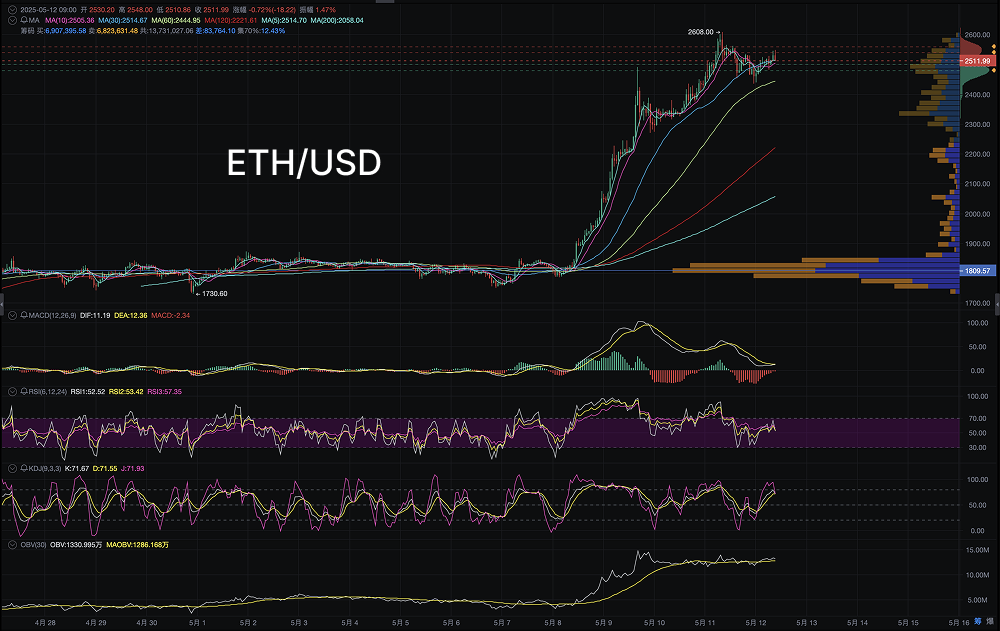

Since May 2025, the price of Ethereum (ETH) has surged over 40% in just a few trading days, skyrocketing from around $1730 to a peak of $2608. This strong breakout has not only reshaped the market's perception of ETH's mid-term trend but has also released strong bullish signals under the resonance of on-chain capital behavior, technical structure, and capital flow.

Candlestick Structure: Breakout Pattern Establishes Bullish Trend

Since mid-April, the price of Ethereum has been trapped in a consolidation range of $1850–2050, forming a typical consolidation platform. It wasn't until May 7 that the price broke through the key resistance level of $2100 with increased volume, accompanied by consecutive bullish candlesticks, forming a "flag breakout + accelerated rise" structure, and subsequently establishing a short-term high near $2600.

The AiCoin candlestick chart shows that Ethereum has currently formed a "five consecutive bullish candlesticks" structure, with solid bodies, and the moving average system (5MA, 10MA, 20MA) displaying a bullish arrangement, with prices consistently running above the short-term moving averages, reflecting strong trend inertia.

Notably, the trading volume significantly increased around May 10, indicating clear signs of major institutional entry, with strong trading momentum supporting the price's accelerated upward phase, further confirming the technical "breakout is valid."

On-Chain Data and Large Capital Movements: OBV and MAOBV Dual Confirmation

From the perspective of capital behavior, the OBV indicator (On-Balance Volume) and MAOBV (OBV Moving Average) have both risen in tandem, reflecting a healthy structure of "volume and price rising together."

Since May 7, OBV has risen from 9 million to the current 13.3 million, with MAOBV also increasing, indicating that substantial capital has indeed entered during the upward process, confirming that the breakout is not a false one. Meanwhile, on-chain tracking data shows that multiple large buy orders in the million-dollar range have continuously entered mainstream trading platforms like Coinbase and Binance between May 8 and May 10.

This phenomenon coincided with ETF subscriptions, creating a "dual capital resonance" effect, which has become the main capital engine for this round of price increase.

