Key Points

– Lightning-fast transaction speed: Sui adopts a unique Narwhal/Bullshark + Mysticeti consensus design, allowing simple transfers to be completed in sub-second levels, with a theoretical throughput exceeding 100,000 TPS.

– Move language provides security guarantees: Sui's Move smart contracts treat tokens and data as "resources," eliminating the risk of asset duplication or loss, making it more reliable than some EVM chains.

– Robust token economy and continuous rewards: The total supply of SUI is fixed at 10 billion, with only about one-third currently released, and half reserved for the community. Daily staking rewards (approximately 5–10% annualized) come from predictable periodic subsidies and transaction fees.

– Thriving ecosystem: DeFi locked value exceeds $2 billion, with popular GameFi projects, a new NFT standard, local decentralized storage (Walrus), a pilot with the Athens Stock Exchange, and WLFI treasury collaboration, the actual value of Sui continues to emerge.

– Unique technical advantages: Unlike Solana, Aptos, or Avalanche, Sui finds a balance between low latency and horizontal scalability, with a more secure object-oriented asset design; meanwhile, deep SUI/USDT trading liquidity is available on mainstream exchanges.

Since the mainnet launch on May 3, 2023, SUI Blockchain (SUI) has grown to become one of the fastest Layer 1 public chains, thanks to its object-oriented data model and Move language-based smart contracts. By May 2025, Sui's on-chain activities have rapidly increased, covering DeFi, gaming, NFTs, and various traditional financial collaborations. This article will delve into Sui's technical architecture, token economy, investment backing, ecosystem progress, SUI price dynamics, compliance prospects, and comparative analysis with Solana.

Table of Contents

SUI Blockchain Technical Architecture

SUI Token Economy: Issuance, Distribution, and Utility

Mysten Labs Financing and Core Investors

Sui Ecosystem Development Progress

Sui Market Performance and Core Data

SUI Blockchain Compliance and Legal Environment

Comparison of Sui with Solana/Aptos/Avalanche

SUI Major News and Controversies

SUI Blockchain Technical Architecture

Move Language and Object-Oriented Model

Sui is built on the Rust version of the Move language launched by the Meta Diem project. Unlike account-based blockchains, Sui treats on-chain assets as "objects" exclusively owned by addresses. Each transaction must explicitly specify which objects to read or modify. If the transaction only involves private objects, global consensus can be skipped, allowing for confirmation in sub-second levels, significantly enhancing parallel throughput.

Image Credit: SUI Official Youtube Channel

Sui Consensus Mechanism: Narwhal, Bullshark & Mysticeti

Sui's two-layer consensus mechanism includes:

– Narwhal: A high-throughput mempool engine for rapid transaction broadcasting.

– Bullshark: A BFT protocol optimized based on Tusk, responsible for transaction ordering and final confirmation.

In early 2024, Sui will launch the Mysticeti consensus engine, further reducing latency by distinguishing between "causally independent" transactions (fast path, no locking required) and dependent transactions (full BFT). Simple transfers can achieve over 100k TPS on the fast path and achieve sub-second final confirmation.

Image Credit: SUI Official Youtube Channel

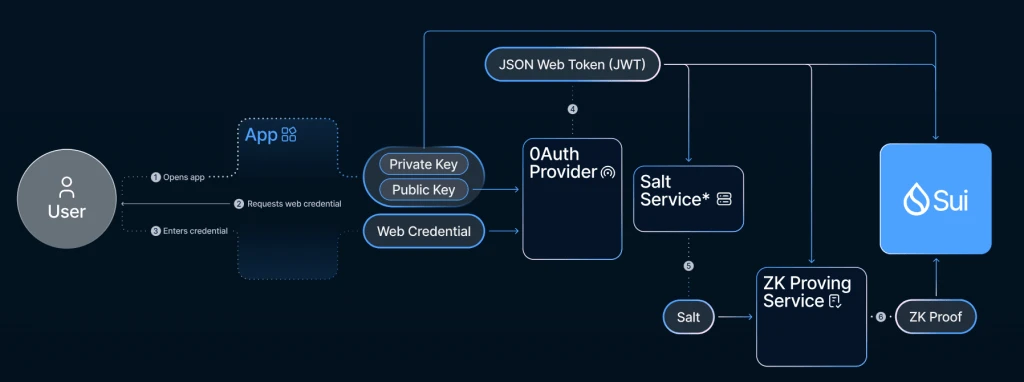

Security, Smart Contracts, and zkLogin

The Move language enforces resource ownership rules, naturally preventing common vulnerabilities such as reentrancy attacks and asset duplication. By 2025, Sui's DPoS validator network will have about 150 nodes to ensure on-chain security. Meanwhile, the zkLogin feature allows DApps to log in using Web2 accounts like Google and Twitch through zero-knowledge proofs without disclosing private information. These features make Sui both high-performance and developer-friendly.

