Visa and Mastercard are competing for dominance in the Web3 payment market.

Author: 100y

Translation: Deep Tide TechFlow

Key Points

Visa and Mastercard are the two major operators of global payment networks, and it is no exaggeration to say that they almost dominate the global payment market. It is expected that the total global payment transaction volume will reach $200 trillion by 2024. If card payments can be processed through blockchain networks in the future, it will bring tremendous growth opportunities for the blockchain and stablecoin industries.

Although the front-end experience of payment systems has significantly improved due to innovations from various fintech companies, the back-end systems that actually process transactions still rely on outdated technology. There are still many issues in settlement and cross-border payments, and blockchain offers promising solutions to these problems.

In April of this year, Visa and Mastercard announced their respective roadmaps for the application of blockchain and stablecoins. Both companies have launched related plans in the following areas: 1) card services linked to stablecoins; 2) settlement systems based on stablecoins; 3) peer-to-peer international remittances; 4) institutional tokenization platforms. It remains to be seen who will take the lead in the Web3 payment market.

The characters "Visardilo Crocodilo" and "Tralalero Mastercara," symbolizing the "out-of-the-box" thinking in the payment field, are waging a war for the next generation of payment systems. Indeed, for financial companies, adopting blockchain and stablecoin-related technologies has become an obvious choice.

1. Background - Can Blockchain Be Used for Payments?

1.1 The Two Giants of Traditional Payments

Source: Statista and Nilson

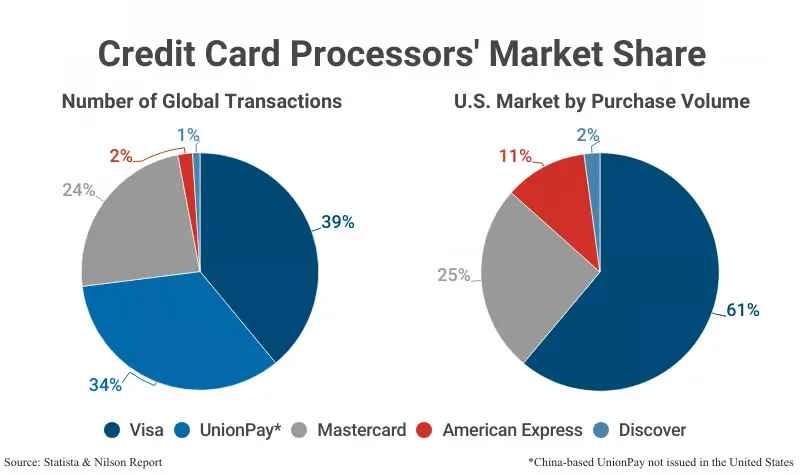

Visa and Mastercard are the leading payment network companies globally. As of 2024, Visa holds a 39% share of the global payment market, while Mastercard holds 24%. Given that UnionPay primarily handles transactions based on the Chinese domestic market, it is fair to say that Visa and Mastercard almost dominate the global payment landscape.

Both companies earn huge profits by providing card payment networks that process transactions between consumers and merchants, settling between issuing institutions and acquiring institutions while charging a small fee. (We will discuss the payment process in detail below.) In fact, Visa and Mastercard achieved operating profit margins of 67% and 57% respectively in 2023. This reflects the low fixed-cost network business characteristics based on large transaction volumes.

According to Upgraded Points, the card network payment transaction volume in the U.S. alone is expected to reach approximately $10.5 trillion by 2024. Combined with UnionPay's domestic transaction volume, the total global transaction volume is expected to be around $200 trillion. If card payment processing in the future is conducted through blockchain networks, it will present significant opportunities for the blockchain and stablecoin industries.

