Preface: Investment carries risks, and operations should be conducted with caution.

Article review takes time, and there may be delays in publication. The article is for reference only, and you are welcome to read!

Article writing time: May 13, 12:40 PM Beijing Time

Market Information

- Australia appoints a new Assistant Minister for Technology to promote cryptocurrency regulation;

- Dell has rejected a shareholder proposal to "include Bitcoin in the company's treasury";

- SEC Commissioner Hester Peirce stated, "Tokenization cannot fully realize its potential without legal clarity.";

- SEC Chairman Paul Atkins stated that his top priority is "to establish a reasonable regulatory framework for cryptocurrencies";

- Goldman Sachs: The significant reduction of tariffs on China by the U.S. has limited impact on the overall effective tariffs in the U.S.;

Market Review

Yesterday, we advised everyone to short Bitcoin around the pressure level of 105,000. The highest point for Bitcoin last night was 105,863, which provided an entry opportunity, and then it began to decline. The current lowest point is 100,678. Although we are still a few thousand points away from our target of 98,000, the profit has reached around 3,300 points. Those who entered can consider reducing their positions and using a trailing stop to aim for the 98,000 level. Ethereum did not provide an entry near 2,750. Although it has currently reached around 2,430, given the current situation, it is not suitable to enter long positions in Ethereum. Those who have entered should exit at breakeven. There is still room below for Bitcoin, so continue to hold short positions, and those who are flat should look for opportunities to position themselves.

Market Analysis

BTC:

From the daily chart of Bitcoin, we indicated yesterday that the pressure range for Bitcoin is between 102,300 and 105,000. The current trend has broken below this range, and last night's rebound just touched the upper pressure level before starting to decline. The daily candle for Bitcoin closed bearish, and with pressure near the high, short-term signals for short positions have emerged. The short position near 105,000 currently has a profit of around 2,500 points, which can be reduced with a trailing stop, continuing to hold until the 98,000-96,000 range. After reaching around 96,000, we will assess whether to look for long positions based on the trend. Please manage your entry opportunities; for short-term trading, control risks and manage your own profits and losses.

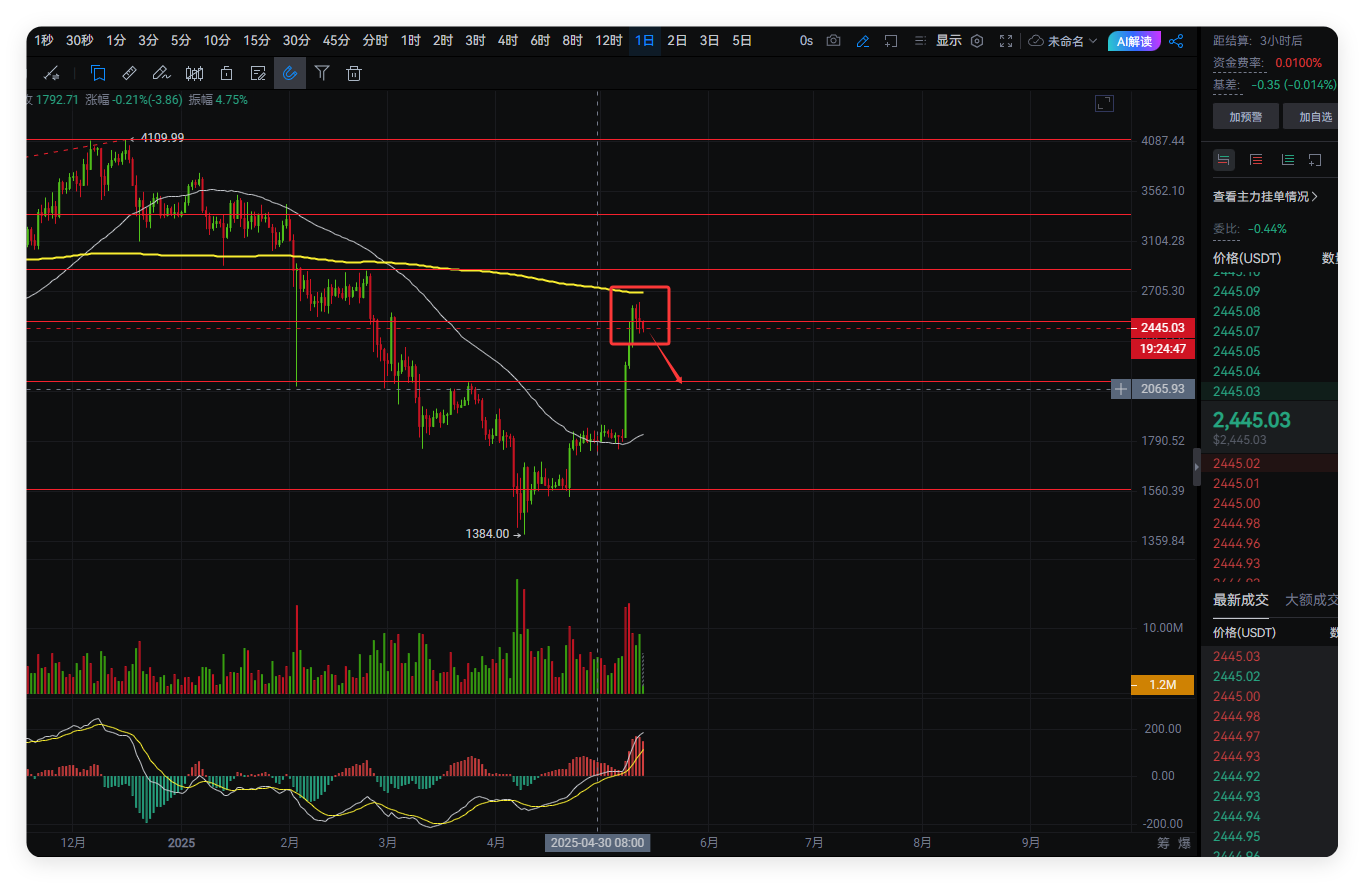

ETH:

The daily chart for Ethereum also closed with a doji star, with pressure from the 200-day moving average. Bitcoin is also under pressure. Although Ethereum has not yet reached its target, it has currently dropped below 2,500. There is a short-term opportunity for a pullback. Ethereum can be shorted around 2,500, with 2,570 as the stop loss and a target near 2,300. Use light positions with a stop loss for this layout, and manage your entry opportunities; for short-term trading, control risks and manage your own profits and losses.

In summary:

Bitcoin has not broken through the upper pressure, and a short-term pullback is expected;

The article is time-sensitive, please be aware of the risks. The above is only personal advice and for reference!

Follow the WeChat public account "Crypto Lao Zhao" to discuss the market together;

If you don't like it, you must have your own standards for what you like. All negativity is the opposite of positive perception. The matter itself is not important; what matters is what changes you can achieve and what impact it can have! Some prefer one-sided trends, some prefer volatility, some excel in upward movements, while others are obsessed with downward trends. No one is absolutely right, and no one is absolutely wrong. If you don't like it, it doesn't meet your standards; what you cannot do may be what others excel at.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。