Every April in the crypto market is filled with confusion and difficulties, and 2025 is no exception. From the tariff clouds at the beginning of the month to Trump's brief easing, the crypto market has become a testing ground for political compliance. Coupled with the dovish expectations of the Federal Reserve and multiple external factors, the market rebounded quickly, with the narratives around AI and Memes showing the most significant recovery. At the same time, benefiting from CZ's typical celebrity effect and Binance Alpha's aggressive airdrop strategy, Memes have become a key indicator of market sentiment and liquidity direction in a short period.

This article will review and dissect the April market: the overall data performance of the cryptocurrency market and the rise and fall of newly issued Meme tokens, further analyzing the capital flow and narrative evolution path of the Meme market in April, and finally looking ahead to the trends and key events in May, aiming to reveal a panoramic view of the monthly trends in the Meme market and provide a reference framework for the May market.

Market Mildly Warms Up: Funds Flow to AI and Memes

In April, the pace of U.S. inflation decline slowed, and the Federal Reserve signaled that "balance sheet reduction (QT) may end this year," leading to ongoing disagreements about the interest rate cut timetable, with overall risk appetite remaining cautious. Amid macro uncertainties, stablecoins continued to "act as a safe haven," benefiting from the inflow of incremental dollar stablecoins. Bitcoin rebounded first from the $82,000 line to the $90,000–$95,000 range, with a monthly increase of over 20%.

Throughout April, the Meme and AI sectors became the core incremental engines of the market. In contrast, most mainstream and long-tail tokens performed mediocrely: among the 30-day gainers on CoinGecko, only three tokens—VIRTUAL, FARTCOIN, and TAO—saw monthly gains exceeding 100%, while the remaining Top 100 assets averaged only single-digit increases.

Liquidity Competition Escalates: Exchange Competition Heats Up

In April, liquidity competition intensified, with major trading platforms engaging in fiercer competition for market traffic. Binance Alpha tied users to the trading interface through a "points + airdrop" mechanism, while the Web3 wallet TGE event attracted significant attention. Gate.io seized early traffic with a combination of "innovation zone + MemeBox," and the OKX DEX aggregator, after 49 days of technical upgrades, rejoined the market share competition.

