Original Title: "Trump's 'Major Announcement' + Fed Rate Cut Winds: On-Chain Data Suggests a Bitcoin Storm"

Original Author: Luke, Mars Finance

In May 2025, the price of Bitcoin (BTC) surged like a runaway horse, reaching a near two-month high of $97,900, then briefly paused around $94,000 before quickly rebounding to around $97,000. This price frenzy ignited passion in the crypto market and led investors to question: what is driving this surge? Is it Trump's high-profile trade declaration, the Fed's monetary policy direction, or Wall Street giants' accelerated embrace of crypto assets? The answer may lie in the interplay of all three. This article will narrate how recent news has sparked Bitcoin's rise, delve into the intricate pulses of on-chain data, and explore market opportunities and concerns, aiming to be both engaging and professionally deep.

Trump's Trade Gamble: The Igniter of Market Sentiment

On May 8, Trump announced that he would deliver a significant statement in the Oval Office the following morning regarding a trade agreement with "a respected major country." The New York Times soon revealed the mystery: the agreement was with the UK. This news acted like a spark, quickly igniting market speculation. Trump's trade policies have always been a barometer for global financial markets, and this time was no exception. He also hinted that he would announce a "very significant message" before his upcoming trip to the Middle East, further stirring investor nerves.

Trump's trade actions have stirred waves multiple times in 2025. In early April, when he announced a 145% tariff on China, Bitcoin's price plummeted to $77,730, and global stock markets experienced their most severe turbulence since 2020. However, on April 10, he unexpectedly suspended some tariffs for 90 days, causing market sentiment to flip, and Bitcoin surged 7% in a single day to $82,350. Now, the trade agreement with the UK is seen as a potential positive, possibly easing global trade frictions and boosting the appeal of risk assets. JPMorgan strategist Bram Kaplan keenly captured this trend, advising investors to buy S&P 500 call options, stating that Trump's announcement could drive the market higher. This wave of optimism quickly spread to the crypto sector, leading to a surge in capital inflows.

The Fed's Subtle Chess Game: A Catalyst for Rate Cut Expectations

On the same day, Fed Chairman Jerome Powell dropped a significant signal at a press conference: the monetary policy outlook may include rate cuts, but the specific path will be anchored to economic data. He downplayed the significance of GDP fluctuations, emphasizing that the Fed would remain flexible. This statement injected a warm hue into the market, as rate cuts are often seen as a spring breeze for risk assets.

In 2025, the Fed's policies have had a particularly notable impact on Bitcoin. On April 23, when Trump denied rumors of firing Powell, the market breathed a sigh of relief, and Bitcoin rebounded. However, the tariff shock in early April had previously driven Bitcoin down to a low of $81,500, highlighting the macro environment's pull on the crypto market. Rate cut expectations indirectly fueled Bitcoin's rise by lowering market liquidity costs, weakening the dollar's appeal, and enhancing demand for inflation hedges.

However, Powell's cautious wording also planted seeds of caution. He clearly stated that policy would closely monitor economic data, and if inflation or employment data exceeded expectations, rate cuts could be delayed. The market is in a delicate balance, where slight changes in external variables could trigger significant volatility.

Wall Street's Crypto Ambitions: The Surge of Institutional Funds

On May 1, Morgan Stanley announced plans to launch crypto trading services on the E*Trade platform in 2026, marking a new phase in Wall Street's embrace of digital assets. Previously, its wealthy clients could invest in crypto assets through Bitcoin ETFs and futures, with advisors allowed to promote ETFs since August 2024. Institutions like Charles Schwab are also following suit, planning to launch similar services. These moves propelled Bitcoin to briefly surpass $97,000 on May 2.

The influx of institutional funds is reshaping the market ecosystem. The U.S. spot Bitcoin ETF has absorbed $4.6 billion in the past two weeks, with assets under management nearing a historical high of 117.1 million BTC. In contrast, the continuous outflow from March to April had put pressure on the market, highlighting institutional funds' sensitivity to the macro environment. Institutional participation not only enhances market liquidity but also paves the way for Bitcoin's mainstream acceptance. However, in mid-April, due to the tariff turmoil, Bitcoin ETFs experienced a continuous outflow of about $1 million over seven days, reminding investors that institutional funds are not a monolith.

