Source: Cointelegraph

Original: “Cryptocurrency Assets Go Mainstream: Top Companies Double Down on Bitcoin (BTC) and Solana (SOL), Coinbase Set to Join S&P 500”

After facing numerous doubts such as "bubble," "Ponzi scheme," and "illegal financing," cryptocurrency assets are now moving towards the center stage of mainstream finance at an unprecedented speed. A survey released by Citi Securities Services in 2023 shows that nearly three-quarters of the financial institutions surveyed are actively taking relevant measures, up from 47% in 2022.

This year, a series of recent actions from top financial institutions and publicly listed companies have become the best footnotes to this trend.

On Monday (May 12), the AI-driven real estate platform DeFi Development Corporation, listed on Nasdaq, announced it has purchased an additional 172,670 Solana (SOL) tokens at an average price of $136.81, totaling an investment of $24 million. The company now holds approximately 600,000 SOL tokens, valued at about $102.54 million at current market prices.

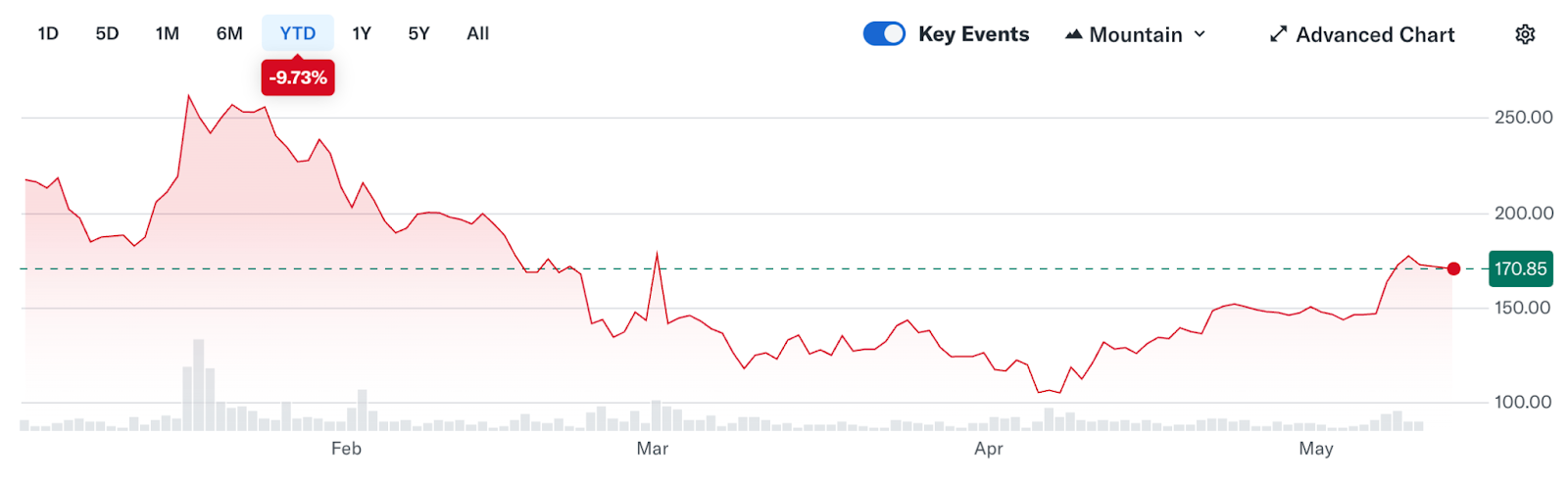

Price trend of SOL tokens this year. Source: Yahoo Finance

The company's CEO, Joseph Onorati, stated in an interview with the media: "Breaking the $100 million holding is an important milestone, but this is just the beginning. Our strategy is to continuously and boldly accumulate assets at the right opportunities, and our goal is to buy as quickly as possible."

Last week, the price of Bitcoin (BTC) once again broke the $100,000 mark, during which Strategy (formerly MicroStrategy) increased its holdings by 13,390 BTC at an average price of $99,856, spending $1.34 billion. Prior to this, Strategy's first-quarter financial report showed that the company recorded a $5.9 billion impairment due to the decline in Bitcoin prices, resulting in a net loss of $4.2 billion, or a loss of $16.49 per share.

Despite this, analysts still give Strategy a "buy" rating and maintain a high target price. For example, Mizuho Securities set a target price of $563 for Strategy, about 40% higher than its current stock price.

Statistics show that more than seven companies in the market have followed Strategy's lead in making Bitcoin a core part of their corporate asset allocation.

Additionally, it is noteworthy that the cryptocurrency platform Coinbase will replace Discover Financial Services in the S&P 500 index on May 19, becoming the first cryptocurrency exchange to be included in this index.

Coinbase's stock performance this year. Source: Google Finance

Last week, Coinbase announced it would acquire the Dubai-based major cryptocurrency derivatives exchange Deribit for $2.9 billion. This transaction is currently the largest acquisition in the cryptocurrency industry and will help Coinbase expand its business footprint outside the United States. Nevertheless, Coinbase's stock price has fallen about 17% this year, underperforming Bitcoin's performance during the same period (which has risen about 10%).

Companies included in the S&P 500 index typically see their stock prices rise, as many funds tracking the index will accordingly include them in their portfolios.

Related: Corporations are the biggest buyers of Bitcoin (BTC) this year, retail investors please stand aside.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。