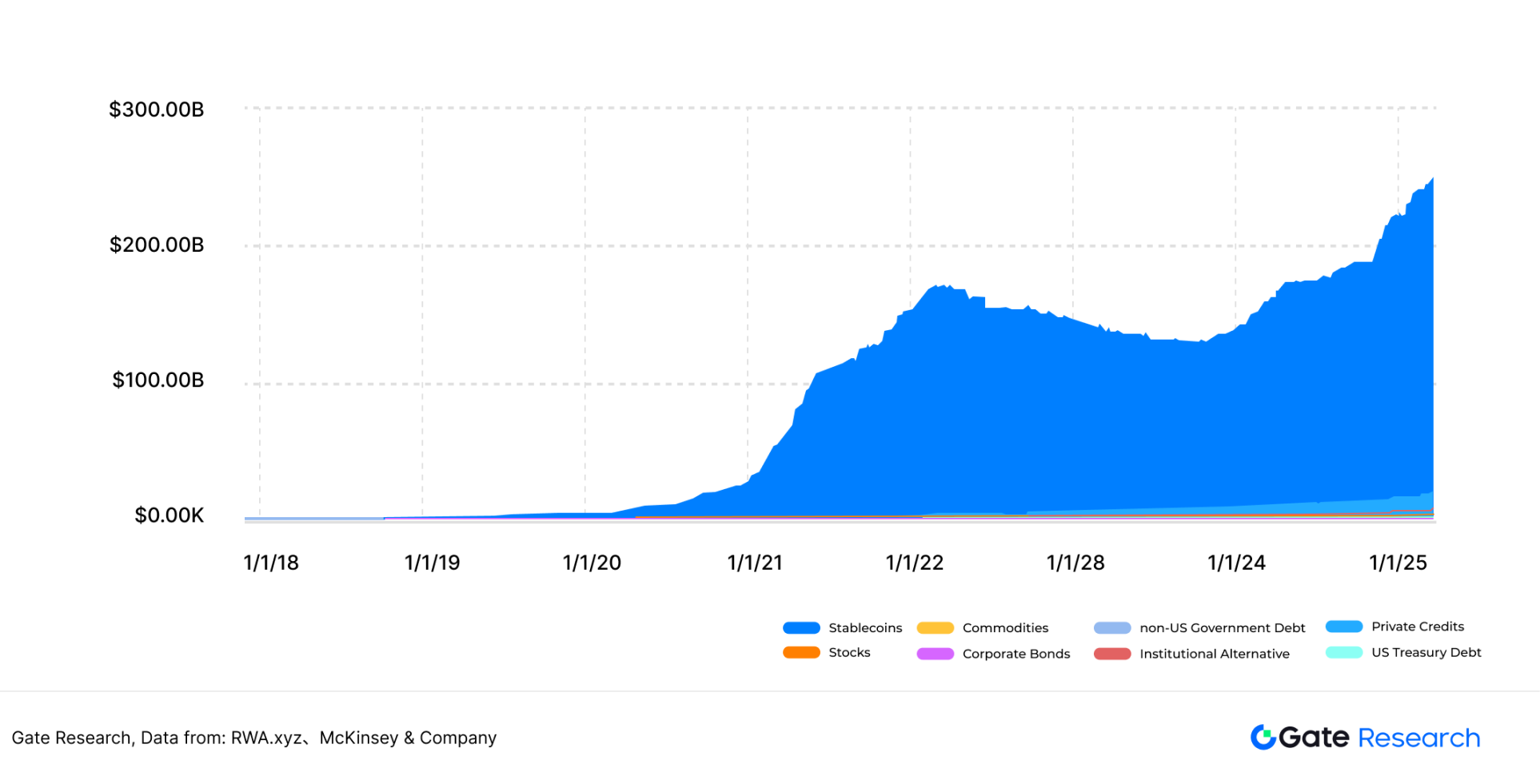

The price feed services invoked by RWA oracles are similar to those invoked by DeFi oracles. Since RWA truly began to take off in 2023, with the landmark event of BlackRock issuing on-chain U.S. Treasury bonds BUIDL occurring in February 2024, RWA is currently in its early developmental stage, with ample room for growth in the future. Consulting firm McKinsey predicts that by 2030, tokenized real-world assets will reach $20 trillion. As of March 2025, data from the RWA.xyz platform shows that the total asset scale of RWA is $247.4 billion (including stablecoins), indicating nearly tenfold growth potential. As an important infrastructure for RWA, oracles can gain significant revenue increments. 【16】【17】

Figure 25: RWA Asset Scale Trend Chart (Including Stablecoins)

4.2 Oracles Providing Services for RWA Projects

● Chainlink has supported Backed Finance's tokenized RWA price feeds.

