This year's performance of crypto stocks listed in the U.S. has far outpaced 90% of altcoins and meme coins.

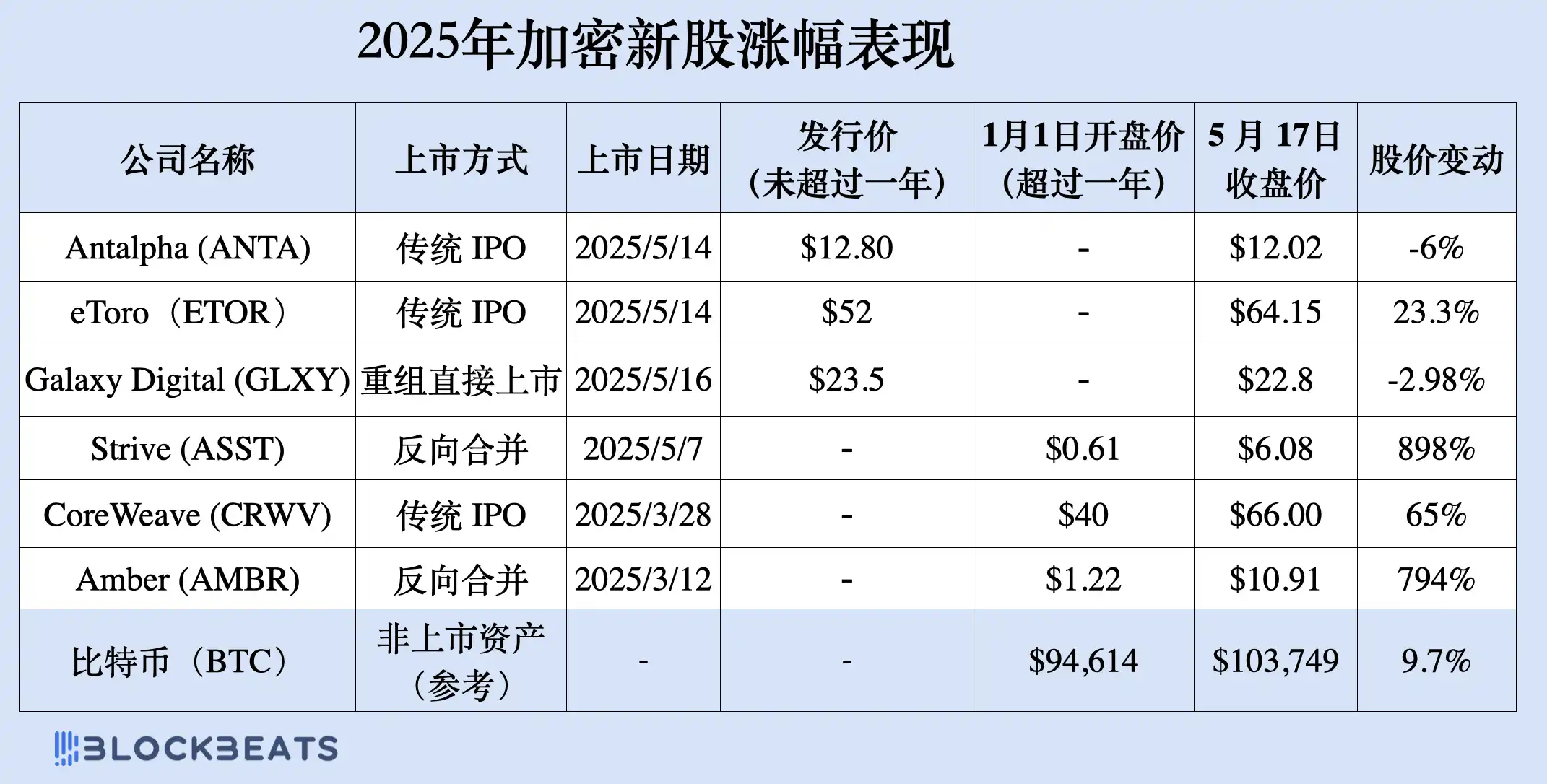

After a sluggish first quarter, the crypto market finally saw a rise in May. Bitcoin experienced a slight increase of about 9.7% amidst fluctuations, but what many do not know is that the new batch of "crypto newcomers" that landed on Nasdaq this year has outperformed Bitcoin and most altcoins over the past few months. Antalpha triggered a trading halt on its first day of listing, eToro closed up 23%, Amber Premium surged nearly 8 times in the first quarter, and Strive, which completed a reverse merger, skyrocketed over 10 times within five months.

In this article, Rhythm BlockBeats will analyze several of the most representative crypto-listed companies of 2025 based on financial report data, stock performance, and business models, to see how they have gained momentum on-chain and accelerated in the U.S. stock market, completing the leap from crypto service providers to global financial institutions.

Antalpha

On May 14, 2025, Antalpha officially landed on the Nasdaq global market through an initial public offering (IPO), with the stock code "ANTA." The IPO issuance price was $12.80 per share, totaling 3,850,000 shares of common stock. On its first day of listing, the stock price surged by 73.59%, triggering a trading halt, making it one of the most watched new stocks in the recent market.

Antalpha is a crypto fintech company focused on Bitcoin mining financial services, with a core positioning to provide structured financing and risk management solutions for the global Bitcoin industry chain. The company primarily serves miners, mining machine manufacturers, and their upstream and downstream ecosystems, with a business system that includes supply chain financing, clearing networks, risk control platforms, and technology service outputs. Specifically, Antalpha provides equipment procurement and operational funding loans to Bitcoin miners and achieves real-time monitoring of collateral positions through its Antalpha Prime technology platform, enhancing asset security and liquidity management. In terms of industry cooperation, Antalpha is also a core loan partner of Bitmain, deeply embedded in the mining ecosystem. Additionally, the company launched the EVM-compatible Bitcoin-pegged asset FBTC in collaboration with Mantle and established standardized solutions in custody and asset security in 2023 in partnership with Cobo.

