Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

RWA Sector Market Performance

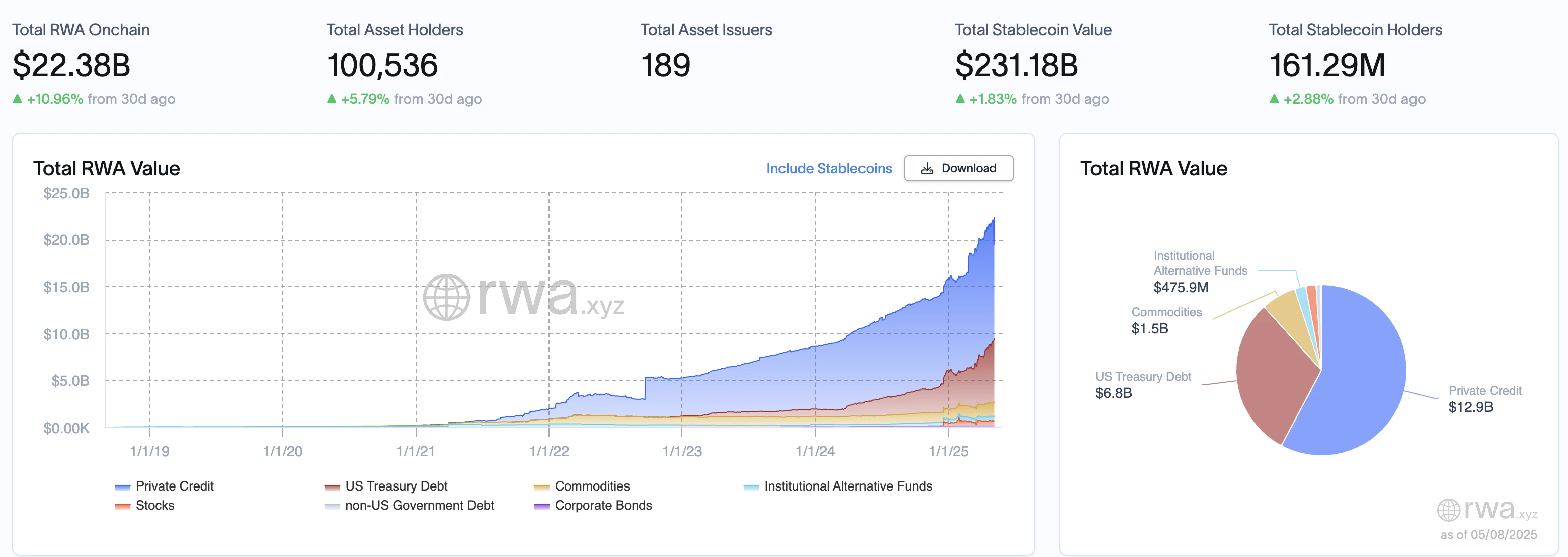

According to RWA.xyz data, as of May 8, 2025, the total on-chain value of RWA reached $22.38 billion, an increase of 10.96% compared to 30 days ago. The total number of on-chain asset holders was 100,536, up 5.79% from 30 days ago, with 189 assets issued. The total value of stablecoins was $231.18 billion, an increase of 1.83% from 30 days ago, while the number of stablecoin holders was 161.29 million, up 2.88% from 30 days ago.

Historically, the total on-chain value of RWA has shown significant growth since 2019, particularly accelerating after 2023, peaking in early 2025, indicating the rapid adoption of tokenized assets. In terms of asset class distribution, private credit dominates with a value of $12.9 billion, accounting for 57.64% of the total value; US Treasury Debt is valued at $6.8 billion, accounting for 30.38%, an increase from last week's 28.69%; commodities are at $1.5 billion, accounting for 6.7%; and international alternative funds are at $475.9 million, accounting for 2.12%. Stocks, non-US government debt, and corporate bonds have relatively small proportions.

From the comparison with last week's data, US Treasury Debt and private credit remain the core engines, contributing a total of $600 million (77.92%) to the week-on-week increase of $770 million. The RWA sector continues to maintain structural growth, dominated by compliant assets (Treasuries, credit), while institutional alternative funds, commodities, and equities are still in the early stages. Meanwhile, the on-chain stablecoin scale decreased by $260 million week-on-week, reflecting that the RWA market is not significantly affected by the overall market trends compared to the increase in non-stablecoin RWA assets ($600 million).

Review of Key Events Last Week

Private equity accelerates tokenization to solve liquidity issues

According to Forbes, private equity is accelerating its exploration of tokenization due to limited traditional exit channels. With high interest rates from the Federal Reserve and Trump-era policies in 2025, IPOs and secondary trading are hindered, and $13.4 trillion in private assets face liquidity bottlenecks. Tokenization allows for the fragmentation of private equity, real estate, and other assets via blockchain, enabling 24/7 trading and expanding the global investor base. BlackRock, Franklin Templeton, and Hamilton Lane have launched tokenized funds, but retail investors need to be cautious of potential liquidity risks and regulatory gaps.

A bipartisan bill in the US Senate aimed at establishing a federal framework for stablecoins has encountered significant divisions during discussions, with some Democratic senators threatening to use a filibuster against the bill, demanding stronger consumer protection and anti-money laundering provisions. One Democratic senator pointed out that the new agreement has numerous "loopholes" in its requirements for stablecoin issuance and bank reserves, and without corrections, it will fail to protect the rights of ordinary users. This division has forced the originally scheduled vote this week to be postponed, making the legislative outlook increasingly uncertain. Market participants are concerned that if the current Congress fails to pass the legislation, the regulatory vacuum for US stablecoins may persist, affecting the industry's growth rate.

