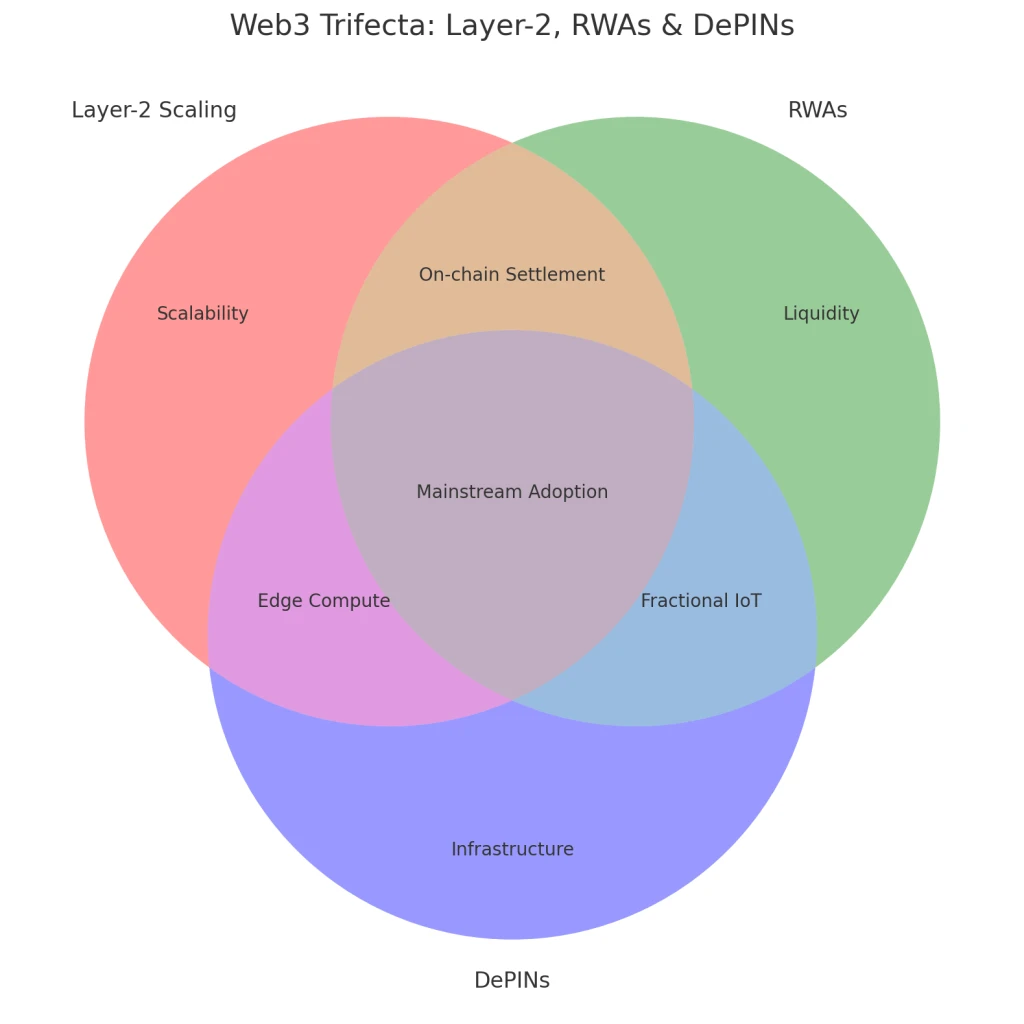

Key Points Overview

– Significant cost reduction through Layer-2 scaling: Rollup technology has driven transaction fees below $1, with throughput exceeding 2,000+ TPS, fundamentally addressing Ethereum's congestion issues before 2025.

– Tokenization of physical assets enables public "fractional ownership": On-chain tokenization allows trillion-dollar assets like real estate, bonds, and artworks to be split into smaller shares, making it easy for ordinary people to participate.