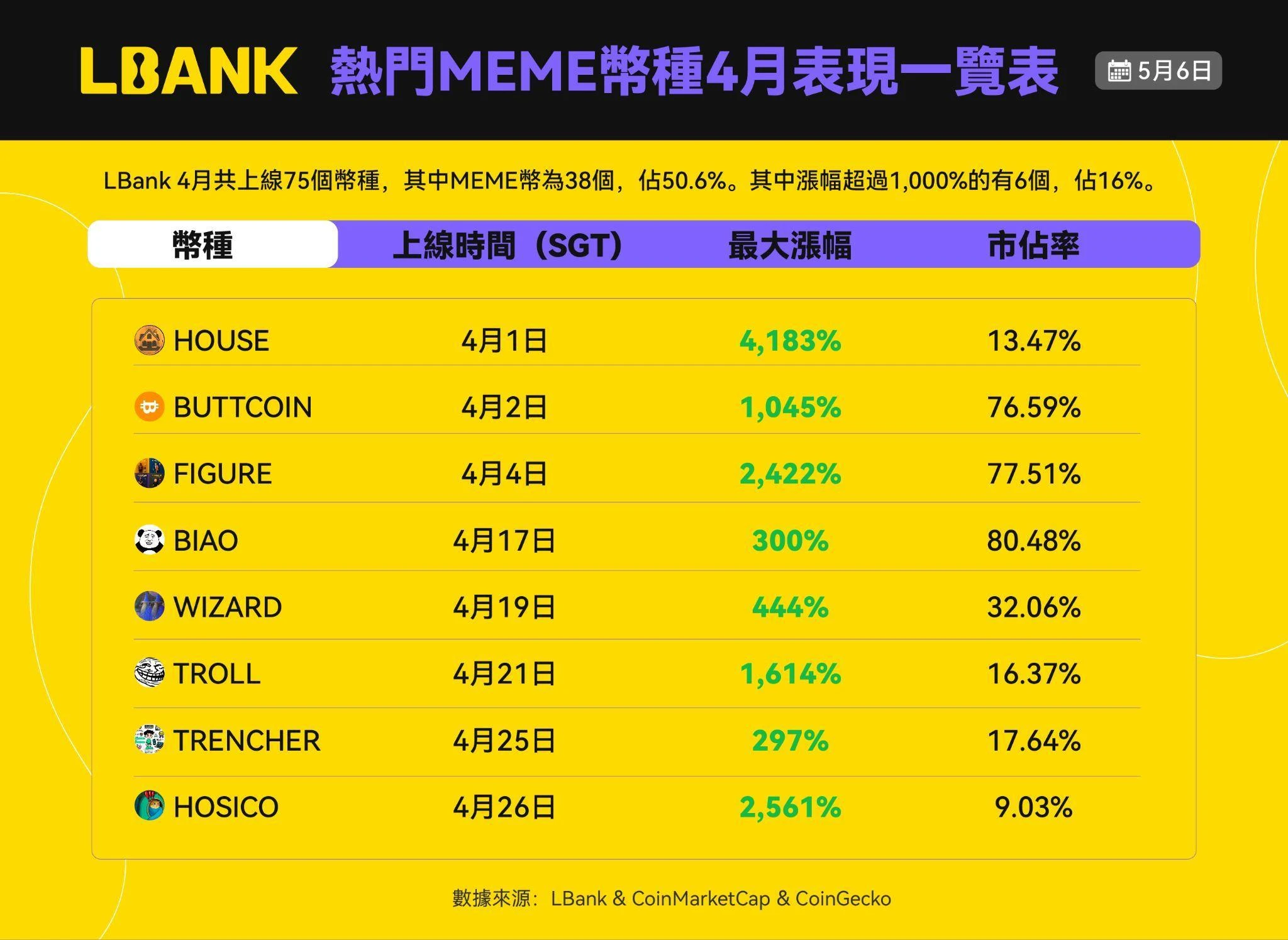

Although LBank has not launched DEX products, it maintained a "fastest listing and top Meme liquidity" advantage, keeping a "48-hour rapid listing" pace, securing its market share as the top CEX for quality Meme assets, continuously locking in maximum returns for popular Memes.

LBank stood out in the Meme sector with its two major advantages of "rapid listing + deep liquidity":

The average increase of the top five Meme coins listed in April reached 3,166%, far exceeding other mainstream CEXs.

CoinGecko shows that LBank ranks among the top in global trading shares for several popular Meme coins, having preemptively listed RFC, HOUSE, TROLL, HOSICO, and others before their explosive growth, maintaining a leading position in market share.

Among them, BIAO, FIGUR, and EBUTTCOIN all exceeded 70% market share, reflecting that LBank's first-mover advantage in Meme launches has created a barrier to entry.

Binance Alpha has newly launched a points system mechanism, injecting new vitality into the BNB chain Meme ecosystem by locking in early liquidity. The dynamic adjustment of point thresholds and airdrop rewards has significantly intensified the atmosphere of high-frequency trading in the market. In April, Binance Alpha launched early Meme coins such as SPX, MOG, POPCAT, and CULT, and at the beginning of May, it quickly followed up with BOOP, Jager, and DONKEY, causing a brief surge in coin prices. Although Alpha, as a testing ground for Binance's spot listings, has been striving to reverse the listing difficulties caused by VC coins, it still lags in listing speed, with many Meme coins often peaking at the moment of announcement, only to see their momentum fizzle out after the actual launch.