In July 2023, the bTokens of Backed Finance, such as bIB01, bIBTA, and bCSPX, have supported the use of Chainlink Price Feeds, including the 0-1 year U.S. Treasury bond investment ETF IBO1, the 1-3 year U.S. Treasury bond fixed income ETF IBTA, and the tokenized real-world asset (RWA) price tracking the S&P 500 index ETF CSPX. Backed Finance plans to integrate Chainlink Proof of Reserve to enhance the transparency of Backed products.

● Redstone introduced Eurozone government bond ETF data sources to the crypto world.

In August 2023, the oracle Redstone partnered with the decentralized stablecoin protocol Angle. After integrating with Redstone, it will provide price feed services for the Eurozone government bond C3M ETF every day at noon, ensuring that its platform and users can access the latest and most reliable data.

● Pyth Network has provided price feed services for the RWA platform Ondo Finance.

In January 2024, the RWA platform Ondo Finance announced a partnership with the oracle project Pyth Network to extend Ondo asset price information across multiple blockchains. As of March 2025, Pyth has provided price feed services on 65 public chains.

- Supra's distributed oracle protocol (DORA) 2.0 provides RWA price feed services.

In July 2024, the oracle protocol DORA 2.0 from the Supra blockchain introduced an RWA price feed mechanism. It accurately and reliably provides real-time price data for numerous traditional assets, with a final confirmation time between 600 to 900 milliseconds. As of March 2025, Supra has provided price feed services on 36 public chains. 【18】

● Chronicle Labs launched the RWA oracle "The Verified Asset Oracle."

In November 2024, the Chronicle Labs team launched a new RWA oracle called The Verified Asset Oracle. Its goal is to expand Chronicle's oracle services to various types of off-chain assets. The specific implementation method involves the VAO oracle first verifying the integrity and quality of these off-chain assets, then transmitting the verified data to the blockchain network. This data will be directly pushed to smart contracts or other on-chain products. According to official disclosures, VAO has already partnered with RWA platforms such as Plume Network, Centrifuge, and Superstate to provide real-time verification services for these products and their ecosystem's off-chain assets.

In summary, current mainstream oracle projects have begun to lay out in the RWA field, from Chainlink's support for traditional assets to Redstone's introduction of European bonds, and to Supra and Chronicle's expansion into financial asset modeling, presenting two development paths: one is to continue the DeFi logic and strengthen the on-chain presence of off-chain financial assets; the other is to explore more complex off-chain entity data modeling to provide real-time data support for high-threshold asset types. This trend indicates that the oracle sector is evolving from "price transmission" to "trusted data infrastructure."

4.3 Non-Financial Assets: High Threshold Off-Chain Data Modeling

The previously published article "Understanding the Core Logic and Hot Projects of RWA" described various RWA assets classified by cash flow. However, from the perspective of data providers for oracles, RWA can be divided into financial assets and non-financial assets.

Financial assets are securitized assets whose fair value can be reflected in real-time, such as stocks, bonds, funds, and futures. The data supply for these assets is relatively easier, with Bloomberg, Robinhood, and Yahoo Finance all providing API interfaces. For oracles, transmission efficiency is the core competitive advantage for financial asset data. The oracles mentioned in section 4.2 that support RWA data mainly focus on financial asset types.

