1. Market Observation

Keywords: NXPC, ETH, BTC

For the week of May 10, the number of initial jobless claims remained at 229,000, in line with market expectations. Meanwhile, the Producer Price Index (PPI) for April unexpectedly declined, and retail sales showed stagnation. Following the release of this data, market expectations for two interest rate cuts by the Federal Reserve before the end of 2025 have increased, leading to a slight decline in the dollar index and a short-term rise in U.S. stock futures. Andrew Tyler, head of the market division at JPMorgan, stated that the core elements of the current bull market remain intact, including the resilience of macro data, improvement in corporate earnings, and easing trade conditions. He believes that despite increased risks of a pullback, the S&P 500 index could reach a historical high of 6,144 points this quarter. Regarding the 10-year U.S. Treasury yield surpassing 4.5%, Tyler views this as not entirely negative and points out that the stock market typically needs 1-2 months to digest high yields. JPMorgan has raised its forecast for the 10-year Treasury yield at the end of 2025 from 4% to 4.35%, primarily based on higher real GDP growth expectations and lower inflation expectations. Additionally, Federal Reserve Chairman Powell mentioned in the latest meeting that the Fed is adjusting its monetary policy framework to respond to significant changes in the post-pandemic inflation and interest rate environment. He noted that the previously established policy framework is no longer applicable to the current environment and warned of potentially more frequent and persistent supply shocks in the future, posing serious challenges to the economy and the central bank.

Bitcoin has oscillated around the current price for a week, with trading volume remaining sluggish. Analyst FilbFilb maintains an optimistic outlook, believing that the trend is extremely bullish, although it may dip below $100,000 in the short term, the overall trend favors the bulls. The market generally expects Bitcoin to challenge its historical high of $110,000 and possibly reach between $120,000 and $150,000 in June. He also pointed out that ETH/BTC needs to rise to the key level of 0.03 to drive a recovery in the altcoin market. JPMorgan analysts predict that Bitcoin may continue to outperform gold in the second half of 2025. Arthur Hayes is even more aggressive, predicting that foreign capital inflow and massive depreciation of U.S. Treasuries will drive Bitcoin to $1 million before 2028, although there may be tactical shorting opportunities in the short term.

As MicroStrategy continues to increase its Bitcoin holdings, institutional investors view MicroStrategy stock as an effective vehicle for indirect exposure to Bitcoin. Institutions such as California pension funds and the Saudi Central Bank are increasing their holdings of related assets, while Wall Street's well-known short seller Jim Chanos has adopted a strategy of being bullish on Bitcoin while shorting MicroStrategy. Additionally, Brazilian listed company Méliuz, Japanese listed company Remixpoint, and cross-border e-commerce DDC Enterprise are also actively increasing their Bitcoin holdings. 10x Research points out that the recent rise in Bitcoin is mainly driven by institutional accumulation rather than retail speculation, and as long as the price remains above $101,000, the long-term bullish trend will continue. Matrixport's analysis also shows that the current rise in Bitcoin is primarily driven by institutional and corporate buyers, with retail participation still low. Historical experience indicates that retail funds often concentrate in the later stages of the market, becoming the final push before a local top.

With Ethereum briefly surging and then retreating, the altcoin market is facing a significant correction. The Believe ecosystem token LAUNCHCOIN has seen a decline after nearly a week of increases, with its market cap now down to $200 million. Leading projects GOONC and YAPPER have dropped 69% and 52%, respectively. In the past 24 hours, the new project $WATCHCOIN, as the first "watch-to-earn" application, plummeted upon opening, with its market cap falling to $17 million. Despite raising over $8 million SOL through presales, concerns have arisen due to the founder's historical controversies and the risk of oversupply. Notably, a former FBI director's Instagram post featuring a shell mosaic spelling "8647" has sparked widespread discussion, but the related on-chain 8647 token currently has a market cap of only about $600,000.

2. Key Data (as of May 16, 12:00 HKT)

(Data Source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $103,957 (YTD +11.19%), daily spot trading volume $33.867 billion

Ethereum: $2,576.41 (YTD -22.44%), daily spot trading volume $25.421 billion

Fear and Greed Index: 69 (Greed)

Average GAS: BTC 0.6 sat/vB, ETH 0.88 Gwei

Market Share: BTC 62.1%, ETH 9.4%

Upbit 24-hour Trading Volume Ranking: XRP, NXPC, BTC, ETH, DOGE

24-hour BTC Long/Short Ratio: 1.0141

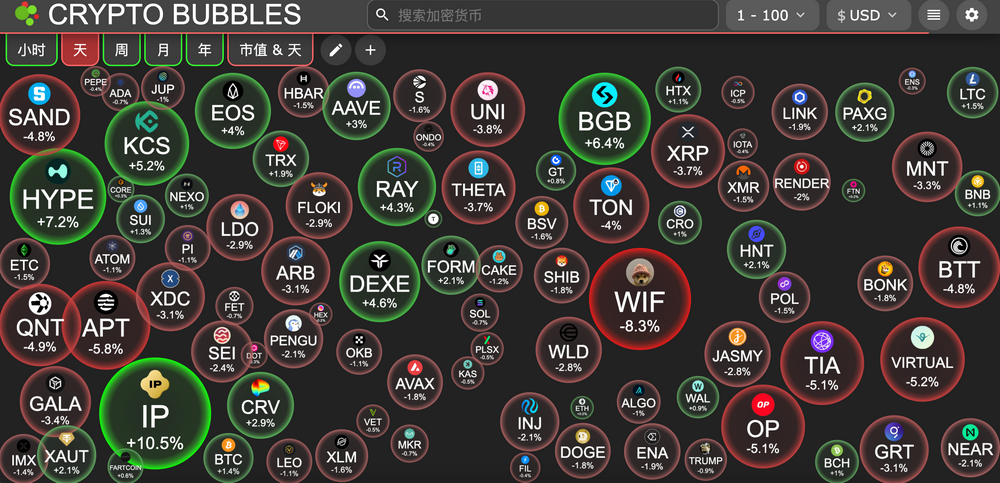

Sector Performance: The crypto market saw a general decline, with the SocialFi sector down 3.49% and the GameFi sector up 2.45%

