The current capital market is experiencing a triple variation of "dollar decoupling - gold soaring - Bitcoin awakening."

Written by: Musol

As I read "Love, Death, and Bitcoin," which folds three hundred years of monetary history into a grand narrative, I glanced at the curve on my phone showing the resonance and rise of gold and Bitcoin, and I momentarily saw the floating remnants of currency in the long river of history—the tulip bubble of the Dutch guilder has not yet dissipated, the echoes of the British pound's naval cannons still linger, and the stars and stripes of the dollar are fading in the torrent of data.

This reminded me of Braudel's insight in "The Mediterranean and the Mediterranean World in the Age of Philip II": the twilight of every hegemonic currency is a metaphor for the entropy of civilization. At this moment, gold awakens in central bank vaults, Bitcoin whispers in the computational matrix, and the dollar hovers on the edge of a debt cliff. The temporal folds formed by the three conceal a capital fable deeper than Keynes's "animal spirits."

Late at night, after rereading William Engdahl's account of the secret history of banking families, I suddenly realized that the shadows cast by the thirteen stone pillars at the founding of the Federal Reserve in 1913 have, a century later, extended into the ETF matrix of the Vanguard Group and BlackRock's Bitcoin spot fund. This fateful cycle resembles Spengler's depiction of the seasonal changes of civilization in "The Decline of the West"—when gold flows from the dictator's chamber in South Africa to the London vaults, when the dollar climbs to the throne of petrodollars from the ruins of Bretton Woods, and when Bitcoin transforms from Satoshi Nakamoto's cryptographic puzzle into "digital gold" in institutional holdings reports, humanity's pursuit of absolute value continues to resonate between the heavy curtain of power and the fissures of freedom.

Let me throw a stone to attract a jade, and with my own experiences and humble opinions, using the remnants of financial history as a torch, I will attempt to illuminate this eternal theater of the collapse and reconstruction of the monetary Babel:

Pt.1. Hegemonic Metamorphosis: From Gold Anchor Chains to the Evolution of Petro-Kingdoms

Tracing back to Hamilton's central bank concept in 1790 and the secret birth of the Federal Reserve in 1913, the gene of dollar hegemony has always been inscribed with the capital will of the "giants of the steel age." The establishment of the Bretton Woods system elevated the dollar to the altar, just as Keynes warned that the "golden shackles" ultimately became the sacrifice of the Triffin dilemma—Nixon's "Sunday of Default" in 1971 announced the end of the gold standard but gave rise to a new order of petrodollars.

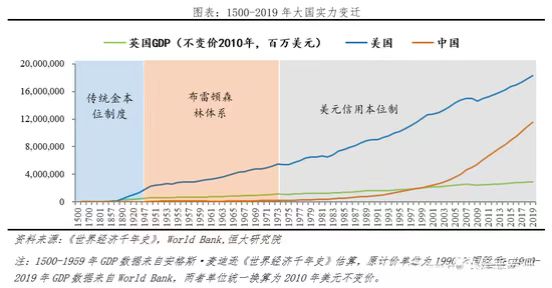

This process mirrors Braudel's depiction of hegemonic transitions in "Material Civilization, Economy, and Capitalism from the 15th to the 18th Century": Dutch financial hegemony yielded to British industrial hegemony, ultimately culminating in the U.S. petro-military complex. The technological prosperity of the Clinton era and Greenspan's loose policies pushed dollar hegemony to its peak but also laid the groundwork for the 2008 subprime crisis, as revealed by Soros's reflexivity theory:

Prosperity itself breeds the seeds of destruction.

Pt.2. The Millennium Paradox: From Barbaric Relics to Signs of Collapse

From the gold coins of the Roman Empire to the anchor of Bretton Woods, gold has always played the role of "Noah's Ark in times of crisis." The price surge triggered by the dollar's decoupling from gold in 1971 (from $35 to $850 per ounce) was essentially an emergency response to the collapse of the fiat currency credit system, confirming Keynes's assertion that "gold is the last bastion and reserve in times of urgent need."