Image Credit: Sui Blockchain Official Website

SUI Token Economy: Issuance, Distribution, and Utility

Total Issuance and Circulation Unlocking

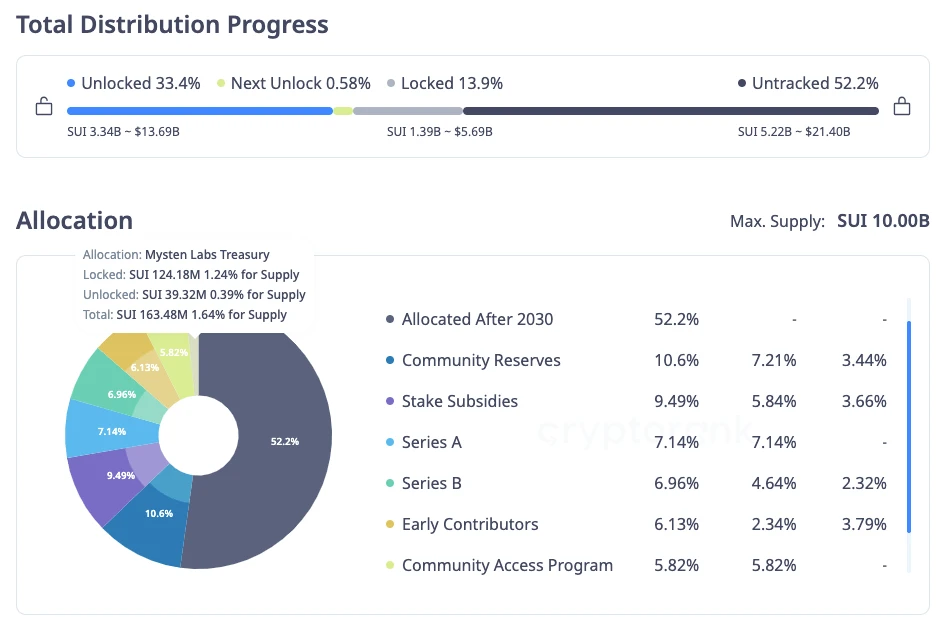

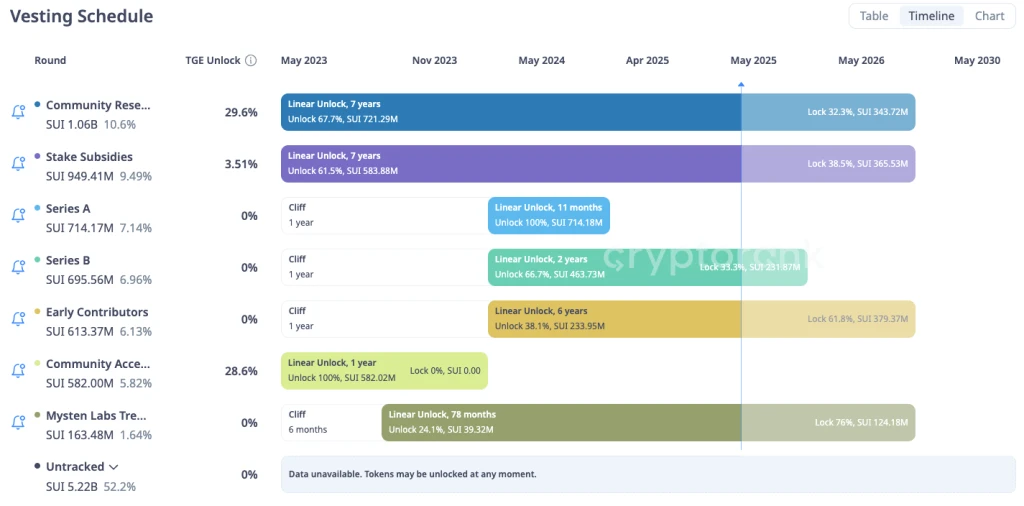

The total supply of SUI tokens is fixed at 10 billion. Approximately 5% (500 million) was put into circulation at the mainnet launch. By May 2025, about one-third (approximately 3.3 billion) will be unlocked, with subsequent unlocks (e.g., another 500 million in May 2025) viewable in real-time on the Sui Foundation dashboard.

