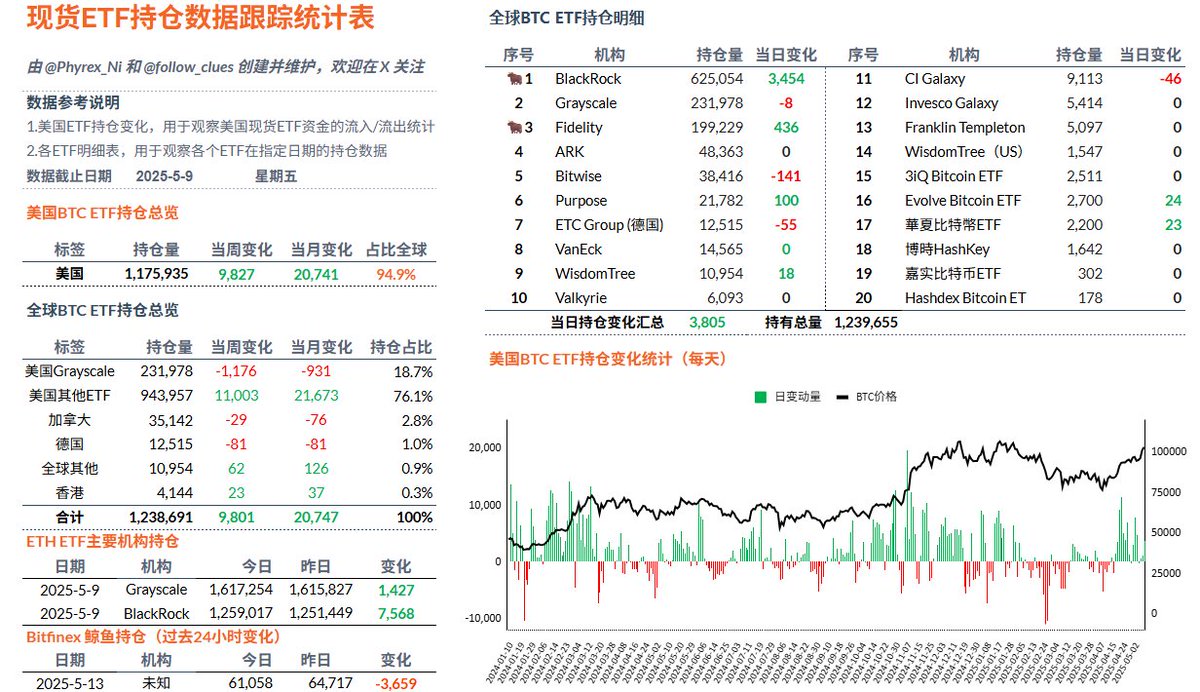

Last Friday, the buying volume of the $BTC spot ETF was quite good, especially since the price was also favorable. This once again illustrates that some ETF investors are no different from most retail investors; they are all chasing highs and cutting losses. On Friday, the net buying by American investors was the second highest of the week, only behind last Monday, with BlackRock being the main buyer. This marks BlackRock's 19th consecutive working day of net buying.

In addition to BlackRock, Fidelity investors were also buying, but the buying volume was relatively small. Apart from these two, among the spot ETF institutions, only Grayscale and Bitwise had a small outflow, while the others were at zero. The slight FOMO sentiment was also seen among BlackRock and Fidelity investors.

Although Bitcoin's price rose nicely last week (Week 69), the actual net buying was only half of that in Week 68. This means that while the price increased, the purchasing power of the ETFs actually declined, indicating that more investors do not see this as a reversal. Instead, many are still in a wait-and-see state.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。