According to BitMart's market report on May 12, BTC reached a high of $105,000 in the past week, and BTC is expected to set a historical high in May.

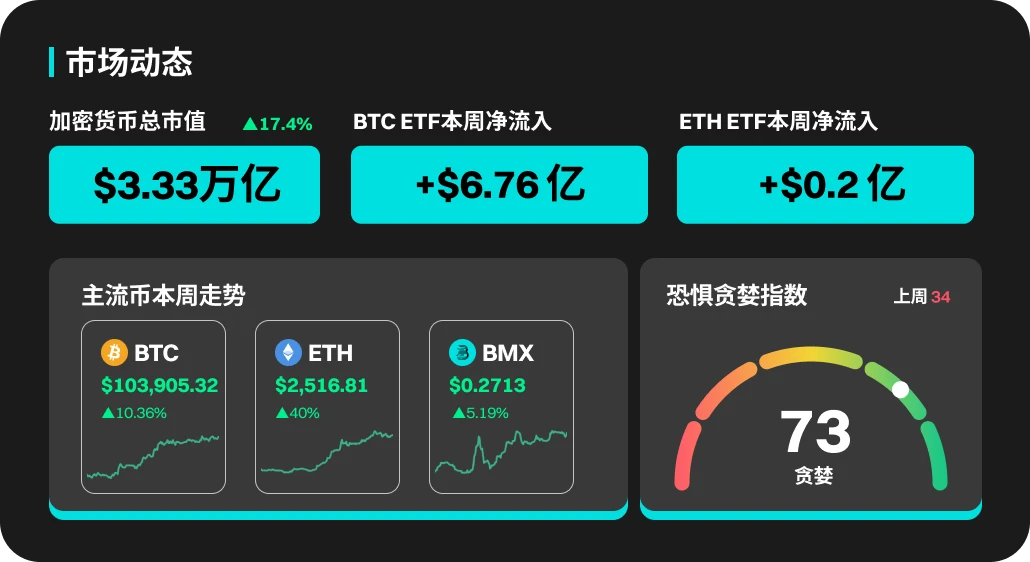

This Week's Cryptocurrency Market Dynamics

Last week, BTC ETF saw a net inflow of $920 million, achieving three consecutive weeks of net inflow, with the previous two weeks seeing inflows of $3.03 billion and $1.81 billion, respectively. The continuous inflow of funds indicates optimism for the market's future. In the past week, BTC reached a high of $105,000, and BTC is expected to set a historical high in May. The market's greed and fear index has been steadily rising, indicating that market sentiment has entered a greedy phase.

Last week, ETH ETF experienced a net outflow of $38 million, but ETH surged significantly from the $1,800 range to $2,600, even seeing a single-day increase of 25%. The ETH/BTC exchange rate rose significantly, currently reported at 0.024; at the same time, ETH's market share rebounded sharply from around 7% to 9%. From the inflow and outflow of ETF funds, the rise of ETH in the past week does not seem to be closely related to the ETF; some community opinions even suggest that the current rise of ETH is merely a short-term rebound due to various indicators being at historical lows.

This Week's Popular Cryptocurrencies

In terms of popular cryptocurrencies, MOODENG, GOAT, PNUT, PI, and KAITO have all performed well. MOODENG's price increased by 566.53% this week, reaching a high of 0.2889 USDT, with a current market cap of $260 million. GOAT's price rose by 212.9%, with a peak price of 0.2503 USDT, and PNUT's price increased by 167.6%.

U.S. Market Overview and Hot News

U.S. stocks showed mixed performance, with the S&P 500 index down 0.8%, the Dow Jones Industrial Average down 1.2%, and the Nasdaq index down 1.5%, mainly affected by tariff uncertainties and mixed earnings reports. Market volatility continues, with tariff exemptions causing a brief rebound, but the U.S.-China trade tensions and stricter chip export restrictions have severely impacted tech stocks. Intel's disappointing earnings report dragged down the Nasdaq index, while Tesla's strong quarterly performance provided some support for the S&P 500 index.

Monday: Federal Reserve Governor Cook and others gave speeches;

Tuesday: U.S. April CPI data;

Thursday: U.S. initial jobless claims for the week; U.S. April PPI data; 2027 FOMC voting member and San Francisco Fed President Daly participated in a fireside chat, and Federal Reserve Chairman Powell delivered opening remarks at an event, while the Federal Reserve held the second Thomas Laubach Research Conference;

Friday: U.S. May one-year inflation expectations preliminary value;

Saturday: Federal Reserve's Barkin and Daly gave speeches;

Popular Sectors and Project Unlocks

In the meme sector, MOODENG, GOAT, CHILLGUY, and others surged, as market funds favored fully circulating popular meme coins during the rebound; MOODENG rose over 130% in a single day, leading the market in altcoin performance, with the token increasing over six times in the past week. Several mainstream trading platforms announced the listing of MOODENG, stimulating demand for the token;

In the AI agent sector, PIPPIN, SWARMS, GRIFFAIN, and others rose, indicating that star tokens in the AI agent track have significantly increased from price lows, showing that AI agents remain one of the most focused sectors for market funds; however, tokens in the AI agent sector are still far from historical highs, indicating skepticism about current AI agent projects, and new AI agent projects may emerge.

APT will unlock approximately 11.31 million tokens on May 12 at 8 AM, valued at about $58.47 million;

Avalanche plans to unlock approximately 9.54 million AVAX tokens on May 17, 2025, accounting for about 2.49% of the total supply, valued at approximately $329 million at current prices. These tokens will be allocated to the team, foundation, strategic partners, etc., and approximately 1.13 million AVAX (about $38.81 million) will be distributed through airdrops;

Risk Warning:

The risks of using BitMart services are entirely borne by you. All cryptocurrency investments (including returns) are inherently highly speculative and involve significant risk of loss. Past, hypothetical, or simulated performance does not necessarily represent future results.

The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve significant risks. You should carefully consider whether trading or holding digital currencies is suitable for you based on your personal investment goals, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。