Image Credit: Cryptorank

Token Distribution Details

– Community Reserve (50%): Used for ecosystem funding, incentives, validator support, and other projects.

– Core Contributors (20%): Allocated to the core team and advisors, released according to a predetermined lock-up schedule.

– Investors (14%): Including a16z, repurchased FTX Ventures, Binance Labs, Coinbase Ventures, etc.

– Mysten Labs Inventory (10%): Used as a company R&D and operational fund, released in phases.

– Community Access and Testers (6%): Allocated through pre-release projects and test networks.

Inflation, Staking Rewards, and Fee Model

Although the total supply is capped at 10 billion, Sui still provides temporary epoch subsidies to ensure security in the early stages of the network. During each epoch, which lasts about 24 hours, validators and their delegators can earn transaction fees and newly minted staking subsidies; as the network matures, the subsidy ratio will gradually decrease. As of April 2025, approximately 1.1 billion SUI (equivalent to one-third of the circulating supply) has been staked, with an annualized yield between 5–10%. Fees remain low and predictable, and when users delete on-chain objects, the corresponding storage fees can be refunded.

Image Credit: Sui Blockchain Official Blog

Mysten Labs Financing and Core Investors

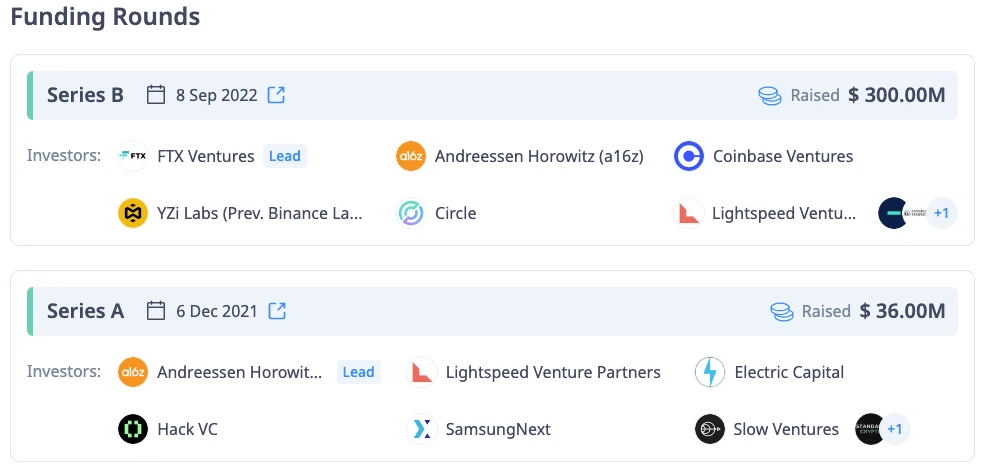

Mysten Labs has completed two rounds of critical financing, laying a solid foundation for the development and launch of the Sui blockchain, and reflecting the high recognition from venture capital for its technology and team:

– Series A Financing (December 2021): Led by Andreessen Horowitz (a16z), raising $36 million, with several early blockchain investment firms participating. This round of funding was used to attract core engineers from the former Meta Diem team, build infrastructure, and accelerate the early development of the Move language.

– Series B Financing (September 2022): At a valuation exceeding $2 billion, FTX Ventures led a $300 million round, with strategic investors such as Binance Labs, Coinbase Ventures, Circle Ventures, Jump Crypto, Franklin Templeton, Apollo Global Management, and Lightspeed participating. The funds were primarily used for mainnet deployment, local SDK development, and large-scale ecosystem incentive projects.

Image Credit: Cryptorank

After FTX's bankruptcy in November 2022, Mysten repurchased FTX Ventures' equity for $95 million, eliminating the risk of price fluctuations in SUI due to large-scale sell-offs.