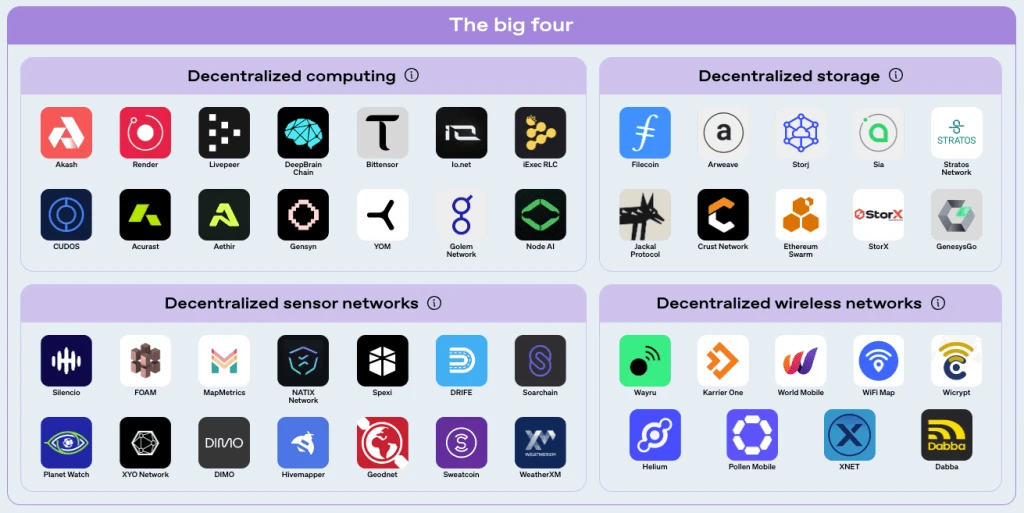

– DePIN network crowdsources real-world infrastructure: From Helium hotspots to decentralized storage and edge computing, community hardware naturally expands, forming a truly decentralized service.

– Web3's three-in-one approach ignites mass adoption: The combined efforts of Layer-2, RWA, and DePIN eliminate cost, liquidity, and infrastructure barriers, paving the way for widespread adoption in the second half of 2025.

Before 2025, users have been plagued by high transaction fees and fragmented applications—these are precisely the pain points that Layer-2 scaling aims to resolve. At that time, Ethereum's "gas wars" often pushed transaction fees to $20–50, deterring the public. DeFi protocols on Layer-1 were in high demand, and congestion could bring everything to a standstill. Meanwhile, the popularity of NFTs gradually waned due to a lack of lasting value, and the traditional financial system remained isolated from the digital market. The three major narratives for the second half of Web3 (2025 H2) directly address these issues:

– Layer-2 rollup reduces costs and increases speed

– Tokenization of physical assets unlocks institutional funds

– DePIN network achieves on-chain coordination of hardware

Table of Contents

Why does Web3 need an upgrade?

What problems can Layer-2 scaling solve?

Why is now the best time to deploy RWAs?

What exactly is the DePIN network?

Why does Web3 need an upgrade?

Consider where Web3 currently stands. High transaction fees, slow networks, and fragmented applications cannot support truly large-scale scenarios. Three forces are currently changing all of this:

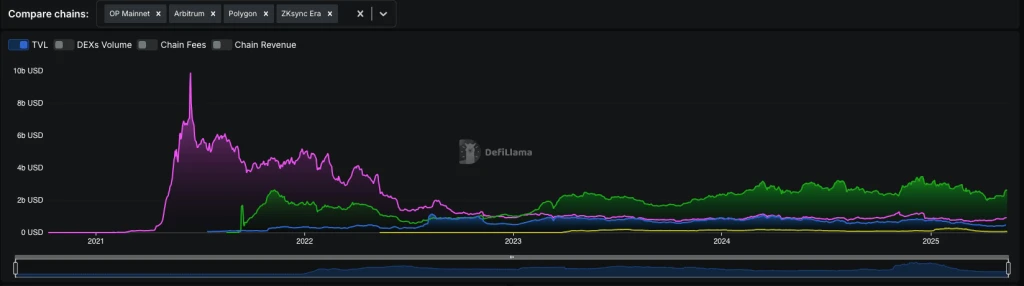

– Layer-2 scaling: The TVL (Total Value Locked) here refers to the dollar value of assets users have locked in Layer-2 smart contracts, such as DeFi protocols and cross-chain bridges.

– Tokenization of physical assets (RWAs): This TVL refers to the value corresponding to loans or real asset collateral that has been tokenized on various protocols.

– Decentralized Physical Infrastructure Network (DePIN): Unlike traditional DeFi, the DePIN network does not focus on TVL; instead, we use the market capitalization of Filecoin (the largest DePIN token) and the staking or locking data of Livepeer and Arweave to roughly outline their on-chain "locked" economic scale.

Combining these three elements creates a "three-in-one" solution for Web3, laying the groundwork for a truly low-fee, cross-chain interoperable blockchain experience in the second half of 2025.

