Cryptographic technology is no longer a toy for niche players.

Written by: Deep Tide TechFlow

Last night, the news that Coinbase's stock would enter the S&P 500 index sparked heated discussions, elevating the status of pure crypto companies in the eyes of traditional capital markets and investors.

However, beyond individual companies, the entire crypto industry and technology still need more recognition.

Also last night, a paper titled "The Evolution of Crypto and Capital Markets" was posted, which quickly garnered 200,000 views and nearly 1,000 likes, rapidly becoming a hot topic of discussion in the English crypto community.

This paper not only received widespread support from the crypto community but also attracted the attention of traditional finance professionals. Haseeb, the founder of Dragonfly, stated that he had printed out the paper to study it, captioning it with LFG (Let's fxxx go).

Beyond the serious academic content, the paper brings more of the U.S. regulatory body's gradual recognition of the "emotional value" of cryptographic technology:

The author of the paper, TuongVy Le, has not yet reached 10,000 followers, and one reason for the high attention is that she was a senior advisor and seasoned lawyer in the SEC's enforcement division, responsible for handling enforcement cases related to the securities market, including the SEC's earliest investigations into cryptocurrencies.

The paper itself discusses that blockchain technology and tokenization can solve the inefficiencies of the traditional securities market. Although cryptographic technology is not perfect, it is still worth using.

The original post pointed out, "Blockchain and tokenization represent the natural evolution of capital markets, just as paper stock certificates were naturally phased out half a century ago."

At the same time, former SEC enforcement experts believe that cryptographic technology is very useful in the securities market. Current SEC commissioner Hester Peirce stated that she is also considering similar issues and suggested using distributed ledger technology to issue, trade, and settle securities.

Some community members jokingly commented that since the SEC is starting to endorse it, how far can the spring of crypto be?

We also read this paper, providing you with another macro-level information reference amidst the noise of market fluctuations.

Experts Write About Crypto

First, let's take a closer look at the background of the paper's author, TuongVy Le.

TuongVy Le not only worked at the SEC for nearly six years but also rose to become the chief legal advisor in the Office of Legislative and Intergovernmental Affairs, directly engaging with "big shots" like the U.S. Congress and the Treasury Department, participating in the formulation of regulatory policies for digital assets.

During the GameStop incident in 2021, where retail investors battled Wall Street, exposing many loopholes in the traditional market, TuongVy Le was at the SEC, assisting in responding to the crisis and strategizing for market structure reform.

After leaving the SEC, she immersed herself in the crypto industry, first serving as a partner at Bain Capital Crypto, focusing on promoting the application of blockchain technology in traditional finance, and briefly working as a legal advisor and compliance officer for the Worldcoin team; she now serves as the General Counsel for Anchorage Digital, helping this first OCC federally chartered crypto company establish a foothold.

With years of financial regulatory experience spanning the regulatory body, traditional finance, and the crypto industry, TuongVy Le may have a more comprehensive background than most crypto practitioners, understanding both the "unwritten rules" of regulation and the "new play" of crypto.

An expert writing a paper calling for the use of cryptographic technology in traditional capital markets benefits the interests of those currently in crypto asset management companies while also using her influence to provide a positive view of cryptographic technology and the industry to more current SEC colleagues.

Overly Complicated Capital Markets

TuongVy's paper does not contain much technical exposition or formulas. A particularly interesting point starts with a cartoon titled "The Self-Operating Napkin."

This cartoon depicts an extremely complex and absurd mechanical device designed to accomplish a very simple task—wiping one's mouth with a napkin. The image is filled with various peculiar parts and actions, such as levers, balls, springs, and even animals, collectively forming a seemingly precise yet ridiculous system.

The satire in this image is very clear, with the core phenomenon being overly complicated. By designing a mechanical system with dozens of steps to complete the simple action of "wiping one's mouth," humans sometimes complicate simple problems.

This is very similar to today's securities trading systems, which involve multiple roles and unnecessary steps in the trading and settlement process. While they seem to collaborate effectively, they are actually heavily criticized.

