Original Title: Liquidity Wars 3.0 where Bribes Become Markets

Original Author: arndxt, Cryptocurrency Analyst

Original Translation: Block unicorn

I believe we will witness the yield wars once again. If you have been in the decentralized finance (DeFi) space long enough, you know that total value locked (TVL) is just a vanity metric until it isn't.

In a highly competitive, modular world of automated market makers (AMMs), perpetual contracts, and lending protocols, what truly matters is who can control liquidity routing. It’s not about who owns the protocol, or even who distributes the most rewards. It’s about who can persuade liquidity providers (LPs) to deposit and ensure that TVL remains sticky. This is precisely where the bribery economy begins.

The informal ticket-buying behavior of the past (Curve wars, Convex, etc.) has now professionalized into a mature liquidity coordination market, equipped with order books, dashboards, incentive routing layers, and in some cases, even gamified participation mechanisms. This is becoming one of the most strategically important layers in the entire DeFi stack.

Changes: From Issuance to Meta Incentives

In 2021-2022, protocols guided liquidity in traditional ways:

Deploy liquidity pools

Issue tokens

Hope that profit-driven LPs would stick around after yields decline

But this model is fundamentally flawed; it is passive. Every new protocol competes with an invisible cost: the opportunity cost of existing capital flows.

I. The Origin of Yield Wars: The Rise of Curve and Voting Markets

The concept of yield wars began to take shape during the Curve wars in 2021.

The Unique Design of Curve Finance

Curve introduced voting-escrowed (ve) token economics, allowing users to lock $CRV (Curve's native token) for up to 4 years in exchange for veCRV, which grants:

· Enhanced rewards for Curve liquidity pools

· Governance rights to vote on weightings (which liquidity pools can issue)

This created a meta-game around issuance:

· Protocols want to gain liquidity on Curve.

· The only way to gain liquidity is to attract votes to their pools.

· Therefore, they began bribing veCRV holders to vote in their favor.

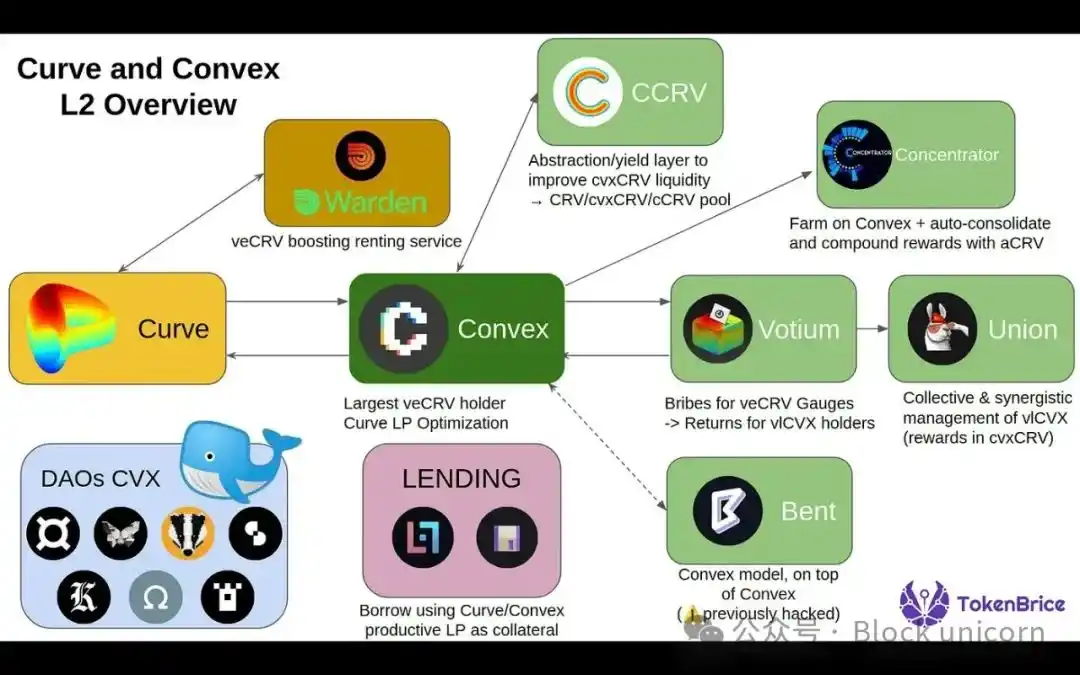

Then Came Convex Finance

· Convex abstracted the locking of veCRV and aggregated voting power from users.