In addition to venture support, Mysten has established strategic partnerships with several institutions:

– Circle: Introduced USDC natively to Sui, enabling seamless circulation of stablecoins;

– Anchorage & BitGo: Provided compliant custody solutions to meet institutional security needs;

– Renowned market makers: Ensured deep liquidity for mainstream trading pairs such as SUI/USDT.

These capital and institutional collaborations form a solid backing for Sui's rapid growth and robust ecosystem.

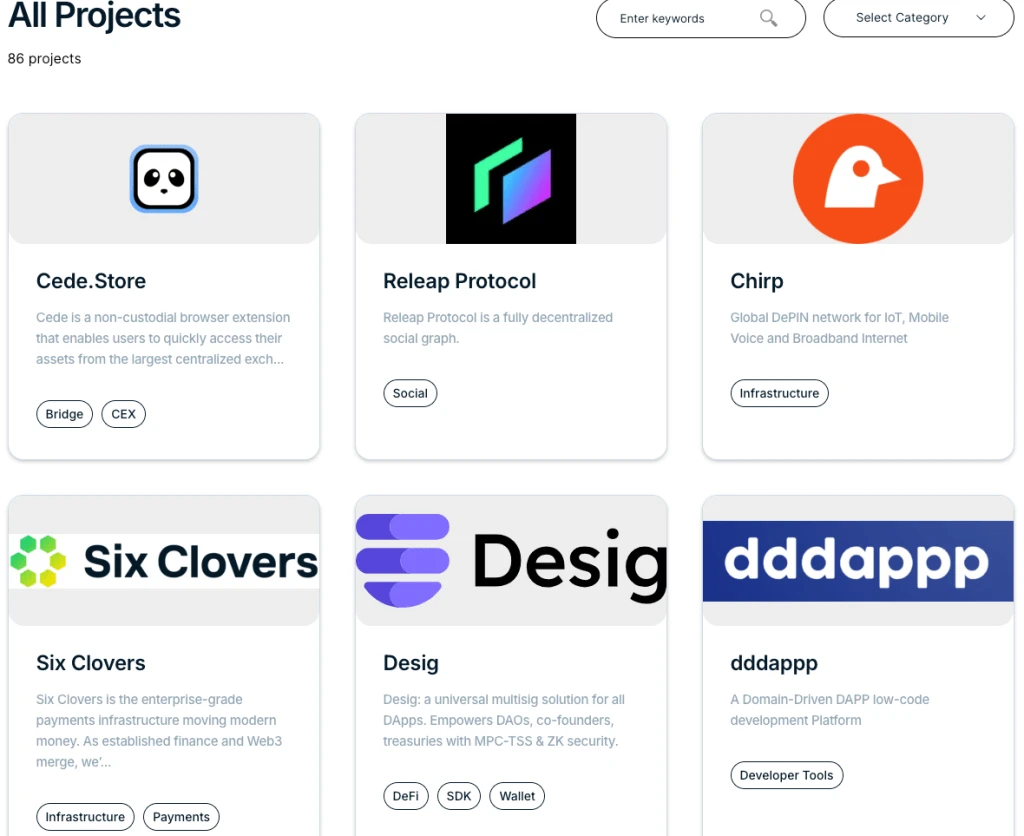

Image Credit: Sui Blockchain Directory

Sui Ecosystem Development Progress

User Adoption and Network Metrics

– Active addresses: Increased from less than 10 million in May 2024 to 120 million in April 2025.

– Transaction volume: Set a record of 65 million transactions in a single day in July 2023; consistently maintained thousands of TPS daily.

– Number of validators: Grew from about 100 to approximately 150 by 2025, thanks to the community delegation program.