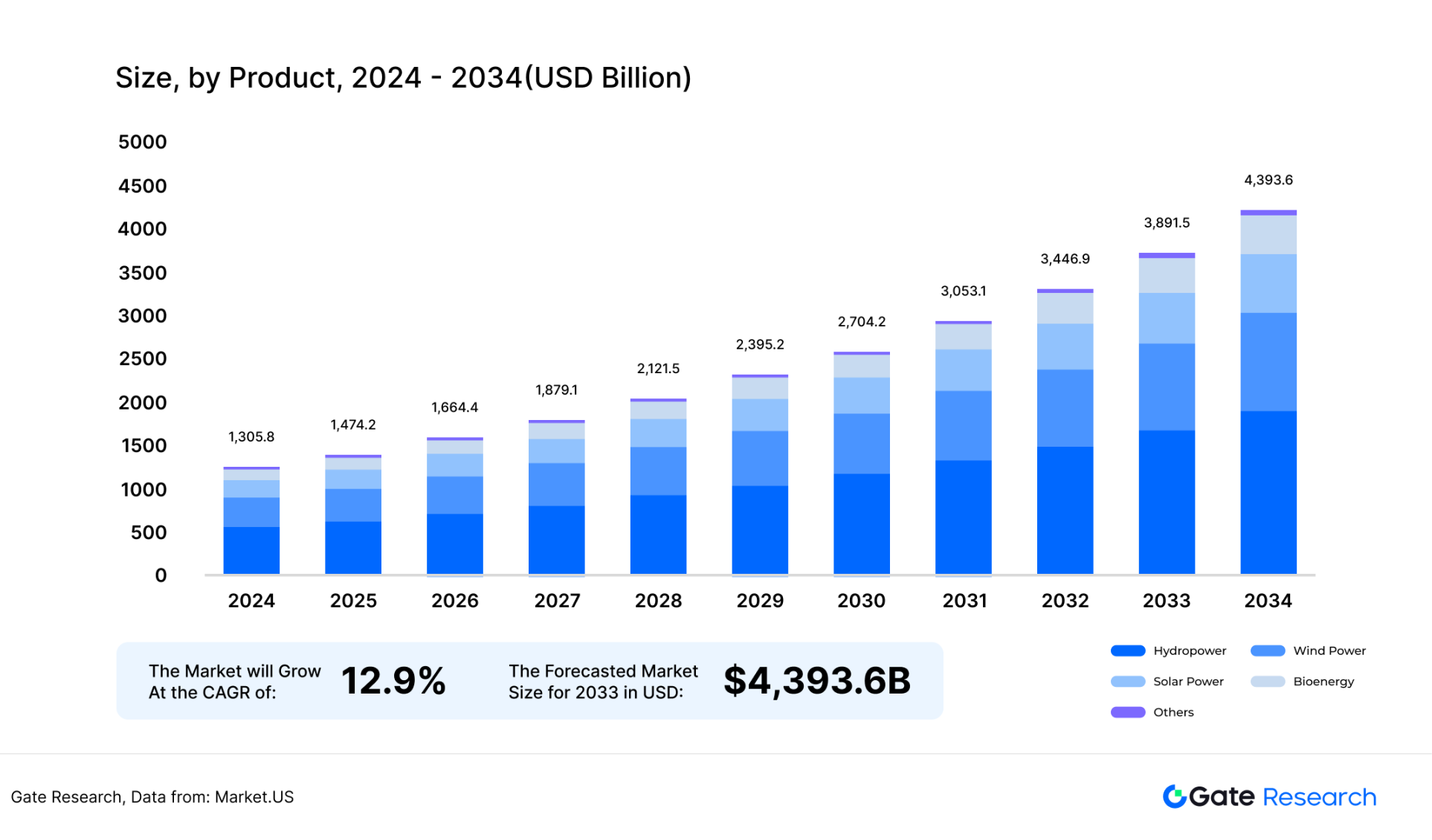

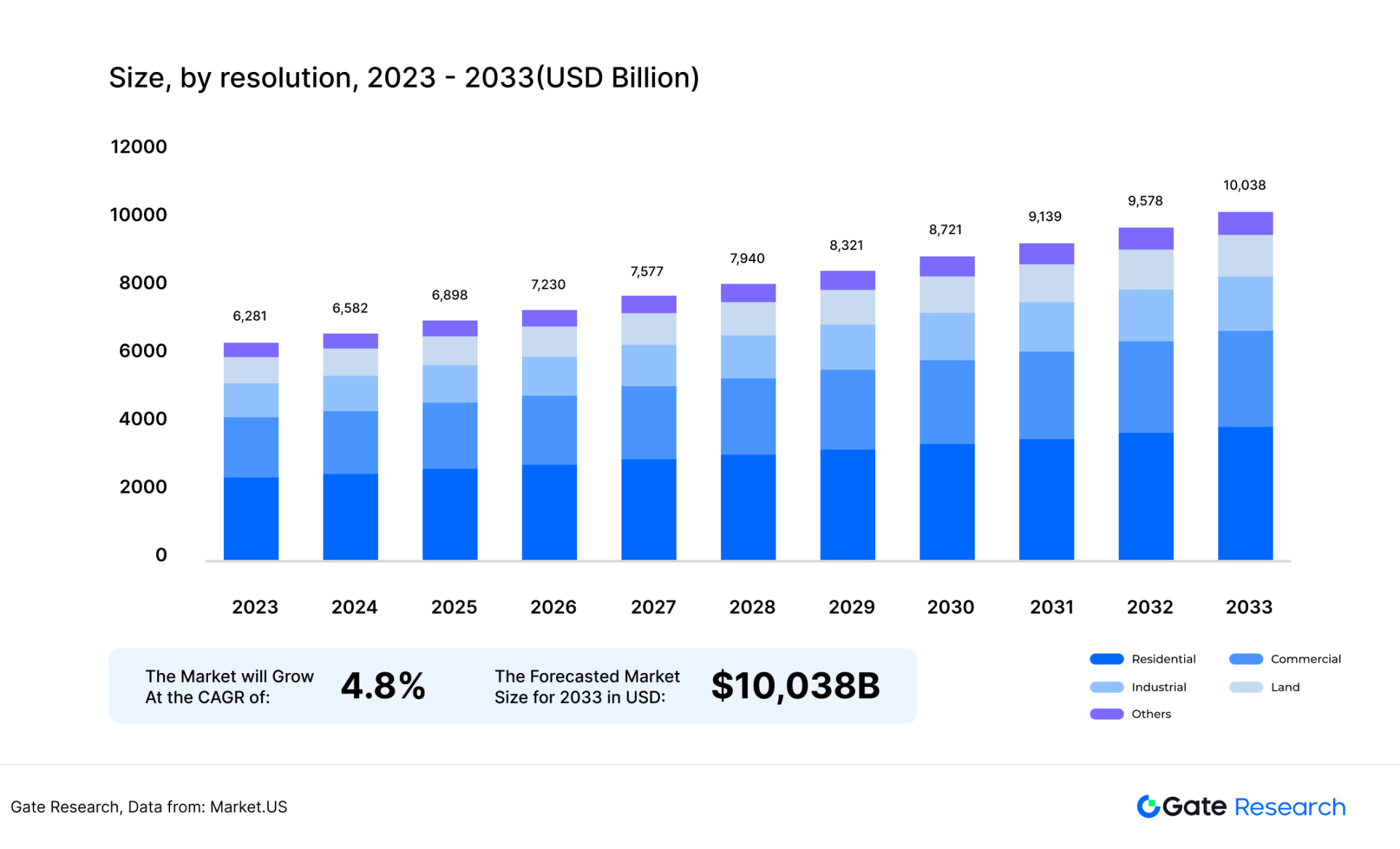

Non-financial assets refer to those that cannot reflect prices in real-time and need to use mathematical modeling or other methods to represent their price at a certain point in time. Examples include real estate, charging stations, photovoltaic components, and artworks. For instance, in the case of charging stations and photovoltaic panels, users invest in tokenized assets through on-chain funds, but these cash flow assets are significantly affected by weather, environment, and equipment management, which may impact their future cash flow distribution. Therefore, it is necessary to create asset models for these tokens to reflect risks in their token prices. According to Market.US, the global market sizes for renewable energy and real estate are projected to be $14 trillion and $6.8 trillion, respectively, by 2025. If a higher proportion of these assets are tokenized, the demand for oracle data will experience explosive growth.

【19】【20】

For these non-financial assets, oracles need to provide more complex services, such as integrating data sources that can reflect asset statuses and influencing factors (e.g., weather data, equipment operation data, etc.), and combining mathematical models to convert this information into trusted on-chain prices or risk assessments, thereby supporting the valuation and management of non-financial RWA tokens. Due to the high threshold for valuation modeling of non-financial assets, off-chain valuation companies need to adjust their valuation models in real-time, thus placing higher demands on the transmission performance of public chains. High-performance chains like Solana have significant advantages in transmission performance. It is speculated that the pricing of non-financial assets may become a major growth point for oracles on the Solana chain in the future.