On-Chain Data: A Delicate Portrait of Market Pulses

On-chain data provides us with a window into the internal dynamics of the Bitcoin market. The recent price recovery has triggered a series of significant changes, revealing the subtle evolution of investor behavior and market structure.

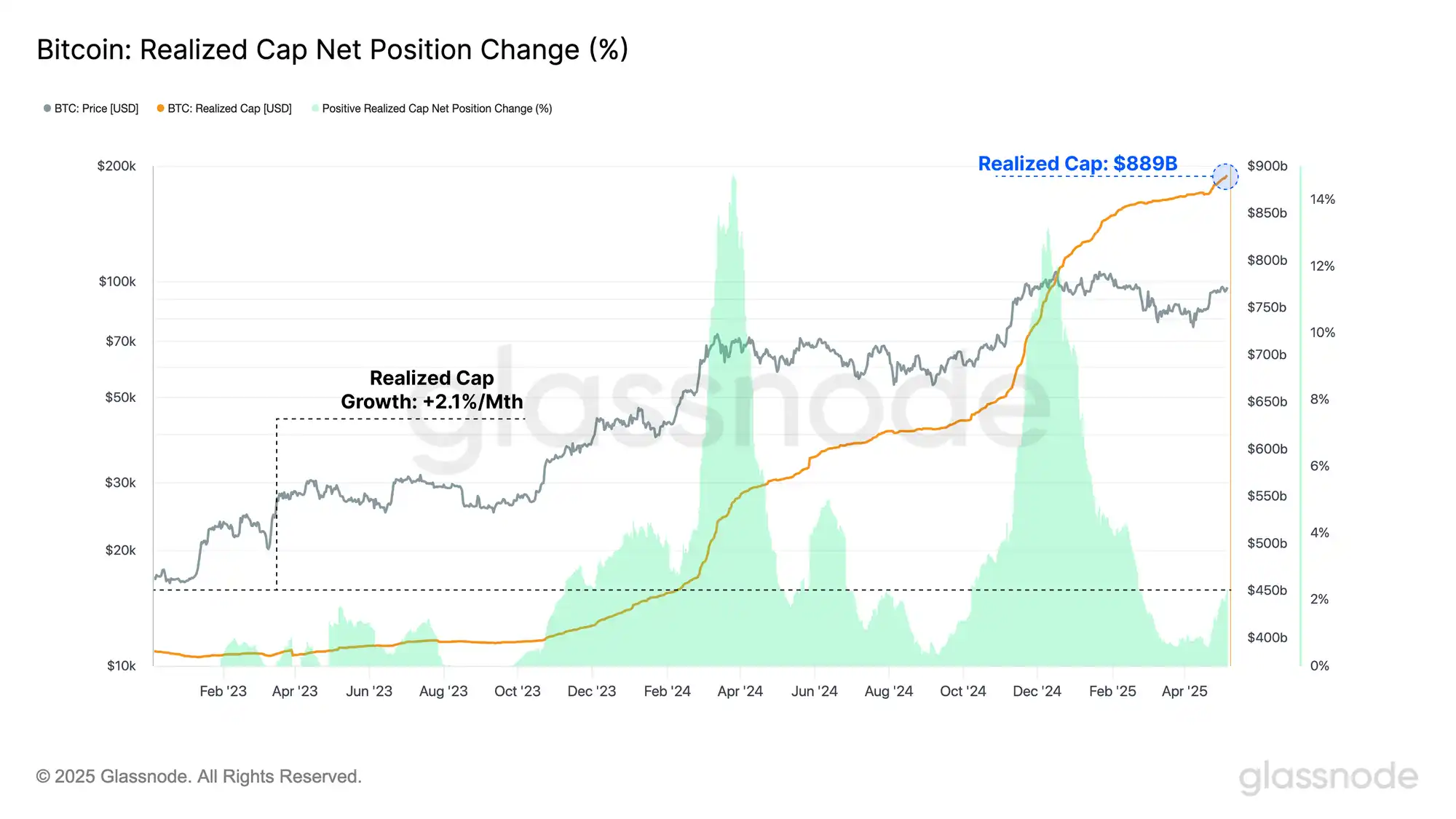

First, Bitcoin's realized cap has climbed to a historical high of $889 billion, growing 2.1% over the past month. This metric measures cumulative net capital inflows, reflecting a strong momentum of capital injection. The net realized profit/loss metric further indicates that net capital inflows have exceeded $1 billion daily in recent weeks, showing that buyers are willing to absorb sell orders at current prices, indicating strong demand. In contrast, realized losses account for only 1-2% of total trading volume, suggesting that most investors who bought at high prices are still holding, with market sentiment leaning towards optimism.

