In the world of cryptocurrency, SBF has always played a contradictory role—he is both a charitable enthusiast who positions himself as a preacher of "effective altruism" and a capital operator well-versed in market games; he claims to protect the future of humanity through technological investments while dragging millions of investors into the abyss due to uncontrolled systemic risks. Similarly, OpenAI CEO Sam Altman is also an "effective altruist," who has repeatedly emphasized the need to advance AGI development while ensuring safety and benefits, attempting to overcome the obstacles of AI development through technology, policy, and social solutions. Two years after the collapse of the FTX empire, as we reassess its investment landscape of "technology benefiting humanity," we find that those once misunderstood forward-looking layouts have gradually revealed astonishing foresight in the evolution of technology; meanwhile, the forced liquidation of billions in assets has now doubled in value, becoming a regrettable loss.

The "OG" of effective altruism is destined to invest in AI unicorns

SBF has repeatedly emphasized in public interviews that his philosophy of action is based on "effective altruism," instilled with extreme altruistic thoughts by his parents from a young age, aiming to bring happiness to more people. He advocates maximizing capital accumulation to support future social welfare, such as preventing pandemics and reducing global poverty.

Since 2014, SBF has been a part of the effective altruism movement, always stressing "making money to do good" as a life mission. In April 2022, he stated in an interview with The New York Times that he would strive to choose a high-income career so that he could donate more charitable funds in the future.

SBF's focus on disruptive technological fields aligns closely with the "long-termism" of effective altruism; he believes AI is at the core of future technological transformation, potentially achieving long-term social value by enhancing efficiency or solving major issues (such as healthcare and climate). For instance, he once planned to use funds to support the technological development for preventing future pandemics, and the application of AI in biomedicine (such as protein folding research) is related to this.

In February 2022, SBF and several colleagues from FTX announced the establishment of the "Future Fund," aimed at funding "ambitious projects designed to improve humanity's long-term prospects." The fund is co-led by one of the founders of the Center for Effective Altruism, Professor Will MacAskill, along with other key figures in the movement. The Future Fund had committed to providing a total of $160 million in funding to various projects by early September, including support for research projects related to pandemic preparedness and economic growth. About $30 million of this was allocated to multiple organizations and individuals exploring AI-related topics.

SBF and his colleagues also funded several other projects dedicated to reducing long-term risks associated with AI, including a $1.25 million grant to the Alignment Research Center. This organization aims to ensure that future AI systems align with human interests and prevent technology from going "out of control." They also provided $1.5 million to Cornell University for similar research.

The Future Fund also provided nearly $6 million in funding to three projects related to large language models. Large language models are a class of increasingly powerful AI that can write tweets, emails, and blog posts, and even generate computer programs. This funding aims to reduce the risk of such technology being used to spread misinformation and lower the likelihood of unintended and harmful behaviors.

In addition to the funding from the Future Fund, SBF and his colleagues directly invested in several startups, such as a $500 million investment in Anthropic. Founded in 2021 by a group of effective altruists who left OpenAI, Anthropic is dedicated to enhancing AI safety by developing its own language models, which can cost tens of millions of dollars to create.

Between 2021 and 2022, SBF and his FTX colleagues invested over $530 million in more than 70 AI-related companies, academic labs, think tanks, independent projects, and individual researchers through grants or investments to address concerns about the technology.

Apart from Solana, SBF could have created another "Sui miracle"

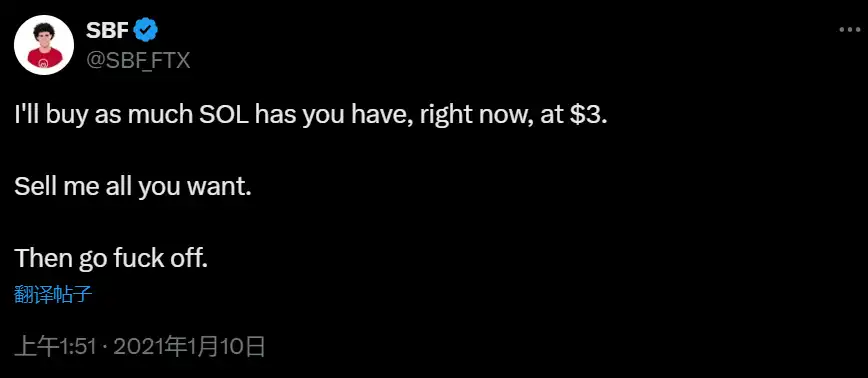

In 2021, as SOL was massively unlocked, SBF made a classic remark: "I would now buy all the SOL you have at $3."

