Today's homework is a bit challenging. I have been organizing the content for a long time but still haven't found the reason for the rise in U.S. stocks while $BTC is falling. In the last 24 hours, the average increase of the Nasdaq and S&P 500 is 3.6%, but so far Bitcoin has already dropped by 2.2%, falling below $101,000 at its lowest point. Although many friends have told me that since BTC led the rise, it is reasonable for it to lead the fall now.

However, it should be noted that U.S. stocks have been rising continuously. After opening with a gap up, they have almost been on an upward trend, and just before the market closed, the Nasdaq index had risen over 4%, and the S&P 500 had also increased by 3.3%. This indicates that investor sentiment in the U.S. stock market is still very high, and it shows that the current market information is favorable for risk markets. The tariffs between China and the U.S. have also entered a pause phase. Although there are still some issues, the market's expectations are positive.

The Russia-Ukraine conflict is also shifting towards a cessation. The Republican Party has raised the debt ceiling to $4 trillion, and the new tax bill has not had as broad an impact as Trump expected. The proposal to exempt tips from taxes is also on the table, and even the significant increase in tariffs in the U.S. in April was due to tariff grabbing. All of this, at least on the surface, looks good.

Although there are some negative data, they have not affected the trend of U.S. stocks at all. The U.S. dollar index is pushing towards 102, and U.S. Treasury yields are rising across the board. The 10-year yield is about to break 4.5%, and the 20-year yield is about to break 5%. Even the CME's forecast for the Federal Reserve's interest rate cuts has decreased from three times to two times. These are indeed unfavorable data, and even the Russell 2000 has risen by 3.5%.

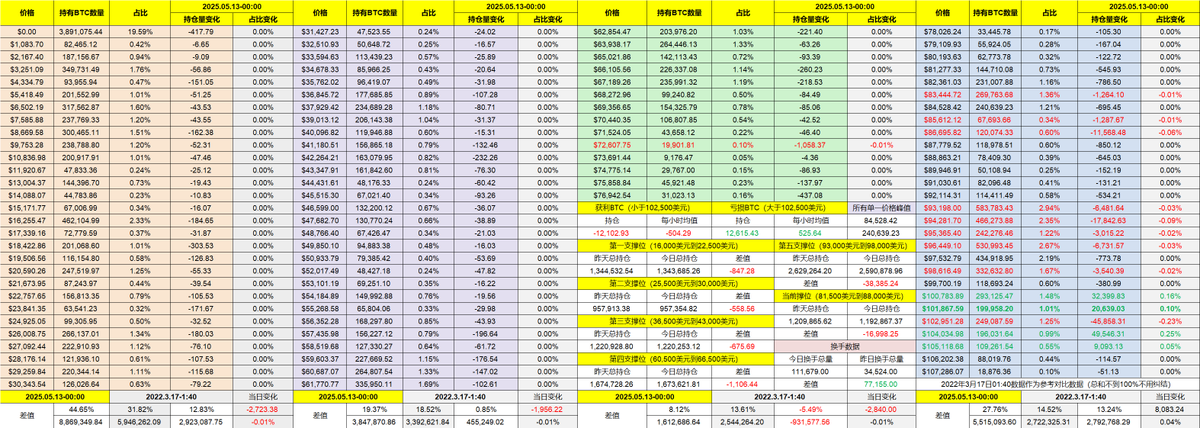

I tried to understand this by checking the exchange's inventory data and found no significant increase in inventory entering the exchanges as BTC prices fell. In fact, the inventory on exchanges has slightly decreased. So, after ruling out macro factors and systemic risks, there hasn't been a large influx.

From the trading volume data, it is evident that after 10 PM Beijing time, there was a significant sell-off, likely due to U.S. investors choosing to exit the market. This timing coincides with the auction of 3-month and 6-month U.S. Treasury bonds, and the data from this auction was not good.

It is clear that yields are rising and bid multiples are declining, indicating that investors are not very interested in short-term U.S. Treasuries and do not expect the Federal Reserve to cut rates in the short term. This coincides with the rise in U.S. stocks, so I personally speculate that some investors, reluctant to sell their U.S. stocks, prioritized liquidating cryptocurrencies, or even used cryptocurrency funds to purchase short-term U.S. Treasuries.

Of course, these are all speculations without complete evidence, but I find it quite strange, and I think there is some possibility to it. After all, after the U.S. stock market closed, cryptocurrencies also showed a rebound trend. Let's continue to observe tomorrow; at least for now, there is indeed no sign of systemic risk.

In the data regarding turnover rates, it can also be seen that although prices are falling, the turnover rate is not very high, and it has even decreased compared to the same period last week. Therefore, this price drop has not triggered panic among investors, and most investors still remain optimistic about BTC.

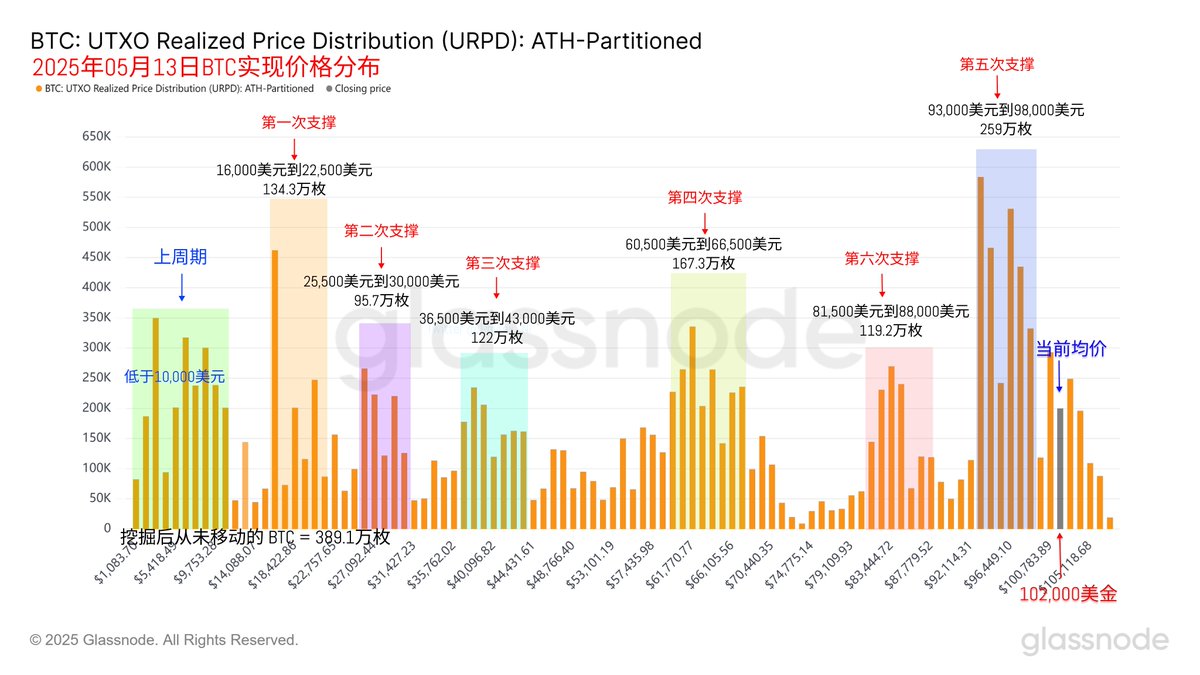

The supporting data still shows no issues. The support between $93,000 and $98,000 is still strong, and the positions between $83,000 and $101,000 are just swapping without significant impact. Therefore, I still maintain a cautiously optimistic attitude towards BTC's price.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。