What does Layer-2 scaling solve?

Layer-2 Scaling: Data Overview

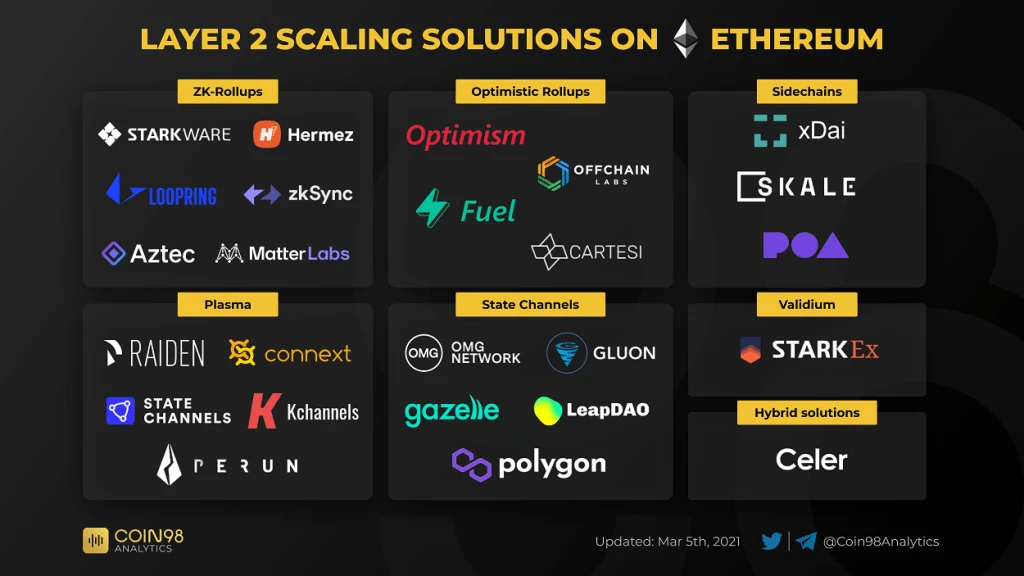

What is Layer-2 Rollup? Why is "Layer-2 Scaling 2025" so important?

Layer-2 scaling mainly has two major factions: Optimistic Rollups and Zero-Knowledge Rollups (ZK Rollups). Both handle transactions "off-chain," only submitting necessary data to the Ethereum mainnet, significantly reducing the burden on the mainnet.

– Optimistic Rollups

For example, Arbitrum (ARB) and Optimism (OP) assume that batch transactions are valid by default, only sending the minimum necessary data to Ethereum, and using fraud proofs to challenge any malicious behavior. This design retains security while drastically lowering on-chain gas fees.

– Zero-Knowledge Rollups

Represented by zkSync Era (ZK), StarkNet, and Polygon zkEVM (POL), they bundle hundreds or thousands of transactions into a cryptographic proof, which is then submitted to the Ethereum mainnet for verification. This not only improves scalability but also ensures privacy protection.

By the end of 2024, EIP-4844 (Proto-Danksharding) introduced a "blob" transaction type, making it cheaper to attach data to Layer-2 networks. This innovation directly led to a surge in usage—by mid-2025, the daily transaction volume of all Layer-2 Rollups exceeded 12 million, compared to about 1 million for Ethereum Layer-1. Average gas fees also plummeted from over $30 per transaction to under $1, becoming a "key turning point" for large-scale Web3 applications in the second half of the year.

Image Credit: COIN98

Key Metrics for L2

– Daily average of over 12 million transactions vs. about 1 million for Layer-1, Rollup has become mainstream;

– Total funding of $220 million over the past 18 months—of which Arbitrum completed a $120 million Series B, and Optimism secured a $100 million strategic round, demonstrating capital's confidence in on-chain scaling;

– DeFi TVL on major L2 networks exceeds $10 billion, with real funds migrating from the Ethereum mainnet.

Image Credit: Defillama

What pain points does Layer-2 solve?

– High transaction fees: By processing transactions in batches, the average cost drops from tens of dollars to under $1, enabling micro-payments and on-chain games to function smoothly;

– Scalability: The combined throughput of Rollups exceeds 2,000 TPS, compared to Ethereum's mainnet at ~15 TPS, removing limitations on application scenarios;

– Interoperability: Shared sequencers and standardized cross-Rollup bridge protocols, like Optimism Superchain, enable seamless asset and data flow between different L2s, eliminating fragmentation.

