Original Author: 1912212.eth, Foresight News

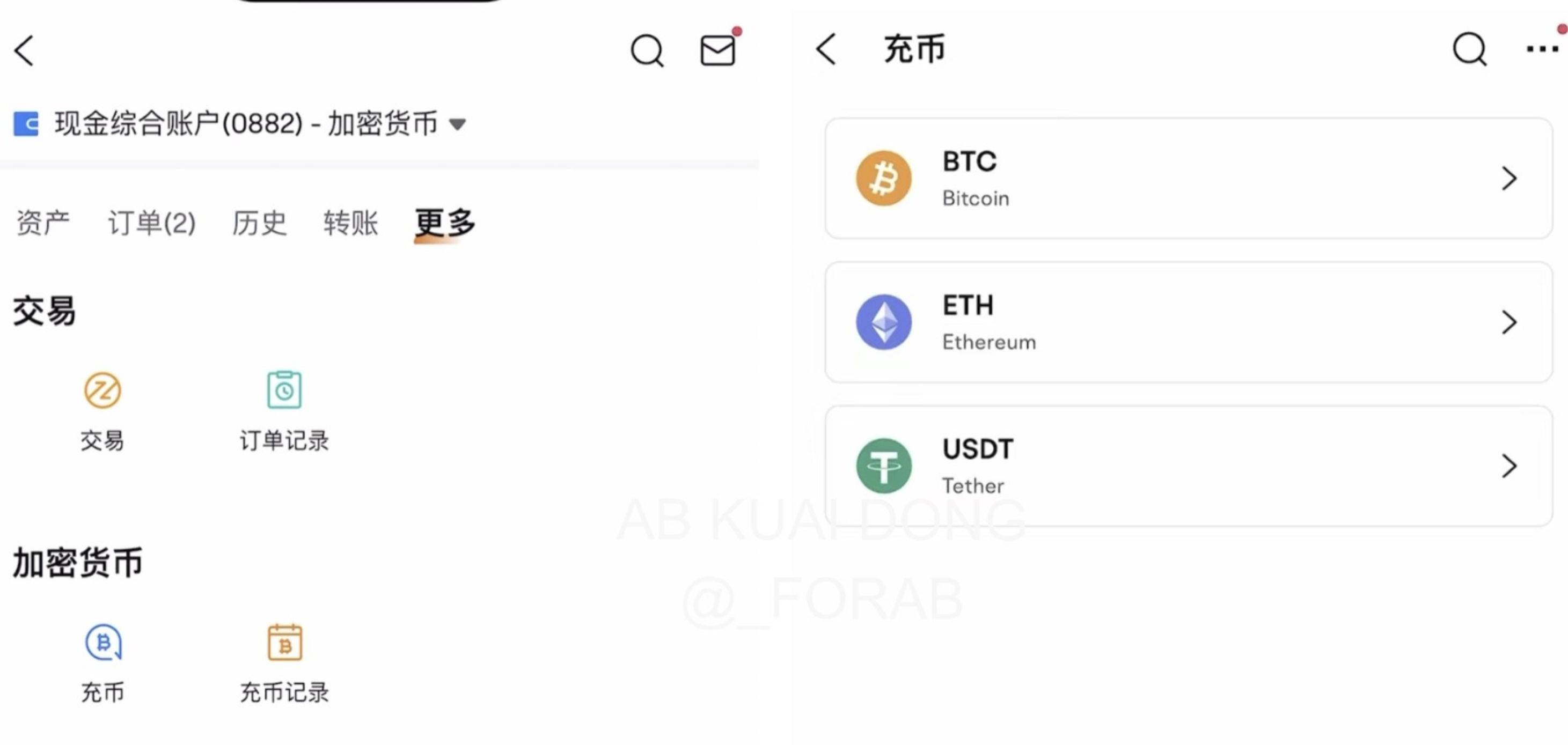

On the morning of May 7, Twitter user FORAB revealed that Futu Securities is testing a token recharge feature, supporting Bitcoin, Ethereum, and USDT. Just a few hours later, it was officially confirmed. Hong Kong fintech giant Futu Securities International (Hong Kong) Limited (hereinafter referred to as "Futu Securities") announced that its core trading platform, Futu NiuNiu, has officially launched BTC, ETH, and USDT recharge services. Qualified investors can complete token recharge and trade cryptocurrencies through the one-stop trading platform Futu NiuNiu, allowing them to invest in more asset classes or withdraw funds.

Hong Kong VATP License Approved This January

Futu Holdings Limited is a fintech company headquartered in Hong Kong, established in 2012, dedicated to providing digital securities brokerage and wealth management services through technological innovation. According to its official data, as of Q4 2024, Futu has over 34 million registered users globally, with approximately 2.5 million paying users, a year-on-year increase of 39.1%. The Hong Kong market has performed particularly strongly, with Futu NiuNiu users covering over 50% of the local adult population. In 2024, Futu's total revenue grew by 86.8% year-on-year, and its non-GAAP adjusted net profit increased by 105.4%.

Futu Securities Founder and CEO Li Hua

Futu Securities is its core subsidiary and, as a licensed broker in Hong Kong, holds licenses 1 (securities trading), 4 (advising on securities), and 9 (asset management) issued by the Hong Kong Securities and Futures Commission (SFC), qualifying it to legally conduct securities trading and related financial services. These licenses ensure that Futu's securities business in Hong Kong is strictly regulated and complies with anti-money laundering and know-your-customer requirements. However, cryptocurrency-related services involve regulation of virtual asset trading platforms (VATP), requiring an additional VATP license application.