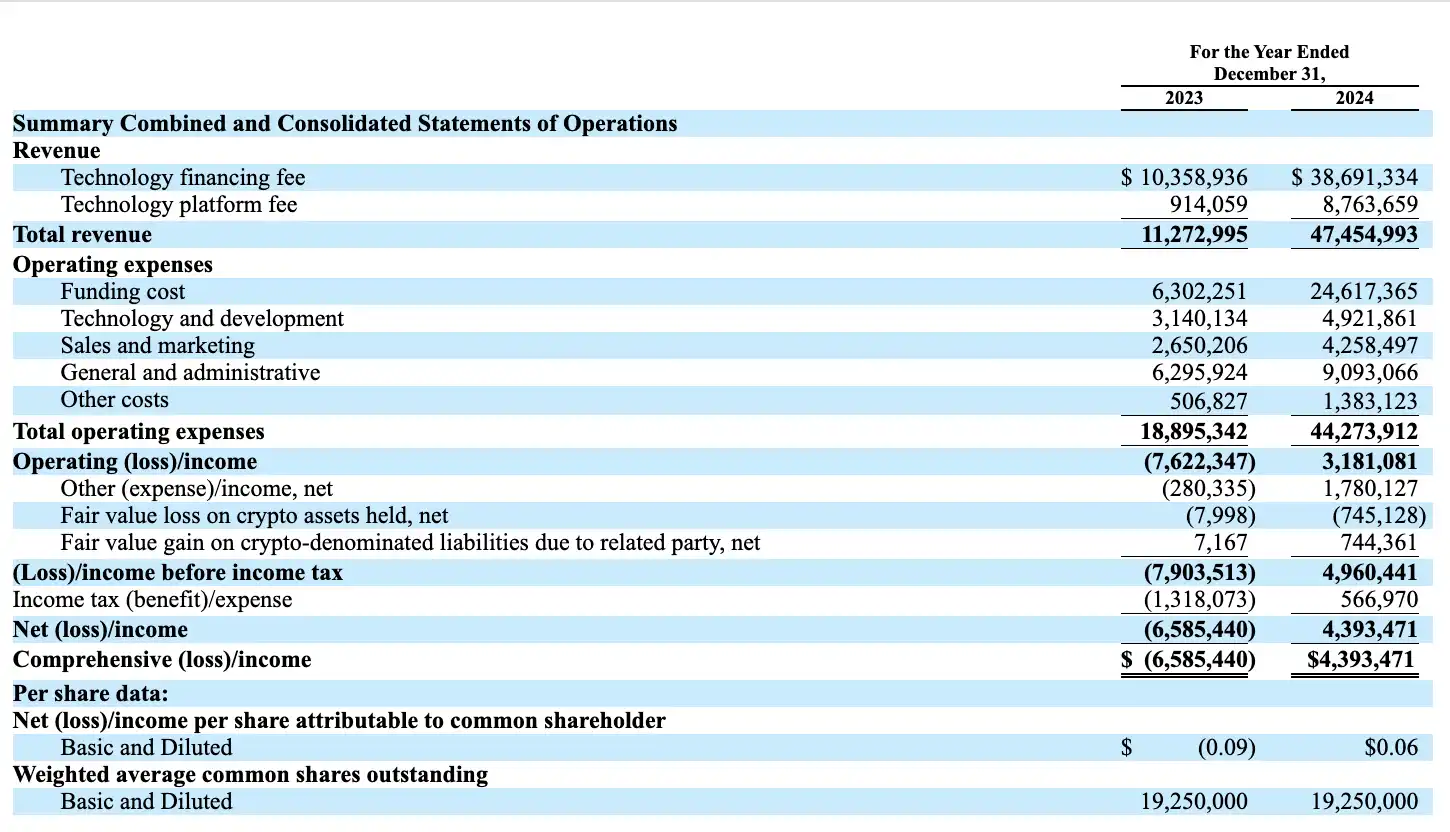

In 2024, Antalpha achieved total revenue of $47.45 million, a 321% increase compared to $11.27 million in 2023, demonstrating strong business expansion capabilities. Its revenue structure also shows a clearer dual-engine model:

On one hand, technology financing fee revenue surged from $10.35 million to $38.69 million, nearly tripling. This portion mainly comes from the structured financing, collateral lending, and clearing business in which the company participates as an institutional funding party, reflecting the increasing market acceptance of its role as a "Bitcoin financial pipeline."

On the other hand, technology platform fee revenue also saw a leap, growing from $910,000 to $8.76 million, a year-on-year increase of 859%. This growth mainly comes from Antalpha packaging its core capabilities such as fund scheduling systems, risk monitoring APIs, and SaaS platforms for external output, showing that it not only possesses financial execution capabilities but is also gradually building a scalable replicable technology service business.

These two types of revenue together form the basic business loop of Antalpha as a compliant crypto infrastructure service provider: on one hand, providing liquidity to the industry through structured financing, regarded as the "plumber of Bitcoin finance"; on the other hand, outputting its technological capabilities in a platformized manner, creating a programmable, integrable "infrastructure as a service" toolchain.

With the rapid growth of revenue scale, the company's operating expenses have also significantly increased. In 2024, total operating costs reached $44.27 million, an increase of about 135% compared to $18.89 million in 2023. Among them, financing costs rose from $6.3 million to $24.62 million, highly matching the expansion of platform asset scale; technology R&D expenses reached $4.92 million, a year-on-year increase of 57%, indicating the company's continued investment in technology stack construction; while marketing and administrative expenses totaled about $13.35 million, mainly used for business expansion, compliance framework construction, and preparations related to the IPO.

Despite the rapid growth in costs, thanks to the release of scale effects, the company achieved operational profitability in 2024, with an operating profit of $3.18 million, compared to a loss of $7.62 million in the same period last year.

Based on the operating profit, after considering other income and expenses, the company achieved a net profit of $4.39 million, successfully making a key transition from loss to positive profit. Among them, the performance of non-core business also played a supporting role: other net income recorded $1.78 million, mainly including interest income and valuation gains on coin-based liabilities; at the same time, due to fluctuations in the prices of certain crypto assets, the company recognized a fair value loss of $740,000 but also obtained an equivalent valuation hedging gain from related party coin-based liabilities. Overall, these non-operating items did not impose substantial pressure on profits but rather provided a certain financial buffer amidst volatility.

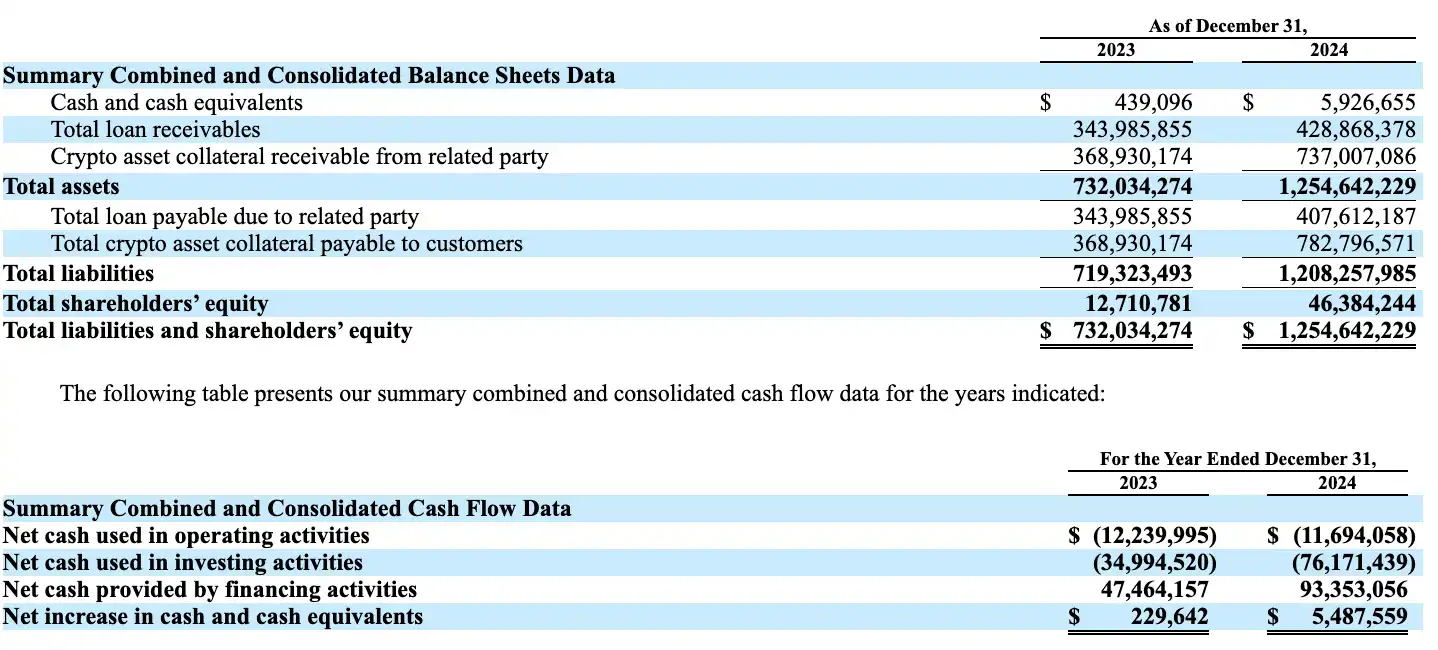

From the asset-liability structure perspective, as of the end of 2024, Antalpha's total assets reached $1.25 billion, a 71% increase compared to $730 million in 2023. Among them, crypto asset collateral receivables surged from $370 million to $737 million, reflecting the rapid expansion of on-chain collateral assets held by the platform as a lending intermediary. At the same time, the loan receivable balance also rose to $429 million, indicating a significant increase in the activity level of the funding supply side.