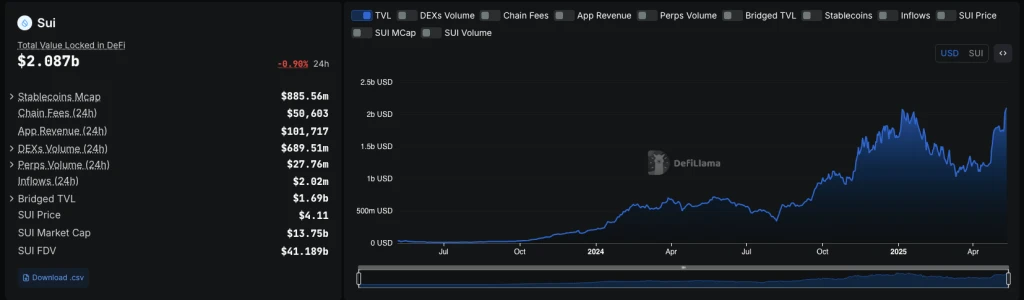

Sui DeFi TVL and Protocol Highlights

TVL: Surpassed $1 billion by the end of 2024, doubling to $2 billion by January 2025.

Core protocols:

– Cetus Protocol: A decentralized exchange with concentrated liquidity.

– DeepBook: An on-chain central limit order book.

– Navi & SuiLend: Lending markets, each with a TVL exceeding $450 million.

Image Credit: Defillama

Gaming, NFTs, and Hardware Projects

– GameFi: Run Legends (earn while you play), 8192 (on-chain puzzle game).

– NFTs: Kiosk standard for trusted listings; popular series like Cosmocadia.

– Hardware: SuiPlay0X1 gaming device (released in April 2024).

Infrastructure, Collaborations, and Strategic Alliances

Walrus: A decentralized storage network launched in March 2025 that can be natively verified on Sui.

ATHEX PoC: Collaborated with the Athens Stock Exchange to digitize the issuance process using zk-proofs.

Native cross-chain bridge: Supports SUI ↔ ETH interoperability.

WLFI–Sui Strategic Cooperation

Macro strategy reserve: WLFI included SUI in its treasury assets, leading to a short-term price increase of about 14% after the announcement.

Joint R&D: Exploring yield farming products and integrated wallets based on Sui's low-latency transactions.

Governance collaboration: WLFI may participate in the allocation of the Sui ecosystem fund.

Stablecoin integration: Minting USD1 stablecoin on Sui and optimizing costs using storage rollback.

Sui Market Performance and Core Data

– SUI Price: Approximately $3.50 as of early May 2025.

– Market capitalization: $11–12 billion, ranking in the top 15.

– Fully diluted market capitalization (FDV): Approximately $33–35 billion based on a total supply of 10 billion.

– Circulating supply: Approximately 3.3–3.4 billion SUI (about 33%).

– 24-hour trading volume: $1.3 billion, covering SUI/USDT, SUI/USD, SUI/BTC.

– Exchange listings: Binance, Coinbase, Kraken, XT.com, Huobi, Gate.io, Gemini, Crypto.com, Bybit, Bitstamp; local DEXs still have active transactions, but centralized exchanges dominate liquidity.

XT.com SUI/USDT spot trading pair

SUI Blockchain Compliance and Legal Environment

– Utility token status: No enforcement actions from the SEC in the U.S.; Coinbase's rapid listing suggests it may be classified as a non-security.

– Institutional products: Grayscale Sui Trust (launching in August 2024); ETP products under the European MiCA framework have already included SUI.

– Compliance measures: Community access programs require KYC; unlocking plans are transparently disclosed.

– Post-FTX resolution: Repurchased FTX-related shares to avoid price impacts from large-scale sell-offs.

– Future outlook: May be viewed as a commodity token in the U.S.; under European MiCA regulation, disclosure is required but is not expected to encounter significant obstacles.

Comparison of Sui with Solana, Aptos, and Avalanche

Consensus and Throughput

– Sui: Narwhal/Bullshark rapid broadcasting + Mysticeti distinguishes "causally independent" transactions, achieving over 100k TPS on the fast path without locking.

– Solana: PoH + Tower BFT, single-chain global ordering, actual throughput in the thousands of TPS, prone to downtime under extreme traffic.

– Aptos: AptosBFT + Block-STM parallel execution, benchmarked at ~13k TPS.

– Avalanche: Gossip protocol sharding, ≈1 second final confirmation, ≈4.5k TPS/shard.

Smart Contract Environment

– Sui & Aptos: Both use Move, resource-oriented to prevent asset duplication and support formal verification.

– Solana: eBPF (Rust/C++), high performance but requires careful memory management.

– Avalanche: EVM compatible, reuses the Solidity toolchain, but inherits EVM's reentrancy and fee fluctuation issues.