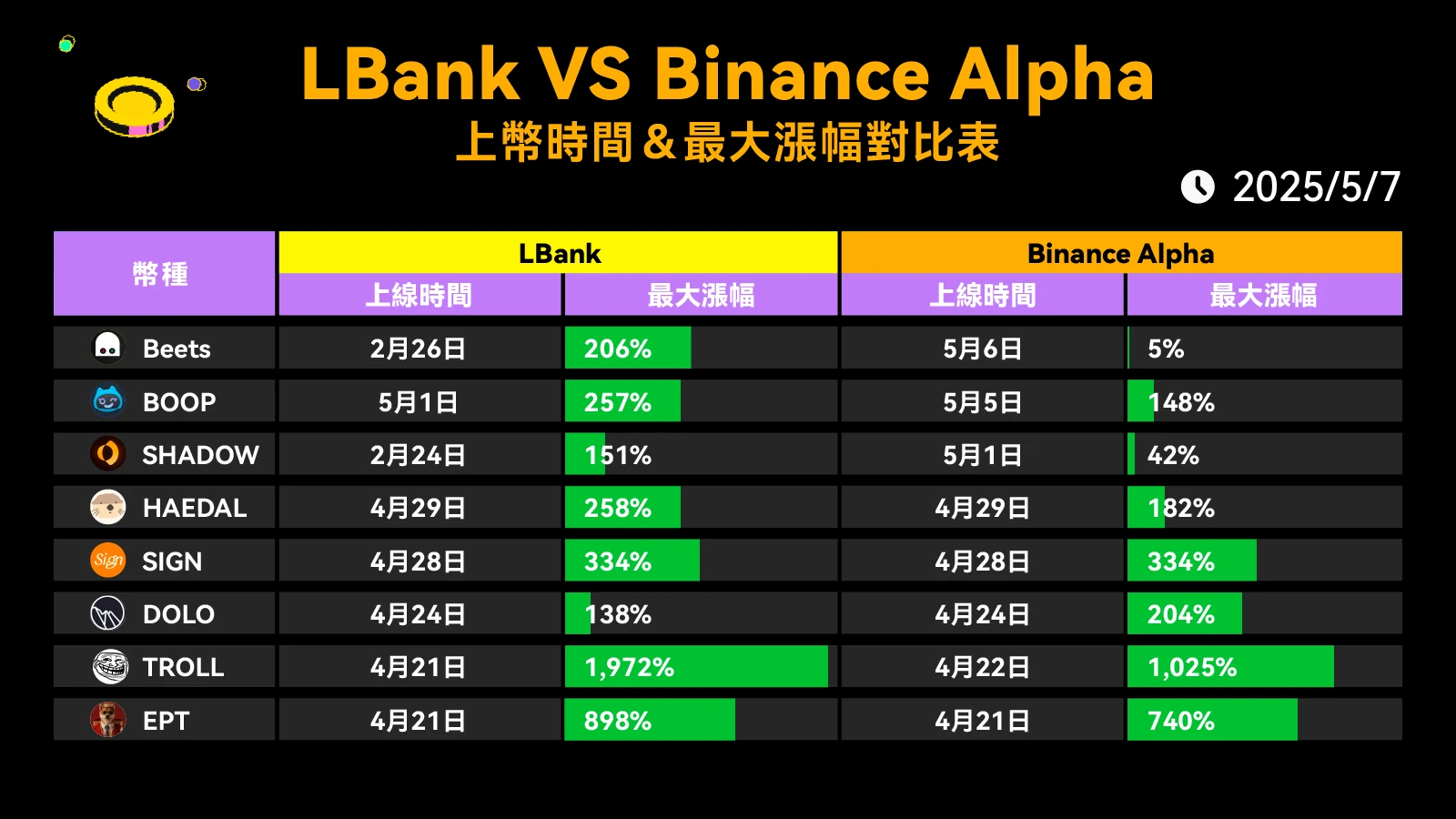

It is worth mentioning that LBank was quick to list these potential Meme tokens at the onset of their popularity, successfully capturing the maximum gains for LBank users. For new coin hunters seeking high elasticity, timing is profit. Practical tests in April showed that the eight Meme coins listed on LBank had an average increase of 527%, while Binance Alpha's was 335%, a difference of 192%, equivalent to capturing about 57% more profit space in the same market wave.