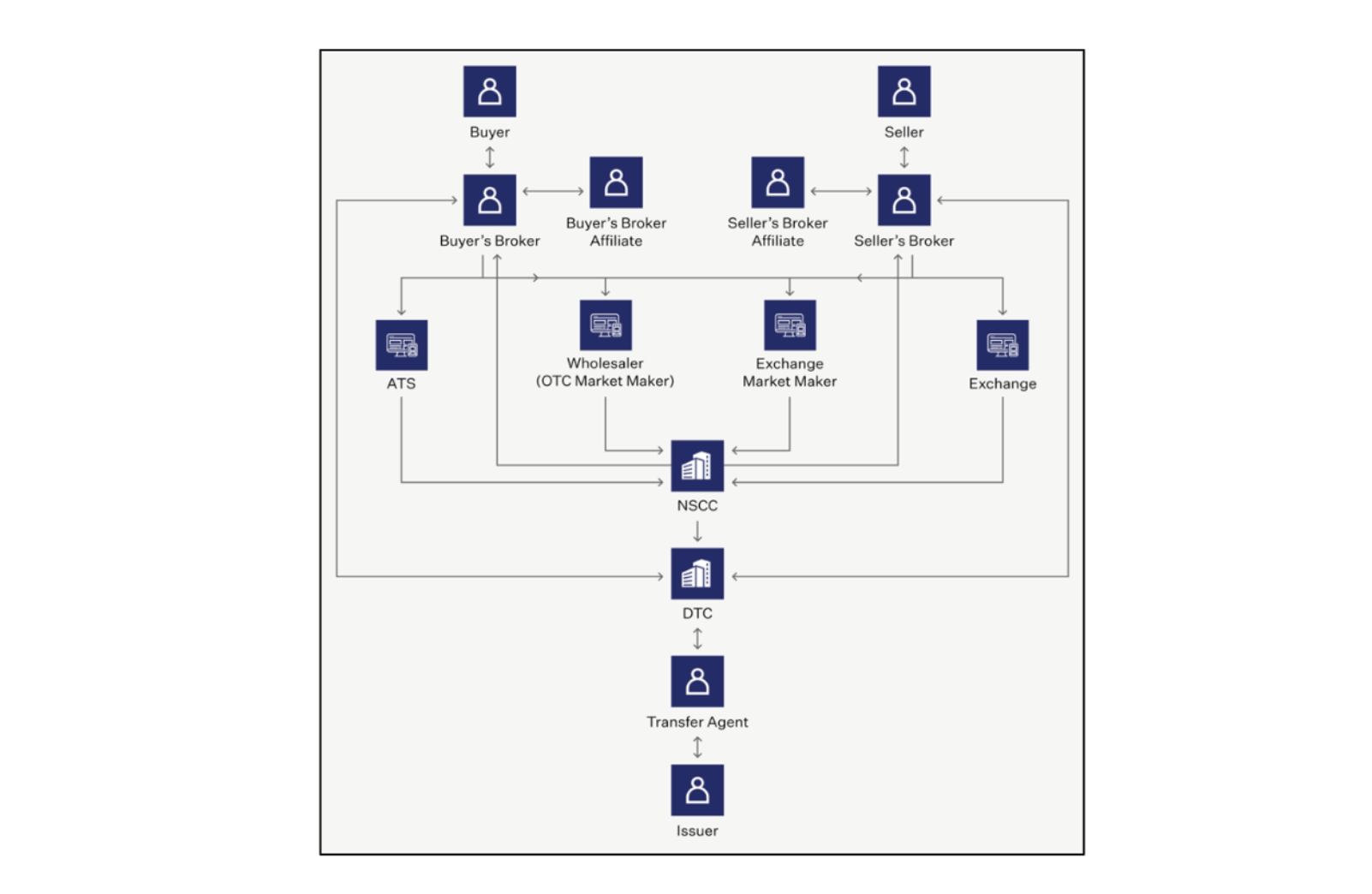

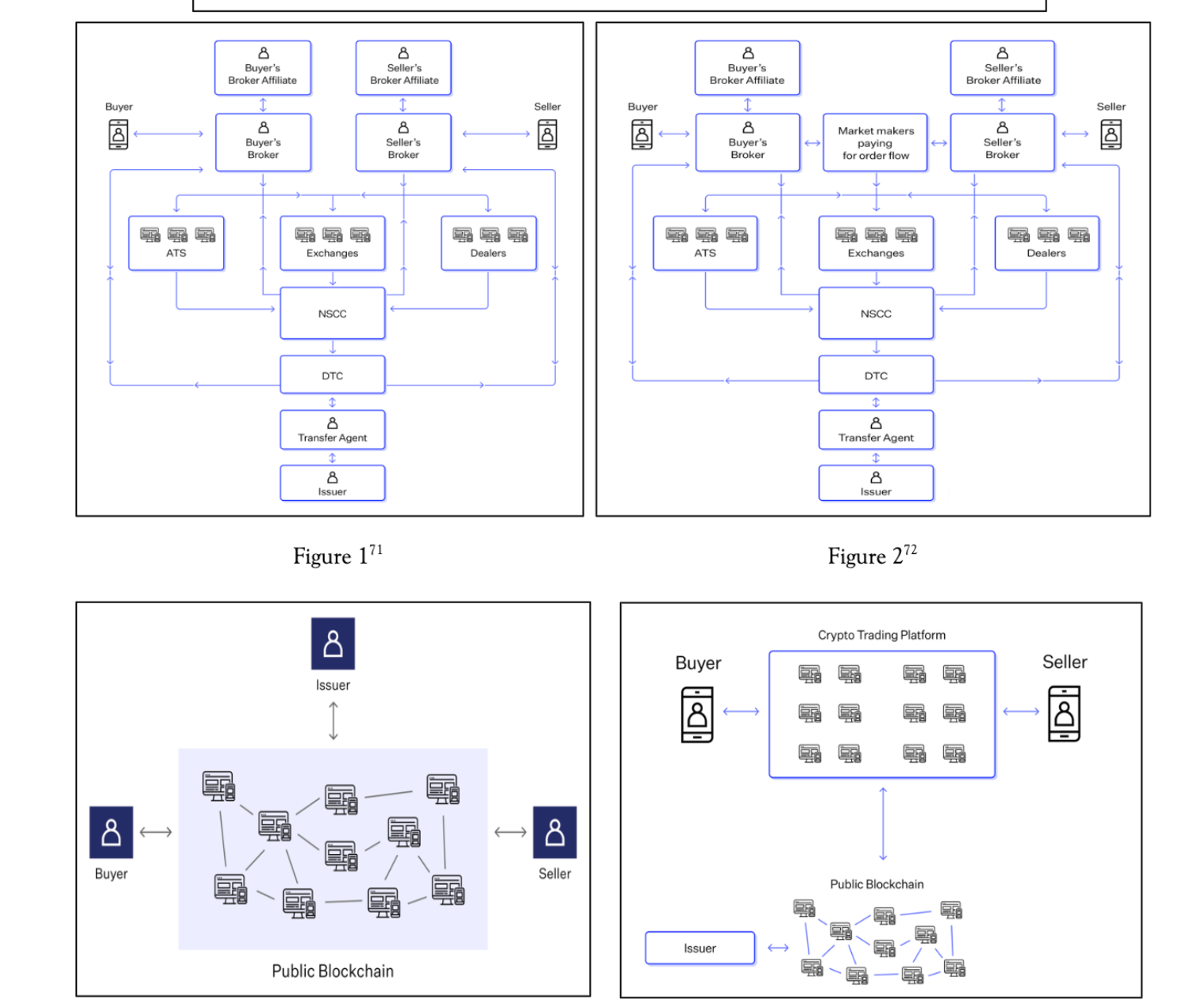

Traditional securities trading involves multiple intermediary steps. Each transaction is not just a simple interaction between buyers and sellers; it also requires brokers, clearing agencies, transfer agents, and other intermediaries. These intermediaries add layers of operational friction and costs to the trading process.

Furthermore, the author points out that the current market structure was designed to address the "paperwork crisis" of the 1960s. At that time, stock trading primarily relied on paper certificates, and this manual processing became unsustainable as trading volumes rapidly increased.

Due to back-office operations being unable to process large volumes of paper certificates in a timely manner, many brokerage firms faced delivery failures and even bankruptcy.

To address this crisis, the market began adopting more complex clearing and settlement systems, introducing more intermediaries and regulations. While this highly intermediated system resolved the crisis at the time, it also brought more complexity and inefficiency.

For example, individual investors must have a broker to trade on the exchange, which increases agency risk, as brokers may engage in excessive trading or recommend unsuitable investments for their own benefit.

Additionally, national securities exchanges and alternative trading systems must adhere to complex rules to prevent trading prices from being worse than quotes from other trading centers, but these rules are difficult to fully implement in practice.

The existence of clearing and transfer agents adds another layer of intermediaries. Clearing agencies act as central counterparties, ensuring the settlement and delivery of transactions. However, this system leads to settlement delays and risks, requiring additional intermediaries to ensure the finality of transactions.

Each step is filled with intermediaries, full of redundancy and inefficiency, but this is actually a policy choice made in an era of insufficient technology.

One thought-provoking point in the author's paper is that if paper stock certificates could be phased out, then the current stock trading system can also be replaced.

CEX, Better than Exchanges?

Although cryptographic technology has its own issues, such as lost private keys or poorly designed smart contract code, the paper's author proposed a very bold idea:

Engaging in P2P trading and using CEX can be better in some ways than traditional securities market trading.

For instance, CEX allows users to access trading platforms directly without going through registered brokers. This reduces agency costs and enables users to have more direct control over order execution;

In CEX, trades are settled immediately upon execution, reducing counterparty risk associated with the T+1 settlement in traditional markets. This also eliminates the need for clearing agents, custodians, or transfer agents; at the same time, CEX supports 24/7 trading, allowing users to respond to market changes at any time, reducing liquidity gaps and price inefficiencies during non-trading hours.

Moreover, users can withdraw their crypto assets to self-custody wallets at any time, having direct ownership of their assets. This contrasts with the indirect ownership of securities in traditional markets.

These features make CEX superior to traditional securities markets in terms of efficiency, flexibility, and user control. However, the author also points out that CEX has its own problems, such as custodial theft and attacks, insider trading, and lack of regulations.

The author's paper is also very straightforward, essentially advocating for the use of technology to replace excessive intermediary steps. However, it does have a somewhat "never thought I'd see this" flavor, as a former SEC enforcement expert not only does not exhibit a high-pressure and exclusionary attitude towards cryptographic technology but instead guides the construction of the securities market by taking its essence.

Although the paper does not address attitudes towards crypto assets, the publication and dissemination of such a paper itself is a positive signal, making it easier to attract more current regulators to examine and embrace cryptographic technology rather than viewing it entirely as a threat.

However, I believe the points made in the article do bring a long-lost sense of certainty:

Cryptographic technology is no longer a toy for niche players but has a real opportunity to break through and become the "new engine" of traditional financial markets.

The good days for the industry are still ahead, and I hope you can also reap the benefits.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。