Of course, the security of bridges and the centralization of sequencers remain two major challenges: cross-chain bridges are vulnerable to hacks, and some Rollups still rely on a single sequencer for block production. The emerging decentralized sequencer committees, watchdog services, and unified scaling standards will determine whether Layer-2 can truly become the "main thoroughfare" for Web3 in the second half of 2025.

Why focus on RWAs now?

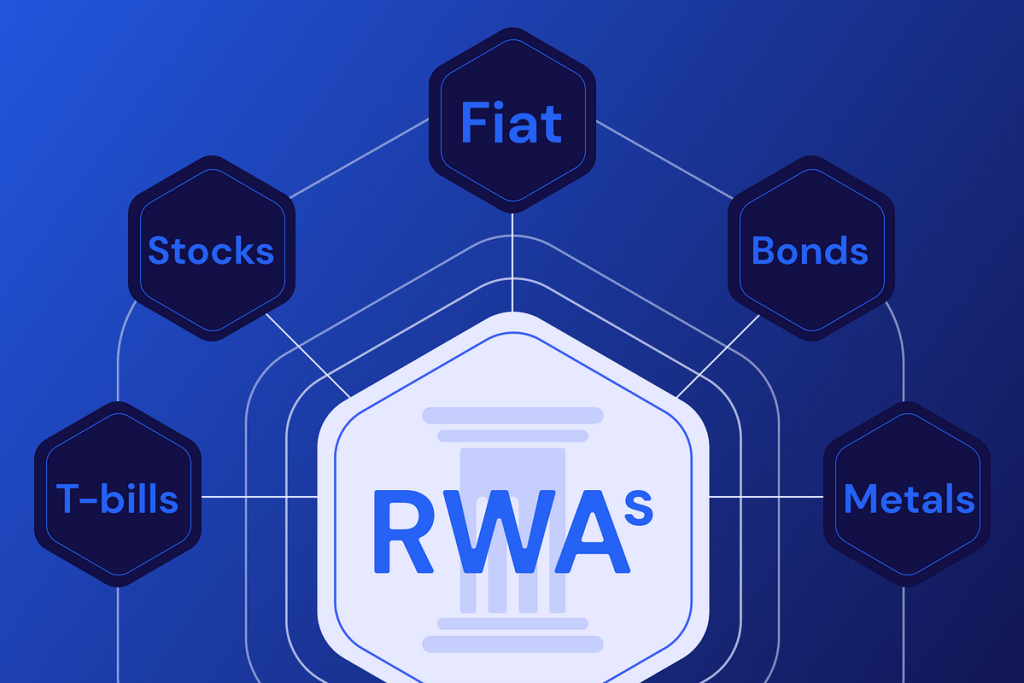

What is Web3 physical asset tokenization?

In a nutshell, it involves "packaging" tangible assets from the real world—such as commercial real estate, accounts receivable, artworks, and even rare collectibles—into digital tokens on the blockchain. Each token represents a small ownership stake in the underlying asset, allowing ordinary investors to buy and sell high-value assets that were previously only accessible to institutions or high-net-worth individuals. Through on-chain fractional ownership, tokenization transforms markets that traditionally had low liquidity into spaces where everyone can participate, as long as they have internet access.

Image Credit: Medium

Key Metrics for RWA

– >$10 billion: By mid-2025, the issuance of RWAs on Layer-2 networks has surpassed $10 billion, indicating that various platforms are implementing tokenization solutions on a large scale.

– 20+ institutional pilots: From Franklin Templeton issuing a money market fund on Optimism Rollup to Société Générale conducting experimental bonds on Polygon zkEVM, major traditional financial institutions are testing the waters on-chain.

– $150 billion: According to the latest estimates, the reachable market for real estate tokenization alone is $1.5 trillion, with corporate and rental properties being the biggest highlights.

These figures illustrate an important trend: asset managers and traditional financial institutions are moving from proof of concept to actual issuance, with Web3 physical asset tokenization transitioning from "niche experiments" to "production-grade deployments."

What pain points does tokenization solve?

– Lowering the barrier to entry: The investment threshold drops from millions of dollars to hundreds of dollars, significantly opening the door to high-value asset markets. For example, a $10 million office building can be divided into 100,000 tokens, each requiring only $100 to enter.

– Increasing efficiency: On-chain contracts embed KYC/AML compliance checks and programmable transfer restrictions, automating compliance processes that would otherwise take days or even weeks; dividend distribution and voting rights can also be executed with a single click via smart contracts, eliminating manual reconciliation.

