🧐 Analysis of the Potential Impact of the SEC Investigation into Coinbase's User Count Inflation and Data Breach Incident on the Cryptocurrency Market:

Coinbase faced a double blow yesterday:

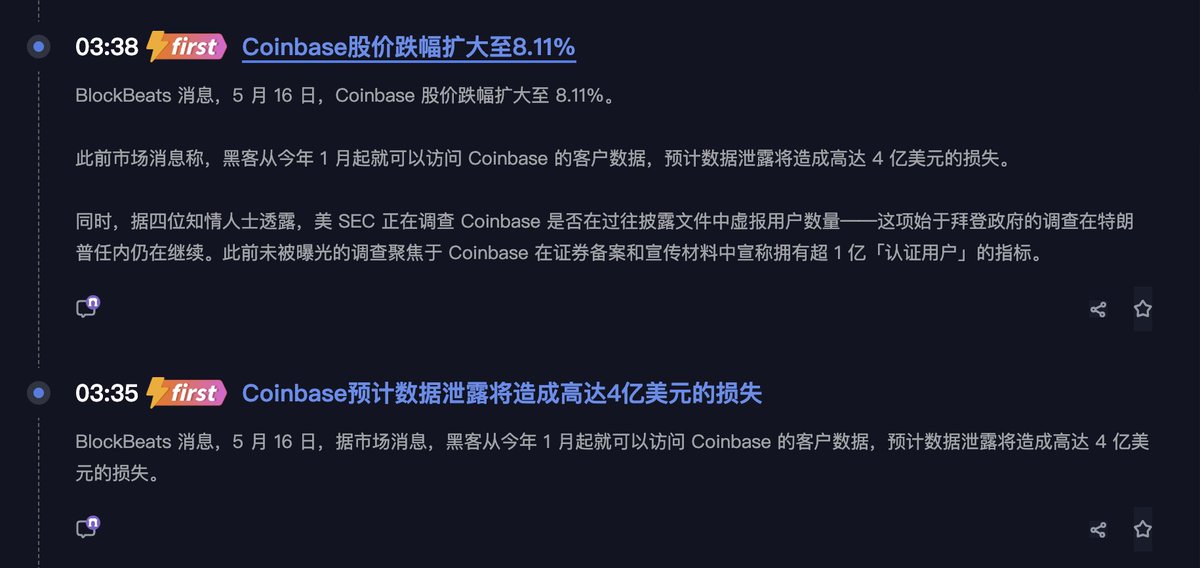

On one hand, the SEC questioned the authenticity of its user count, while on the other, outsourced customer service leaked user data, potentially resulting in a loss of $400 million.

You might think this doesn't concern you, but in reality, the implications for the entire industry are far from simple.

🧵 Let me elaborate on my views regarding this dual crisis at Coinbase:

1️⃣ Incident 1: What is the SEC investigating?

The SEC is focusing on the "verified user" data disclosed by Coinbase, questioning whether it exaggerated the user count (claiming over 100 million).

The issue is that many of these may just be "zombie accounts" that registered an email but never actually traded.

Coinbase's response is also quite familiar:

"This is an old issue from a previous administration; we no longer use this metric. We now disclose 'monthly active trading users.'"

However, the SEC is not investigating what you currently use, but whether you misled investors in the past—this blame is not easily shed.

✅ Opinion:

While this may not necessarily lead to substantial fines, it will create a slight crack in the trust regarding exchanges' "disclosure compliance."

Investigation Focus: The SEC is investigating whether Coinbase inflated the number of "verified users" in historical disclosure documents (previously claiming over 100 million users). This metric includes accounts that only verified an email/phone number but did not actively trade, potentially misleading investors about the actual user base.

Coinbase's Response: The company's Chief Legal Officer stated that this investigation is a "leftover issue from the previous administration," and the relevant metric has not been used for 2.5 years, having shifted to disclosing "monthly trading users" and other more relevant data. However, the ongoing SEC investigation may raise market concerns about exchange transparency.

2️⃣ Incident 2: Impact of the Data Breach:

Data Breach Incident: More frightening than "hackers" is "people."

This time, it wasn't a system breach, but rather the outsourced customer service team was compromised.

Hackers bribed overseas employees to obtain sensitive information such as names, addresses, and ID numbers of some monthly active users.

⚠️ Although private keys were not leaked, for high-net-worth users, having KYC information in the wrong hands is more dangerous than losing coins—because it could lead to real personal threats.

Coinbase estimates losses between $180 million and $400 million, with the stock price dropping 7.2% on the day.

3️⃣ Potential Impact on the Cryptocurrency Market

Short-term Emotional Shock: Coinbase's stock price fell!

According to Twitter sentiment provided by SoSoValue @SoSoValueCrypto, users generally expressed doubts about the security of centralized exchanges (e.g., "KYC data leaks could pose physical security risks").

Some investors may turn to decentralized platforms (with Hyperliquid mentioned as an alternative).

Long-term Regulatory Pressure: Unlikely to transmit to the market!

If the SEC investigation confirms the inflation of user counts, it may strengthen regulatory standards for disclosures by crypto companies, potentially affecting compliance costs for other exchanges.

However, Coinbase's history indicates (e.g., the SEC lawsuit was withdrawn in 2023) that legal risks do not necessarily translate directly to Bitcoin prices.

4️⃣ Correlation of Bitcoin and Market Indicators:

1) Bitcoin Spot ETF Fund Flows:

According to SoSoValue's chart data, recent weekly net inflows into Bitcoin ETFs have remained stable (Total Bitcoin Spot ETF Net Inflow), showing no significant outflows due to the Coinbase incident.

2) Bitcoin Fundamentals: The current hash rate and price remain high, indicating that network security has not been directly affected by the incident.

5️⃣ Conclusion:

Localized Impact: The Coinbase incident may suppress the performance of exchange-related tokens (like COIN) and temporarily weaken market confidence, but Bitcoin, as an independent asset, has not shown signs of on-chain or funding deterioration.

Industry Warning: The incident highlights the weaknesses of centralized entities in data protection and compliance disclosure, potentially accelerating the industry's shift towards non-custodial solutions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。