On the liability side, total liabilities rose from $719 million to $1.208 billion, mainly composed of platform customer coin-based loans and collateral obligations. This growth is basically matched with the asset side, with no significant liquidity mismatch risk. Meanwhile, the company's shareholders' equity increased from $12.71 million to $46.38 million, reflecting that under the impetus of business growth and continuous profitability, the company's net assets are steadily accumulating, laying a solid foundation for subsequent financing and capital operations.

In terms of cash flow, Antalpha had a net cash outflow of $11.69 million from operating activities in 2024, and an investment cash outflow of $76.17 million, indicating that the company is still in a high-investment, high-growth phase. However, through active financing activities, the company obtained a net financing amount of $93.35 million that year, resulting in a net cash increase of $5.48 million for the year, with a year-end cash and cash equivalents balance of $5.92 million, maintaining robust liquidity.

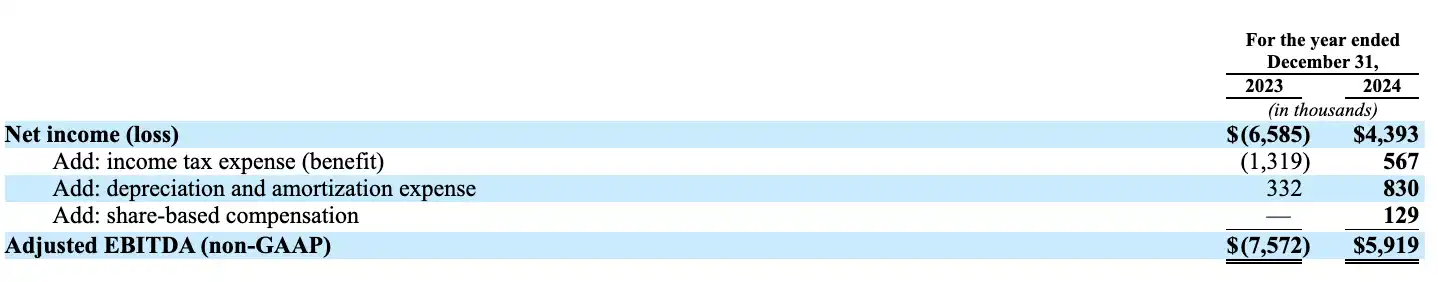

To further reflect operational efficiency and true profitability, Antalpha disclosed a non-GAAP financial metric—Adjusted EBITDA. After excluding income tax, depreciation, amortization, and stock-based compensation, this metric improved significantly from -$7.57 million in 2023 to +$5.91 million in 2024, indicating that the company's core operating model is continuously optimizing and has successfully entered the profit release stage.

Galaxy Digital

Galaxy Digital is a comprehensive digital asset service company that spans crypto finance and traditional capital markets, founded by former Goldman Sachs partner Mike Novogratz in 2018. Since its inception, Galaxy has aimed to create a "new generation Morgan Stanley," with main businesses covering asset management, cryptocurrency trading, market making and lending, investment banking services, structured products, and rapidly growing emerging sectors such as data centers and AI high-performance computing leasing.

Galaxy's path to listing is quite representative. As early as 2018, Galaxy completed a reverse acquisition with a Canadian shell company, Bradmer Pharmaceuticals, to go public on the Toronto Stock Exchange's Venture (TSX Venture) under the stock code GLXY. With the maturation of the regulatory environment and the establishment of compliance frameworks, Galaxy began a structural reorganization in 2022, initiating a complex Up-C structure design, relocating its registered office from the Cayman Islands to Delaware, USA, and establishing a new holding entity, Galaxy Digital Inc., as the public trading company that will soon be listed on Nasdaq.

This Up-C model allows the company to retain the flexibility of its existing partner structure while achieving transparency for public shareholders' rights and optimizing the voting rights structure. It is a standard restructuring path often adopted by U.S. new economy companies like Coinbase and Robinhood before going public. It reflects how crypto industry companies have navigated traditional regulatory barriers in recent years, gradually moving towards mainstream capital markets.

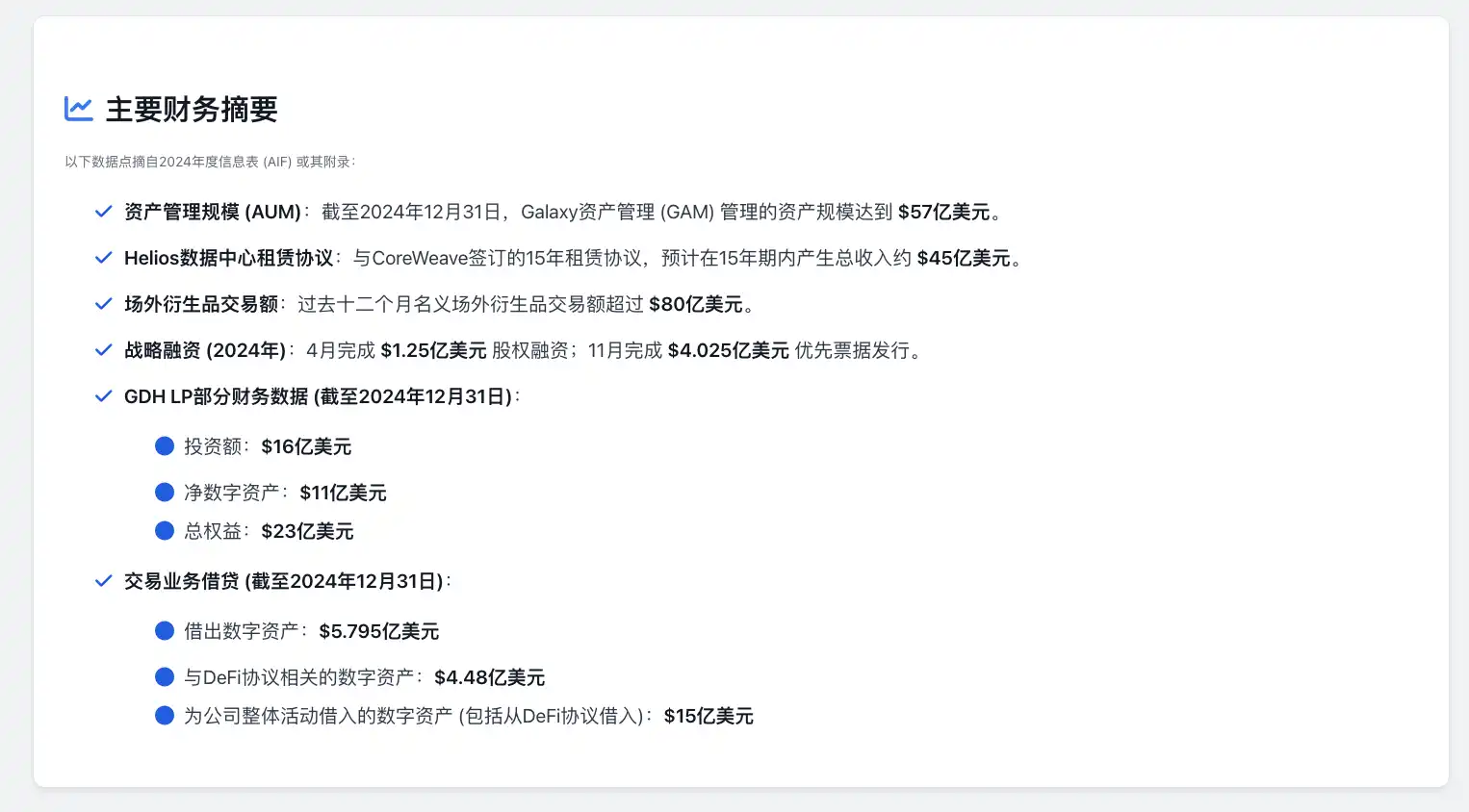

The asset management business is one of Galaxy's standout segments in 2024. The total assets under management (AUM) grew to $5.7 billion, setting a new historical high. Of this, $3.5 billion came from ETF products issued in collaboration with global traditional financial giants like Invesco and State Street, while $2.2 billion was composed of alternative investment portfolios such as hedge funds and venture capital funds. The spot Bitcoin ETF (BTCO) and spot Ethereum ETF (QETH) jointly launched by Galaxy and Invesco went live at the beginning and mid-year, respectively, quickly penetrating the U.S. mainstream market; at the same time, Galaxy also partnered with State Street to launch three crypto-ecosystem-themed ETFs, covering decentralized technology and Web3 technology-related indices.

