Original Title: "Ethereum Leads the Charge, Is 'Altcoin Season' Coming Back? What Do Analysts Think"

Original Source: Editor Jr., BlockTempo

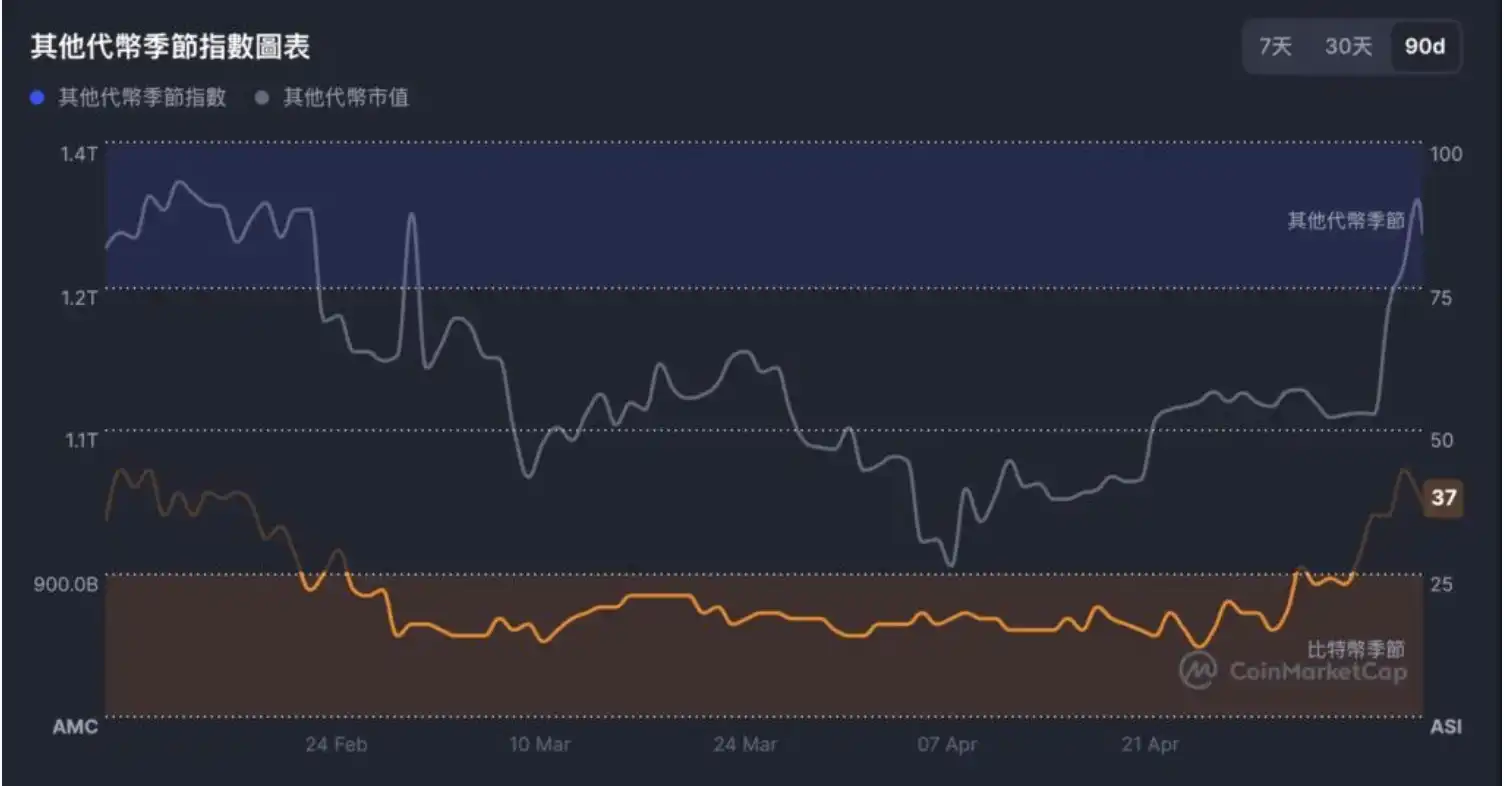

Recently, Ethereum (ETH) has shown strong upward momentum surpassing Bitcoin. This morning (May 11), after Trump announced significant progress in trade talks with China, ETH briefly broke through $2,600, reigniting short-term optimism in the market. Meanwhile, the Altcoin Season Index tracked by CMC has recently rebounded from a low, standing above 40, reaching a nearly 90-day high. This has sparked heated discussions about whether "Altcoin Season" is about to arrive.

Divergent Views Among Analysts

Some market observers hold a positive outlook on the future of altcoins. Analyst Mister Crypto predicts that the market may experience a "life-changing" trend in the next three to six months, with daily returns of 40% for altcoins potentially becoming the norm.

Technical trader Moustache also pointed out that altcoins often experience explosive growth after repeated accumulation, believing that the current market structure is similar to that of 2016 and 2020, declaring that "the altcoin season of 2025 has officially begun."

Cautious Perspective: Market Heat and Challenges Coexist

However, not all analysts are optimistic. Analyst 2Lambroz acknowledges that an altcoin season may be approaching but points out that "people want to chase the rise but lack faith in a strong narrative." He observes that, unlike in 2021, there has not been a large influx of retail investors, and traders are rotating their funds more quickly, lacking the motivation for long-term holding.

Commentator Rekt Fencer questions the optimistic sentiment, noting that most altcoins have dropped 90% since last December, and the recent rebound of about 10% may be overinterpreted, sarcastically asking, "Is this the altcoin season we've been waiting for?" He believes that Bitcoin's dominance remains above the critical threshold of 54%, and institutional preference for Bitcoin may continue to influence the flow of funds. This round of the market may be more fragmented, with significant differences in the performance of altcoins across different sectors.

Key Indicators and Macroeconomic Variables

In addition to technical analysis, the future direction of the altcoin market is also influenced by multiple key factors. First, the price of Bitcoin and its market dominance are crucial. An increase in Bitcoin's price boosts market sentiment, but changes in its dominance remain key to judging the altcoin season. Second, overall market sentiment and risk appetite are also important factors. Optimistic developments in the global macroeconomy and geopolitical landscape, such as progress in US-China trade negotiations and easing tensions between India and Pakistan, may drive funds into risk assets, including cryptocurrencies and meme coins.

Hank Huang, CEO of Kronos Research, stated that the cryptocurrency market is rebounding on the wave of global optimism, with Ethereum's strong rebound driving the altcoin market. However, whether funds can effectively rotate from Bitcoin to altcoins and the level of retail participation remain key points of observation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。