Original Title: "Ethereum Soars 50% in a Week, Aiming for $3000, Bitcoin ETF Attracts $41 Billion Igniting Bull Market"

Original Author: Lawrence, Mars Finance

Market Overview: Ethereum Leads, Crypto Assets Surge Across the Board

In the past 24 hours, the cryptocurrency market has entered a new round of frenzy. Ethereum (ETH) has strongly broken through the $2700 mark, reaching a high of $2725, with a daily increase of 8% and a cumulative increase of over 50% in the past 7 days, marking its best weekly performance since 2022.

Bitcoin (BTC) has also risen to $104,200, with a 24-hour increase of 1.5%, firmly staying above $100,000; Solana (SOL) has risen over 5% to $185, while meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) have followed suit with increases of 4%-5%. This surge is driven by record inflows into Bitcoin ETFs, Ethereum's technical upgrades, and a shift in the macroeconomic landscape, pushing the crypto market into a new phase of "institutional bull."

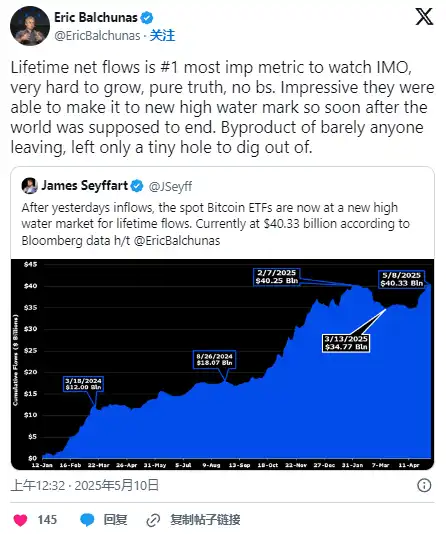

Bitcoin ETF: Attracting Over $41 Billion Against the Trend, Becoming the Core Channel for Institutional Entry

1. Historic Breakthrough: Record Inflows

As of May 13, the cumulative net inflow into U.S. Bitcoin spot ETFs has reached $41.1 billion, surpassing the peak of February 2024 and setting a new historical record. This data indicates that since its approval for listing in January, the demand for Bitcoin allocation from traditional financial institutions has continued to heat up, even during the market correction in April, funds have still flowed in steadily.

2. Policy and Market Sentiment Resonance

The "Stablecoin Regulatory Act" promoted by the Trump administration at the beginning of the year and the SEC chairman's nomination of pro-crypto individuals have cleared policy obstacles for ETFs. Although there was a brief outflow of funds (a cumulative outflow of $5 billion) due to concerns over the global trade war in March-April, with the U.S.-U.K. tariff agreement reached and U.S.-China trade negotiations resumed, risk appetite has rebounded, leading to a surge in ETF inflows to $882 million in a single week in May, accelerating institutional "bottom fishing."

3. Analyst Views: Long-term Confidence Indicators

Bloomberg ETF analyst Eric Balchunas pointed out: "Net inflows are the most genuine confidence indicator; even at the peak of the Trump tariff panic, funds quickly flowed back, proving that Bitcoin's 'digital gold' narrative has gained mainstream recognition." ETF.com analyst Sumit Roy added that ETFs have lowered the participation threshold for retail and institutional investors, becoming a core driving force for Bitcoin to break through $100,000.

Ethereum's Surge: Technical Upgrades + Short Squeeze + Whale Accumulation as Triple Engines

1. Pectra Upgrade Implementation, Strengthening Technical Barriers

On May 7, Ethereum successfully implemented the Pectra upgrade, introducing key technologies such as account abstraction (EIP-7702) and increasing staking limits, significantly reducing gas fees and enhancing network flexibility. This upgrade is seen as a key measure to combat competing public chains like Solana, directly stimulating developer and investor confidence.