Additionally, as the diversification, asynchronicity, and dynamic evaluation characteristics of non-financial assets become increasingly prominent, oracles will not only bear the responsibility of "on-chain data" but will also need to possess the capability of "off-chain model adaptation and continuous verification." This means that future oracle projects will enter a new round of competition in terms of data depth, modeling complexity, and collaboration with high-performance public chains.

Figure 26: Global Renewable Energy Market Size

Figure 27: Global Real Estate Market Size

5. Multi-Type Data Dedicated Oracles: Industry Growth Curve Expanding from 2 to N

Current mainstream oracles are primarily focused on the on-chain transmission of price data, forming a standardized service path represented by DeFi price feeds. However, as on-chain demand expands, especially with emerging scenarios like RWA, DePIN, AI, and DeSci requiring more complex demands for the types, formats, and real-time nature of off-chain data, the service capabilities of oracles are transitioning from "generalized transmission" to "vertical processing"—building dedicated collection, verification, and upload systems for specific types of data. In the future, the industry will shift from "unified price feeds" to a parallel development state of "multi-type dedicated oracles," entering an expansion phase of "from 2 to N."

5.1 IoT Data Oracles: DePIN Capacity Expansion

The concept of DePIN shares many similarities with RWA, as both represent a certain mapping of real-world assets on-chain. However, the essential difference is that RWA focuses on investment for one-time returns or continuous cash flow, while DePIN emphasizes the use of storage, bandwidth, and graphics cards rather than investment. The emergence of IoT oracles allows device users to monitor device data in real-time, similar to the concept of device data networking in the industrial internet.

