Source: Cointelegraph

Original: “Corporates are the biggest Bitcoin (BTC) buyers this year, retail investors take a back seat”

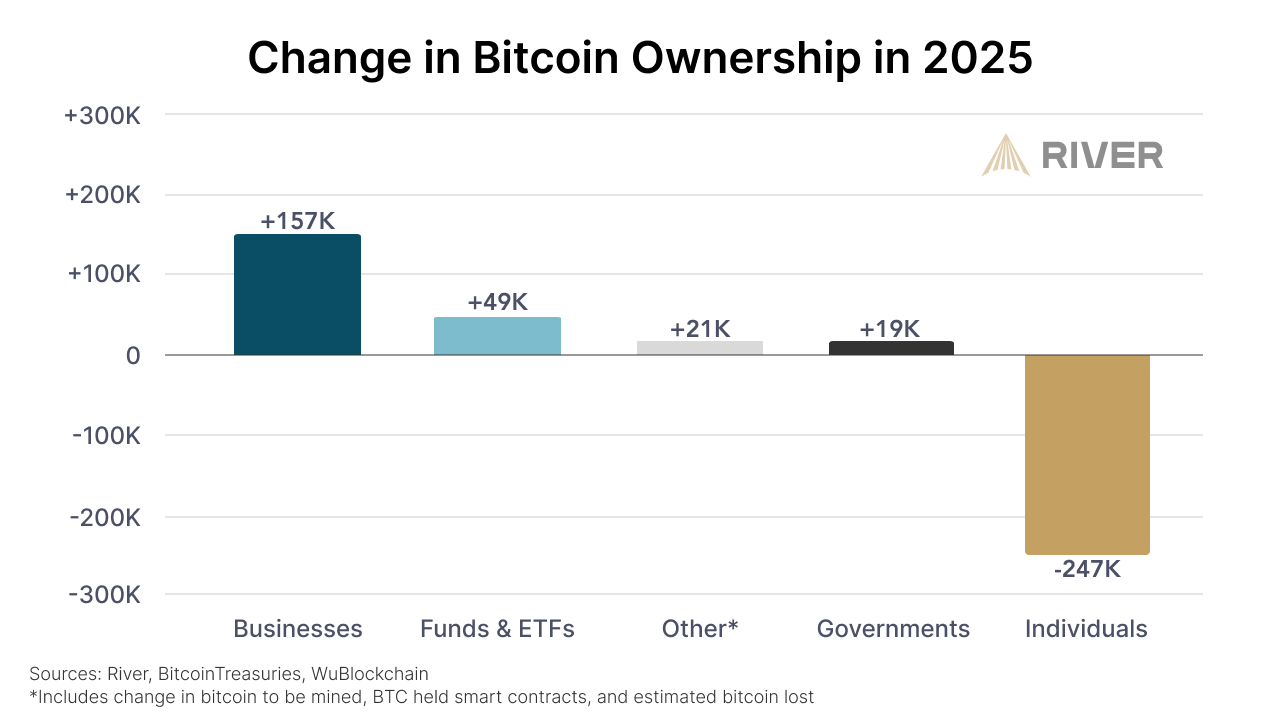

According to the latest research data, corporations and companies have become the largest net buyers of Bitcoin so far this year, surpassing the scale of purchases by exchange-traded funds and retail investors.

According to Bitcoin investment firm River, companies represented by Michael Saylor's Strategy have purchased more Bitcoin this year than any other category of investors, with a total increase of 157,000 Bitcoins held by corporations, valued at approximately $16 billion at current market prices.

Strategy contributed 77% to this group's growth, River reported on May 12 on the X platform. The firm also noted that participants are not limited to large corporations.

The firm stated, "We see companies from various industries registering to use River. They recognize the transformative potential of Bitcoin and its impact on future developments."

River's report shows that the second largest category of buyers after corporations is ETFs, with a net increase of 49,000 Bitcoins, valued at $5 billion. Following closely are governments, with an increase of about 19,000 Bitcoins, while retail traders or individual investors have seen their Bitcoin holdings decrease by 247,000 Bitcoins this year.

According to the firm’s statistics, since 2024, the total amount of Bitcoin held by corporations has increased by 154%. River also conducted a segmented analysis of its own clients by business category.

The data shows that financial and investment institutions are the largest buyers of this asset, accounting for 35.7% of the total, followed by technology companies at 16.8%, and professional consulting firms at 16.5%. The remainder includes real estate, non-profit organizations, consumer and industrial sectors, healthcare, as well as energy, agriculture, and transportation companies.

Recently, there have been several large-scale corporate purchases, with Strategy spending $1.34 billion to acquire an astonishing 13,390 Bitcoins, and Metaplanet adding 1,241 Bitcoins to its asset pool, surpassing El Salvador in holdings as of May 12.

New entrants to the Bitcoin market in 2025 include the video streaming platform Rumble (which made its first purchase in March), the Hong Kong construction company Ming Shing, and the Hong Kong investment firm HK Asia Holdings Limited.

Bitwise reported in April that at least twelve publicly traded companies made their first Bitcoin purchases in the first quarter of 2025. The firm added that the amount of Bitcoin held on the books of publicly traded companies increased by 16% during this period, with over 95,000 Bitcoins added to corporate portfolios.

Analysts believe that the concentrated purchases of this asset by these large corporations will put pressure on the supply-demand relationship, as Bitcoin supply is limited, with miners producing only 450 coins per day.

CryptoQuant CEO and market analyst Ki Young Ju stated that Strategy's accumulation of Bitcoin has outpaced total miner output, resulting in an annual deflation rate of -2.3% for the asset.

At the same time, author Adam Livingston recently pointed out that Strategy is effectively creating a "synthetic halving" effect for Bitcoin by surpassing miner supply through high demand.

Related: Bitcoin (BTC) has a profit-taking point at $106,000 before hitting a new high.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。