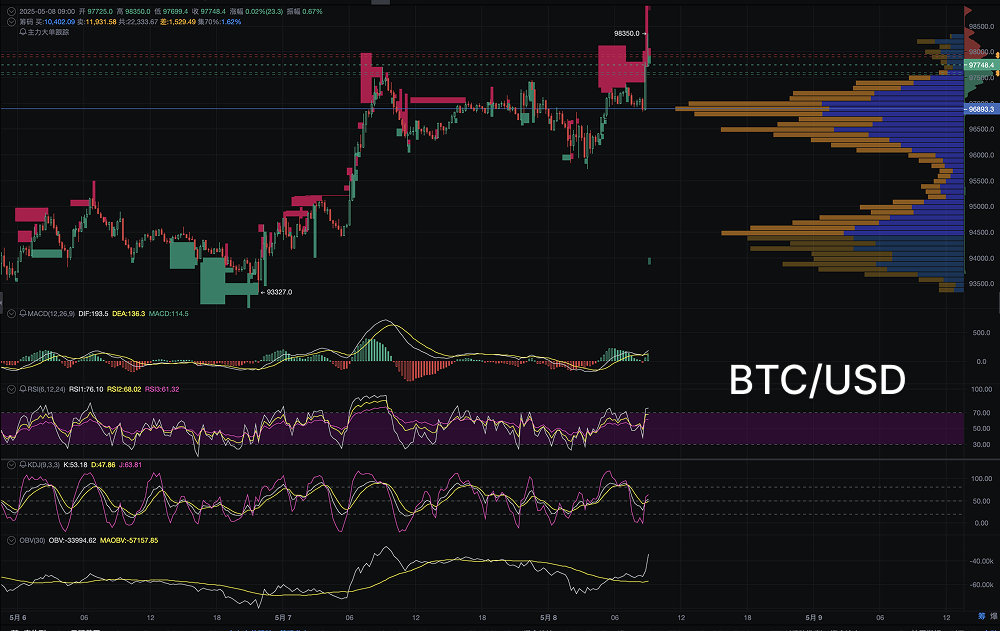

After the Federal Reserve's benchmark interest rate decision, on the morning of May 8, Bitcoin's price strongly broke through the key resistance level of $96,000, and continued to rise to around $97,700 within the following hours, reaching a peak of $98,350, marking a new high since the adjustment in late April 2025. Combining the latest pre-market candlestick data and trading volume observations on May 8, Bitcoin is showing a typical "strong aftershock attack" pattern with bullish volume breakout and successful digestion of the dense trading area.

Candlestick pattern breakout confirmation: strong sealing at the upper edge of the box, volume anomaly releases buying pressure

From the AiCoin chart, after Bitcoin formed a double bottom pattern around $93,300 on the evening of May 6, it began to significantly increase in volume starting at 6:00 AM on May 7. Especially after being under pressure for several days in the $96,000-$96,800 dense trading area, it quickly broke through at noon on the 7th, accompanied by a MACD zero-axis crossover and an increase in trading volume, confirming that the upward trend has a momentum foundation.

The morning chart on May 8 is even more critical: after consolidating around $97,800, Bitcoin suddenly surged significantly, breaking through to $98,350 with volume, and the candlestick body far exceeded the upper standard deviation of the average, indicating that the main funds have completely suppressed the bears.

- MACD: The fast and slow lines are turning upward, with green momentum bars continuously turning red, short-term momentum is restarting;

- RSI: The 6-hour line has reached around 68, approaching the overbought area, strong but caution is needed for a pullback;

- OBV (On-Balance Volume): A clear V-shaped rise has appeared, confirming net capital inflow;

- KDJ: The J value has broken through 80, high-level stagnation has not yet formed a death cross, short-term still has upward inertia;

It is worth noting that there has been no significant selling pressure from upper shadow lines during the past two days of rising, indicating limited pressure at the resistance level, consistent with the typical "resistance turning into support" pattern. The key support below is currently located in the $95,300-$96,000 range.

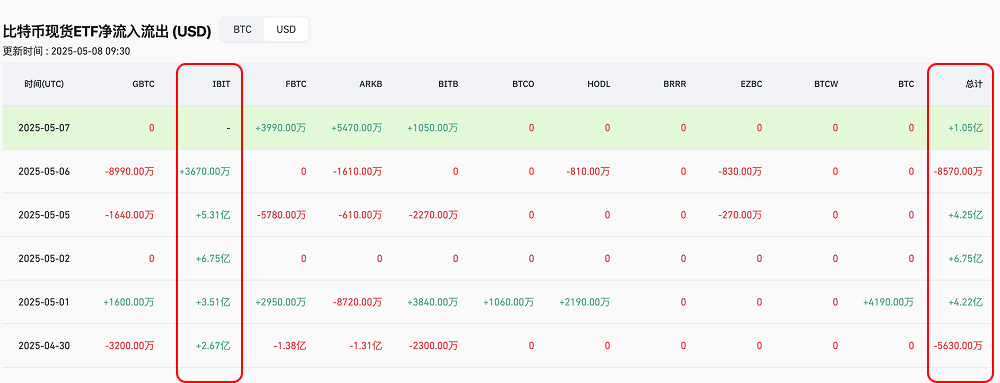

ETF fund flow and market structure: Main players are once again building positions, clear signals of capital inflow

According to SoSoValue data, on May 7, 2025, Bitcoin spot ETFs saw a net inflow of $105 million, marking the first large-scale net inflow in the past five days.