Moreover, Galaxy launched a multi-asset hedge fund product, the Galaxy Absolute Return Fund, designed specifically for institutional investors and emphasizing a no-coin exposure fund portfolio. In terms of trading and derivatives business, the annual report did not disclose detailed annual trading revenue data, but Galaxy emphasized its ongoing investments in product diversity, depth of institutional services, and compliance capabilities, introducing multiple new cryptocurrencies and leveraged trading products to continuously enrich the trading tools on its derivatives platform.

At the same time, Galaxy is also continuously laying out its blockchain underlying services, including node hosting services, RPC interface products, and multi-chain verification services, gradually building a product system of "financial infrastructure as a service" and exploring opening it up to project parties and developers in a SaaS model. By the end of 2024, Galaxy's organizational scale continued to expand, with local teams established in London, Tokyo, Hong Kong, Singapore, and other locations in addition to its New York headquarters, maintaining a total workforce of several hundred, with recruitment focused on asset management, infrastructure operations, and compliance teams.

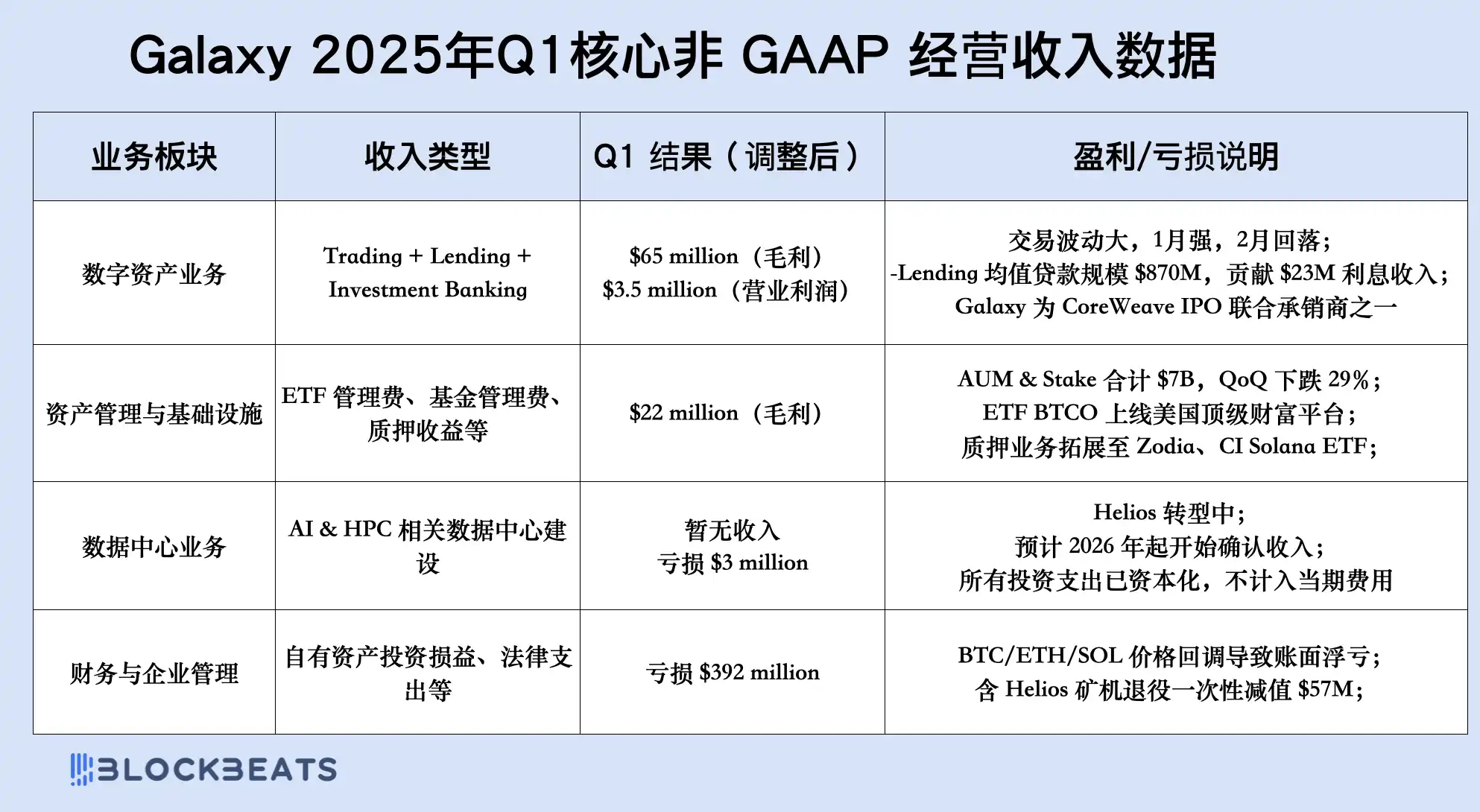

Starting from Q1 2025, Galaxy also completed a restructuring of its financial report structure, integrating the original three major business lines into two operational segments and one corporate segment to better align with its strategic focus. The "Digital Assets" segment encompasses all services related to crypto-native businesses, such as trading, investment banking, asset management, and infrastructure construction (including staking, tokenization, and custody technology); the "Data Centers" segment independently presents the long-term value and transformation progress of the Helios project, which is expected to start recognizing revenue in early 2026; the "Treasury and Corporate" segment mainly includes the impact of investment holdings on the balance sheet, as well as the remaining mining business and other non-operating projects.

In the Q1 2025 financial report, Galaxy Digital disclosed total revenue of $12.98 million under GAAP. This figure stems from the U.S. GAAP "gross-up" treatment of digital asset trading, which requires the total amounts of buy and sell transactions between customers to be recorded as both revenue and expenses, rather than just recording the actual earned spread or fees. Although this accounting method complies with regulatory requirements, it does not accurately reflect the company's profitability and can easily exaggerate revenue appearances, particularly in a company like Galaxy that combines asset management, financial services, and digital infrastructure.

To more accurately present operational performance, Galaxy simultaneously disclosed a non-GAAP metric—Adjusted Gross Profit—as its main reference for internal management and external communication.

In Q1 2025, Galaxy's non-GAAP operating revenue totaled $87 million, including $65 million from digital asset-related businesses and $22 million from asset management. This revenue primarily comes from proprietary trading, prime brokerage, structured credit, ETF management fees, and fund income, forming a stable and sustainable cash flow source for the company, further demonstrating that its "trading-asset management-infrastructure" integrated operational system is continuously functioning.

After deducting the corresponding costs, Galaxy recorded a net operating profit of $3.5 million, mainly contributed by the digital asset business. This demonstrates the resilience and scalability advantages of its core business against the backdrop of the overall crypto market still undergoing fluctuations and adjustments.

However, the GAAP report shows a net loss attributable to shareholders of $295 million for the quarter, which is not due to a decline in core business but rather caused by two non-recurring items: first, the price correction of core holding assets like BTC and ETH in Q1, resulting in paper losses; second, Galaxy's retirement and restructuring of old mining machines for the Helios project, leading to a one-time large asset impairment. Although these non-operating losses depressed profit performance on the report level, they did not affect Galaxy's cash flow and core operational quality.