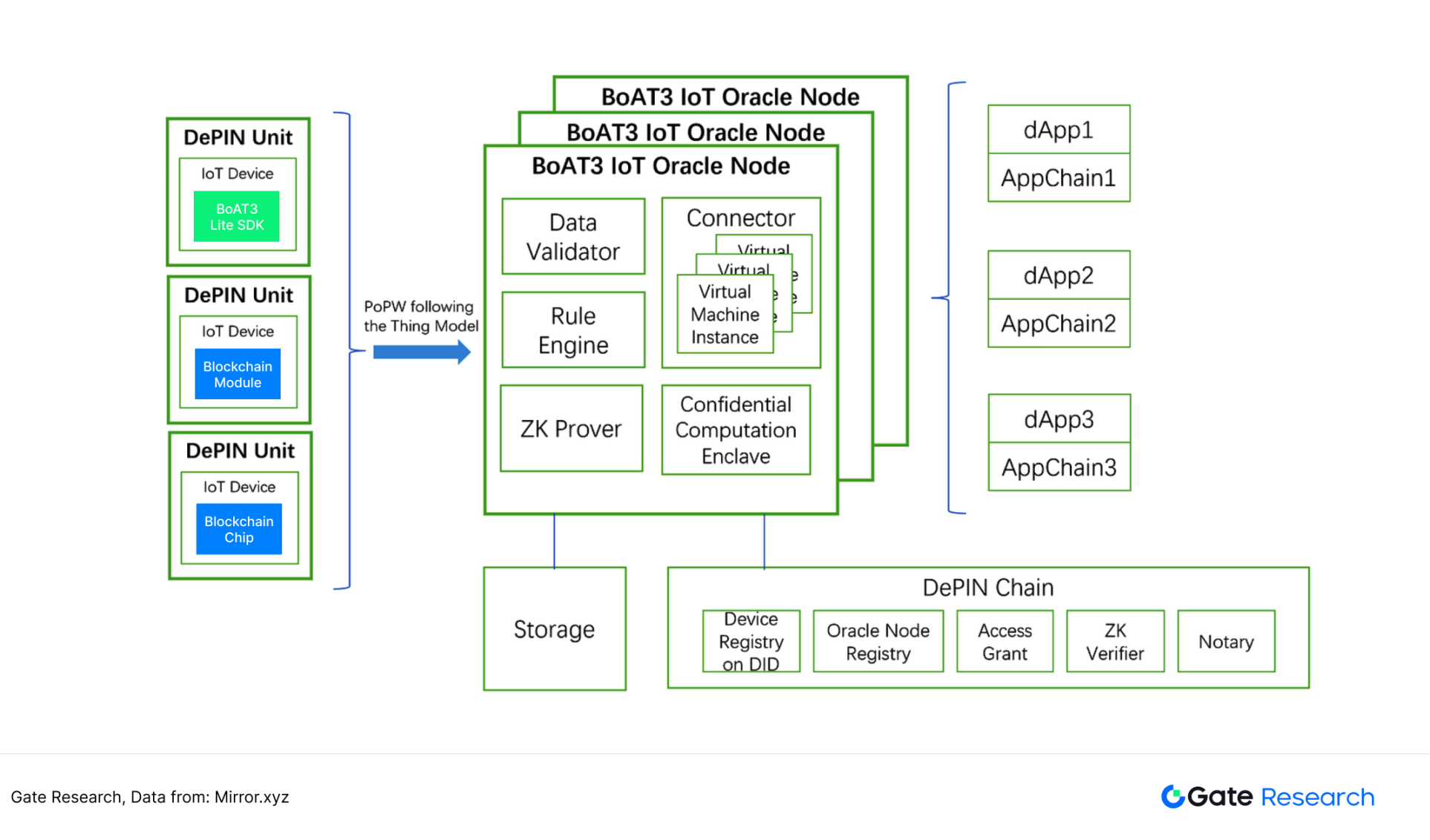

To bring off-chain hardware data on-chain, the concept of IoT oracles has emerged. As early as 2023, the aitos.io project proposed an oracle paradigm based on IoT data—BoAT3. BoAT3 is a PoPow (Proof of Physical Work) paradigm, which can be understood as the amount of work done by off-chain hardware (for example, how much weather data a thermometer has collected) being uploaded to the blockchain, with the work amount counted in DU (DePIN Unit). 【21】

Figure 28: BoAT3 IoT Oracle Architecture Diagram

However, this architecture has not demonstrated sufficient influence since its proposal. The core reason, in my opinion, lies in the unclear conversion mechanism of DU for different hardware. For instance, a Filecoin storage hard drive has 1TB of data written, a Helium base station hotspot has 100GB of bandwidth used, and a BTC miner has 5TH/s of cloud computing power utilized; the data from these different hardware cannot be unified into the same DU. The IoT generates a large amount of non-standardized data daily, such as 1MB of weather data, 1MB of human pulse data, and 1MB of car charging data, each with different values. Therefore, a unified measurement standard is crucial for this sector. Once the units are standardized, on-chain data demanders can more easily assess the amount of work completed by on-chain devices.

Currently, IoT oracles are still in the early stages of development, with a limited number of projects. The blockchain oracle Echolink, deployed on Solana, is one of the few designed for DePIN, having connected approximately 8 million hardware devices. The IoT data is based on a PoDW (Proof of Device Work) architecture. 【22】

5.2 Code Oracles: Bittensor at the Right Time

Bittensor is one of the most successful examples of the integration of AI and blockchain. It is a decentralized machine learning network. Demanders publish algorithmic problems on-chain and offer rewards for different models to mine solutions; the model that best solves the algorithmic problem will receive the most rewards.

The underlying logic of Bittensor has certain similarities with oracles, as oracles connect DeFi protocols with off-chain price data, while Bittensor connects the demanders of on-chain algorithmic problems with off-chain AI models.

Dissecting Bittensor's success, the underlying data uploaded to the chain is still program code, and in the future, there may be dedicated oracles to upload off-chain code to the chain. One possible scenario is the code vulnerability checks for DEXs like Uniswap, Sushiswap, and GMX. For example, as a leading decentralized exchange, Uniswap launches a bug bounty program every quarter, allowing white hat hackers to find vulnerabilities in the V2, V3, and V4 contracts.

If there were specialized oracles for uploading code, they could find the optimal solutions for different white hat hackers to correct the code through environmental simulation and testing, uploading the optimal code to the demander, Uniswap. This would not only save Uniswap's code auditing resources but also mitigate the centralization risks of traditional code review platforms like Immunefi and HackerOne. 【23】

Figure 29: Uniswap V4 Launched a Bug Bounty Program of Up to $15.5 Million

5.3 Biomolecular Oracles: The Infrastructure of Crypto × Biotech

In the fourth quarter of 2024, the DeSci narrative, backed by Vitalik and CZ, became one of the main hotspots in the cryptocurrency industry. Some projects that received cryptocurrency funding hope to use the funds for the development of biomolecules. On the one-stop token issuance platform Pump.science, three longevity candidate molecules have successfully issued tokens.