Ecosystem and Adoption

– Sui: DeFi TVL ~$2B, GameFi, NFTs, and market-validated TradFi PoC.

– Solana: Large DeFi/NFT ecosystem, Solana Pay, numerous retail users.

– Aptos: Focused on social identity and DeFi applications.

– Avalanche: Rich enterprise-level sharding cases, active EVM DeFi.

Decentralization and Security

– Sui & Aptos: About 150 validators, DPoS model.

– Solana: About 1,800 nodes, but high hardware costs.

– Avalanche: ~1,300 nodes, flexible sharding.

– Stability: Sui has had no major outages, only one dApp vulnerability; Solana has experienced multiple downtimes; Aptos is stable; Avalanche is core stable but dApps are prone to attacks.

Overall, Sui achieves a balance between ultra-high throughput, sub-second finality, and security with its object-oriented Move VM, combined with low fees and deep SUI/USDT liquidity, making it a strong competitor in the next-generation Layer-1 public blockchain space.

Major News, Updates, and Controversies about the SUI Blockchain

– Mainnet launch (May 2023): Successfully went live with over 100 validators participating; set a record of 65 million transactions in a single day.

– No large-scale airdrop: The limited-time sale of the community access program sparked a discussion on fairness.

– Internal sell-off allegations (October 2024): Rumors circulated that insiders sold approximately $400 million worth of SUI, but the project's transparent dashboard data clarified the situation.

– $29 million stolen (December 2024): Approximately 6.27 million SUI were stolen due to a third-party wallet vulnerability, highlighting the need for improved on-chain forensic tools.

– Mysticeti upgrade: Continues to maintain performance leadership through consensus improvements.

– zkLogin and Walrus launch: Introduced innovations in user experience and decentralized storage.

– ATHEX collaboration: A high-profile traditional finance pilot project with the Athens Stock Exchange is underway.

Frequently Asked Questions about the Sui Blockchain

- Where can I buy SUI?

You can trade SUI/USDT in the spot market on XT.com, enjoying deep liquidity and low fees. After registering or logging in and completing KYC, you can start trading on the XT.com SUI/USDT trading pair.

- How do I stake SUI to earn rewards?

After purchasing SUI on XT.com, go to the "Earn" or "Staking" page, search for "SUI," and select a validator or delegation pool. Your staked SUI will earn rewards daily per epoch (currently around 5–10% annualized), and you can flexibly unbind at the end of each epoch.

- Where can I learn about Sui's technology and tokenomics?

– Official documentation: See Sui Docs for complete specifications on Move, consensus, and tokenomics.

– Tokenomics dashboard: Track unlocking progress and circulation in real-time on the Sui Foundation tokenomics page.

– Community resources: Join the Sui Discord for discussions, check tutorials, and follow Twitter/X @SuiNetwork for the latest updates.

Where can I check the price and market data of SUI?

XT.com provides real-time charts and order books, and you can also monitor prices through platforms like CoinMarketCap or CoinGecko.

How can I participate in the Sui ecosystem as a developer or validator?

– Developers: Visit Sui DevHub for SDKs, tutorials, and hackathon information.

– Validators: Refer to the Sui Foundation Validator Guide to understand node requirements and submit applications.

Future Outlook and Conclusion

As of May 2025, the Sui Blockchain (SUI) ranks among the fastest, safest, and most developer-friendly platforms. Future focuses will include:

– Expanding on-chain governance to empower community decision-making;

– Further decentralizing the validator network to enhance security and stability;

– Promoting more practical use cases, such as the production environment deployment at ATHEX.

With over $2 billion in DeFi locked value, a thriving gaming and NFT ecosystem, strategic partners like WLFI, and a mature and robust tokenomics model, Sui is steadily moving towards new heights, competing with other projects in the high-performance blockchain arena. Whether you are trading SUI/USDT, participating in staking to earn rewards, or building the next Web3 application, Sui provides a solid foundation for decentralized finance and more scenarios with its low latency, parallel execution, and Move-driven security features.

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with over 1 million monthly active users and user traffic exceeding 40 million within the ecosystem. We are a comprehensive trading platform supporting over 800 quality cryptocurrencies and more than 1,000 trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading options, including spot trading, margin trading, and futures trading. XT.COM also has a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。