– Enhancing transparency: The immutable ledger of the blockchain records every token transfer and ownership change, reducing counterparty risk and allowing for real-time verification during audits, with all details clearly visible.

Infrastructure and Regulatory Support

– Compliance platforms: Vendors like Tokeny, Securitize, and Fnality have established institutional-grade compliance channels, integrating identity verification, token minting, and custody services to support institutional issuance in a one-stop manner.

– Settlement stablecoins: PayFi series stablecoins (such as USDP, USDY) are becoming low-cost, high-efficiency settlement channels for cross-chain cash flow.

– Clear regulations accelerate deployment: In the first quarter of 2025, the Monetary Authority of Singapore released the "Digital Asset Tokenization Guidelines," and the EU's MiCA came into effect, clarifying the definition of tokenized securities and investor protection, releasing previously constrained capital and allocating budgets for on-chain issuance by major banks and asset management companies.

As the predictions for the second half of Web3 (2025 H2) gradually come true, physical asset tokens will become a key bridge between TradFi and DeFi, bringing trillion-dollar assets on-chain and ushering in a new financial era that is accessible, transparent, and efficient.

What is the DePIN network?

DePIN Use Cases and the "Uber for Infrastructure" Concept

Decentralized Physical Infrastructure Network (DePIN) utilizes blockchain coordination and token incentives to crowdsource real-world hardware and services, similar to how Uber summons rides. Projects reward individuals for deploying and operating equipment, building open, permissionless infrastructure that expands through community participation rather than centralized investment.

Image Credit: Onchain.org

Typical Use Cases for DePIN

– Decentralized Wireless (DeWi): Networks like Helium (HNT) encourage users to install LoRaWAN or 5G hotspots. Each hotspot earns HNT rewards based on the amount of data transmitted and network demand.

– Distributed Storage: Protocols like Filecoin (FIL) and Arweave (AR) allow node operators to rent out disk space for on-chain data persistence. Storage providers stake tokens to securely store encrypted files and earn FIL or AR rewards, providing a decentralized alternative to AWS and Google Cloud.

– Edge Computing: Services like Render Network (RNDR) and Akash Network (AKT) connect users' idle GPU and CPU computing power to clients needing rendering, machine learning, or scientific computing. Contributors earn token rewards based on usage.

– Mapping and Sensors: Hivemapper collects street view images through crowdsourced dashcams, allowing users to earn HONEY tokens upon upload, supporting a globally updated mapping project that rivals commercial map services.

This model transforms underutilized resources like home routers, idle server racks, and unused vehicles into productivity nodes, all coordinated on-chain and managed by a token holder DAO.