· It became the "kingmaker of Curve," wielding significant influence over the flow of $CRV issuance.

· Projects began bribing Convex/veCRV holders through platforms like Votium.

Lesson 1: Whoever controls the weight controls liquidity.

II. Meta Incentives and Bribery Markets

The First Bribery Economy

Initially, it was just about manually influencing issuance, but it evolved into a mature market where:

· Votium became the off-chain bribery platform for $CRV issuance.

· Redacted Cartel, Warden, and Hidden Hand emerged, extending this to other protocols like Balancer and Frax.

· Protocols no longer just paid issuance fees; they strategically allocated incentives to optimize capital efficiency.

Expansion Beyond Curve

· Balancer adopted a voting escrow mechanism through $veBAL.

· Frax, TokemakXYZ, and others integrated similar systems.

· Incentive routing platforms like Aura Finance and Llama Airforce further complicated the landscape, turning issuance into a capital coordination game.

Lesson 2: Yields are no longer about annual percentage yield (APY), but about programmable meta incentives.

III. How Yield Wars Are Fought

Here’s how protocols compete in this meta-game:

· Liquidity Aggregation: Aggregating influence through wrappers like Convex (e.g., Balancer's AuraFinance).

· Bribery Activities: Allocating budgets for ongoing voting bribes to attract desired issuance.

· Game Theory and Token Economics: Locking tokens to create long-term consistency (e.g., ve model).

· Community Incentives: Gamifying voting through NFTs, raffles, or additional airdrop games.

Today, protocols like turtleclubhouse and roycoprotocol are guiding this liquidity: they are not blindly issuing but auctioning incentive mechanisms to liquidity providers (LPs) based on demand signals.

Essentially: "You bring liquidity, and we will direct incentives to the most important places." This unlocks secondary effects: protocols no longer need to forcibly acquire liquidity; they coordinate it.

Turtle Club

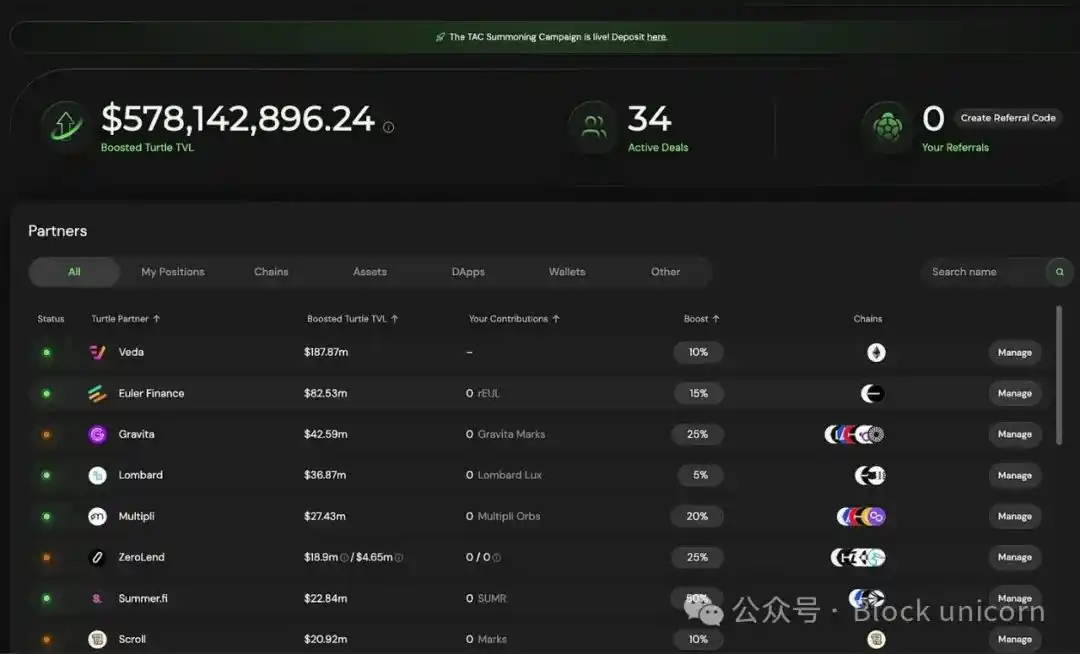

One of the lesser-known but extremely effective bribery markets. Their liquidity pools are often embedded in partnerships, with total value locked (TVL) exceeding $580 million, utilizing dual-token issuance, weighted bribes, and surprisingly sticky liquidity provider (LP) bases.