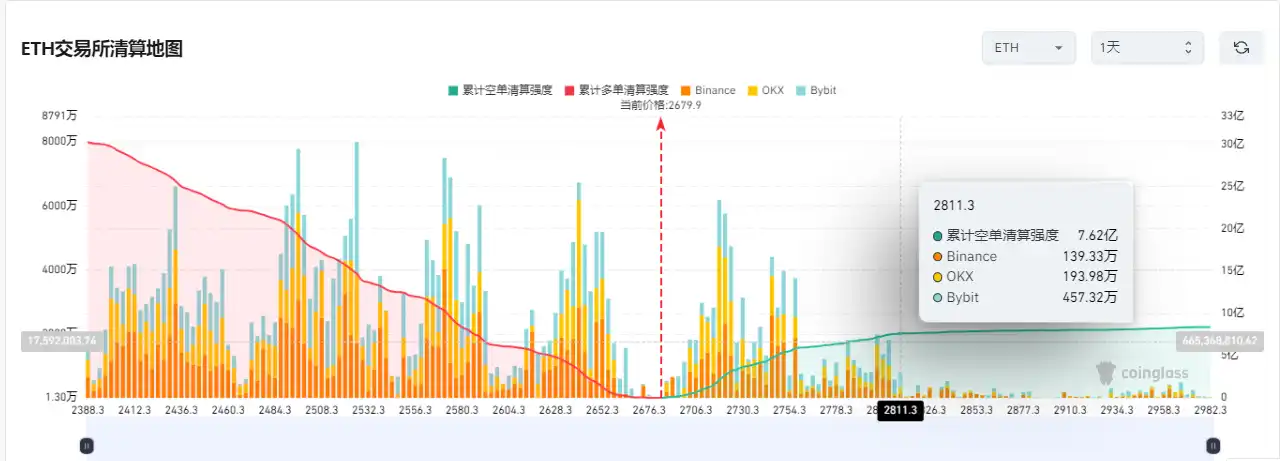

2. Futures Market "Short Squeeze" Ignites Short-term Rally

Starting from May 8, a large-scale liquidation of short positions occurred in the Ethereum futures market, with a cumulative liquidation amount reaching $438 million, far exceeding the long position liquidation amount ($211 million). The price surge forced shorts to cover their positions, creating an upward spiral. During the same period, Ethereum's open interest surged by 25% ($21.28 billion → $26.77 billion), and the perpetual contract funding rate rose to 0.15%, indicating that bulls dominate the market.

3. Strategic Accumulation by Whales

On-chain data shows that "whales" holding over 10,000 ETH have been continuously accumulating since late April, with their holdings reaching the highest level since March 2025 (over 40.75 million ETH). Whale movements typically indicate large investors' recognition of mid-to-long-term value, further solidifying bullish market expectations.

Macro Drivers: Cooling Inflation and Trade Easing Boost Risk Assets

1. Rising Expectations for Fed Rate Cuts

In April, the U.S. CPI year-on-year increase was 2.3% (previous value 2.8%), close to the Fed's 2% target, with core CPI only increasing by 0.2% month-on-month, below expectations. After the data was released, the market's bets on the probability of a rate cut in September rose to 48.9%, and expectations for liquidity easing stimulated funds to flow into the crypto market.

2. Easing Global Trade Tensions

On May 8, the U.S. and U.K. reached a tariff agreement, reducing tariffs on British car exports to the U.S. from 27.5% to 10%, and eliminating steel tariffs; U.S.-China trade negotiations resumed, weakening the risks of a "tariff war." The dismantling of trade barriers creates a favorable environment for risk assets like cryptocurrencies.

3. Traditional Financial Market Correlation

The Nasdaq and S&P 500 indices rose by 1.6% and 0.7%, respectively, with tech stocks and crypto assets strengthening in tandem. Amberdata's derivatives head Greg Magadini pointed out: "ETH's correlation with U.S. stocks has increased; if risk assets continue to rebound, Ethereum is likely to break through the $2800 resistance level."

Market Concerns: High Volatility and Technical Risks

1. Options Market Hides Correction Signals

Despite the surge in spot prices, Ethereum's options implied volatility remains low, indicating that the market is unprepared for a short-term surge. Deribit data shows that $2800 is a key gamma resistance level; if it cannot be effectively broken, profit-taking may occur.

2. Divergence in Institutional Funds

The capital attraction of Bitcoin ETFs far exceeds that of other assets (with Ethereum ETFs seeing only $1.5 million in weekly inflows), and competing public chains like Solana and Sui are diverting funds (with Sui seeing $84 million in YTD inflows), which may exacerbate market volatility.

3. Regulatory and Geopolitical Variables

Trump's "digital gold strategy" still carries uncertainties, and the SEC's review of Ethereum's security attributes has not concluded. If there is a sudden shift in policy direction, the market may face severe adjustments.

Conclusion: The Second Half of the Bull Market Begins, Seeking Structural Opportunities Amid Volatility

This round of crypto market surges is both a milestone in the institutionalization process of Bitcoin ETFs and a result of the resonance between Ethereum's technical ecosystem and macro benefits. In the short term, the market needs to digest the gains and focus on the key resistance at $2800; in the medium to long term, institutional fund entry, technical upgrades, and the rate cut cycle may jointly support the continuation of the bull market. Investors should pay attention to ETH/BTC dynamics, spot ETF developments, the Fed's policy path, and Layer 2 ecosystem progress, seizing structural opportunities amid volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。