GBTC and FETH Lead the Exit for Bitcoin and Ether ETFs

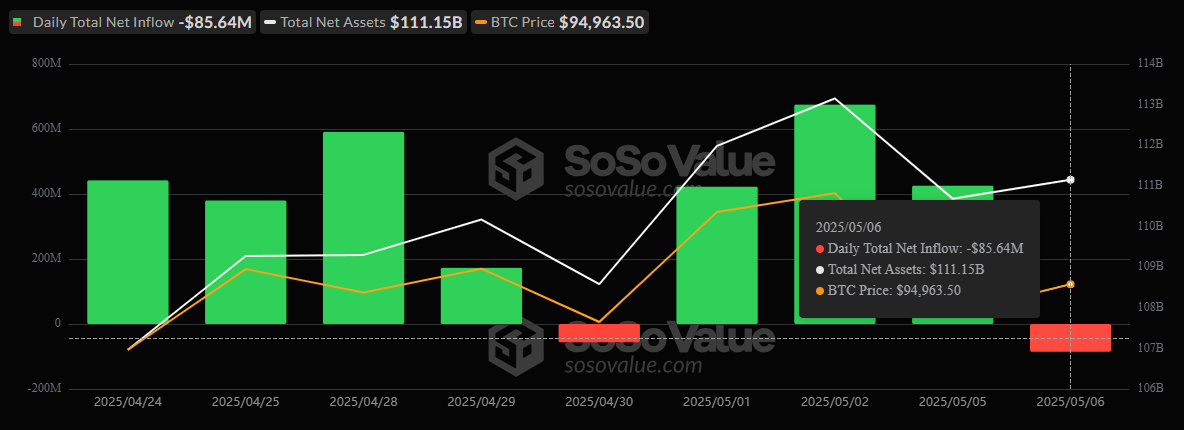

The tide briefly turned on Tuesday, May 7, as both bitcoin and ether ETFs logged net outflows, ending a solid start to the week. After 3 days of positive momentum, bitcoin ETFs saw $85.64 million pulled from the market, bringing a pause to their recent inflow streak.

Grayscale’s GBTC led the retreat, posting a hefty $89.92 million outflow, followed by Ark 21Shares’ ARKB with $16.12 million. Franklin’s EZBC and Vaneck’s HODL each saw modest exits of $8.26 million and $8.06 million, respectively. The lone bright spot? Blackrock’s IBIT, which continued to attract capital, pulling in $36.73 million.

Source: Sosovalue

Total value traded across bitcoin ETFs came to $1.46 billion, and net assets ended the day at $111.15 billion.

The ether ETF market wasn’t spared either. Fidelity’s FETH was the sole mover, logging a $17.87 million outflow while the rest of the funds sat idle. With total ether ETF volume at $135.25 million, net assets ticked down slightly to $6.18 billion.

A quieter day for crypto ETFs, but one that reminds investors: the flows don’t always go one way.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。