Original Title: What’s wrong with CDP stablecoins on HyperEVM?

Original Author: @stablealt

Original Translation: zhouzhou, BlockBeats

Editor's Note: CDP "stablecoins" like feUSD and USDXL on HyperEVM are unable to maintain a $1 peg due to a lack of strong arbitrage mechanisms, weak demand in Hyperliquid, and low borrowing costs, causing their prices to fall below $1. Hyperliquid natively offers leveraged trading, and users do not need CDP stablecoins. As airdrops and reward points are exhausted, CDP tokens will lose value and ultimately fail to sustain.

The following is the original content (reorganized for readability):

Disclaimer: This article is not intended to FUD or attack the CDP protocol on HyperEVM.

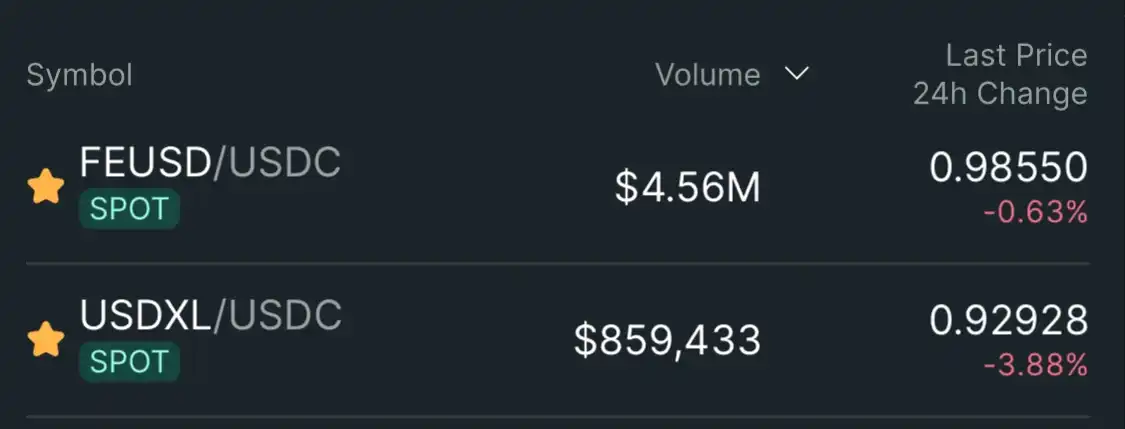

In short: CDP stablecoins, such as feUSD and USDXL, are not truly stable or capital efficient. They lack strong arbitrage mechanisms, have limited use cases primarily for leveraged trading, and Hyperliquid already provides a better user experience and liquidity natively. Therefore, the trading prices of these tokens are below their $1 peg, and without incentives like airdrops, they are likely to gradually disappear.

Collateralized Debt Position (CDP) stablecoins promise to provide a decentralized alternative to dollar-backed stablecoins (like USD and USDT) or centralized synthetic dollars (like USDe), but reality often falls short of expectations. feUSD, USDXL, and KEI are some of the latest attempts to emulate Liquity, but they all face serious issues such as peg stability, scalability, or incentive design flaws.

This article will analyze these issues, what paid KOLs haven’t told you, and why these problems are not just growing pains—they are structural issues.