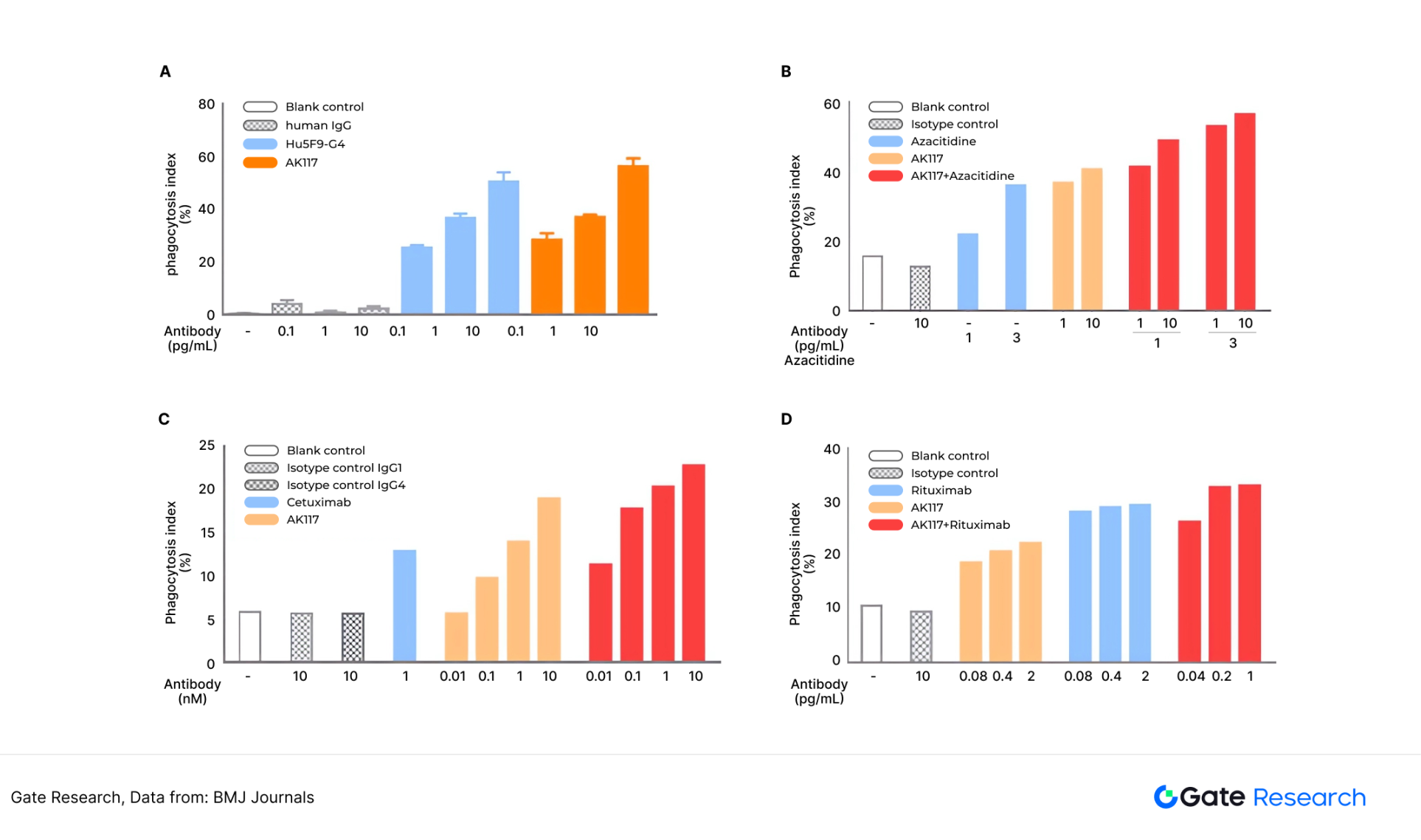

Although the meme attributes of these tokens far exceed their real scientific research value, if more and more biotech projects secure funding through on-chain channels to develop biomolecules in the future, the related compound reaction data can help investors determine whether a project is worth investing in. If there were dedicated oracles for biomolecules, with multiple node operators scoring the clinical trial results of biomolecules, they could effectively lower the understanding barriers for on-chain investors in the biopharmaceutical industry through a decentralized approach.