US SEC announces fourth crypto roundtable to be held on May 12, SEC Chair and Nasdaq to attend

According to official news, the US Securities and Exchange Commission (SEC) has announced the detailed agenda and guest list for its roundtable titled "Tokenization: On-Chain Assets - The Intersection of Traditional Finance and Decentralized Finance," scheduled for May 12.

This roundtable is part of the SEC's series of regulatory activities for crypto assets launched in March and will take place from 1:00 PM to 5:30 PM local time at the SEC headquarters, open to the public and will be live-streamed on the SEC's official website.

Additionally, another roundtable originally scheduled for June 6, titled "DeFi and the American Spirit," has been rescheduled to June 9. Previously registered participants will be automatically transferred to the new date without needing to re-register, while new users can continue to sign up.

Attendees from the SEC include: Chair Paul S. Atkins, Director of the Crypto Working Group Richard B. Gabbert, Commissioner Hester Peirce, among others.

Other attendees include: Cynthia Lo Bessette (Fidelity), Eun Ah Choi (Nasdaq), Will Geyer (Invesco), etc.

Citi partners with MAG to tokenize $3 billion in real estate assets and launch MBG token

Citi has reached a $3 billion tokenization agreement with UAE developer MAG and blockchain company Mavryk, creating the world's largest RWA tokenization project. The collaboration will bring assets such as the Ritz-Carlton residences in Dubai on-chain, opening them to global investors through the MultiBank.io platform, allowing holders to earn daily returns. The MBG token will support platform access, staking, and fee payments, with plans to expand to $10 billion in asset tokenization in the future.

Report predicts RWA sector market value will reach $50 billion by 2025

A joint report by Keyrock and Centrifuge titled "The Great Tokenization Shift of 2025" predicts that by the end of 2025, the RWA sector market value will reach $50 billion, with US Treasuries expected to dominate, reaching a market value of $28 billion. The current RWA market size is $18.85 billion, with private equity accounting for 55%, but tokenization of Treasuries is expected to surge to $3.97 billion by 2024. The report states that regulatory clarity and institutional adoption will drive growth, with tokenization addressing issues such as slow settlement and fragmented liquidity in the Treasury market, while also enhancing liquidity in private equity and retail investor participation.

Kyrgyzstan plans to issue gold-backed stablecoin USDKG in Q3 2025

Kyrgyzstan plans to launch a gold-backed stablecoin pegged to the US dollar, called Gold Dollar (USDKG), in the third quarter of this year. The stablecoin will be supported by $500 million in gold from the Kyrgyzstan Ministry of Finance, aimed at facilitating smooth cross-border transfers in a country where remittances account for 30% of GDP. Additionally, there are plans to expand the reserves to $2 billion in the future.

According to insiders, USDKG is designed specifically for cross-border transactions and international trade, initially focusing on the Central Asian market, with future expansion to Southeast Asia and the Middle East.

Latest Updates on Hot Projects

Ondo Finance (ONDO)

Official website: https://ondo.finance/

Introduction: Ondo Finance is a decentralized finance (DeFi) protocol focused on tokenizing real-world assets (RWA), aiming to bring traditional financial assets such as US short-term Treasuries and bonds onto the blockchain for on-chain investment and liquidity. Its core products include tokenized yield-stable assets (such as USDY), providing transparent and efficient financial tools through smart contracts. Ondo emphasizes collaboration with regulators and is committed to promoting tokenization innovation within a compliant framework while enhancing asset interoperability through cross-chain solutions.

Latest updates: On April 24, the Ondo Finance team met with the SEC's crypto task force in Washington, D.C., to discuss the future of tokenization and digital asset regulation. Ondo expressed its eagerness to work with regulators to develop a thoughtful regulatory framework for digital assets. On May 3, Ondo announced the expansion of its tokenized US short-term Treasury asset USDY to the Solana ecosystem and launched a pioneering bridging solution that allows USDY to be seamlessly transferred between the Solana and EVM (Ethereum Virtual Machine) ecosystems.

Usual (USUAL)

Official website: https://usual.money/

Introduction: Usual is a decentralized stablecoin protocol aimed at creating a fair, community-driven financial ecosystem through the tokenization of real-world assets (RWA). Its core goal is to transform the centralized profit model of traditional stablecoins (such as USDT) into a user-owned and governed model, redistributing value and control to the community through its stablecoin products USD0 and USD0++, as well as the governance token USUAL. The project combines the stability of physical assets with the composability of DeFi, dedicated to providing users with secure, transparent, and high-yield financial tools.

Recent Updates: On May 2, Usual completed the redistribution of the third round of early redemption fees, distributing 8.25 million USUALx to eligible USUALx holders. Previously, the Usual community approved the UIP-7 proposal, which sanctioned the method for redistributing the early redemption fees collected earlier.

Recommended Related Articles

RWA Weekly Report: Summarizing the latest industry insights and market data.

“On-chain Reconstruction of Global Tourism: A New Wealth Paradigm of Web3 + RWA”

This article introduces how Coinsidings 2.0 leverages RWA asset tokenization, consumption option mechanisms, AI computing power closed loops, and DeFi dividend systems to transform travel spending into on-chain value flow, building a new wealth network that allows users to achieve "travel as investment, consumption as profit" during their travels.

The article focuses on the tokenization of US stocks, detailing its development history, market status, opportunities, challenges, and market prospects. Under the influence of Trump’s deregulatory policies, the RWA sector has gained attention, and tokenized stocks are ushering in new development opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。