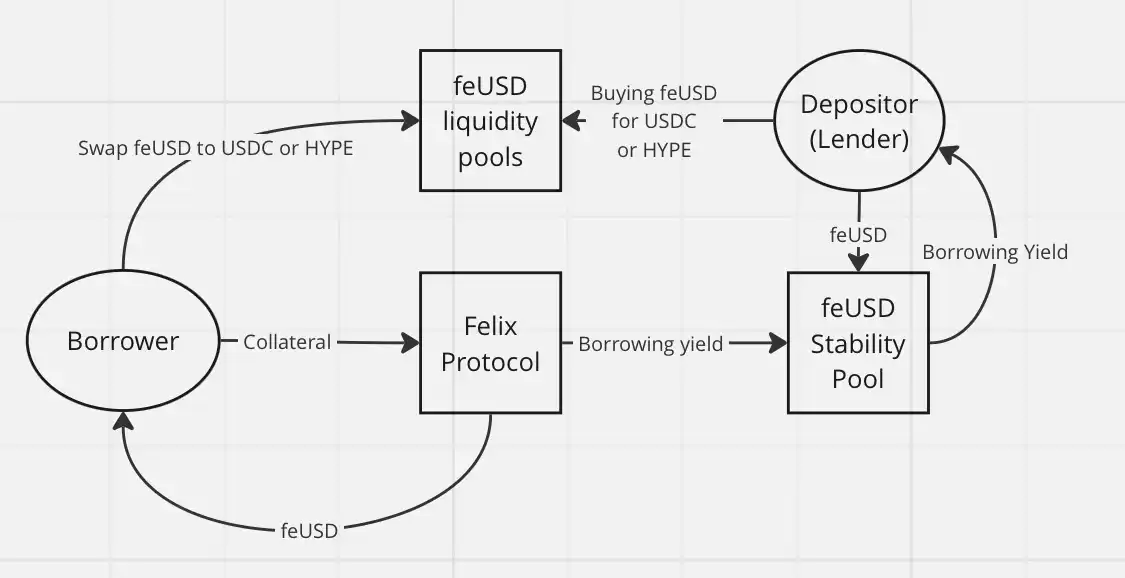

Overview of CDP Design

First, let’s understand the basic concept: CDP "stablecoins" are not true stablecoins or "dollar" tokens. This is why DAI is called "DAI" and not USDD or any other name. It is misleading to name CDP stablecoins with a "USD" prefix, which may confuse DeFi newcomers. They lack arbitrage mechanisms and direct collateralization. Each CDP token is minted out of thin air and may be worth far less than $1.

To mint a CDP token, users must lock collateral worth more than 100% to borrow the token. This reduces capital efficiency and limits growth. To mint 1 token, you need to lock more than $1 in value. Depending on the loan-to-value ratio, this ratio may be even higher.

Without strong mechanisms like Felix's redemption (where arbitrageurs can steal someone's collateral if the borrowing rate is too low) or Dai's PSM module, CDP tokens cannot maintain a 1:1 peg to the dollar, especially when their primary use case is leveraged trading.

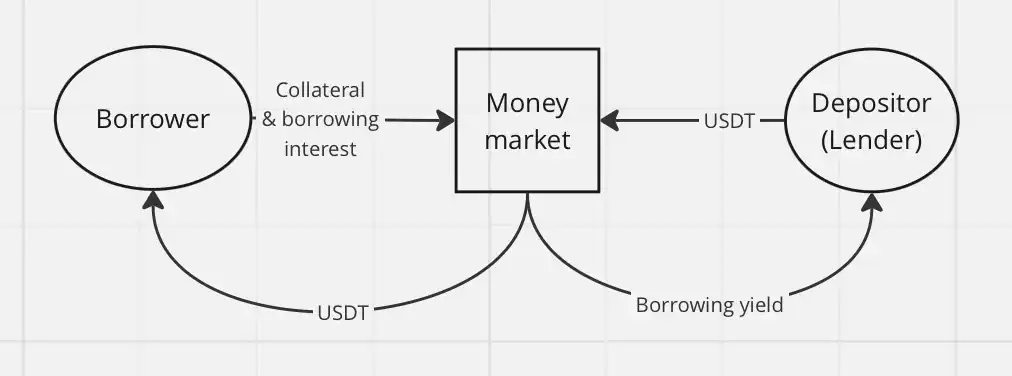

In DeFi, CDPs are just another form of lending. Borrowers mint CDP stablecoins and exchange them for other assets or yield strategies they believe can outperform the protocol's borrowing rates.

What Happened?

Everyone exchanges their CDP stablecoins for other assets, usually more stable centralized assets like USDC or USDT, or for more volatile assets (like HYPE) for leveraged trading. Holding these tokens makes little sense, especially when you have to pay borrowing rates: feUSD has a borrowing rate of 7% APY on Felix, while USDXL has a borrowing rate of 10.5% APY on HypurrFi.

Take USDXL as an example: it has no native use case, and users have no reason to hold it. This is why it can fluctuate at prices like $0.80 or $1.20—its price is not anchored by any real arbitrage mechanism. Its price merely reflects the demand for borrowing HYPE. When USDXL's trading price is above $1, borrowers can borrow more USD; when it is below $1, they can borrow less—it's that simple.

feUSD is slightly better. Felix provides users with a stable pool, allowing them to earn 75% of the borrowing fees and liquidation bonuses, with the current APY around 8%. This helps reduce price volatility, but like USDXL, there is still no strong arbitrage mechanism to keep feUSD firmly at $1. Its price will still fluctuate based on borrowing demand.

The core issue is that users who buy feUSD and place it in the stable pool are essentially lending their USDC or HYPE (through Felix) to those minting feUSD. These CDP tokens have no intrinsic value. They are only valuable when paired with valuable tokens like HYPE or USDC in liquidity pools.

This introduces third-party risk; without airdrops or other incentives, DeFi users have little reason to borrow illiquid, unpegged tokens like feUSD or USDXL, or to purchase them as exit liquidity for borrowers. Since you can directly borrow stablecoins like USDT or USDe, why would you do this? After all, the stablecoins you borrow will ultimately be converted into other tokens, so you don’t need to worry about the decentralization of the borrowed assets.

Classic lending through the flywheel mechanism of money markets, like Hyperlend, is much simpler and produces the same economic effect for the end user.