For example, Beets was listed on LBank on February 26, with a maximum price increase of 206%; however, Binance Alpha only listed it on May 6, with a mere 5% increase. The 70-day information gap directly amplified the profit space by 201%. TROLL was listed on LBank on April 21, surging 1,972% within a day; although Binance Alpha followed up the next day, the main upward wave had passed, leaving only a 1,025% increase, allowing for an additional profit of 947% by being ahead by 24 hours.

At the same time, we noticed that the Meme launch platforms have also entered a new dimension. ElizaLabs launched auto.fun, replicating the "zero-code issuance" experience of pump.fun, but added AI agent deployment features, allowing anyone to launch an "AIMeme" in three minutes. Meanwhile, Virtuals Protocol introduced GenesisLaunch: as long as one holds VIRTUAL and earns points, they can prioritize subscription to AIAgent-themed new coins based on weight, turning "fair launches" into a community operation tool. The dual acceleration of liquidity competition and Launchpad competition has made the "liquidity-topic-yield" flywheel turn faster, making high-frequency trading the main theme of the April market.

Attention Fatigue: The Power Game of Celebrity Endorsements is Marginally Diminishing

In the past two years, "billionaire name changes and founder endorsements" have almost been the killer technique for Meme coin markets; however, the market's sensitivity to celebrity endorsements significantly decreased in April. Musk changed his X account nickname to "GorklonRust," causing the GORK token to surge nearly 100% within 24 hours, but after briefly peaking at $0.083, it quickly fell back to around $0.06, with a daily increase of less than 20% being completely swallowed. A similar situation occurred with the CZ-related DONKEY token: after it launched on Binance Alpha on May 5, it surged but retracted over 45% within 72 hours. Zerebro's co-founder attempted to replicate the celebrity effect through "suicide live streaming + legacy coins," but after a backlash in public opinion within 48 hours, the market cap plummeted from $30 million to $2 million, ultimately becoming a "scam script."

This indicates that while celebrity tweets can still cause instant price drops or surges, their effectiveness is compressing from "days" to "hours," after which they enter a habitual "buy high and sell" cycle. The reason for this is that the market is becoming fatigued with "personalized narratives," and the effect of purely dramatizing segments to create FOMO is significantly diminishing.