1.2 Card Payment Process

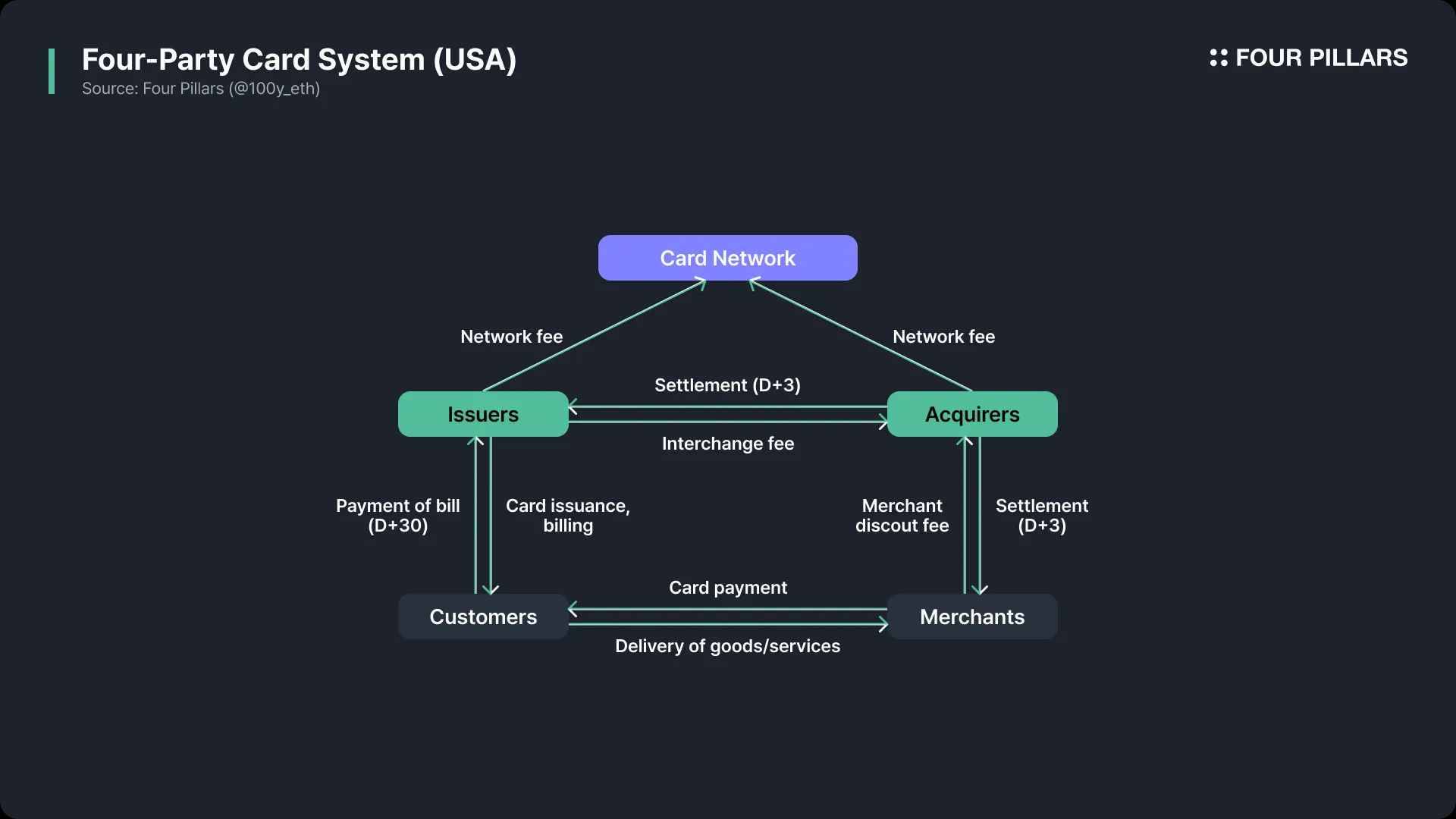

Both Visa and Mastercard operate open card payment networks using a "four-party model," which includes the issuing institution, acquiring institution, merchant, and cardholder. Visa and Mastercard do not directly issue cards or provide loans; they only provide the payment network. The basic process of the widely used four-party model in the U.S. is as follows:

Payment Request (D+0: Transaction Day): When a cardholder makes a purchase at a merchant, a payment request is initiated through the card. The payment information is transmitted from the merchant to the acquiring institution, then to the card network, and finally to the issuing institution. Payment Authorization Day (D+0: Transaction Day): The issuing institution checks the cardholder's credit limit, card validity, and any signs of fraud, then decides whether to approve the payment. The approval information is returned to the merchant in reverse order, completing the transaction. Settlement (D+3: Third Business Day After Transaction): The issuing institution pays the acquiring institution after deducting settlement fees, while the acquiring institution pays the merchant after deducting merchant fees. The card network charges network fees to both the issuing and acquiring institutions for each transaction. Billing and Repayment (D+30: 30th Business Day After Transaction): The cardholder receives a bill from the issuing institution in the following month and repays the amount due.

1.3 Can Blockchain Be Used for Payments?

Over the past few decades, various fintech services related to payments have emerged, from the initial PayPal to later services like Stripe, Square, Apple Pay, and Google Pay. These services have brought innovations to the front end, allowing users to complete payments more easily and quickly than ever before. However, the back-end processes that actually execute payments have changed little. As a result, existing payment systems still face several issues.

The first issue is settlement time. In traditional payment processes, most merchants and acquiring institutions process transactions in daily batches. This batch processing typically occurs once a day. Additionally, settlements are usually processed only on business days, so if holidays or weekends are involved, the overall settlement time may be extended.

The second issue is the high costs of international transactions. When the issuing institution and the merchant are in different countries, cross-border fund transfers are required during the authorization and settlement processes. This incurs approximately 1% in cross-border transaction fees and 1% in foreign exchange fees, making international payments more expensive than domestic payments.

There is a system that can solve both of these problems: blockchain. As a decentralized network, blockchain can operate 24/7 without being limited by national borders, enabling fast settlements and lower fees even for international transactions. Based on these advantages, Visa and Mastercard have actively adopted stablecoins and blockchain technology in their payment networks in recent years. So, how exactly are they utilizing blockchain?