SBF's investment in Solana was based on its technological advantages. Solana is seen as a competitor to Ethereum, with higher transaction speeds and lower fees. In a September 2021 interview, SBF stated that Solana is "one of the few blockchains with long-term development potential" capable of supporting industrial-grade applications. FTX had a close relationship with Solana, and SBF personally held a large amount of SOL, demonstrating his confidence in it.

Sui is a public chain founded by Evan Cheng, a core member of the former Meta (Facebook) Libra team, continuing Libra's high-performance design philosophy and focusing on high performance and scalability. FTX Ventures invested in Sui's predecessor, Mysten Labs, in 2021, acquiring subscription rights and equity for 890 million Sui tokens, valued at approximately $100 million (Sui Blockchain Explained: How It Works and What You Need to Know). SBF likely invested due to Sui's technological advantages (high throughput, low latency) and team background, similar to Solana.

Sui launched its mainnet in May 2023, and as of May 7, 2025, its market capitalization exceeded $11.5 billion, ranking among the top 20 cryptocurrencies globally. Its technical features include high performance (processing tens of thousands of transactions per second), low fees, and the use of the Move programming language to support dynamic assets and complex smart contracts, making it a representative of high-performance public chains. Its TVL (Total Value Locked) reached $1.78 billion in 2025, surpassing established public chains like Avalanche. Due to its founding team's core members being of Chinese descent, it has also attracted a large number of Chinese developers, whose development efficiency significantly exceeds that of Western teams, leading to rapid growth in Sui's ecosystem in the DeFi and gaming sectors.

Sui is seen as a potential leader of the next generation of public chains, with its team background (core members from Meta Libra) lending it authority. Support from investment institutions like a16z, FTX Ventures, and Coinbase Ventures further enhances its industry standing. Sui has a total supply of 10 billion tokens, with a circulating market value of approximately $11.5 billion, demonstrating market confidence in its future.

Forced to "sell off" hundreds of times, is it a case of talent being envied or a naive misunderstanding?

In early 2025, FTX creditor Sunil Kavuri posted on X, pointing out that SUI reached a market capitalization of $16 billion at $5.20, meaning that the 890 million SUI tokens sold by FTX for $96 million in March 2023 are now worth $4.6 billion. As of now, although the SUI token price has fallen to $3.4, it is still valued at $3 billion.

Months after FTX filed for bankruptcy, in 2023, it sold its shares back to Sui network developer Mysten Labs. FTX Ventures had previously acquired these shares, which included equity in Mysten Labs and the rights to purchase SUI tokens after investing $101 million in Mysten Labs' $300 million Series B funding. This means FTX Ventures sold these shares at a loss.

Sunil Kavuri's post prompts a reevaluation of SBF's investment vision. Looking back, several of FTX's initial lead investments had a forward-looking pattern, but due to FTX's bankruptcy liquidation, they had to be sold at a low price, with individual asset losses amounting to hundreds of millions.

In March 2024, FTX sold about two-thirds of its stake in AI startup Anthropic, which accounted for 8% of the total equity, for a total of $884 million. The Abu Dhabi sovereign wealth fund Mubadala's subsidiary ATIC will purchase nearly $500 million of FTX's shares in Anthropic. Currently, this stake is valued at about $3 billion.

In April 2024, FTX sold up to 30 million SOL at a significant discount price of $64, with a total value of about $1.9 billion, accounting for two-thirds of its total SOL holdings, attracting the attention of industry giants like Galaxy Trading and Pantera Capital. According to Bloomberg, Galaxy Trading specifically created a $620 million fund to acquire FTX's discounted SOL. Based on the current SOL price of $148, this portion of assets is now valued at about $4.4 billion.

On May 6, 2025, the Financial Times reported that Anysphere, the company behind the AI code editor Cursor, completed a $900 million funding round led by Thrive Capital, reaching a valuation of $9 billion. FTX was a seed round investor in Cursor, but after bankruptcy liquidation, its liquidation team sold the Cursor shares it held for $200,000, while these shares have now skyrocketed to about $500 million…

During the FTX liquidation, over $14 billion in assets were recovered, including cash, digital assets, and investments, but the specific assets sold and their sale prices at the time were not disclosed. Looking back now, the losses from these sales are likely to be in the tens of billions.

SBF's dramatic rise and fall reflects the fervor and fragility of the cryptocurrency industry. From betting on high-performance public chains to laying out in the AI sector, his decisions have always revolved around the grand narrative of "effective altruism," but ultimately fell into the abyss due to a lack of risk control and moral ambiguity. Following SBF's forward-looking investment vision, this round of Sui may shine brightly like the previous round of Solana, showcasing the industry's eternal pursuit of technological iteration and wealth effects. The wheels of industry iteration continue to roll forward, and more emerging fields will emerge in the future, while finding quality targets among a plethora of new products remains an eternal topic for investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。