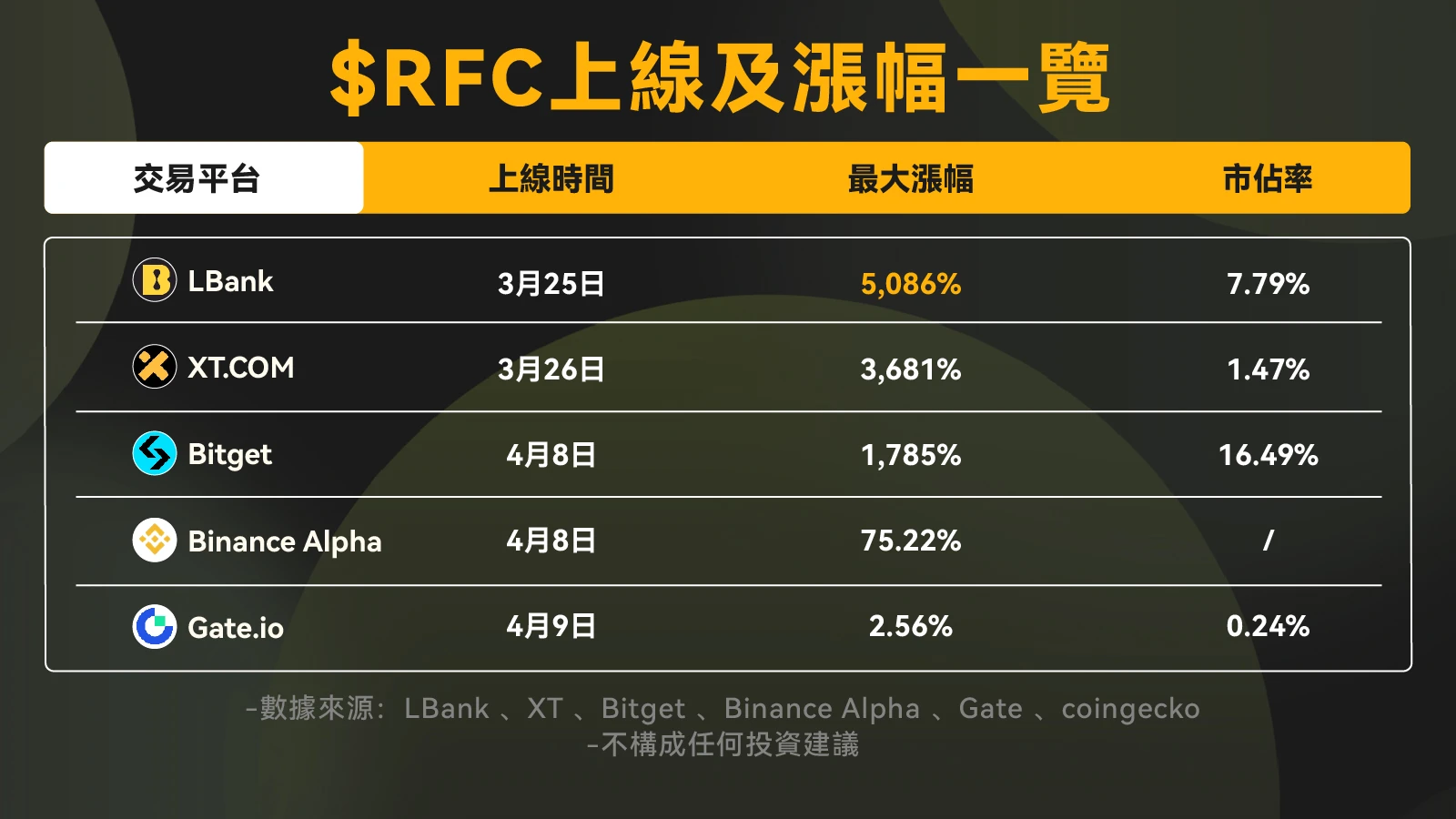

As the "celebrity halo" fades more quickly, it becomes particularly crucial to launch assets before the steepest part of the emotional curve. LBank's speed advantage is thus amplified: when popular meme coins like RFC and FIGURE began to gain traction on social media, LBank completed the review and launched them immediately, helping users capture the first wave of increases of 5,086% and 2,422%; when spot liquidity began to withdraw, LBank quickly launched perpetual contracts, providing new opportunities for both bulls and bears while offering early holders a hedging exit. In other words, in an environment where the marginal effect of celebrity endorsements is diminishing, being ahead in the listing rhythm + timely supplementing derivatives allows LBank users to not only seize the "first bite of meat" from the emotional surge but also have tools to safely cash out or reverse positions as the heat dissipates.

New Blood in Memes: Abstract & Meme Culture Returns to Its Roots

Currently, the total market value of the Meme sector hovers around $56 billion, slightly rebounding from the March low, and is in a "mid-stage consolidation" range. CoinGecko data shows that leading Meme assets (DOGE, SHIB) remain in the billion-dollar market cap club, while mid-tier newcomers like RFC and HOUSE are distributed in the $10M–$100M range, still in the "price discovery + community diffusion" stage; a large number of micro-cap tokens around $10M occupy over 70% of the Meme asset pool, with high volatility and elimination rates.

At the same time, we noticed that since April, a batch of new coins with more "abstract narratives" and ironic meanings have been shifting the focus of discussion back to the essence of Memes: using humor, satire, and community co-creation to express critiques of reality. Among the most representative are the three major "new blood" tokens: RFC, TROLL, and HOUSE.