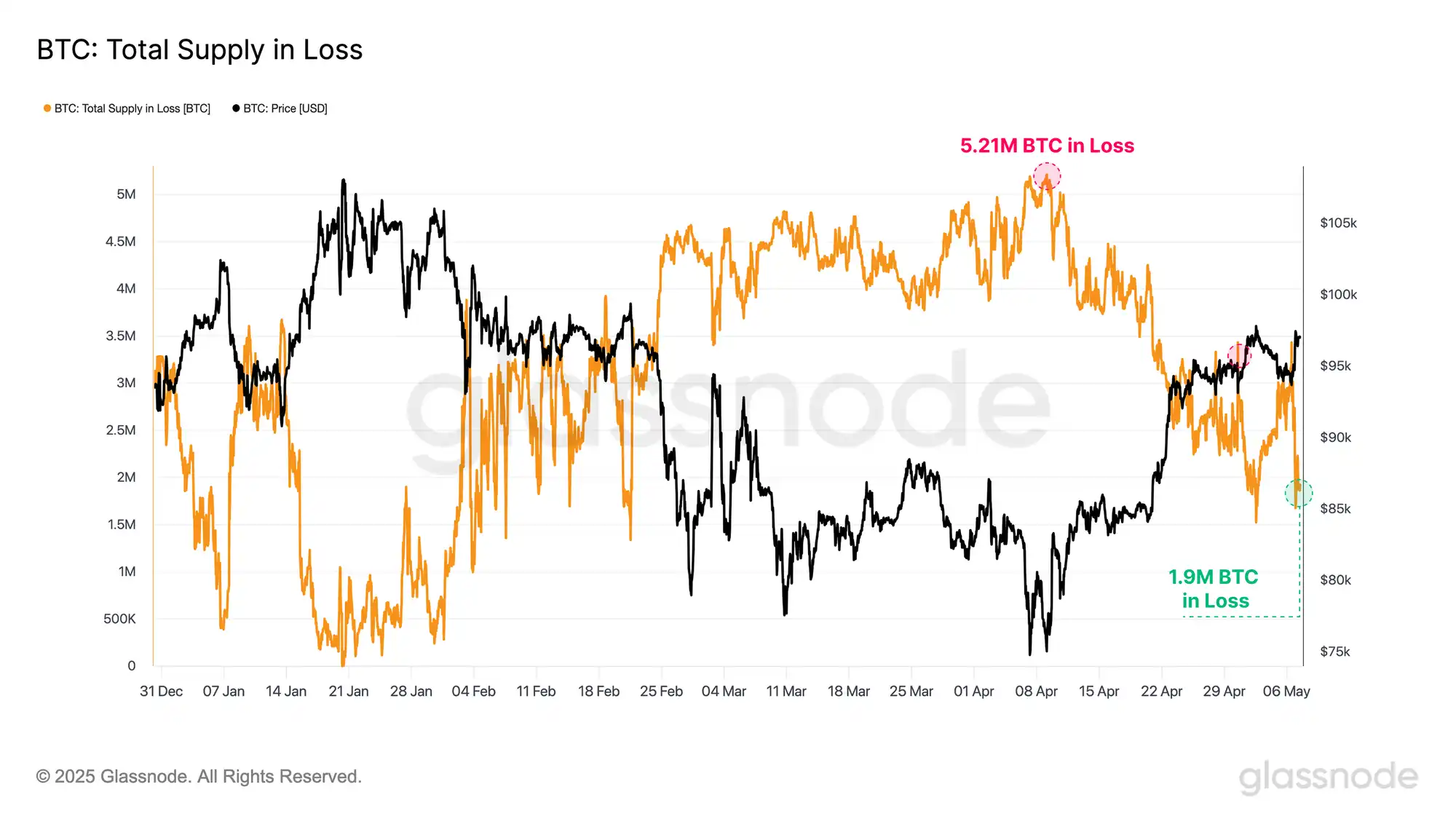

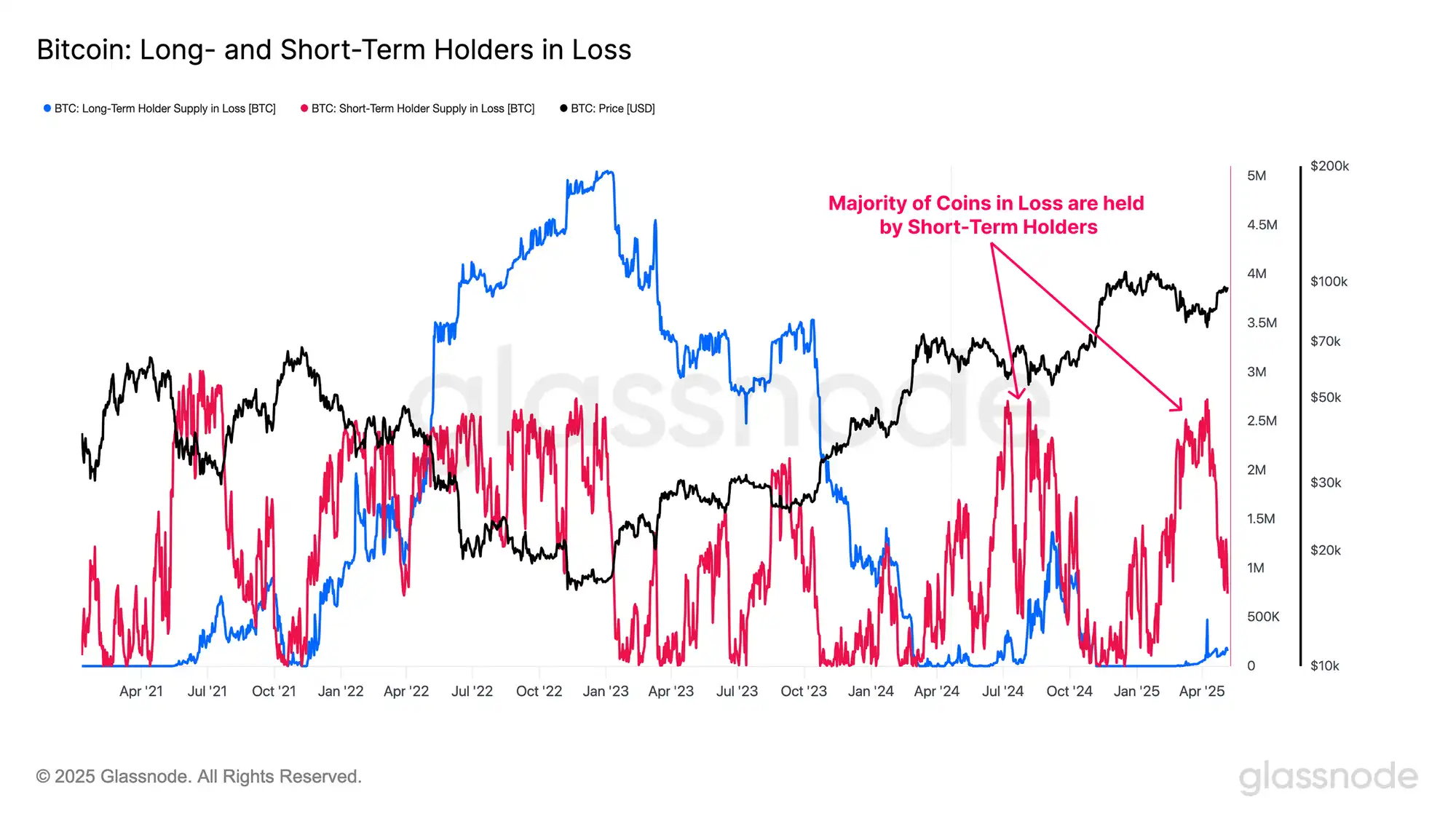

Second, the price recovery has significantly alleviated investors' financial pressure. At the recent low of $74,000, over 5 million BTC were in a state of unrealized loss. As the price rebounded to $97,000, about 3 million BTC returned to profitability, especially benefiting short-term holders (STH). The unrealized loss metric shows that the financial pressure on short-term holders has receded from the +2σ high during the August yen arbitrage trading collapse and early 2025 market slump to neutral levels. This improvement is directly reflected in trading behavior: the proportion of profitable trades among short-term holders has surged, marking a turning point from a loss-dominated market to a profit-dominated one.

Additionally, the behavior of long-term holders (LTH) is also noteworthy. Since the low point, over 254,000 BTC have been held for more than 155 days, indicating long-term investors' confidence in current prices. The realized supply density metric further reveals that a large number of BTC with similar cost bases are clustered around the current price. These coins were primarily accumulated between December 2024 and February 2025 and have not been sold despite enduring recent lows. The presence of this supply increases the market's sensitivity to price fluctuations, as small changes could trigger large-scale trades.