2. Key Points: The Payment War Has Begun

Visa's Four Strategies

Source: Visa

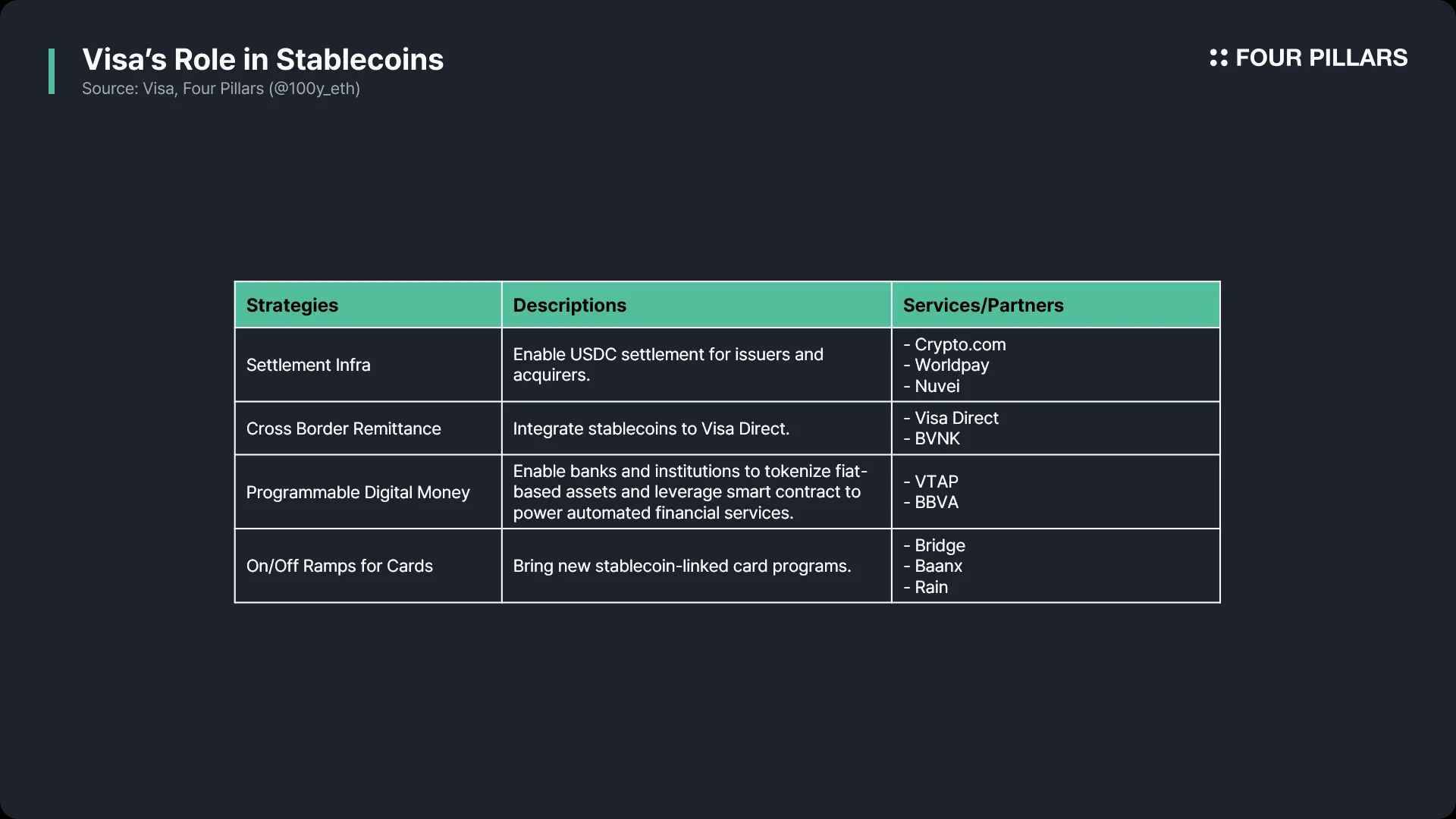

Visa operates one of the largest payment networks in the world—VisaNet, which can process up to 65,000 transactions per second and supports payments at 150 million merchants in over 200 countries. Visa views stablecoins as a core component of future digital payment systems and announced four specific strategic initiatives in April of this year to integrate stablecoins into its existing payment network.