RFC: RetardFinderCoin originated from the popular X platform account @IfindRetards, which gained fame by mocking absurd statements with a single sentence and received multiple "likes/replies" from Musk—official statistics show that Musk interacted 22 times within a month, and the account's followers surged to 700,000. On April 6, Musk's tweet "Investigating" triggered RFC's market cap to rise from $10 million to $30 million within two days. As the earliest trading platform to list RFC, LBank successfully captured a staggering increase of 5,086%. Currently, RFC still hovers around a market cap of approximately $10.7 million, ranking in the thousands; although it has fallen over 60% from its peak, it has not gone to zero, with the community still generating thousands of "report stupid tweets" content daily, forming a high-viscosity cultural cycle.

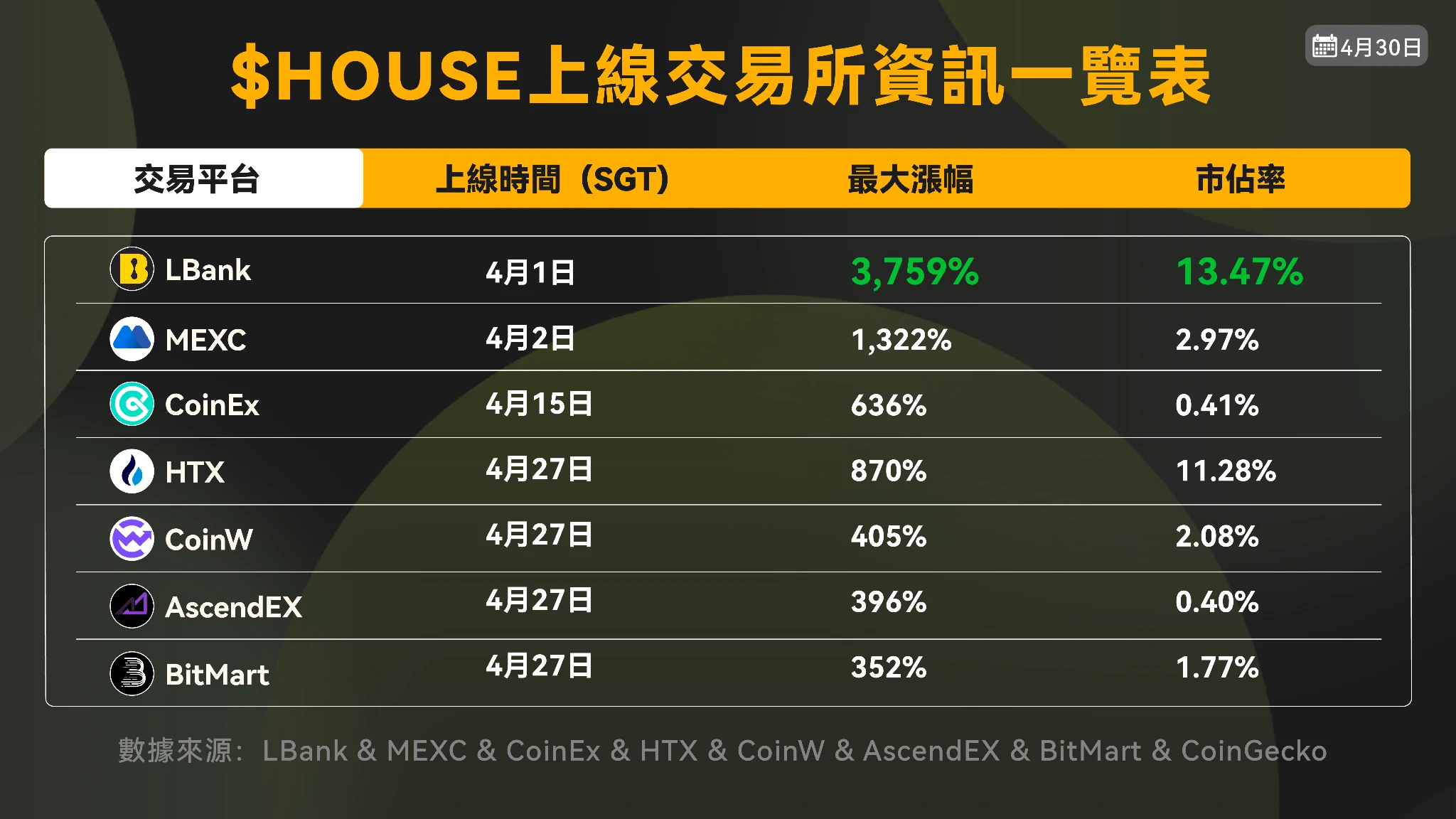

HOUSE: "Since we can't afford a house, why not buy Housecoin?" — HOUSE transforms the global youth's helplessness towards high housing prices into an absurd meme. On April 1, LBank launched HOUSE, which surged by a maximum of 3,759%, achieving a market share of 13.47%. Its market cap first broke the $100 million mark by the end of April; even after a 40% retracement from its all-time high (ATH), it currently maintains a sideways range of about $53 million to $63 million. Compared to traditional "one-day wonders," HOUSE successfully converts FOMO traffic into a long-term holding community by continuously outputting housing price jokes and "building on-site" memes, with many analysts viewing this "escape from quick turnover" experiment as a replicable model in the Meme sector.