Their model emphasizes fair value redistribution, meaning issuance is guided by voting and real-time capital velocity metrics. It’s a smarter flywheel: LPs are rewarded based on the effectiveness of their capital rather than just its size. This time, efficiency is finally incentivized.

Royco

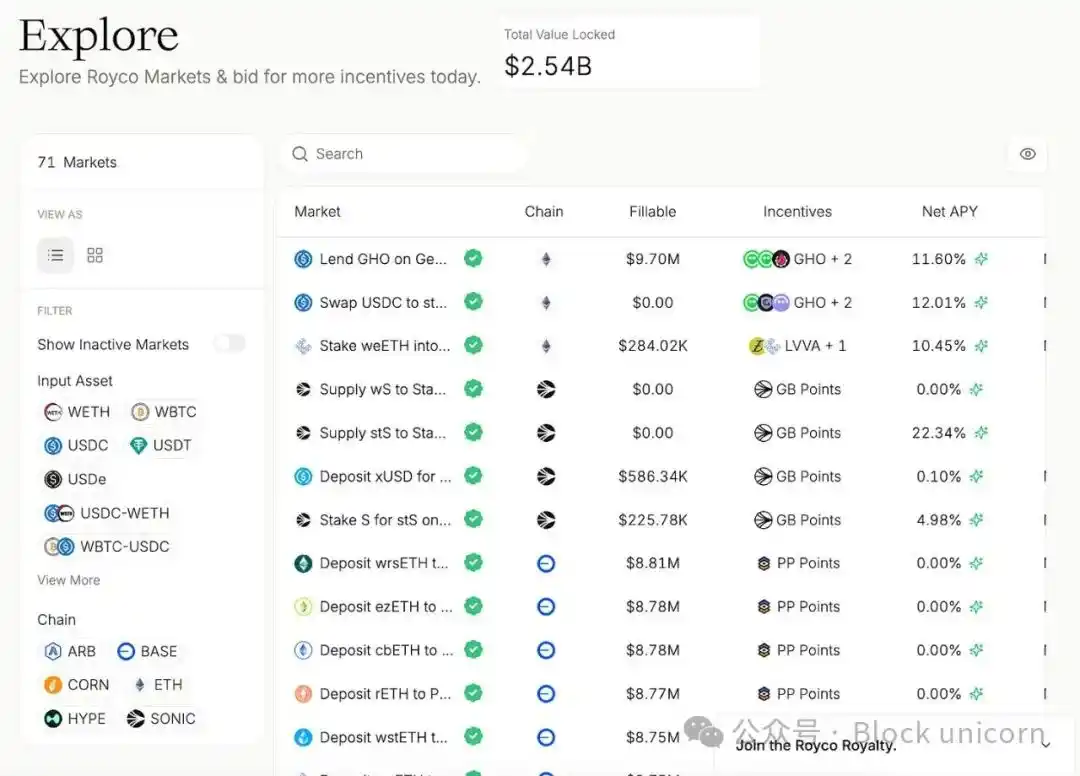

In just one month, its TVL surged to $2.6 billion, with a month-over-month growth of 267,000%.

While some of this is "points-driven" capital, the important aspect is the infrastructure behind it:

· Royco is an order book for liquidity preferences.

· Protocols cannot just offer rewards and hope. They issue requests, and then LPs decide where to allocate funds, ultimately coordinating into a market.

This narrative is not just about the meaning of yield games:

· These markets are becoming the meta-governance layer of DeFi.

· HiddenHandFi has already accumulated over $35 million in bribes across major protocols like VelodromeFi and Balancer.

· Royco and Turtle Club are now shaping the effectiveness of issuance.

Mechanisms of Liquidity Coordination Markets

- Bribery as Market Signals

Projects like Turtle Club allow LPs to see where incentives are flowing, make decisions based on real-time metrics, and earn rewards based on capital efficiency rather than just capital size.

- Liquidity Requests (RfL) as Order Books

Projects like Royco allow protocols to list liquidity needs like orders in a market, with LPs filling them based on expected returns.

This becomes a two-way coordination game rather than a one-way bribery.

Ultimately, if you determine the flow of liquidity, you influence who can survive in the next market cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。