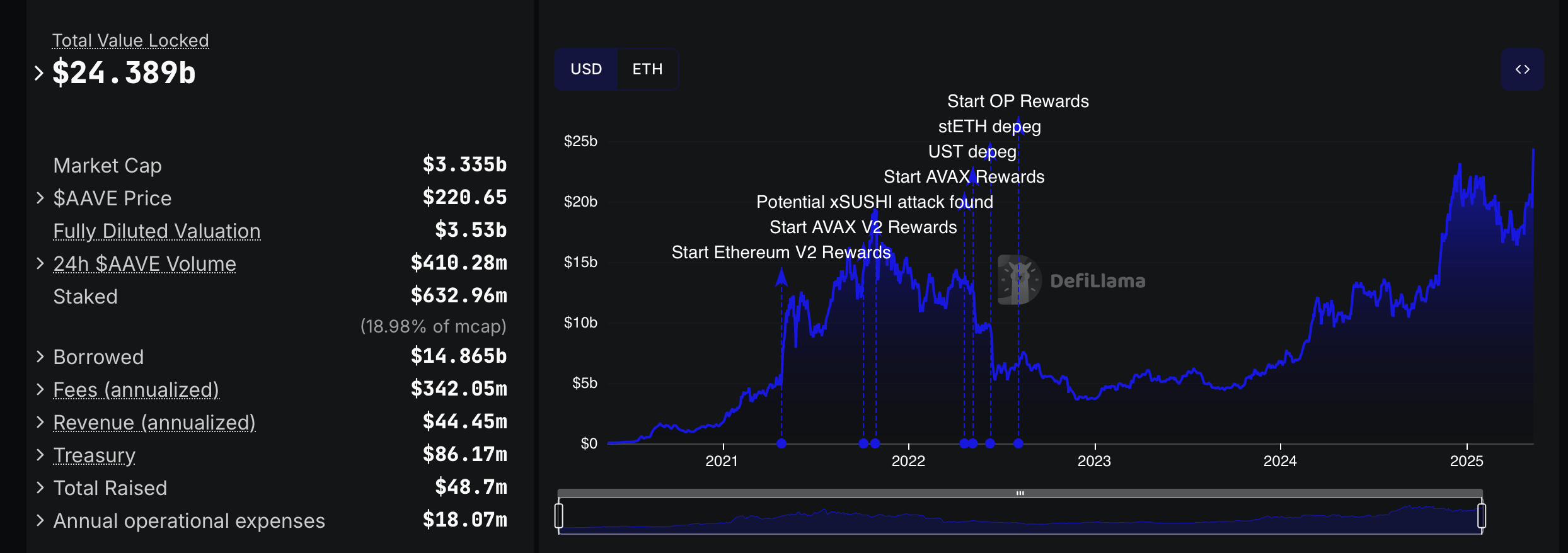

The lending protocol’s latest milestone places it among the largest DeFi platforms by TVL, with a market capitalization of $3.335 billion and a fully diluted valuation of $3.53 billion. Aave’s native token, AAVE, is trading at $222 with a 24-hour volume of $410.28 million.

Source: Defillama.com

Roughly $14.865 billion is currently borrowed on the platform, with $632.96 million in AAVE staked—amounting to nearly 19% of its market cap. The annualized protocol fees stand at $342.05 million, while annualized revenue is recorded at $44.45 million. Treasury holdings total $86.17 million.

The project has raised $48.7 million to date and incurs $18.07 million in annual operational expenses. Activity on the platform appears to be supported by both institutional and retail participation as the broader DeFi sector experiences a resurgence.

Historical events plotted on the TVL chart via defillama.com reflect pivotal moments such as Ethereum V2 and Avalanche (AVAX) rewards launches, the stETH and UST’s depeg, and incentive programs like Optimism (OP) rewards.

Aave is a noncustodial liquidity protocol that enables users to lend and borrow crypto assets without intermediaries. It uses overcollateralized loans and supports a wide range of digital assets across multiple blockchains.

The decentralized finance protocol also includes features like flash loans, interest rate switching, and staking-based governance, offering users flexibility and transparency in decentralized finance operations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。