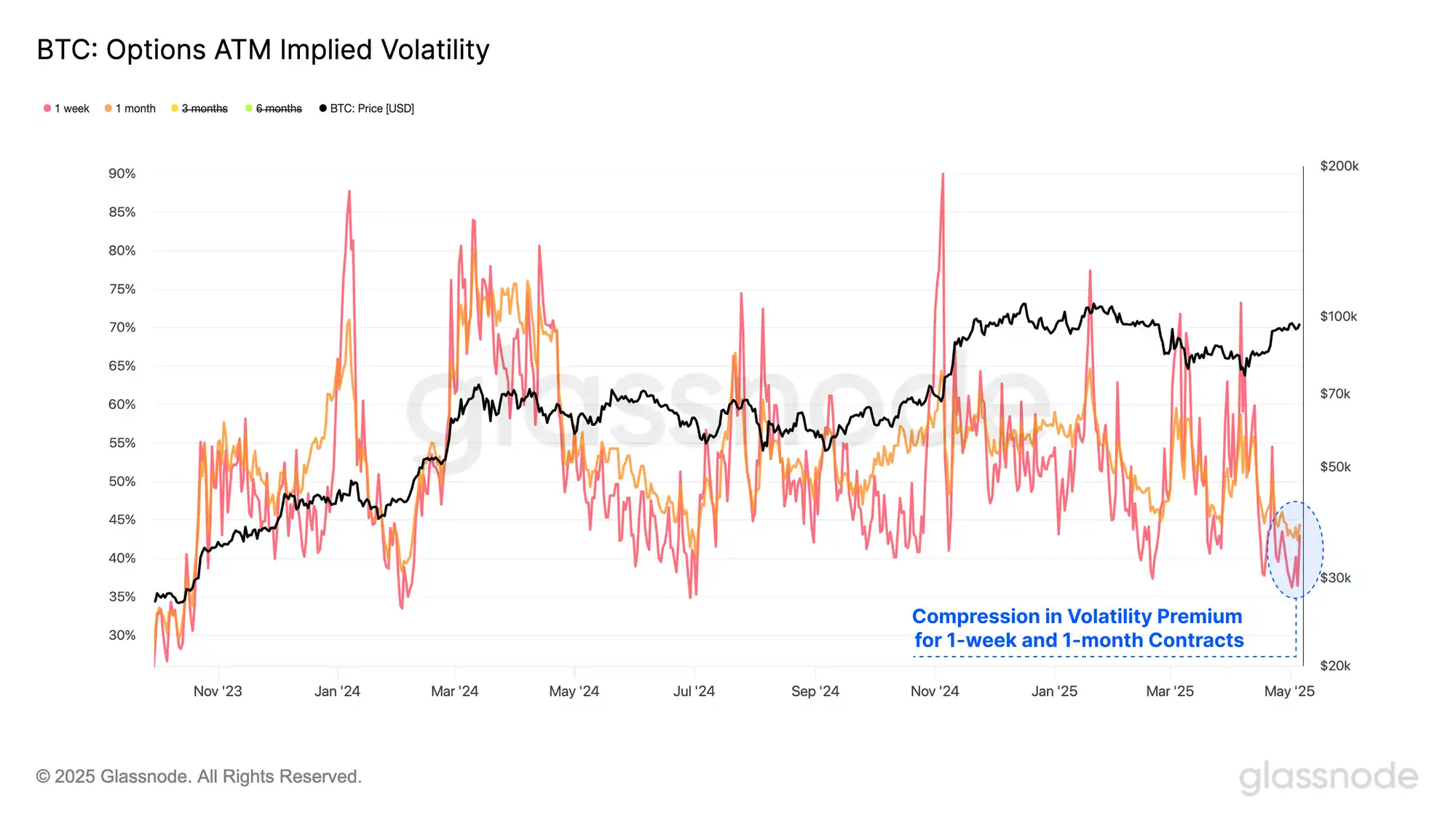

Finally, the options market provides an external perspective on volatility. The 1-week and 1-month ATM implied volatility has dropped to the lowest level since July 2024, reflecting investors' underestimation of future volatility. Historically, low volatility often precedes periods of high volatility, and combined with the high realized supply density, the market may be brewing a storm.

Market Critical Point: Concerns Beneath the Surge

Bitcoin's surge is in full swing, but the market stands at a delicate critical point. The price hovers near the cost basis of short-term holders (around $95,000), a level that has historically been a litmus test for upward momentum. If this support can be maintained, the market may push further; if it breaks, recent momentum could falter.

Signals from on-chain and options markets further exacerbate this uncertainty. High supply density means the market is more sensitive to price fluctuations, while low implied volatility suggests that investors may be underestimating future volatility risks. External catalysts—such as Trump's trip to the Middle East or the Fed's interpretation of economic data—could ignite volatility.

Conclusion: Bitcoin's Opportunities and Fog

The Bitcoin market in 2025 resembles a drama filled with peaks and valleys. Trump's trade policies inject vitality into risk assets, the Fed's rate cut expectations ignite market imagination, and Wall Street's crypto strategies endorse Bitcoin's long-term value. On-chain data delicately sketches a picture of capital inflows, restored investor confidence, and heightened market sensitivity.

However, beneath the surge lies a fog. The market is at a critical juncture, where slight changes in external variables could disrupt the fragile balance. Trump's next move, the Fed's policy path, and the direction of institutional funds will be key clues in the short term. In the long run, Bitcoin's decentralized nature and scarcity remain its core appeal, but macroeconomic uncertainties, regulatory pressures, and competition from traditional safe-haven assets may pose challenges.

For investors, this is a moment of both opportunity and risk. A saying from on-chain analysts may be worth pondering: "The value of Bitcoin lies in the sovereignty it grants individuals, not in momentary price fluctuations." In this digital wave, rationality and patience will be the best navigators. Regardless of how the market fluctuates, maintaining clear judgment may lead to greater distances than chasing the surge.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。