Today is another extraordinary day. The assignments have become increasingly difficult to write over the past two days. Both ends of the market are releasing positive news through events. For $BTC, the continuous passage of state strategic reserves has begun to raise investors' expectations. On the political front, Trump and more countries or regions have reached agreements, and the remaining tough challenges seem to be China and Europe. Additionally, there have been reports of a trend towards easing in China early this morning.

Yesterday, Powell's pessimistic comments on tariffs and the economy were completely ignored by the market, especially after the trade agreement between the U.S. and the U.K. was reached. BTC continued to rise alongside U.S. stocks. Interestingly, the index that rose the most in the U.S. stock market was the Russell 2000, while in the cryptocurrency market, $ETH's increase surpassed that of most altcoins, rising over 17% in a single day.

Of course, when sentiment starts to FOMO, there has already been an overflow of funds into sector rotation. However, it is difficult to determine how long this trend can be sustained, especially since before any monetary policy truly shifts towards easing, events will remain the main driver of market movements.

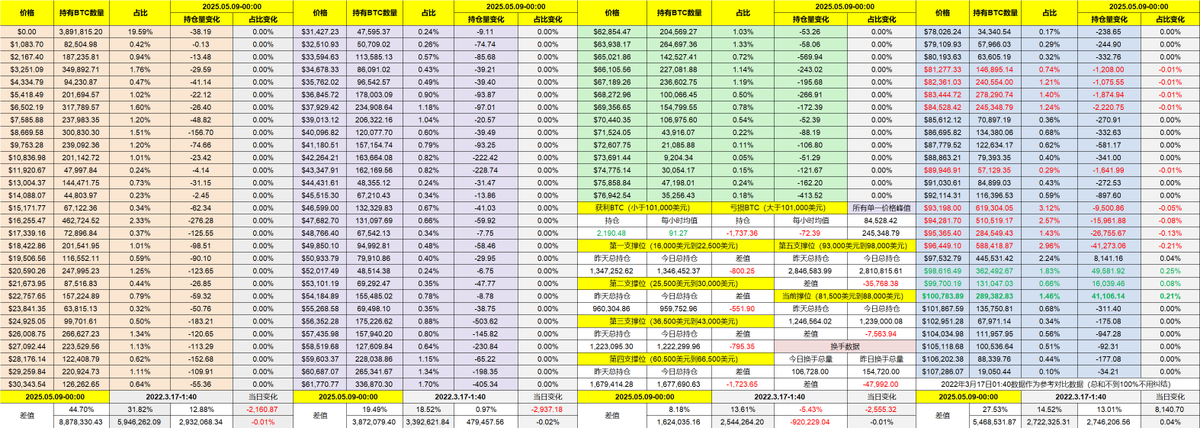

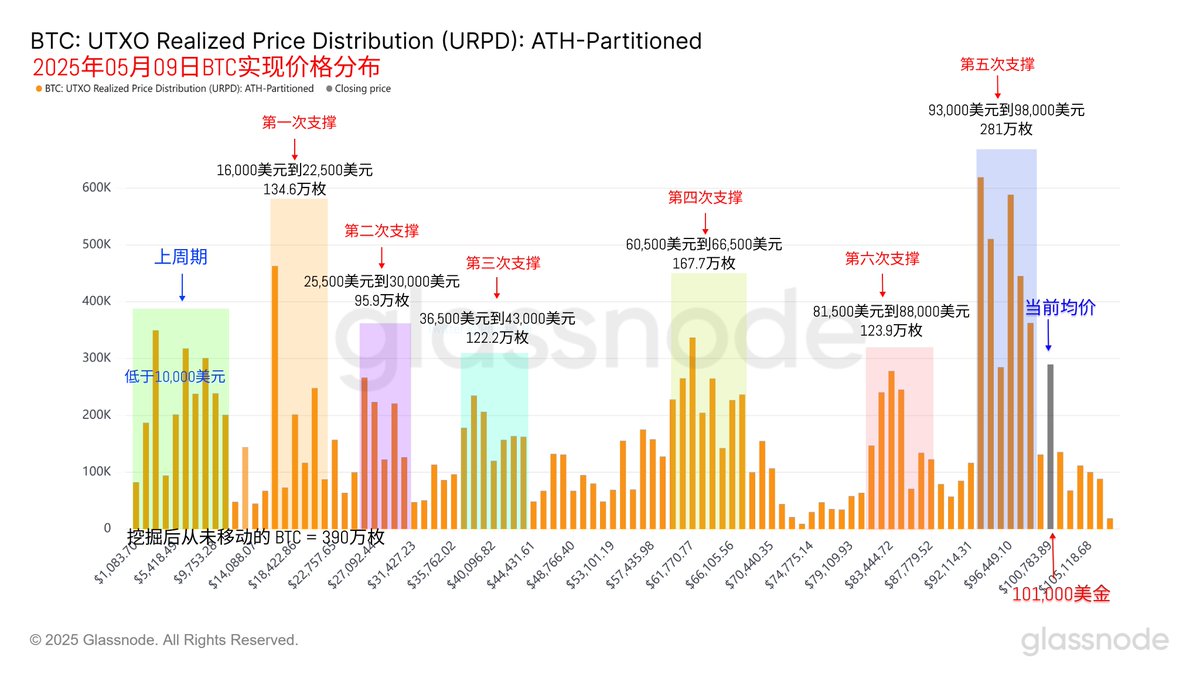

Looking back at Bitcoin's data, although BTC's price has seen a significant increase, the turnover rate has not only failed to increase but has actually decreased. This indicates that the short-term investors' speculation has begun to weaken after the price rise. Either short-term investors are expecting further price increases, or they simply do not have many tokens left in hand.

From the data we have been discussing, more BTC is being transferred to long-term, high-net-worth investors. I also looked at the exchange's stock data, and there has not been an influx of BTC into exchanges preparing to exit due to the price returning to $100,000. Instead, the stock on exchanges is still decreasing, indicating that even above $100,000, the number of buying investors exceeds that of selling investors.

From the support data, although some investors in the $93,000 to $98,000 range have reduced their holdings, the amount sold is still relatively small and insufficient to disrupt the current support situation. Whether these investors will continue to be a resistance to price increases will depend on whether the market continues to release positive news.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。