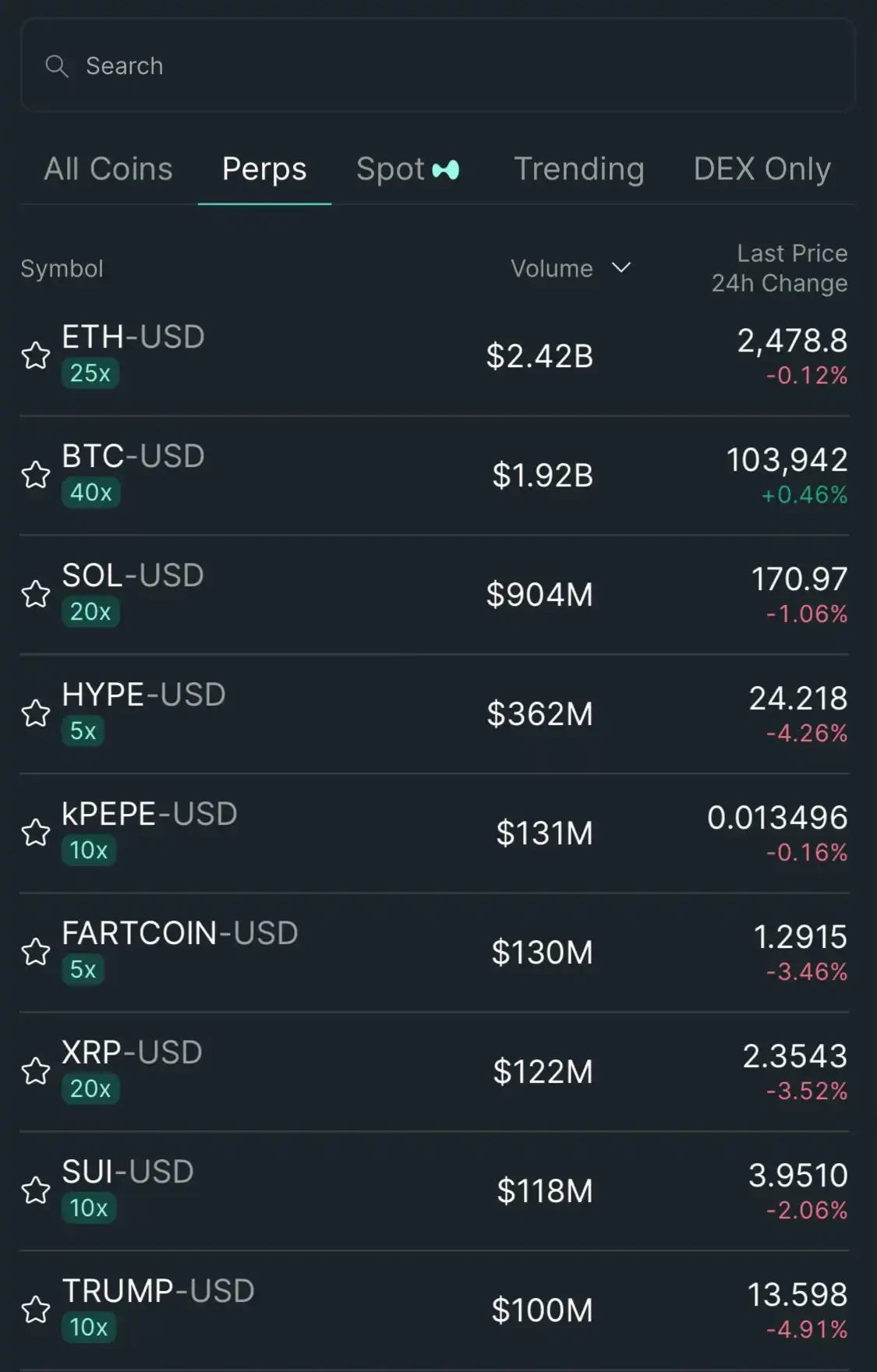

Another reason CDPs have not succeeded on HyperEVM is that leveraged trading is already a native feature of the Hyperliquid ecosystem. On other chains, CDPs provide decentralized leveraged trading. However, on Hyperliquid, users only need to use the platform itself, leveraging perpetual contracts (perps) and an excellent user experience, without relying on CDP stablecoins.

With Hyperliquid, there is no need to leverage trading through third-party protocols. I see the only use case for CDPs is for leveraged farming and the cyclical operation of HLP.

In summary, here are the reasons why CDP "stablecoins" perform poorly on HyperEVM:

- Lack of strong arbitrage mechanisms

- Weak demand for CDP products in Hyperliquid

- Low borrowing costs and no reason to hold CDP tokens

As a result, CDP "stablecoins" like feUSD and USDXL are trading at soft peg prices below $1: feUSD at $0.985 (-1.5%), USDXL at $0.93 (-7%).

Conclusion: I do not believe CDP stablecoins have any potential in the Hyperliquid ecosystem. Users do not need them—Hyperliquid already provides a better user experience and deeper liquidity, natively supporting leveraged trading. Once airdrops and reward programs are exhausted, CDP tokens will lose their remaining utility.

Hypurrliquid, do not do exit liquidity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。