The initial suppression followed by the rise of gold during the 2008 financial crisis exposed the fundamental contradictions of the modern financial system: when liquidity black holes consume all assets, only gold can transcend monetary illusions and become the "ultimate settlement tool." Today, Trump's tariff cannon and debt snowball (with $36 trillion in national debt and a GDP ratio of 124%) are replaying historical scripts, while global central banks' gold purchases exceeding a thousand tons for three consecutive years echo Mundell's "impossible trinity" in the digital age—the triangular support of sovereign credit currencies (exchange rate stability, free capital movement, independent monetary policy) is collapsing, and gold is once again becoming the ultimate choice of "stateless currency."

Pt.3. Three Shadows: From Obsidian Cocoon to Gilded Metamorphosis

The blockchain spark sown by Satoshi Nakamoto in the ashes of the 2008 financial crisis has undergone three phases of value discovery:

The dark web payment tool of 2013, the ICO frenzy vehicle of 2017, and the institutional asset allocation of 2020 ultimately culminated in the ultimate transformation of "digital gold" during the global credit crisis of 2025. This evolutionary trajectory aligns with Schumpeter's theory of "creative destruction"—the collapse of the old system clears ecological niches for new species. BlackRock CEO Larry Fink's declaration that "Bitcoin is the international version of gold," along with MicroStrategy's radical strategy of holding 500,000 BTC, marks the formal coronation of traditional capital's recognition of Bitcoin's value storage attributes. Meanwhile, the Trump administration's executive order to include Bitcoin in strategic reserves recreates the historical mirror of Nixon's shock in 1971:

When the foundation of fiat currency credit is shaken, decentralized assets become candidates for the new order.

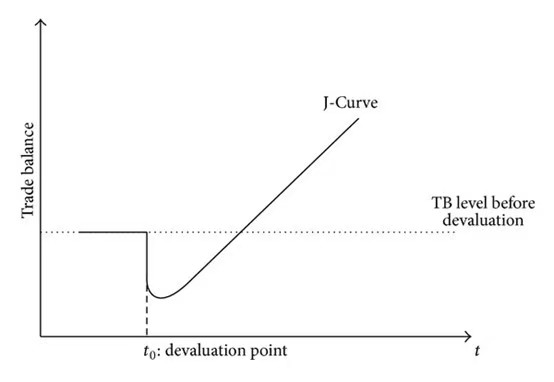

Pt.4. J-Curve Sanctification: The Birth Pains of Paradigm Rebirth

The current capital market is experiencing a triple variation of "dollar decoupling - gold soaring - Bitcoin awakening," and the essence of this structural transformation is the generational replacement of monetary paradigms. As economic historian Kindelberger pointed out in "A Financial History of Western Europe": changes in the monetary system often lag behind technological revolutions by 50-100 years.

Bitcoin is currently facing the J-Curve dilemma—short-term constraints from the valuation logic of tech stocks, long-term benefits from the consensus of digital gold—reminiscent of the dormant period before gold broke free from the gold standard's shackles in the 1970s. Viewed through the lens of Kondratieff's long wave theory, we stand at the historical intersection of the sixth wave of technological revolution (digital civilization) and the reconstruction of monetary order, where Bitcoin may play the role of gold in the 19th century during the industrial revolution:

Both the grave digger of the old system and the stepping stone of the new civilization.

Looking back over three hundred years of monetary history, from Hamilton's central bank blueprint to Satoshi Nakamoto's cryptographic utopia, humanity's pursuit of value storage has always oscillated between centralized power and decentralization. The twilight of dollar hegemony, the re-coronation of gold, and the wild growth of Bitcoin together form the monetary trio of this era.

As Marx said: "Money is not a thing, but a social relationship," when the trust bonds of globalization show cracks, the rise of digital currency may herald the realistic projection of Hayek's ideal of "denationalization of money." In this era full of uncertainty, the only certainty is that the evolution of monetary forms will never cease, and we are all witnesses and authors of this millennial monetary epic.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。