Galaxy Digital's revenue structure in Q1 2025 reflects its increasingly mature diversified operational framework. Trading and lending businesses continue to play a core role in cash flow generation. In January, the market rebounded strongly, and Galaxy's proprietary trading and client matching businesses achieved considerable returns. However, entering February, crypto asset prices stabilized, volatility decreased, and trading volume subsequently declined, putting some pressure on trading operations. Nevertheless, its lending segment still maintained stable growth, with total loan balances reaching $870 million, a 25% increase from the previous quarter, mainly driven by increased demand for structured financing and liquidity from institutional clients. This quarter, the lending business generated $23 million in interest income, reflecting Galaxy's significant achievements in stable income asset allocation.

In asset management, although the market downturn led to a reduction in total managed and staked assets to $7 billion, nearly a 30% decrease quarter-on-quarter, management fee income remained robust, demonstrating good client stickiness and product moat. The Bitcoin spot ETF—BTCO, jointly issued with Invesco, successfully entered multiple top wealth management platforms in traditional finance in Q1, cumulatively covering over $2 trillion in asset systems. This marks that Galaxy's ETF products have truly penetrated mainstream compliant funds. Additionally, its crypto venture fund, Galaxy Crypto Venture Fund II, also completed fundraising of over $160 million in this quarter, showing strong capital appeal in the primary market.

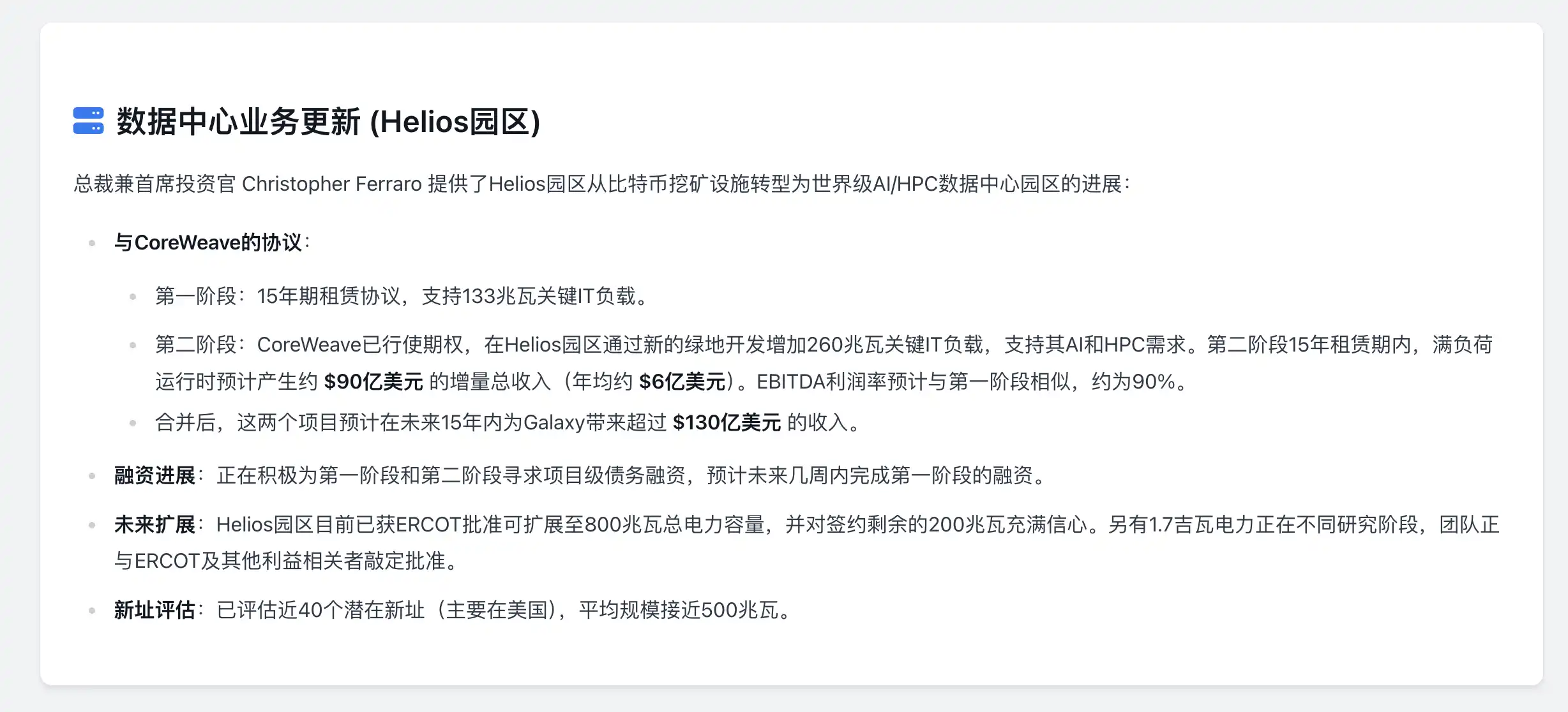

Notably, Galaxy is building its AI data center business, specifically the Helios project located in Texas. Although this segment has not yet begun to recognize revenue this quarter, its transformation process has entered a critical stage. The first two phases of the project have deployed a total computing power of 393 megawatts and have signed a 15-year long-term lease agreement with AI infrastructure leader CoreWeave. According to the agreement, this data center is expected to generate approximately $1.3 billion or more in cumulative revenue for Galaxy over the next fifteen years. Currently, this expenditure is considered a capitalized investment and does not affect current profits, but it is clearly a key component of Galaxy's next growth curve.

At the same time, Galaxy reported a net loss of $295 million this quarter, primarily not from core business but due to paper losses triggered by the price correction in the digital asset market and asset impairment from the retirement of old mining machines in the Helios project. These floating items totaled $392 million, which, while suppressing GAAP net profit, did not actually affect its operational income and cash flow performance. From a non-GAAP perspective, Galaxy's main operating profit remains stable, with structural income continuously generated from asset management, trading matching, lending, fund issuance, and other segments.

It can be said that this quarter's financial report serves as a transformation window for Galaxy to fully "connect with Wall Street" from operational layers to accounting systems. From the GAAP report, it appears to be a company under pressure amid market fluctuations; however, from a non-GAAP perspective, Galaxy is steadily building a global multi-asset platform with stable cash flow, a broad financial product line, and AI data centers as a medium- to long-term pivot.

eToro

eToro completed its IPO pricing on May 14, 2025, and officially listed on Nasdaq (stock code ETOR) on May 15, selling 6 million shares at a price of $52 per share, raising approximately $312 million from investors. This listing values the company at $4.2 billion. The platform was established in 2007 in Israel, with its core business providing social trading services for multi-assets such as cryptocurrencies, stocks, and ETFs, positioning itself as a competitor to Robinhood.

Previously, eToro attempted to go public through a SPAC merger (valued at $10.4 billion in 2021) but terminated the plan in 2022 due to changes in the market environment. Notably, a fund under BlackRock had committed to purchasing $100 million worth of shares at the offering price before the IPO, indicating strong interest from institutional investors in the Web3 sector.