- ARKB (ARK Invest) saw a net inflow of $54.7 million, making it the largest capital-raising product of the day;

- FBTC (Fidelity) followed closely with an inflow of $39.9 million;

- BITB (Bitwise) also recorded a net purchase of $10.5 million;

- This set of data releases three clear signals:

Signs of sentiment recovery: After three days of fluctuations, the ETF market was the first to give a "capital inflow" pricing signal, indicating that some institutional investors believe the price adjustment is basically in place; Redistribution of incremental main players: Unlike the previous dominance of IBIT, on May 7, funds showed a "multi-point bloom," with ARKB and FBTC returning to main positions, indicating that mainstream institutions are redeploying bullish positions;

The market structure has not turned bearish, but rather collectively increased allocation: Despite short-term fluctuations, as of now, the total market value of major ETFs still maintains above $110 billion, accounting for 5.91% of Bitcoin's circulating market value, and there continues to be structural buying support. It is worth mentioning that the zero change in GBTC also represents that the continuous redemption tide of this fund is slowing down, with investors gradually shifting from arbitrage-driven to trend-following.

Overall, the ETF fund movements on May 7 constitute important support for Bitcoin's spot price, especially against the backdrop of unclear macro interest rate policies, the warming of ETF funds is likely to become an important driving force for the continuation of the upward trend in the coming week.

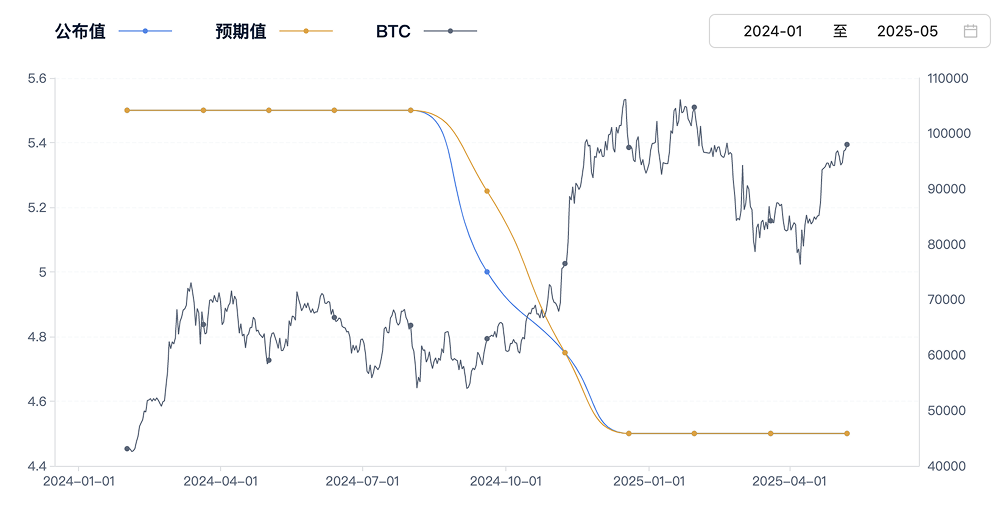

Federal Reserve decision and macro sentiment: Is Bitcoin decoupling from traditional financial logic?

At 2:00 AM on May 8 (Beijing time), the Federal Reserve's FOMC announced that it would maintain the federal funds rate at 4.25%-4.5%, marking the third consecutive time it has held steady.

In the statement, the Federal Reserve explicitly expressed concerns about "dual risks coexisting"—the simultaneous rise of inflation and unemployment, reflecting the extreme trade-offs faced by policymakers.

It is noteworthy that:

The market had already priced in the expectation of "maintaining interest rates" this time, with the futures market on Monday pricing the probability of pausing interest rate cuts this week at over 95%; This meeting did not provide a timeline for rate cuts, but rather reinforced the tone of "continuing to observe"; "New Federal Reserve correspondent" Timiraos pointed out that the Federal Reserve may gradually shift from "preventing recession" to "maintaining inflation," reflecting a shift in decision-making focus.

Trump has repeatedly called for interest rate cuts, accusing the Fed of suppressing job recovery, and the voices of "growing divergence between the Fed and the White House" continue to ferment. However, during this period, Bitcoin has risen against the trend, showing signs of decoupling from traditional risk assets such as U.S. stocks and crude oil—while U.S. stocks have slightly pulled back and the S&P 500 has not reached a new high for the year, Bitcoin has taken the lead in breaking through, indicating that some investors have begun to view it as a new choice for avoiding the risks of Federal Reserve policies.

This sign is worth close attention, as it may mark the beginning of Bitcoin's further consolidation of its status as "digital gold."

Conclusion: Strengthened safe-haven logic, asset attributes may face re-evaluation

Bitcoin's current technical breakthrough is not an isolated event, but the result of multiple factors overlapping:

- Strong technical completion of the upper edge breakout of the box;

- Main funds concentrated entry, on-chain outflow volume reaching a new high in several weeks;

- Although ETFs show net outflows, structural funds have not withdrawn, and IBIT continues to accumulate;

- The "policy wavering" behind the Federal Reserve's decision to maintain interest rates has instead enhanced Bitcoin's safe-haven appeal.

As Bitcoin breaks through $97,000 in the short term, it will face psychological battles at the round number of $100,000. If market sentiment continues to lean bullish and ETF inflows restart, the probability of challenging new highs in the coming weeks is extremely high.

More profoundly, this round of increase may become a landmark turning point for Bitcoin's asset attributes to "decouple from traditional financial risk assets." In 2025, as the global economy faces a mix of inflation, stagflation, and geopolitical uncertainties, the logic of Bitcoin as a "new generation safe-haven asset" is gradually gaining market validation.

This article only represents the author's personal views and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。