Top officials from Washington and Beijing convened this weekend in Geneva, Switzerland, and Wall Street Journal (WSJ) sources with direct knowledge of the situation say further conversations are expected to continue on Sunday. The negotiations signify the first conclave of American and Chinese envoys. Before the negotiations commenced, both nations levied substantial tariffs on mutual imports, setting the stage for this weekend’s dialogue.

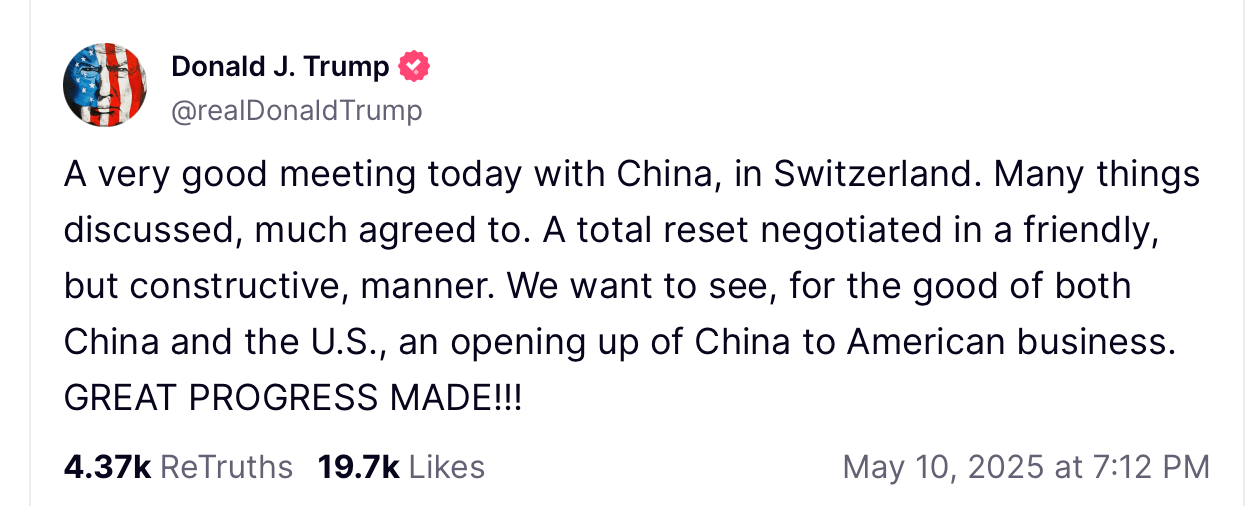

Trump hinted on Saturday that the talks were going well.

Markets—including equities, cryptocurrencies, and gold—are teetering in suspense as the U.S.-China negotiations in Geneva carry the potential to significantly reshape the contours of global trade and finance. The S&P 500, along with other major indexes, has clawed back some ground since the tariff announcements but continues to hover roughly 8% below its peak levels.

Market turbulence remains pronounced, with the Cboe Volatility Index (VIX) holding above its historical mean, signaling persistent unease. In recent days, even an offhand remark from the U.S. president or an unofficial leak from Beijing has been enough to jolt asset prices with considerable force.

Moreover, any constructive outcome from the Geneva discussions—be it a scaling back of tariffs, a framework for future dialogue, or merely a softening in tone—has the potential to ignite a swift rally across equities, digital assets, and could even prompt a retreat in gold prices. WSJ reporter Brian Schwartz revealed that some delegates from both China and the U.S. departed ahead of schedule.

WSJ sources, however, indicated that Bessent and Greer remained behind for an additional hour. The trade negotiations between the U.S. and China have unfolded under a deliberate veil of secrecy, reflecting the intense sensitivity and substantial consequences at play. Delegates steered clear of press interactions, aware that even subtle cues or offhand remarks could be misconstrued and ripple through financial markets with destabilizing effects.

Trump’s statement on Saturday, effusive yet diplomatically toned, suggests a potential turning point in what has been a deeply strained economic relationship. While specifics remain elusive, the characterization of a “total reset” hints at a broader strategic shift. With expectations now recalibrated, markets and policymakers alike are left parsing each phrase for clues on whether this détente will hold—or unravel.

Moreover, on Sunday, the White House released a press release that noted the U.S. reached a trade deal with China. Treasury Bessent and Trade Rep. Greer said the U.S.-China trade talks in Switzerland were highly productive, with agreements reached more swiftly than expected. Bessent credited the Swiss venue and emphasized Trump’s full awareness of the developments. Greer highlighted the urgency tied to the $1.2 trillion U.S. trade deficit and expressed confidence the new deal addresses key issues.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。