The U.S. Consumer Price Index (CPI) data for April will be released on Tuesday, while a significant breakthrough in the Sino-U.S. trade negotiations in Geneva adds a layer of complex market sentiment to this key economic indicator. The market generally expects that the CPI may reflect a trend of slowing inflation, combined with rising expectations for a Federal Reserve interest rate cut, which could drive Bitcoin prices to challenge historical highs and accelerate the rise of the altcoin market.

Sino-U.S. Trade Agreement: A New Variable in Inflation Expectations

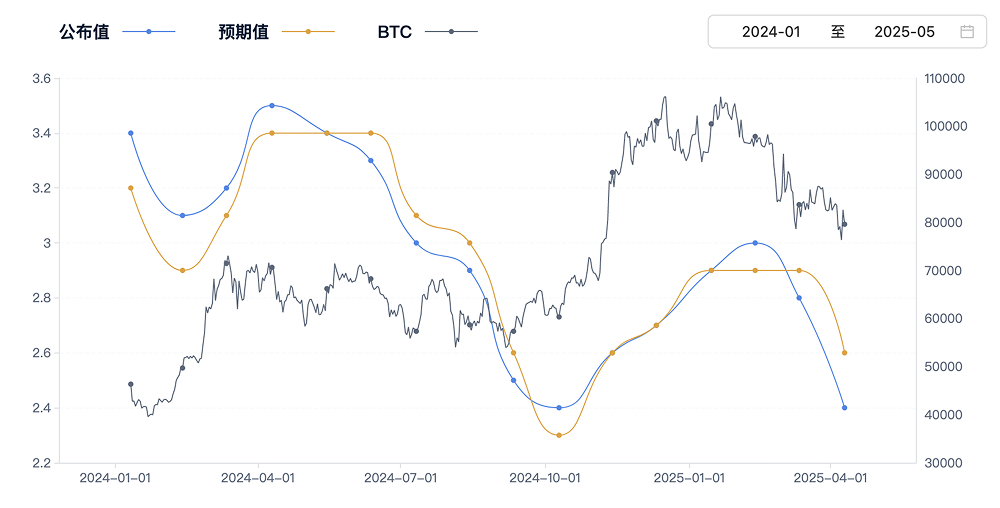

Since March 2025, the Sino-U.S. trade war has escalated, with both sides imposing tariffs exceeding 100% on each other's goods, leading to a surge in global supply chain costs and heightened inflation expectations. The U.S. March CPI data showed a year-on-year increase of 2.4%, below the market expectation of 2.6%. However, analysts pointed out that this data failed to fully reflect the immediate impact of the trade war escalation, showing significant lag. The breakthrough in the Geneva negotiations changed this situation. According to BBC Chinese, on May 7, the Trump administration announced a "liberation day" for tariffs, and both sides initiated emergency consultations in Geneva, Switzerland, ultimately reaching an agreement to establish a long-term trade consultation mechanism and possibly suspend some reciprocal tariff measures.

This agreement directly weakened the arguments of the bears, who claimed that high tariffs would continue to push prices up and exacerbate inflationary pressures. Instead, the market began to bet that trade easing would alleviate supply chain bottlenecks and reduce the cost of imported goods, thereby putting downward pressure on CPI data. The Royal Bank of Canada (RBC) predicts that the year-on-year increase in April CPI will slightly decline from 2.4% in March to 2.3%, while core CPI (excluding food and energy) will remain unchanged at 2.8%, with rent increases continuing to slow. A survey by 10x Research shows that the market has a more conservative expectation for overall CPI, believing it may remain flat at 2.4%.

"The achievement of the trade agreement is equivalent to throwing a bucket of cold water on inflation expectations," said Markus Thielen, founder of 10x Research, in an interview with CoinDesk. "Unless the CPI data significantly exceeds expectations, the market may interpret it as a positive, thereby pushing up the prices of risk assets."

Bitcoin and Altcoins: Catalysts for a Historic High?

Against this backdrop, Bitcoin (BTC) has become the focus of market attention. AiCoin data shows that as of May 12, Bitcoin's price hovers around $105,000, just a step away from its historical high of $109,350. Since rebounding from a low of $75,000 in early April, Bitcoin has shown a strong V-shaped recovery, with a rise of up to 10% in the past week. This surge is attributed to the continued inflow of funds into spot Bitcoin ETFs. According to Coinglass statistics, BlackRock's IBIT spot Bitcoin ETF has recorded net inflows for 20 consecutive trading days, accumulating over $5 billion.

The positive news from the trade agreement further ignited market optimism towards cryptocurrencies. Analysts on platform X pointed out that if a joint statement from China and the U.S. confirms tariff reductions or suspensions, the market may overlook the short-term fluctuations in CPI data and instead bet on long-term economic improvement expectations, potentially pushing Bitcoin to break through the $110,000 mark. Some analysts believe that the rise in Bitcoin will accelerate the upward movement of altcoins like Ethereum (ETH), forming a market pattern of "BTC leading, ALT following."

X user @Mrpixelraf warned that Bitcoin may experience a "spike drop" before the CPI data is released, influenced by leveraged trading liquidations or sudden negative news, advising investors to set stop-loss orders and avoid full-position operations.

Federal Reserve Rate Cut Expectations: A Magnifying Glass for CPI Data

The importance of CPI data lies not only in its revelation of inflation trends but also in its guidance for Federal Reserve monetary policy. The Federal Reserve has kept the federal funds rate unchanged in the range of 4.25%-4.5% and reiterated that it will decide whether to cut rates based on data. The market generally believes that if the April CPI confirms a slowdown in inflation, the Federal Reserve may initiate a rate cut cycle as early as June or July, which would provide strong support for risk assets.

"The warming of rate cut expectations is a direct catalyst for high-risk assets like Bitcoin," Thielen analyzed. "If the CPI data is below or in line with expectations, it will enhance the market's confidence in the Federal Reserve's easing policy, driving funds into the crypto market."

However, the trend of core CPI may be a key variable. RBC expects core CPI to remain flat at 2.8% year-on-year, but if rents or service prices unexpectedly rise, it could lead to core CPI exceeding expectations, thereby weakening rate cut expectations. FX678 analysis pointed out that recent surveys from the Institute for Supply Management (ISM) manufacturing sector show rising input prices, indicating that wholesale price inflationary pressures still exist, which may transmit to consumers in the coming months.

Global Perspective: Comparison and Insights from China's CPI

It is noteworthy that against the backdrop of Sino-U.S. trade easing, China's April CPI data also reflects the complexity of inflation pressures. According to media reports, China's April CPI fell by 0.1% year-on-year, recording negative values for the second consecutive month, indicating that the trade war has exacerbated weak domestic demand and downward price pressures. This data contrasts with the mild decline in U.S. CPI, highlighting the differences in the economic cycles of the two countries. A spokesperson for China's Ministry of Commerce previously stated that Beijing is evaluating ways to alleviate tariff pressures through negotiations to stabilize exports and domestic demand.

The divergence in CPI data between China and the U.S. provides important references for global investors. The mild decline in U.S. CPI may boost global risk appetite, while the continued weakness in China's CPI may strengthen the renminbi exchange rate, indirectly benefiting offshore market sentiment.

The April CPI data will play a key role against the backdrop of Sino-U.S. trade easing. Whether it is Bitcoin's surge or the warming of Federal Reserve rate cut expectations, the market stands at an important crossroads. Investors need to closely monitor the joint statement from China and the U.S. on Monday and the CPI data on Tuesday, cautiously seizing the opportunities and risks brought by the resonance of macro and crypto markets.

This article represents the author's personal views and does not reflect the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。