As early as 2021, Futu expressed interest in the crypto market. According to reports from Caixin, Futu Holdings Vice President Robin Li Xu stated that the company had applied for digital currency-related licenses in Hong Kong, the United States, and Singapore, planning to enter crypto trading, although the process was slow. Hong Kong's regulation of crypto assets has gradually opened up in recent years. In 2023, the Hong Kong SFC launched the VATP licensing system, allowing compliant platforms to provide cryptocurrency trading services to retail investors. Notably, Futu Holdings' wholly-owned subsidiary PantherTrade applied for a VATP license that year, and by the end of January 2025, the Hong Kong SFC approved PantherTrade's VATP license.

The cryptocurrency recharge service launched by Futu Securities allows ordinary users to recharge Bitcoin (minimum 0.0002 BTC) and Ethereum (minimum 0.001 ETH) to their accounts via personal wallets, with funds typically credited within one hour; professional investors can recharge USDT using designated networks with no fees. This feature enables Futu NiuNiu users to seamlessly manage cryptocurrencies and traditional assets on the same platform, significantly enhancing the flexibility of their investment portfolios from Hong Kong stocks, U.S. stocks to Bitcoin and ETFs.

Futu's move is not an isolated case but part of a global trend of fintech platforms embracing cryptocurrencies. Robinhood in the U.S. is a prominent example. This platform, which disrupted traditional brokers with "zero commissions," launched Bitcoin and Ethereum trading services as early as 2018 and gradually expanded to assets like Dogecoin and Litecoin. Robinhood's crypto business quickly became one of its revenue pillars, with its 2023 financial report showing that crypto trading revenue accounted for nearly 20% of its total revenue. Similarly, global investment platforms like eToro have made cryptocurrencies a core business, attracting a large number of young investors. Futu Securities' initiative is clearly inspired by these pioneers, and the launch of its crypto recharge service is not only a necessary choice in market competition but also a keen response to changing user demands.

Lowering the Barrier for Stock Trading Users to Buy Coins

For traditional stock trading users of Futu NiuNiu, the launch of the cryptocurrency recharge service is quite attractive. First, it enriches the diversity of investment portfolios. Stock trading users are accustomed to investing in traditional assets like Hong Kong stocks, U.S. stocks, and ETFs, but cryptocurrencies, as alternative assets with high growth potential, have attracted global investors' attention in recent years. In 2024, Bitcoin's price once broke through $100,000, demonstrating strong market demand. Futu allows stock trading users to recharge BTC, ETH, and USDT through the same account, directly participating in the crypto market without the need to register additional accounts on crypto exchanges, thus lowering the learning and operational barriers.

Secondly, Futu's crypto services provide stock trading users with a new tool to hedge market risks. The stock market and the crypto market often exhibit different volatility cycles; for example, when Bitcoin plummeted in 2021, some stock markets remained stable. Stock trading users can diversify investment risks by allocating a small amount of crypto assets, especially to capture opportunities in the crypto market during downturns in traditional markets.

The USDT recharge feature provides professional investors with a stable funding transfer station, facilitating flexible switching between the stock market and the crypto market. Compared to platforms like Robinhood that attract young investors through crypto trading, Futu NiuNiu's stock trading user base has a high proportion of young and high-net-worth individuals, who are more accepting of cryptocurrencies. This feature from Futu is expected to further enhance platform stickiness and attract users to increase their account funds.

Diversified Investment for Crypto Trading Users

For "crypto trading" users who are enthusiastic about cryptocurrency trading, Futu Securities' recharge service also brings certain appeal. First, the Futu NiuNiu platform supports Bitcoin, Ethereum, and USDT recharge, covering mainstream assets in the crypto market. Bitcoin and Ethereum, as the top two cryptocurrencies by market capitalization, have high liquidity and market recognition; USDT, as a stablecoin, provides value anchoring for transactions, reducing volatility risks.

Secondly, Futu's brand endorsement and compliance provide higher security guarantees for crypto trading users. Compared to some crypto exchanges that have suffered asset losses due to technical vulnerabilities or hacking attacks, Futu, as a licensed broker, relies on a mature trading system and strict regulatory requirements, significantly reducing funding risks. For example, the U.S. platform Robinhood attracted a large number of users through crypto trading, with compliance and technical stability being key factors. Futu's similar positioning is expected to replicate this success, attracting crypto trading users who are sensitive to security and transparency.

Additionally, Futu NiuNiu's one-stop platform allows crypto trading users to quickly convert between crypto assets and traditional financial assets. Users can manage Bitcoin and Hong Kong stocks, U.S. stocks, and other assets within the same account, eliminating the hassle of cross-platform transfers and improving capital utilization efficiency. This seamless connection is particularly appealing to crypto trading users seeking diversified investments; some crypto trading users also pay attention to opportunities in U.S. and Hong Kong stocks. When the cycles of the crypto and stock markets misalign, it allows investors to flexibly grasp fluctuations and seize dual opportunities in both the crypto and stock markets.

However, crypto trading users should note that Futu's crypto services are currently mainly aimed at users in Hong Kong and overseas, as users from mainland China cannot participate due to regulatory restrictions. Additionally, Futu has set a professional investor threshold (8 million HKD asset proof) for USDT recharge, leading some in the market to jokingly say it "blocks retail investors." The extremely high threshold makes it nearly impossible for small retail investors to participate in trading on the platform, and the current number of participants in the recharge service remains unknown.

Conclusion

For Futu itself, this move not only meets the needs of existing users but may also attract new users, further expanding its market share. From an industry perspective, Futu's entry should not be underestimated. Crypto assets are accelerating into the mainstream, and the compliant operation of traditional financial platforms injects transparency into an already trust-deficient crypto industry. Finally, Futu's actions may trigger a chain reaction. Local Hong Kong brokers like Victory Securities have already supported crypto recharges, and Futu's entry will encourage more traditional financial institutions to follow suit, accelerating industry consolidation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。