Technical Indicator Resonance: MACD and KDJ Release Strong Bullish Signals

Multiple technical indicators also confirm the strength of the current bullish structure:

- MACD formed a golden cross on May 5, with both DIF and DEA turning positive, and the red bars continuously expanding until May 11, entering a high-level consolidation without forming a divergence, indicating that bullish energy has not yet been fully released;

- Both RSI and KDJ indicators remain in the strong zone (above 50-70), slightly overbought in the short term but showing no signs of reversal, indicating that market sentiment remains bullish;

- The Bollinger Bands are expanding, with prices running near the upper band, indicating a possibility of short-term consolidation but maintaining a healthy long-term trend.

The overall technical structure is in the "post-breakout pullback accumulation" phase. If the short-term adjustment does not fall below the $2400 level, it is expected to further challenge the previous high of $2600 or even higher.

Macroeconomic and Policy Catalysts: L2 Expansion and Pectra Upgrade

This market movement is not without foundation. From a fundamental perspective, there are at least three core positives:

Layer 2 Ecosystem Explosion: Ethereum's Layer 2 networks like Arbitrum and zkSync have recently welcomed multiple ecosystem airdrops and TVL growth, significantly enhancing the value of ETH as a main chain asset;

Staking APR Increase: The staking yield for ETH has risen from 3.3% to 3.9%, reflecting increased staking demand, reducing market circulation, and forming a supply contraction logic.

The Pectra (Prague + Electra) upgrade that Ethereum is undergoing has become a core catalyst driving this round of price increase. Among them, the introduction of EIP-7702 will greatly simplify user interaction logic, paving the way for the popularization of smart wallets, bringing ETH closer to the infrastructure positioning of a "mainstream payment and application platform."

More importantly, the introduction of Verkle Tree signals long-term expansion for the Ethereum mainnet, creating upstream and downstream synergy with the short-term performance improvement of the Rollup ecosystem, injecting long-term sustainable valuation premium into ETH. Several leading VCs (including Paradigm and a16z) have significantly increased their holdings of ETH following the announcement of the upgrade roadmap, with on-chain data showing that VC wallets accumulated over 120,000 ETH from late April to early May; at the same time, developer activity and GitHub submission frequency have significantly increased, reflecting the technical community's high recognition of the upgrade prospects. The Deribit options market has also reacted, with ETH implied volatility jumping from 24% to 37%, indicating that the market expects significant volatility in the future.

Market Structure and Long/Short Comparison: Short Covering and Bullish Collective Drive

From the perspective of the futures market, the funding rate for ETH perpetual contracts has remained positive over the past three days, indicating a strong willingness among long positions to pay, without any significant signs of a "short squeeze" acceleration. In other words, the current rise is not based on excessive short squeezing but rather on sustained capital pushing.

CME ETH futures position data also shows that long positions have increased by over 15%, with a rise in the proportion of institutional clients, reflecting that the current trend has the backing of traditional financial forces.

Market Outlook: $2500 as Key Support Level, Breakout May Reach $2800-$3000

Based on the current candlestick patterns, technical indicators, ETF capital flow, and macro logic, the following judgments can be made:

- Short-term support level: $2400–2500 range;

- Resistance level: $2600 previous high, next resistance level at $2800;

If the price maintains above $2500 to build a platform, it is expected to form a "flag continuation" pattern, with target levels potentially reaching the $3000 mark; if it falls below $2400, it will pull back to the $2100 support level.

Investors are advised to pay attention to ETF capital flows, large on-chain transfers, and changes in the ETH/BTC exchange rate as three leading indicators for judging whether the trend will continue.

Conclusion: Ethereum Enters a Period of Multiple Resonance Explosions, Beware of Short-Term Pullbacks but the Trend Remains Unchanged

In summary, the 40% surge in Ethereum is not a result of chaotic speculation but a structural breakout driven by various fundamental and capital catalysts. The movement of ETF capital, on-chain capital entry, technical indicator resonance, and the market's reassessment of interest rate cut expectations together form the core foundation of this round of price movement.

The subsequent market may face short-term technical adjustments, but if the macro and capital conditions do not significantly reverse, Ethereum is likely to have returned to the main upward phase of a bull market. Currently, it is a key confirmation window for the "atypical early bull market."

This article represents the author's personal views and does not reflect the stance and views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。