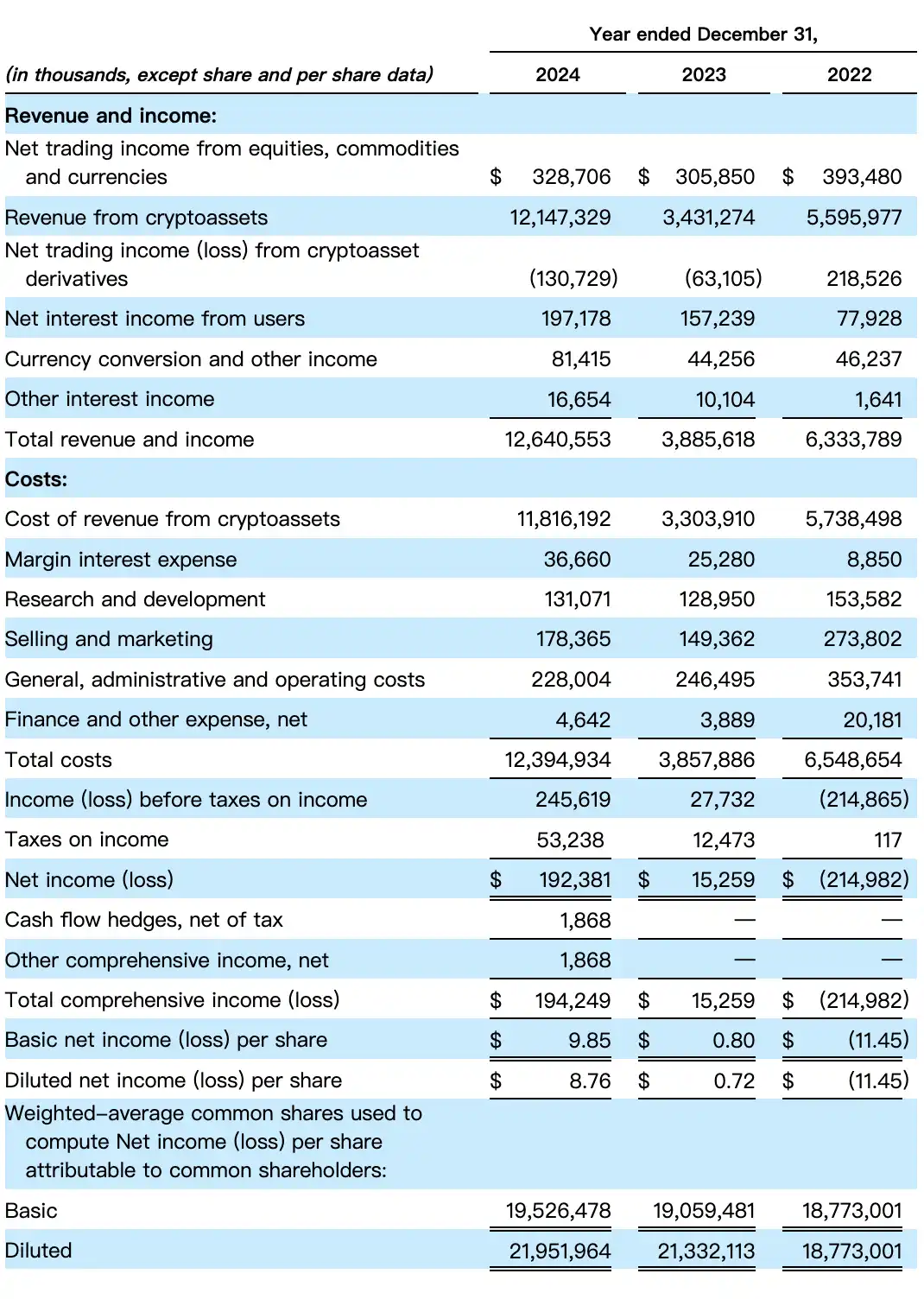

In 2024, eToro's total revenue and other income reached $12.64 billion, more than three times that of 2023 ($3.89 billion) and far exceeding the $6.33 billion in 2022. Among them, revenue from crypto asset trading was the primary contributor, reaching $12.147 billion, accounting for over 96%, while this revenue was only $3.431 billion in 2023, indicating a significant increase in the platform's market share during this round of crypto market activity.

In non-crypto asset business, eToro also maintained steady growth: net income from stock, commodity, and forex trading reached $329 million; net interest income from users was $197 million, a year-on-year increase of about 25%; foreign exchange conversion and other income amounted to $81.41 million; and other interest income was $16.65 million.

At the same time, it is worth noting that the crypto derivatives trading segment recorded a net loss of $131 million in 2024, which is related to its risk exposure management and some volatility trading strategies, reflecting the double-edged sword nature of the crypto leveraged market.

While eToro's revenue saw significant growth, its expenses also expanded noticeably. In 2024, total costs reached $12.39 billion, of which the cost of revenue from crypto assets (i.e., counterparty and market execution fees) amounted to $11.816 billion, nearly tripling year-on-year; sales and marketing expenses reached $178 million, a year-on-year increase of about 20%, primarily used for user growth, brand expansion, and pre-IPO market investments; general and administrative expenses were approximately $228 million, slightly lower than $246 million in 2023; R&D expenses were $131 million, maintaining a relatively stable level; interest expenses on margin, financial costs, and other minor cost items totaled about $49 million.

Despite the significant increase in total costs, eToro's profitability achieved a leap this year due to revenue growth far exceeding the increase in costs.

Driven by strong revenue, eToro achieved a pre-tax profit of $245 million, nearly nine times that of 2023 ($27.73 million). After deducting $53.24 million in income taxes, the net profit was $192 million, compared to only $15.25 million in the previous year, and a loss of $215 million in 2022.

CoreWeave

CoreWeave, formerly known as Atlantic Crypto (founded in 2017), initially focused on providing GPU mining infrastructure for cryptocurrencies like Ethereum. With Ethereum's transition to a PoS consensus mechanism in 2022, it quickly adjusted its strategy, repurposing GPU clusters originally used for mining towards graphics rendering and AI training, seizing the opportunity presented by the generative AI boom, and becoming a company focused on AI cloud computing services, collaborating with several mining companies in the crypto space.

CoreWeave went public on Nasdaq on March 28, 2025, under the stock code "CRWV," raising $1.5 billion and valuing the company at approximately $23 billion. Although the stock price performed poorly on its first day of trading, the company's layout in the AI infrastructure sector attracted significant attention, with Nvidia as a strategic investor purchasing $250 million in stock, earning it the nickname "Nvidia's favorite child" in the U.S. stock market.

On May 14, CoreWeave released its first financial report post-IPO, showing that its revenue growth far exceeded analysts' expectations.

Revenue: For the quarter ending March 31, revenue reached $981.6 million, a staggering 420% year-on-year increase (compared to $188.7 million in the same period last year), far surpassing the market expectation of $853 million;

Earnings per share: The net loss was $1.49 per share, with the net loss expanding from $129.2 million in the same period last year to $314.6 million, partly due to $177 million in stock-based compensation expenses related to the IPO;

Business growth rate: The revenue growth rate for the full year of 2024 was 737%. Although growth slowed somewhat this quarter, it still maintained triple-digit high growth.

In terms of business model, CoreWeave provides computing power services by renting Nvidia GPUs to enterprises, competing with tech giants like Amazon Web Services, but industry leaders like Google and Microsoft have become its key clients, with Microsoft contributing 62% of CoreWeave's revenue in 2024 ($1.92 billion).

Notably, OpenAI signed a five-year partnership agreement with CoreWeave this quarter, valued at up to $11.9 billion, combined with its reliance on Microsoft (which contributed 62% of CoreWeave's revenue in 2024), highlighting its critical position in the AI computing power sector.

Strive Asset Management

Strive Asset Management completed its Nasdaq listing through a reverse merger on May 7, having reached a final merger agreement with Nasdaq-listed company Asset Entities Inc. (NASDAQ: ASST). Following the merger, the company continues to trade on Nasdaq under the "Strive" brand. After the transaction, Strive holds 94.2% of the new company's shares, with former CEO Matt Cole serving as Chairman and CEO.

Strive was co-founded by Vivek Ramaswamy, a leader in the U.S. government's efficiency department, and its investors include vice-presidential candidate JD Vance, who has close ties to the Trump camp. The company is seen as a significant force in promoting the "Bitcoin Strategic Reserve."