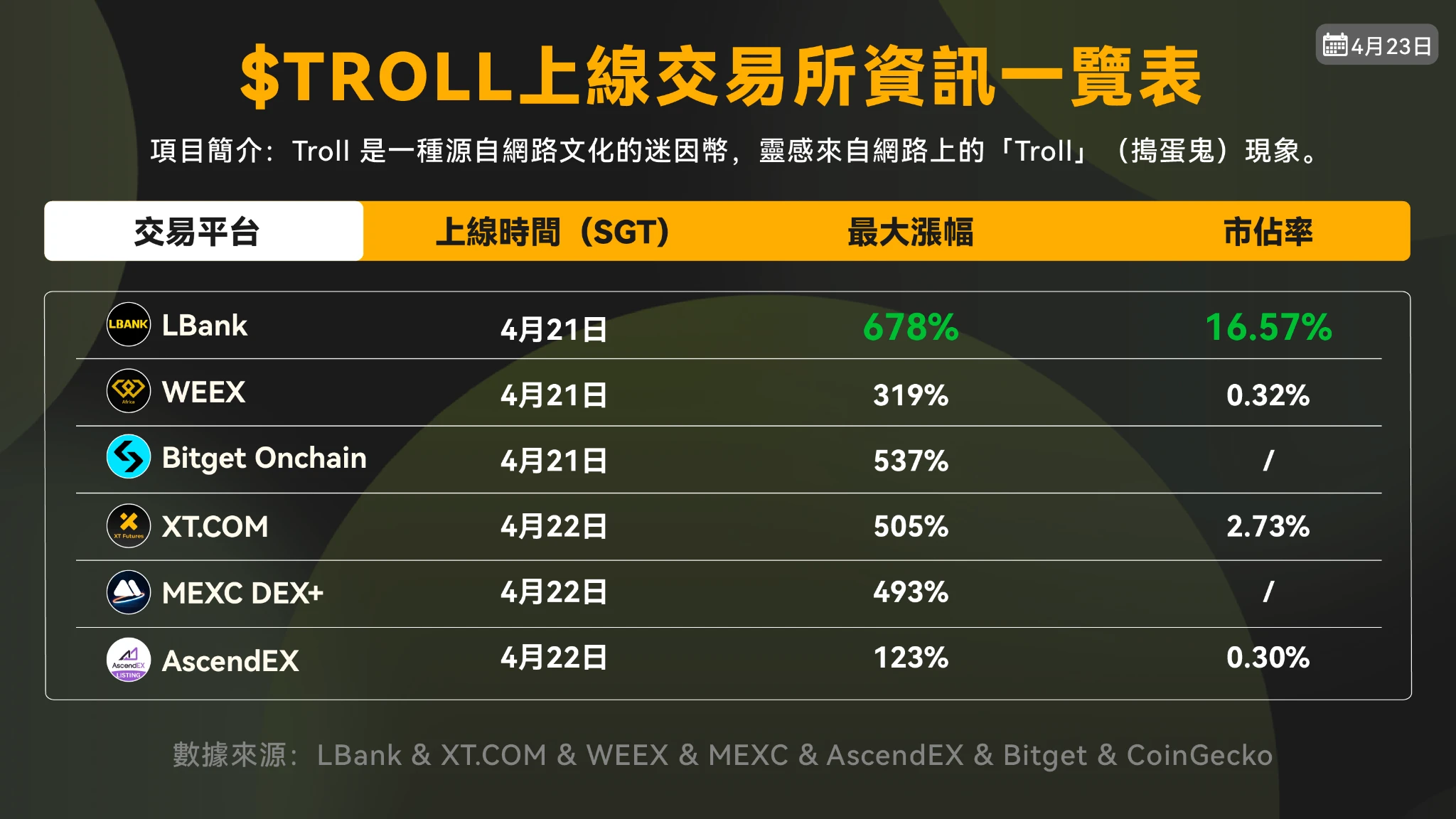

TROLL: TROLL is inspired by the classic meme Trollface created by Carlos Ramirez (online name Whynne) in 2008 — a symbol of early internet anti-authoritarianism and parody spirit. Initially obscure, the coin suddenly exploded on April 20, with its market cap soaring by 59,944% in a single day, peaking at $27.37 million. On April 21, LBank keenly recognized TROLL's potential and preemptively listed it, successfully locking in a maximum increase of 678% and a market share of 16.57%. According to DEXScreener data, TROLL's market cap currently fluctuates around $16 million. The project team collaborated with the original artist to launch "original manuscript NFTs" and community comic contests, allowing classic meme culture to be re-created and amplified, significantly extending the half-life of its popularity.

RFC, HOUSE, and TROLL each hit upon a triple satire of contemporary youth towards authority, reality, and internet history. The rise of these Meme tokens also reminds us that when Memes embrace abstraction and meme culture again, resonating with real community emotions, rapid rise and fall is not an inevitable fate, and funds shift from pure profit-seeking to resonance with stories and culture.

May Outlook: Continuation of Trends and Key Focus

Overall, in April, under the combined influence of the three engines of "Bitcoin stabilization - social narrative ignition - exchange liquidity competition," the Meme coin market continued to ferment, and this trend is expected to extend into May.