1. Modernizing Settlement Infrastructure

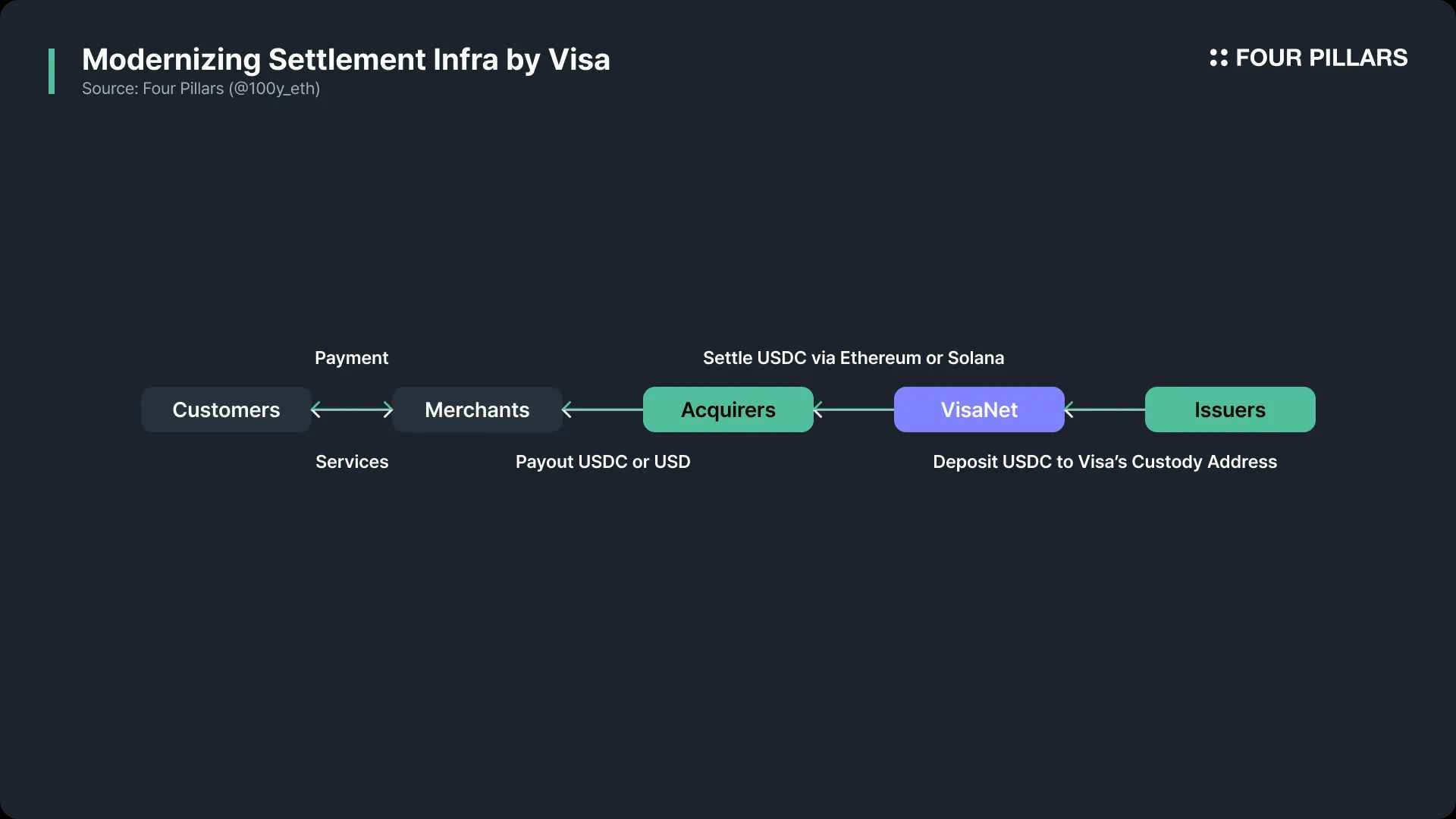

Since 2021, Visa has begun piloting the use of USDC (U.S. Dollar Stablecoin) for payment settlements through its existing VisaNet network. To date, over $225 million in settlements have been completed. Traditionally, issuing institutions needed to remit funds to Visa in U.S. dollars for settlement, but now they can settle directly using USDC. This not only enhances settlement efficiency but also reduces cross-border transaction costs.

For example, the Crypto.com Visa card allows users to make payments through their cryptocurrency accounts. In the past, these cryptocurrency-focused companies needed to convert digital assets into fiat currencies like U.S. dollars to complete payment processing, a time-consuming and costly process. Now, they can settle directly using USDC. In collaboration with Anchorage, Visa has created custodial accounts to securely store stablecoins. Issuing institutions like Crypto.com can transfer stablecoins to these accounts via the Ethereum network to complete settlements.

By eliminating the need to convert cryptocurrencies into fiat and conduct cross-border transfers, Crypto.com has reduced the average prepayment time from 8 days to 4 days and lowered foreign exchange fees to 20 to 30 basis points.

Visa not only allows issuing institutions to settle using USDC but has also launched a feature that allows acquiring institutions to settle directly using USDC. In September 2023, Visa established settlement infrastructure for acquiring institutions like Worldpay and Nuvei, enabling them to receive USDC via the Ethereum and Solana networks. Acquiring institutions can pass USDC to merchants or convert it to fiat currency as needed.

In summary, Visa has successfully built a pipeline that allows issuing institutions to settle with acquiring institutions using USDC instead of U.S. dollars through the Visa network. In the future, Visa plans to expand this stablecoin settlement system to more partners and regions, implement 24/7 real-time settlements, and support multiple blockchains and stablecoins.

2. Strengthening Global Remittance Infrastructure

Visa has supported large-scale cross-border transactions through its VisaNet infrastructure. One of its services, Visa Direct, enables peer-to-peer fund transfers via cards, wallets, and account numbers, covering payment scenarios between friends and businesses and customers. Visa plans to further enhance the efficiency of global remittances by integrating stablecoins into Visa Direct. Additionally, Visa recently invested in BVNK, a startup developing stablecoin infrastructure for enterprises, aiming to expand its stablecoin capabilities beyond the retail sector to encompass the corporate ecosystem.