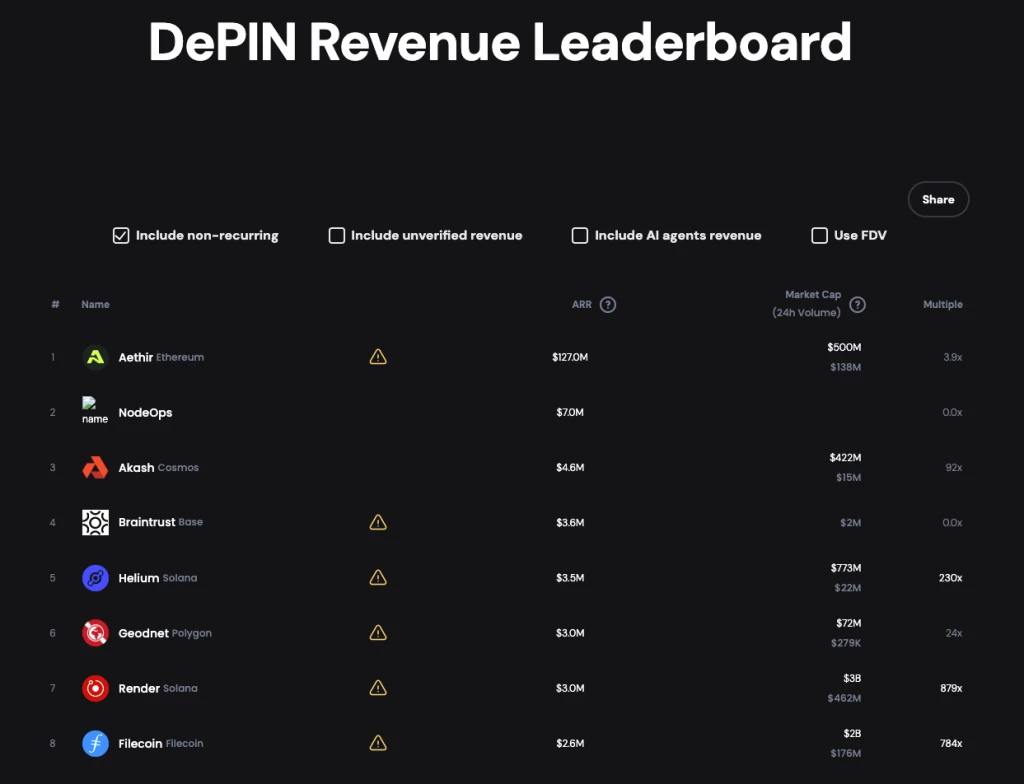

Key Data Points for DePIN

– Helium (HNT) has over 350,000 active hotspots globally, transmitting millions of IoT messages daily;

– In 2024, institutional venture capital invested approximately $150 million in DePIN startups, with leading investors including a16z and Multicoin Capital;

– As of the second quarter of 2025, Filecoin (FIL) has committed storage capacity exceeding 250 PB, indicating rapid growth in decentralized storage.

These figures reflect both the scale of community participation and investors' confidence in decentralized wireless networks and other DePIN use cases.

Image Credit: DePIN.Ninja

What problems does DePIN solve?

– Capital efficiency: Utilizing existing devices—Wi-Fi routers, GPUs, storage drives—avoids high infrastructure costs, turning idle resources into productivity;

– Scalability: As more participants join, the network naturally expands its coverage and capacity, no longer constrained by centralized budgets or bottlenecks;

– Community ownership: Token governance mechanisms allow participants to jointly decide on protocol upgrades, fee structures, and resource allocation, ensuring true decentralized control.

Challenges and Prospects for DePIN

Despite its promising outlook, DePIN faces several challenges:

– Regulatory complexity: Wireless network projects need to apply for telecom spectrum licenses, and data-intensive networks must comply with privacy regulations like GDPR;

– Supply-demand mismatch: Early incentive programs may exceed actual demand, leading to many hotspots being underutilized due to a lack of IoT devices or customers;

– Sustainability of token economics: Designing a model that smoothly transitions from high initial incentives to long-term usage-based reward structures to prevent inflationary collapse.

To go further, DePIN projects need to collaborate with enterprises (such as IoT hardware manufacturers and telecom operators) and refine their token economic models. However, predictions for the second half of Web3 (2025 H2) indicate that DePIN networks, as community-owned infrastructure, will be both efficient and resilient, laying a solid foundation for a truly decentralized IoT, storage, and computing ecosystem.

In conclusion

By the end of 2025, Layer-2 scaling, Web3 physical asset tokenization, and DePIN use cases will work together to eliminate the bottlenecks of cost, liquidity, and infrastructure in Web3. This prediction for the second half of 2025 signals the dawn of a new blockchain era characterized by low fees, cross-chain interoperability, and community co-construction. Are you ready to dive in? Join the conversation on Twitter/X and share your thoughts!

Frequently Asked Questions

Q1: What is Layer-2 scaling in 2025?

It refers to solutions like Optimistic Rollup and ZK Rollup, which process transactions off-chain in batches to reduce fees and increase the throughput of Ethereum (ETH).

Q2: What is Web3 physical asset tokenization?

It involves converting real-world assets (such as real estate and invoices) into fragmented tokens that can be traded on-chain, enhancing liquidity and transparency.

Q3: What are the use cases for DePIN?

They include decentralized wireless networks (like HNT), distributed storage (like FIL), edge computing (like RNDR), and crowdsourced mapping (like Hivemapper), all utilizing token incentives to crowdsource hardware resources.

Q4: How do these narratives align with the Web3 predictions for the second half of 2025?

They address the pain points prior to 2025—high gas fees, liquidity islands, and costly infrastructure—clearing the path for blockchain mainstream adoption.

Q5: How can I get involved?

You can start by building on L2 testnets, piloting RWA issuance on compliance platforms, or deploying a DePIN node; many projects offer grants and developer tools.

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with more than 1 million monthly active users and over 40 million user traffic within the ecosystem. We are a comprehensive trading platform supporting over 800 quality cryptocurrencies and more than 1,000 trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading options including spot trading, margin trading, and futures trading. XT.COM also features a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。