On a macro level, the U.S. and China have resumed tariff negotiations, alleviating market risk aversion; New Hampshire has become the first state in the U.S. to pass legislation for a "strategic Bitcoin reserve," opening a new chapter for public funds to participate in digital assets.

On the technical and narrative front, Ethereum is about to undergo the Pectra upgrade, aimed at addressing challenges in scalability, security, and user experience within the Ethereum ecosystem; the trend of combining AI and MEME is expected to deepen, with more AI-themed Memecoins likely to emerge; at the same time, the RWA narrative is also beginning to surface, with May expected to become a new market hotspot.

In terms of social hotspots, the "TRUMP Dinner" on May 22 will once again test the chemical reaction between political figures and tokenized narratives; the new coin issuance plan from Trump's Truth Social platform may become the next wave of emotional catalysts.

Looking back at April, the resonance of Meme and AI narratives ignited the market under the stabilization of Bitcoin, celebrity effects, and liquidity competition, while LBank's "rapid listing" rhythm and the Alpha accelerator of the BNB chain pushed the capital game to a climax. Looking forward to May, macro positives, Ethereum upgrades, AI Memes, and RWA narratives are still extending. What truly determines returns is not only the speed of catching the wave but also the respect for retracements. Maintaining curiosity, persisting in research, and controlling positions may be the most worthwhile strategies to uphold before the next market wave arrives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。