3. Launching Programmable Digital Currencies

One of the main advantages of stablecoins compared to traditional cash is the ability to leverage smart contracts on the blockchain. Visa is highly focused on the potential of automated financial services based on smart contracts and announced the launch of the "Visa Tokenized Asset Platform (VTAP)" in October 2024.

VTAP is a blockchain-based financial infrastructure that allows banks and financial institutions to issue and manage fiat-backed digital tokens (such as stablecoins and tokenized deposits). Since these functionalities are provided through Visa's API, integration with existing financial systems becomes very easy. Tokens issued through VTAP can be combined with smart contracts to automate complex processes, such as conditional payments or customer loans.

Currently, VTAP has not been publicly released and is still operating in a sandbox environment. Initially, it tested token issuance, transfer, and redemption functionalities in collaboration with the Spanish bank BBVA. According to the roadmap, Visa plans to launch pilot projects for real customers on the Ethereum public blockchain starting in 2025.

4. Developing Stablecoin Recharge and Withdrawal Cards

Visa is helping issuing institutions provide recharge (on-ramp) and withdrawal (off-ramp) services through stablecoin-linked cards. To date, Visa has processed over $100 billion in cryptocurrency purchases and $25 billion in cryptocurrency spending through its cards. To expand this ecosystem, Visa is collaborating with stablecoin card infrastructure companies such as Bridge, Baanx, and Rain. Bridge is a stablecoin infrastructure platform acquired by Stripe. Recently, Bridge partnered with Visa to launch a card issuance solution that allows users to make real-world payments using stablecoins. Fintech companies can provide stablecoin-linked card services to users through Bridge's simple API. Cardholders can directly use their stablecoin balances for payments, while Bridge converts the stablecoins into cash and pays the merchants. Currently, this service has been launched in Argentina, Colombia, Ecuador, Mexico, Peru, and Chile, with plans to gradually expand to Europe, Africa, and Asia. Baanx is a London-based fintech company founded in 2018, focusing on connecting traditional finance with digital assets. In April 2025, Baanx announced a partnership with Visa to launch a stablecoin payment card that allows users to pay directly with USDC from their self-custodied crypto wallets. During the payment process, USDC is sent in real-time to Baanx via smart contracts, which then converts it into fiat currency to complete merchant settlements. Rain is a fintech company founded in 2021 that operates a global card issuance platform based on stablecoins. Rain provides APIs to facilitate businesses in issuing Visa cards linked to stablecoins, as well as various financial services, including 24/7 real-time payment settlements, tokenization of credit card receivables, and automation of settlement processes through smart contracts.

Mastercard's End-to-End Stablecoin Payment Solution

Source: Mastercard

Like Visa, Mastercard is one of the leading companies in the global payment network space. Unlike Visa, which processes payments through its high-capacity centralized network VisaNet, Mastercard processes payments through Banknet, a robust distributed structure supported by over 1,000 data centers worldwide. On April 28, 2025, Mastercard announced that it has established an end-to-end infrastructure covering the entire stablecoin payment ecosystem, from wallets to checkout functionalities.

1. Card Issuance and Payment Support

Mastercard collaborates with several crypto wallets (such as MetaMask), crypto exchanges (such as Kraken, Gemini, Bybit, Crypto.com, Binance, and OKX), and fintech startups (such as Monavate and Bleap) to provide stablecoin payment services.

MetaMask has partnered with Mastercard and Baanx to launch the MetaMask card, allowing users to make card payments using crypto assets stored in MetaMask. Payment settlements are completed in the background through Monavate's solution, which connects the Ethereum network with Mastercard's Banknet and converts cryptocurrencies into fiat currency. The MetaMask card will initially launch in Argentina, Brazil, Colombia, Mexico, Switzerland, the UK, and the US.

Mastercard also collaborates with the aforementioned crypto exchanges to support users in making payments using stablecoins in their accounts.

