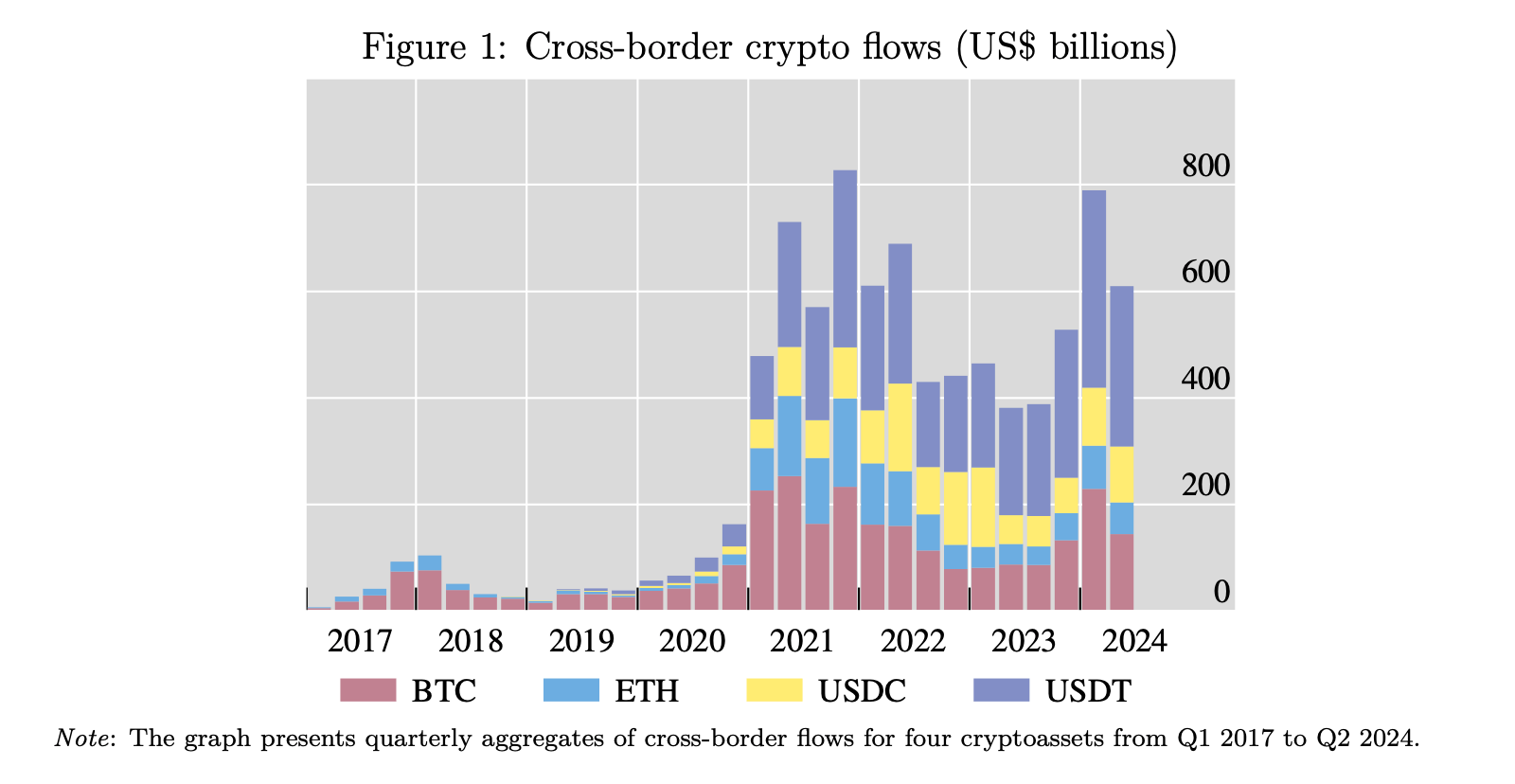

The latest Bank for International Settlements (BIS) working paper #1265 reveals cross-border crypto asset flows reached $2.6 trillion in 2021, rivaling 12% of global goods trade, with stablecoins accounting for nearly half. Authored by Raphael Auer, Ulf Lewrick, and Jan Paulick, the study analyzes bitcoin, ethereum, and stablecoin transactions across 184 countries from 2017 to mid-2024.

The U.S. and U.K. remain key hubs, but activity has shifted toward emerging markets like India, Indonesia, and Turkey. China’s regulatory crackdown accelerated this trend, with Turkey and Russia emerging as major players in stablecoin flows. Network density for crypto assets surpasses traditional banking, though concentration is lower.

Crypto flows are increasingly tied to global financial conditions, with tighter U.S. monetary policy and dollar strength reducing volumes. Conversely, high inflation and exchange rate volatility in emerging markets correlate with higher crypto usage. Stablecoins, particularly USDT and USDC, thrive as transactional tools, while bitcoin (BTC) retains speculative appeal.

The study identifies crypto assets as alternatives to costly remittances. Corridors with high traditional fees saw stablecoin and small bitcoin transactions rise by up to 25%. Low-value bitcoin transfers under $500 were especially linked to remittance substitution.

“Our analysis points to cryptoassets also being used as a transactional medium,” the BIS authors state. “This is most apparent for stablecoins and low-value BTC payments. Higher opportunity costs of fiat currency usage, such as high inflation, spur bilateral cross-border transactions in both unbacked cryptoassets and stablecoins.”

The working paper’s authors add:

Moreover, high costs of remittance payments through traditional financial intermediaries are associated with significantly larger cross-border flows in stablecoins and low-value BTC payments from advanced economies to emerging markets and developing markets.

Capital flow restrictions aimed at traditional finance had little effect on crypto, sometimes correlating with increased activity. Crypto networks’ pseudo-anonymity may facilitate circumvention, the authors note, highlighting challenges for global regulators.

While crypto’s role in payments grows, the paper warns of risks from its integration with mainstream finance. BIS authors Auer, Lewrick, and Paulick note that policymakers face dual challenges: fostering innovation and mitigating systemic vulnerabilities, particularly in emerging economies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。