Taking BMJ Journals as an example, it is one of the top four comprehensive medical journals globally, covering authoritative data in fields such as general medicine, clinical specialties (like gastroenterology, rheumatology, neuroscience, etc.), epidemiology, drug research, and medical education. Such medical journals or databases could serve as data nodes for biomolecular oracles, uploading clinical performance data of biomolecules to the oracle, providing data support for the token value of biomolecules. 【24】

Figure 30: Clinical Data Display from BMJ Journals (Kangfang Biotech's AK117 Molecule)

In summary, oracles are evolving from a "general data layer" that serves standardized financial protocols to a "multi-modal infrastructure" that supports vertical scenarios. The demand for uploading off-chain data in various fields such as IoT, AI code, and life sciences is driving the emergence of a batch of dedicated oracles.

Conclusion

From the current consensus of cryptocurrency users regarding oracles, the main function of oracles is to aggregate and verify off-chain price data, supplying it to DeFi applications on-chain. Since 2022, the integration of the blockchain world with the real world has become increasingly close. The purpose of RWA is to use on-chain funds to invest in off-chain assets (gold, stocks, real estate, energy); the purpose of DePIN is to aggregate off-chain distributed hardware (hard drives, graphics cards, routers) to reduce the cost of using hardware; the purpose of DeSci is to bring off-chain research projects (biopharmaceuticals, artificial intelligence) on-chain to weaken the monopoly of centralized journals. Meanwhile, AI represented by Bittensor aims to bring off-chain AI models on-chain to solve complex algorithmic problems.

As mentioned above, the demand for on-chain data is no longer limited to trading price data like BTC/USDT or ETH/USDT, but requires more real-world data such as gold prices, IoT data, biomolecular data, and program code. For oracles, processing multi-modal data presents both opportunities and challenges. The opportunity lies in that the handling of multi-modal data will allow oracle revenues to no longer overly depend on price feeds, leading to more revenue increments. The challenge is that oracles need to reconstruct certain business scenarios in both the front-end data verification layer and the back-end smart contract execution layer.

In the past three years, the hotspots in the crypto market have continuously shifted between Meme, DeSci, AI Agent, and DePIN, while the important infrastructure of oracles has not received sufficient discussion. In the future, as on-chain demand for more modal data increases and the performance of smart contracts improves, RWA is expected to become the main second growth curve for the oracle sector, while vertical dedicated oracle startup projects will continue to emerge.

Data Sources

Grand Research, https://www.grandviewresearch.com/industry-analysis/decentralized-finance-market-report

Defillama, https://defillama.com/oracles

Linkwell Node, https://docs.linkwellnodes.io/blog/Build-A-Chainlink-Price-Feed-With-Flux-Aggregator

Chainlink, https://blog.chain.link/smart-contract-automation-zh/

Cointelegraph, https://cn.cointelegraph.com/news/chainlink-introduces-chainlink-runtime-environment-framework

Dune, https://dune.com/agaperste/pyth-network-vs-chainlink-price-feeds

Pyth, https://docs.pyth.network/price-feeds/use-real-time-data

Techflow, https://www.techflowpost.com/article/detail_18981.html

Redstone, https://docs.redstone.finance/docs/dapps/redstone-push/

Medium, https://medium.com/@entrepreneur6666/three-ways-to-integrate-redstone-59a519e07708

RWA.xyz, https://app.rwa.xyz/

McKinsey & Company, https://www.mckinsey.com/industries/financial-services/our-insights/from-ripples-to-waves-the-transformational-power-of-tokenizing-assets

Market.US, https://market.us/report/renewable-energy-market/

Market.US, https://market.us/report/real-estate-market/

Mirror.xyz, https://mirror.xyz/0x6510f5d8CC090b38BE8Bf1BBCd28d15e726395A2/IteGyM3tFgbbPLwrAimt9vwpRKe47coFcpKKll3XYaM

Echolink, https://echolink.network/

BMJ Journals, https://jitc.bmj.com/content/9/Suppl_2/A288

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。