2. Providing USDC Settlement Support for Merchants

Despite the growing popularity of stablecoin-based payments, most merchants still prefer to settle in fiat currency. However, if merchants have the need, Mastercard also supports settlements in USDC through partnerships with Nuvei and Circle. In addition to USDC, Mastercard also supports the settlement of stablecoins issued by Paxos through its collaboration with Paxos.

3. On-Chain Remittance Support: Mastercard Crypto Credential Service

Sending stablecoins via blockchain offers simplicity, speed, and low costs. However, when applied to real-life scenarios, user experience, security, and compliance remain major challenges. To address this, Mastercard has launched the “Mastercard Crypto Credential” service, allowing users of crypto exchanges to create aliases through a verification process, making it easier to send stablecoins using these aliases. Visa and Mastercard are actively expanding the application scenarios for stablecoin payments, from card issuance to on-chain settlements to merchant support. Through deep collaboration with fintech companies, crypto wallets, and exchanges, they are driving the integration of blockchain technology with traditional payment systems. This marks a significant step forward for stablecoin payments globally and lays the foundation for the future development of the crypto industry.

Mastercard's Crypto Credential service simplifies the payment experience for users on the blockchain through an alias system, eliminating the need to input complex crypto wallet addresses and significantly enhancing user-friendliness. Additionally, if the recipient's wallet does not support a specific cryptocurrency or blockchain before the transfer, the transaction will be blocked in advance to prevent asset loss. In terms of compliance, Mastercard automatically exchanges the Travel Rule data required for international remittances, meeting regulatory requirements and ensuring transaction transparency. Currently, exchanges supporting this service include Wirex, Bit2Me, and Mercado Bitcoin. The service has been launched in Latin American countries such as Argentina, Brazil, Chile, Mexico, and Peru, as well as in European countries like Spain, Switzerland, and France.

4. Corporate Tokenization Platform

Mastercard's Multi-Token Network (MTN) is a private blockchain-based service designed to help financial institutions and businesses issue, destroy, and manage tokens, enabling real-time cross-border transactions. Here are some application cases of MTN:

Ondo Finance has tokenized its short-term bond fund based on U.S. Treasury bonds (OUSG) and integrated it into MTN. This allows businesses to purchase and redeem OUSG in real-time around the clock without relying on traditional financial infrastructure while also earning stable returns.

JPMorgan has integrated its blockchain payment system Kinexys with MTN to support real-time payment needs for businesses.

In May 2024, Standard Chartered successfully conducted a pilot project through MTN to tokenize and trade carbon credits as part of a proof of concept.

The Moment of Competing for Dominance in the Web3 Payment Market

As the U.S. government's support for cryptocurrencies becomes increasingly clear, the motivation for adopting blockchain and stablecoins across various industries continues to grow. As one of the core functions of blockchain networks, financial infrastructure naturally attracts the attention of payment network giants like Visa and Mastercard. Both companies are actively developing the next generation of payment infrastructure.

Notably, both Visa and Mastercard released plans related to blockchain and stablecoin payment systems in April 2025 (Visa published its role in stablecoins on April 30, 2025, while Mastercard unveiled its end-to-end capabilities for stablecoin transactions on April 28, 2025). Both companies emphasized the following four areas: 1) stablecoin-linked card services; 2) corporate tokenization platforms; 3) stablecoin settlement systems; 4) peer-to-peer (P2P) remittances.

This indicates that Visa and Mastercard are competing for dominance in the Web3 payment market.

Will the adoption of blockchain payment systems significantly disrupt existing market shares and competitive dynamics? The author believes that the next generation of systems will significantly change the payment infrastructure itself but will not drastically alter market shares or competitive structures. Blockchain payment systems will enhance the efficiency of settlements and international transactions, helping businesses optimize revenue models and improve competitiveness. However, the market share in the payment industry ultimately depends on the business and marketing relationships between merchants, acquirers, and issuers. These relationships have been deeply rooted over decades of development, so the application of blockchain may not significantly change the competitive landscape.

Resource Links:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。