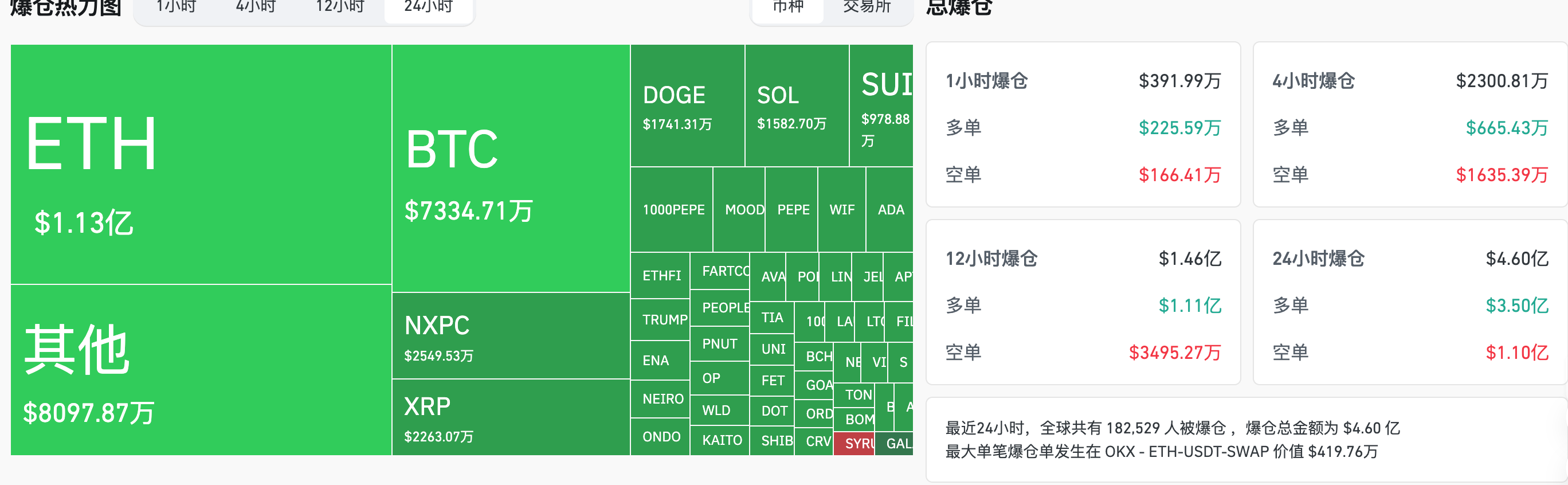

24-hour Liquidation Data: A total of 182,529 people were liquidated globally, with a total liquidation amount of $460 million, including $73.347 million in BTC, $113 million in ETH, and $25.495 million in NXPC.

BTC Medium to Long-term Trend Channel: Upper line ($102,098.66), lower line ($100,076.91)

ETH Medium to Long-term Trend Channel: Upper line ($2,351.39), lower line ($2,304.82)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of May 15)

Bitcoin ETF: +$115 million

Ethereum ETF: -$39.7859 million

4. Today's Outlook

Solayer will conduct its second quarter token unlock, 100% for ecosystem incentives and growth

Decentralized computing network Acurast will launch token sales on CoinList

Terra: Deadline for submitting loss claims to the Terraform liquidation trust fund is May 17

Resolv: Registration for the RESOLV token genesis event ends on May 17

Arbitrum (ARB) will unlock approximately 92.65 million tokens on May 16, accounting for 1.95% of the current circulation, valued at about $42.7 million.

Immutable (IMX) will unlock approximately 24.52 million tokens on May 16, accounting for 1.35% of the current circulation, valued at about $17.9 million.

ApeCoin (APE) will unlock approximately 15.6 million tokens on May 17, accounting for 1.95% of the current circulation, valued at about $10.3 million.

Avalanche (AVAX) will unlock approximately 1.67 million tokens on May 17, accounting for 0.4% of the current circulation, valued at about $41.3 million.

Melania Meme (MELANIA) will unlock approximately 26.25 million tokens on May 18, accounting for 6.63% of the current circulation, valued at about $10.4 million.

Today's Top 500 Market Cap Gainers: NXPC up 80.26%, MASK up 14.91%, XCN up 14.43%, PRIME up 14.35%, MERL up 13.85%.

5. Hot News

Wintermute received 10 million MIRAI seven hours ago, approximately $105,000

U.S. lawmakers will hold a final vote on the stablecoin GENIUS bill on May 19

FTX will begin distributing over $5 billion to creditors on May 30 according to its bankruptcy plan

0x acquires competitor Flood, striving to expand its market share in the DEX aggregator space

Movement Labs is reported to have privately committed up to 10% of token allocations to advisors

The number of initial jobless claims in the U.S. for the week ending May 10 is 229,000, as expected

Hong Kong family office Avenir Group holds $691 million worth of BlackRock Bitcoin ETF

Ukraine plans to launch a strategic Bitcoin reserve under the new cryptocurrency law

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。