Strive Asset Management has applied to U.S. regulators for approval to list an exchange-traded fund (ETF) that invests in convertible bonds issued by MicroStrategy and other companies. This ETF aims to provide exposure to "Bitcoin bonds," described as "convertible bonds issued by MicroStrategy or other companies that plan to use all or most of the proceeds to purchase Bitcoin."

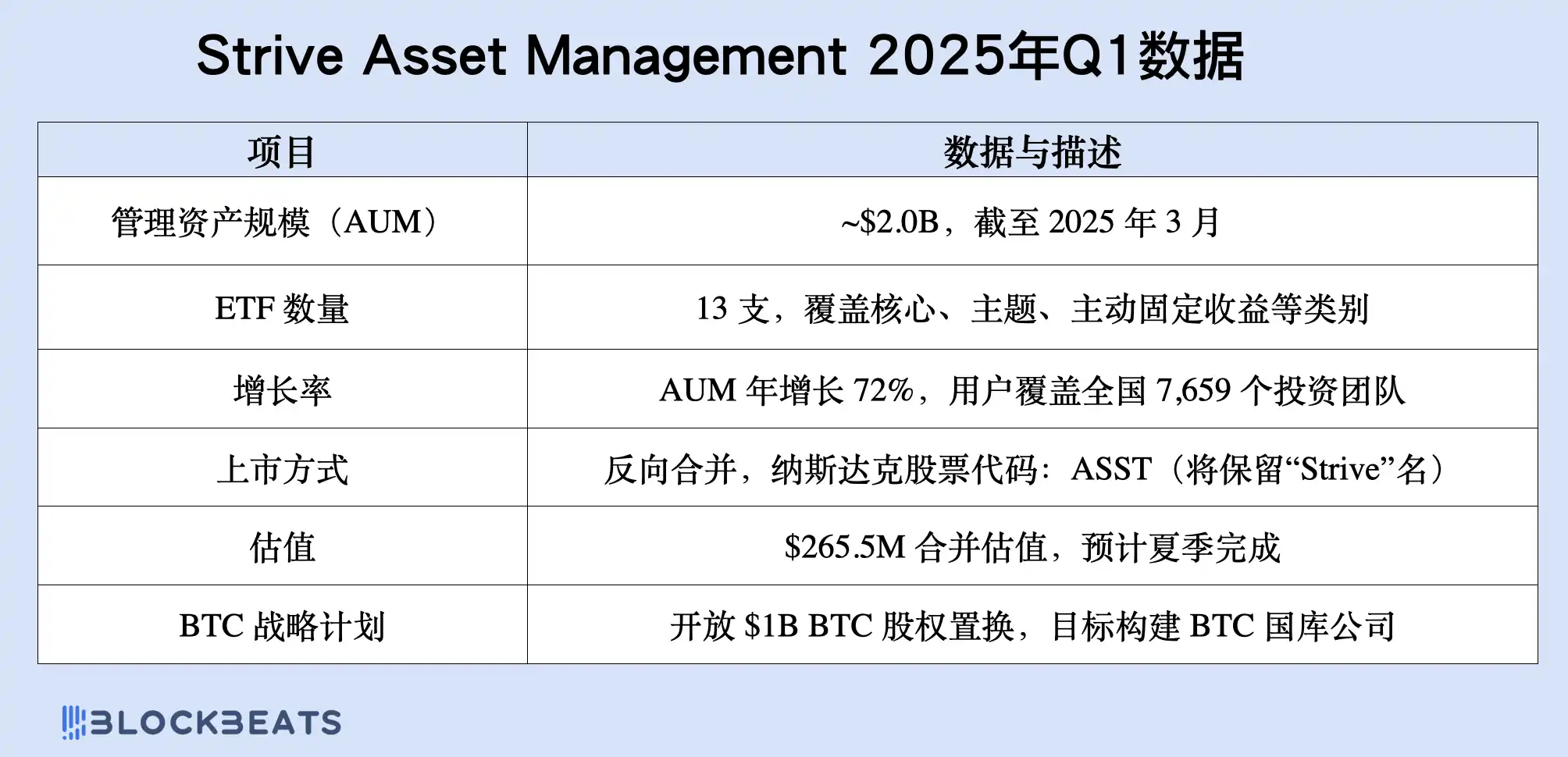

As of Q1 2025, Strive's total assets under management (AUM) reached approximately $2 billion, a year-on-year increase of over 70%. Strive's primary business structure is built around ETF products, and in less than three years, the company has launched 13 exchange-traded funds covering various dimensions, including core index strategies, thematic investments, and actively managed fixed-income funds.

These ETF products have become its main source of recurring revenue, especially after gaining recognition in the retail market, rapidly expanding to over 7,000 registered investment advisor (RIA) teams and entering multiple corporate 401(k) pension platforms. At the same time, the company has also made breakthroughs in technology platform services, beginning to provide "technology platform fee" income to high-net-worth clients and institutions through direct investment portfolios, customized index services, and tax optimization tools, which has also become a new revenue growth curve.

Although the company has not yet released a complete GAAP financial report, its investor documents released in May 2025 indicate that the revenue structure is becoming increasingly clear, with a focus on organizational expansion and market promotion on the expense side. The company heavily relies on social media and content operations for market penetration, with over 200,000 users on TikTok and Discord communities, and annual interactions in the tens of millions. Additionally, as Strive prepares to enter the public market, its expenditures on compliance, human resources, and listing structure have also significantly increased, constituting its main operating cost items.

Alongside the merger, Strive launched a groundbreaking financial engineering plan: opening a Bitcoin equity swap window of up to $1 billion. Through IRS Section 351, the company allows Bitcoin holders to swap BTC for Strive equity without triggering capital gains tax. This mechanism is referred to as the "Bitcoin Balance Sheet Engineering," aimed not merely at accumulating Bitcoin but at transforming BTC into a foundational anchor for company value pricing, creating a capital allocation platform supported by BTC as a reserve asset and stable income streams.

Furthermore, Strive has formally established Bitcoin as the "Capital Deployment Hurdle Rate" within the company, meaning that any investment decision, merger transaction, or financing activity must be judged based on "whether it outperforms the long-term annualized return of BTC." This philosophy reflects the company's firm belief in a Bitcoin standard economy: if capital appreciation returns cannot exceed those of BTC, then it is not worth pursuing.

From a new ETF issuer to a compliant public platform building a "Bitcoin Asset Treasury" model, Strive's transformation speed can almost be described as "radical." However, based on its capital structure, business performance, and user community stickiness, it is redefining the boundaries of asset management companies in a manner distinct from traditional Wall Street.

Amber Premium

Amber Group was founded in 2017 and is headquartered in Hong Kong, serving as a global crypto financial service provider. On March 12, 2025, Amber Group's crypto financial institution service and solution provider Amber International (brand name: Amber Premium) completed a merger transaction with iClick Interactive Asia Group Limited, beginning trading on the Nasdaq Global Market under the stock code "AMBR."

As a core subsidiary of Amber Group, Amber Premium will fully leverage its proprietary blockchain and financial technology, AI-enabled risk management, and Amber Group's years of market experience and influence to continue strengthening its execution services, expanding compliance products, and promoting the scaled development of institutional-level digital asset finance through deepening institutional cooperation and enhancing compliance security.

In 2024, Amber International remains in a critical transitional period of large-scale strategic transformation. From a financial performance perspective, although it is still in a loss state overall, signs of improvement in several core indicators are beginning to emerge, especially the growth potential of new business segments is being preliminarily released.

