Time remains the same, the market continues, and behind the silence lies hidden fervor; everything that appears is destined to be. After a long period of fluctuation, enthusiasm has not waned. Some are joyfully sleepless, while others are wide awake in sorrow, and this is just the beginning. The storm has yet to arrive. The market creates a group of people while also eliminating another group. Everyone will experience favorable conditions, and no one can escape adversity. When the market favors you, be a bit braver and more decisive.

Hello everyone, I am trader Gege. Continuing from the last article, during the holiday, I spent time with my family. We cannot always focus on market trading; we also need to pay attention to matters outside of trading. In the early morning, there will be an interest rate meeting and a speech from old Powell. Powell wants to lower interest rates quickly, but he will not easily compromise. It is certain that there will be no rate cuts, but the key is to pay attention to what Powell says. Regarding market movements based on news, I have always advocated just observing; there is no significant meaning in short-term trading based on news fluctuations. The recent rebound is due to the exhaustion of negative news and a reduction in bearish sentiments, along with some positive news. How far this rebound can go, let's discuss from a technical perspective.

First, let's start with the weekly chart of Bitcoin. The overall trend and direction have always been within my expectations, which I won't elaborate on; you can refer to my previous articles. The MACD's double line death cross was also detailed in my previous views. Fluctuations can also repair the death cross. Currently, we need to observe whether it can break upward to form a golden cross. If it can, then I am optimistic about an upward fluctuation in the next 2-3 months. However, some conditions must be supported. The first is that any upcoming pullback must not break below the 90000-89000 line. If it breaks, then the large range adjustment will continue. The second is whether the upper boundary of 100000-102000 can break and stabilize. If it can stabilize, then the bullish trend can continue; otherwise, it will still fluctuate downward. The 100,000 mark is just a step away, so refer to the above boundary lines for the overall trend direction. As for the bull and bear market, my previous views remain unchanged. The bull-bear boundary defined by me and the MA60 must not be broken; I do not consider bearish trends. My loyal followers should know my stance, unlike some in the market who shout "bear" when it drops and "bull" when it rises.

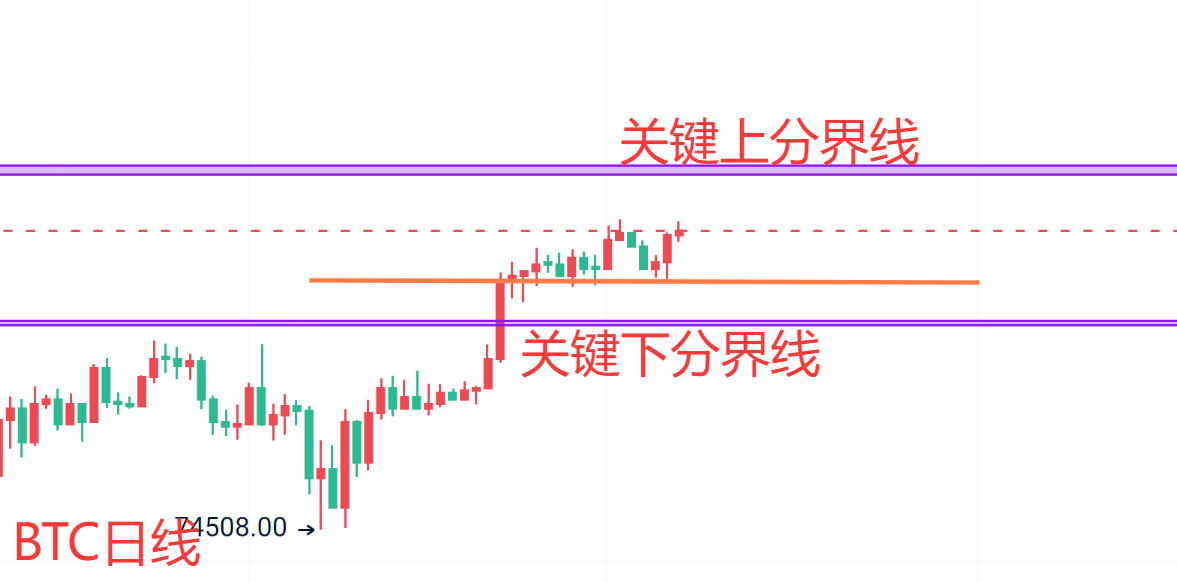

In the short term, the daily K-line shows a high-level fluctuation platform. The key short-term support is at the 93000-92000 line, which is also near the middle track support, so we can pay attention to this line in the short term. The short-term resistance above is at the 98000-99000 line, with a focus on the closing situation of the daily K-line. Although the previous K-line closed bullish, the MACD volume bars show signs of divergence, indicating a need for a pullback correction.

Ethereum's daily K-line has been fluctuating in the $100 range for nearly half a month. The breaking point of this structure is getting closer. The weekly K-line has stood above the MA7, so we should focus on whether the pullback does not break below the MA7. If it does not, I remain optimistic about an upward fluctuation. This thought aligns with what I previously provided, and following the previous strategy to enter long positions should yield certain results. My short-term view on Ethereum remains unchanged; as long as the pullback does not effectively break below the 1700 line, I continue to see an upward fluctuation. Conversely, the probability of testing the 1500 line again increases. The overall trend and direction of Bitcoin and Ethereum can refer to the above thoughts, and the short-term strategies are as follows.

Short-term Bitcoin: Enter long at the 95500-94800 line, target 97500-97800, if broken, look at 99000.

Short-term Ethereum: Enter long at the 1750-1730 line, target 1850-1870, if broken, look above 1900.

PS: Try to use the strategy activation only once.

The suggestions are for reference only. Ensure proper risk control when entering the market, and manage profit and stop-loss spaces on your own. Specific strategies should be consulted in real-time.

Alright, friends, we will say goodbye until next time. I wish everyone continued success in the crypto world! More real-time advice will be sent internally. Today's brief update ends here. For more real-time advice on Bitcoin and Ethereum, find Gege.

Written by/ I am trader Gege, a friend willing to accompany you in your resurgence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。