Recently, the Sa Jie team has been receiving a large number of inquiries about RWA projects, with underlying assets being quite diverse, including agricultural products, real estate, precious metals, and even some purely conceptual projects that sound quite fantastical…

In fact, the Sa Jie team has already made it clear in previous articles that under the premise that the announcements on September 4 and September 24 in our country remain effective, except for RWA projects that have undergone strict review through the Hong Kong Ensemble sandbox and are issued under regulation, which possess a certain "criminal risk resistance capability," other types of RWA are very dangerous (especially those issued to residents of mainland China).

Therefore, today the Sa Jie team will clarify which mainland assets can be used in the Hong Kong sandbox and which cannot, so that partners can conduct business more efficiently and save on consultation fees.

01 Basic Understanding: Restrictions and Judging Criteria for Mainland Assets in RWA

First, it is clear that assets physically located in mainland China and primarily operating for mainland residents can be used for RWA. Several successful RWA projects in the past have already proven this point.

However, there are indeed restrictions for assets located in mainland China wishing to issue RWA in Hong Kong. Based on the practical experience of the Sa Jie team, the following three types of assets cannot be used for RWA:

- Assets that do not comply with the legal regulations of Hong Kong;

- Assets that do not comply with the legal regulations of mainland China;

- Assets that are currently not suitable for issuance in Hong Kong.

Mainland Assets Issuing RWA in Hong Kong Must Comply with the "Dual Compliance Principle"

This logic is quite understandable. The assets are located in mainland China, but the tokenized assets are actually sold and operated in Hong Kong. The entire financing chain spans both mainland China and Hong Kong, so it naturally needs to comply with the "dual compliance principle"—the underlying assets must be compliant in both mainland China and Hong Kong.

1. Hong Kong Regulatory Aspects

Since Hong Kong is primarily responsible for the tokenization and financial operation of assets in RWA projects, we need to pay special attention to the legal regulations related to financial supervision regarding the requirements for underlying assets when issuing financial products, such as the "Securities and Futures Ordinance," "Banking Ordinance," "Insurance Ordinance," and "Anti-Money Laundering and Terrorist Financing Ordinance."

The Sa Jie team has previously mentioned that currently, there are no clear normative legal documents regarding the issuance and regulation of RWA in Hong Kong, and it is still in the exploratory stage. Therefore, there remains a "one project, one discussion" situation during the review process of RWA projects in the sandbox. However, the absence of clear normative legal documents does not mean that everyone has to feel their way across the river; understanding the consistent regulatory principles for financial assets in Hong Kong and referring to the specific issuance rules for similar financial products can greatly improve the success rate.

In principle, Hong Kong has consistently adopted the "substantive regulatory principle" (also known as "look-through regulation") for financial assets, which means that compliance is determined by the substance of the asset rather than its appearance. It is not feasible to cover an illegal core with a compliant exterior. Specifically, the judgment needs to be based on the regulatory rules applicable to the physical assets corresponding to the RWA. For example, if the underlying asset is a bond, then the review standards for the underlying asset would be governed by Hong Kong's "Securities and Futures Ordinance" and related normative documents.

2. Mainland Regulatory Aspects

Since the tokenized underlying asset is physically located in mainland China, it is essential to focus on the legality of the underlying asset itself and the legality of its operational methods, which need to be viewed from two aspects.

Regarding the legality of the underlying asset itself, according to China's "Civil Code" and related judicial interpretations and practical experiences, assets can be classified into three categories based on their circulation ability:

- Circulating assets

- Restricted circulation assets

- Prohibited circulation assets

Circulating assets refer to those that are legally allowed to circulate freely among civil subjects; restricted circulation assets refer to those that have certain limitations on their circulation scope and degree; prohibited circulation assets refer to those that are explicitly prohibited from circulation and transfer by law. The Sa Jie team believes that assets used for RWA should be "circulating assets" or "restricted circulation assets" that are permitted to circulate.

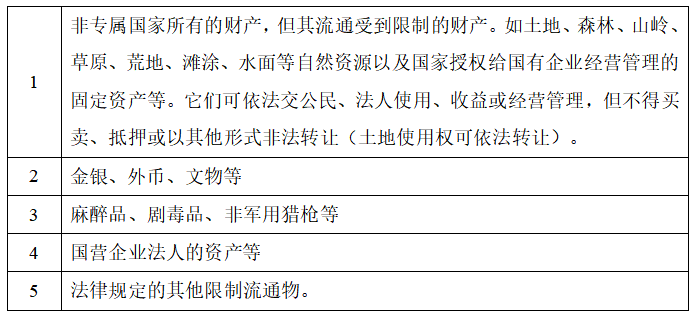

In practice, "restricted circulation assets" generally include:

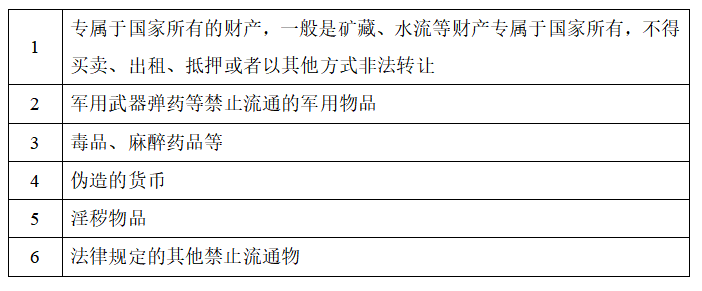

"Prohibited circulation assets" generally include:

Regarding the legality of operational methods, since Hong Kong has cash flow requirements for the underlying assets of RWA projects (currently issued projects all have actual application scenarios), the underlying assets also need to comply with the laws of our country in terms of operation: staying away from red lines and obtaining the necessary administrative permits for operation.

Assets Currently Not Suitable for Issuance in Hong Kong

These assets themselves meet the requirements of the "dual compliance principle," but are currently not suitable for issuance in Hong Kong.

On one hand, RWA in Hong Kong is still in the sandbox experimental stage, so there is caution in selecting underlying assets. The clearly recommended types of underlying assets are those with "high-tech" and "clean green" attributes. Therefore, the Sa Jie team believes that to issue RWA projects in Hong Kong at this stage, the underlying assets must at least meet one of the above two criteria, such as carbon emission rights, which, although not tangible, are closely related to property rights in the green economy.

On the other hand, some assets that are intended to be revitalized through RWA but cannot generate good cash flow are also not suitable for RWA in the Hong Kong sandbox, as the probability of success is low. For example, some real estate with low economic value, no matter how much it is "empowered" through emerging concepts, cannot change the reality of its gradually decreasing market value; the possibility of issuing RWA for such assets is very low.

02 These Specific Mainland Assets Generally Cannot Issue RWA…

After understanding the principles and standards for judging whether underlying assets can issue RWA, we will provide concentrated answers to some assets that have received a lot of inquiries recently or need to be discussed separately, saving everyone on consultation fees.

Jewelry and Cultural Artifacts RWA

Jewelry and cultural artifacts RWA is a category with a high volume of inquiries, and it is also the most challenging to provide clear legal opinions on. This is mainly because there are many varieties of jewelry and cultural artifacts, and the regulations and special restrictions are scattered across laws, judicial interpretations, administrative regulations, departmental rules, and national standards. If the category is uncommon, it generally requires a lot of legal research to provide an opinion. Overall, at this stage, it is not recommended to use jewelry and cultural artifacts as underlying assets for RWA.

If your assets fall into the following categories, they can be outright rejected:

- Gem products with gambling characteristics. Simply put, these are items whose quality cannot be judged by their appearance and must be cut to know the internal quality of the raw material, such as jadeite rough stones, unpeeled green pine rough stones, uncut pearls, etc.;

- Treated jewelry and gemstones, such as B-grade jadeite, C-grade jadeite, etc.;

- Bioproducts (organic gemstones) that are banned from sale by the state, such as ivory, hornbill products, conch, queen conch, coral, rhinoceros horn, tortoiseshell, copal resin, seaweed, amber pillows, amber powder, cinnabar, etc.;

- Low-quality or treated jadeite or jadeite imitations, such as sodalite jade, Guatemalan jade, heat-treated jadeite, etc.;

- Pure gold, pure silver, and other precious metals that have specific legal restrictions on circulation or are prohibited from circulation.

Intellectual Property RWA

Intellectual property, such as copyrights, trademarks, and patents, has already seen many projects in the overseas crypto asset space, and several film projects have even achieved quick financing through tokenization. Currently, we have not seen successful cases in Hong Kong RWA projects, but the Sa Jie team believes that intellectual property is not an impossible area to explore for RWA underlying assets. Each specific project should be analyzed individually; if the intellectual achievement has significant commercial value, it can be boldly attempted once regulatory norms are clarified.

Agriculture and Agricultural Products RWA

"Can sunshine green grapes be used for RWA?" Not long ago, a partner brought promotional materials for a similar grape project in China to consult the Sa Jie team. We do not comment on specific projects, but abstractly speaking, for agricultural and agricultural product RWA projects, if the project meets the standards of scientific ethics review, has high technological content and research value, and possesses good commercial value, it can also be boldly attempted once regulatory norms are clarified.

Pure Concept RWA

Partners must understand one thing: RWA is not crowdfunding. For such projects, the Sa Jie team generally gives a direct rejection opinion.

03 Final Thoughts

To extend a point: for underlying assets that are neither in mainland China nor in Hong Kong, can they issue RWA in Hong Kong? The Sa Jie team believes that there are currently no regulations stating that assets must be located in specific places to apply for RWA in Hong Kong. From the perspective of Hong Kong as an "international financial center," the physical location of the underlying asset should not be a barrier to RWA; authenticity, credibility, compliance, and investment value are the hard indicators.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。