First, looking at the revenue side, Amber achieved continuous operating revenue of $32.806 million, a decrease of about 9% compared to $36.051 million in 2023. This decline was primarily influenced by the pressure of the macroeconomic environment, particularly the tightening of marketing budgets by advertisers, which caused one of the company's main revenue sources, marketing solutions, to decline by 13% year-on-year. However, its enterprise solutions segment still recorded slight growth, indicating that the demand for digital services has somewhat hedged the downside risks of traditional advertising business. Meanwhile, the company maintained good cost control, with a total gross profit of $16.747 million for the year, and a gross margin of about 51.0%, which is basically on par with the previous year's 52.9%, showing that while revenue fluctuated, the overall profitability quality of the company remained stable.

However, on the expense side, Amber's operating costs saw a significant increase, with total operating expenses rising from $30.725 million in 2023 to $34.107 million in 2024, an approximate year-on-year increase of 11%. The changes in the expense structure were quite drastic: sales and marketing expenses plummeted from $17.28 million to $7.118 million, a reduction of over 59%, indicating that the company consciously reduced traditional promotional spending and shifted towards more efficient marketing methods. However, the savings in marketing expenses did not fully translate into profit margins. The largest increase in expenses occurred in general and administrative costs, which skyrocketed from $10.838 million to $26.058 million, a year-on-year surge of about 140%. This was primarily due to one-time costs related to legal, audit, compliance, and human resources associated with the Amber DWM acquisition. R&D expenses remained relatively stable at $8.78 million for the year, slightly down from the previous year, indicating that the company maintained rational control over its technology investments.

In the non-operating section, the company also faced a net loss of $72.1 million, significantly higher than the $22.99 million in 2023. This loss may involve impairments of long-term investments, losses due to exchange rate fluctuations, and additional costs incurred during the Amber DWM acquisition process. After considering interest income and expenses, Amber's pre-tax operating loss expanded to $24.07 million (compared to $13.03 million in 2023). Ultimately, the net loss attributable to common shareholders was $23.935 million, equivalent to a loss of $2.61 per ADS, with the loss margin widening year-on-year, reflecting the financial pressure concentrated from the acquisition transformation.

Additionally, the company has gradually exited the mainland China market since 2023, and the related termination of business continued to be a drag in 2024, resulting in a net loss of $5.104 million. Although this was a significant reduction from the previous year's $25.187 million, it still posed a certain burden on the group's finances. Despite recording a one-time disposal gain of $2.585 million to partially hedge this, the overall impact led to Amber's total net loss attributable to shareholders reaching $29.007 million for the year, equivalent to a loss of $3.17 per ADS. This represented an improvement compared to the $3.78 loss per ADS in 2023, but overall, the company remained in a "growing pains" phase during its deep transformation.

Notably, Amber recorded a foreign currency translation gain of $37.49 million in 2024, primarily from the appreciation of Asian currencies against the U.S. dollar. This exchange gain effectively offset some of the book losses, keeping the company's comprehensive loss controlled at $22.593 million, significantly better than the previous year's $38.673 million. This indicates that, after excluding the impacts of exchange rates and one-time accounting items, Amber's operational quality is steadily improving.

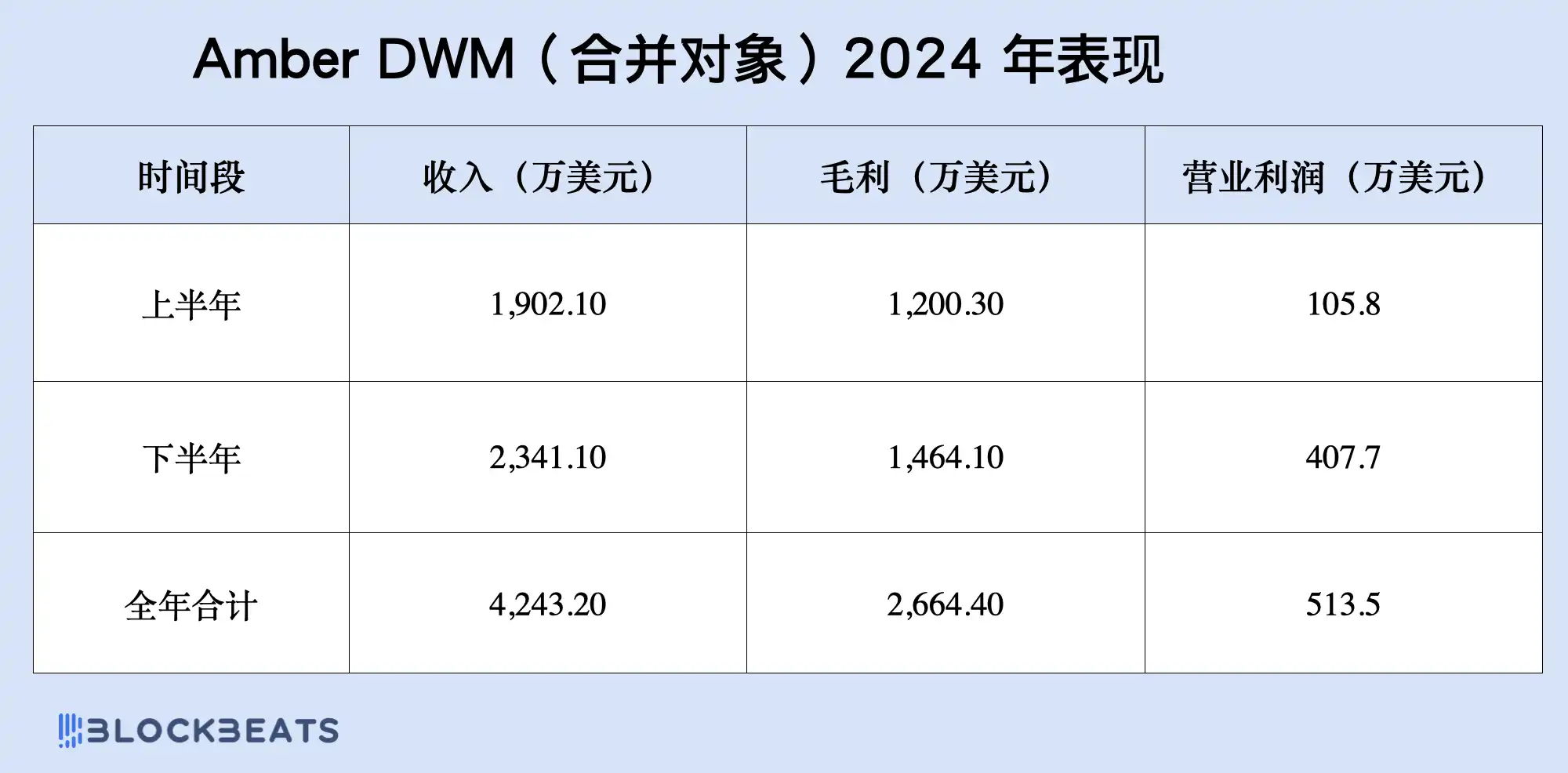

Of particular interest is Amber DWM, the business entity that officially completed its merger in 2025, which showed impressive independent financial performance in 2024. Although it has not yet been consolidated, Amber disclosed in its annual report that this segment's annual revenue exceeded $42 million, with significant profit growth in the second half of the year. This business entity operates under the Amber Premium brand and is the core segment of the company's comprehensive transformation towards compliant crypto financial services, covering institutional crypto asset custody, OTC liquidity matching, portfolio management, and payment solutions for high-net-worth clients, all of which possess high added value and growth potential.

Looking ahead to 2025, Amber Premium is highly anticipated. The company expects its revenue for the first quarter of 2025 to reach between $12.5 million and $13.5 million, achieving 30% of DWM's revenue from the previous year in just one quarter, indicating a rapid expansion. At the same time, Amber has announced the establishment of a $10 million crypto asset reserve fund, officially incorporating crypto assets into the company's balance sheet for the first time. This not only represents the evolution of its financial system towards a Web3 financial model but also marks Amber's transition away from the old model, fully transforming into a crypto technology financial platform.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。