Bitcoin ETFs Rebound Strong But Ether ETFs Hit by $21.77M Outflow

The bulls returned to bitcoin ETFs midweek, pushing aside Tuesday’s slip with $142.31 million in net inflows. Capital flooded into four key funds, with Ark 21shares’ ARKB taking the lead at $54.73 million, followed by Fidelity’s FBTC with $39.92 million, and Blackrock’s IBIT, which added $37.19 million. Bitwise’s BITB rounded out the day with a modest $10.48 million inflow. No fund recorded outflows, a rare all-green showing.

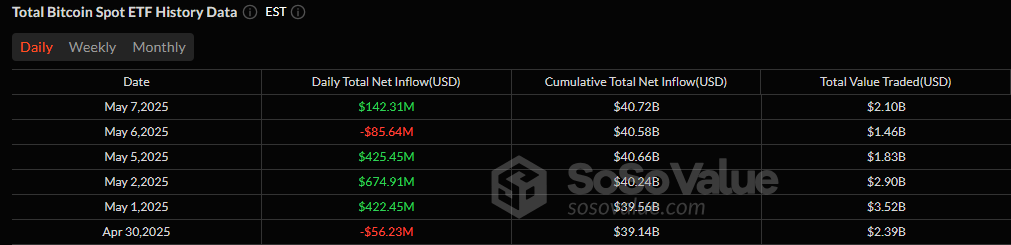

A much-needed rebound pushed total bitcoin ETF net assets to $112.71 billion, with $2.10 billion traded across the board.

Source: Sosovalue

Meanwhile, ether ETFs couldn’t shake off their outflow trend. For the second straight day, the segment posted losses, this time totaling $21.77 million, which came entirely from Blackrock’s ETHA, while the other eight ether funds remained still.

Despite the positive momentum on the bitcoin side, Ether ETF net assets closed slightly lower at $6.20 billion, with $123.21 million in total value traded.

Markets may be shifting, but bitcoin‘s ETF inflow streak suggests investor conviction is holding steady, even as ether faces more cautious sentiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。