Ethereum has been declining for several months, but has recently risen. Can the upgrade turn the tide?

Author: Isaac Olatunji

Translated by: Baihua Blockchain

Source: Unsplash

Source: Unsplash

Unless one is isolated from the world, almost no one in the cryptocurrency space has missed Ethereum's decline over the past few months. Price trends, market dominance, and community sentiment—all are at historical lows! This top cryptocurrency seems to be in a significant downturn—this cycle hasn't even reached a new all-time high. However, in the past few days, Ethereum appears to be rebounding. Why has it performed poorly for several months? Can the current momentum drive it to recover?

The Dilemma of Ethereum

There is no doubt that Ethereum is struggling. Since December 2024, whenever market sentiment shifts leading to an overall decline in the crypto market, only Bitcoin has managed to rebound to previous price levels and break through, while Ethereum has almost failed to return to its starting point after dropping.

Here’s a look at Ethereum's market performance over the past few months. In November 2024, the market was in an upward phase, with Bitcoin priced at approximately $96,405 and Ethereum at $3,703. On December 1, 2024, the market saw a slight decline, with Bitcoin dropping to $93,557 and Ethereum falling to $3,337. Although both top cryptocurrencies reached significant price points later that month, they failed to maintain the upward momentum and fell again.

About a month later, on January 1, 2025, Bitcoin was priced at $94,500, slightly higher than the previous month, while Ethereum further declined to $3,298. By February 1, the price data showed Bitcoin had significantly dropped to $84,381, and Ethereum fell to $2,236. Bitcoin reached $102,000 later that month, but Ethereum failed to rebound to its previous highs. In fact, when Bitcoin rebounded from $84,381 in February to $94,304 in April, Ethereum continued to decline, unable to retest its previous highs. In reality, the BTC/ETH ratio has widened, as shown in the chart data.

Source: CoinMarketCap

Source: CoinMarketCap

As of the time of writing, Ethereum is trading at approximately $2,400, which is a decent increase considering its performance over the past few months. However, it has yet to challenge higher price ranges. What exactly is wrong with the Ethereum market? Let’s analyze a few key points.

Bitcoin and Meme Coins Stealing the Spotlight

In recent months, Bitcoin and meme coins have stolen the spotlight. You may have heard about the U.S. government's plan to establish a Bitcoin reserve. This plan has been widely discussed among retail and institutional investors, and many U.S. state governments are also working on establishing strategic Bitcoin reserves. Texas and New Hampshire have made progress in this regard, as have other states in the U.S. and some other countries.

The interest from sovereign nations has further attracted the attention of market whales and institutional investors. Recently, Michael Saylor announced that Strategy (formerly MicroStrategy) has made additional purchases of Bitcoin to solidify its position as the publicly traded company holding the most Bitcoin. Out of a total supply of 21 million Bitcoins, Strategy holds over 555,000 Bitcoins.

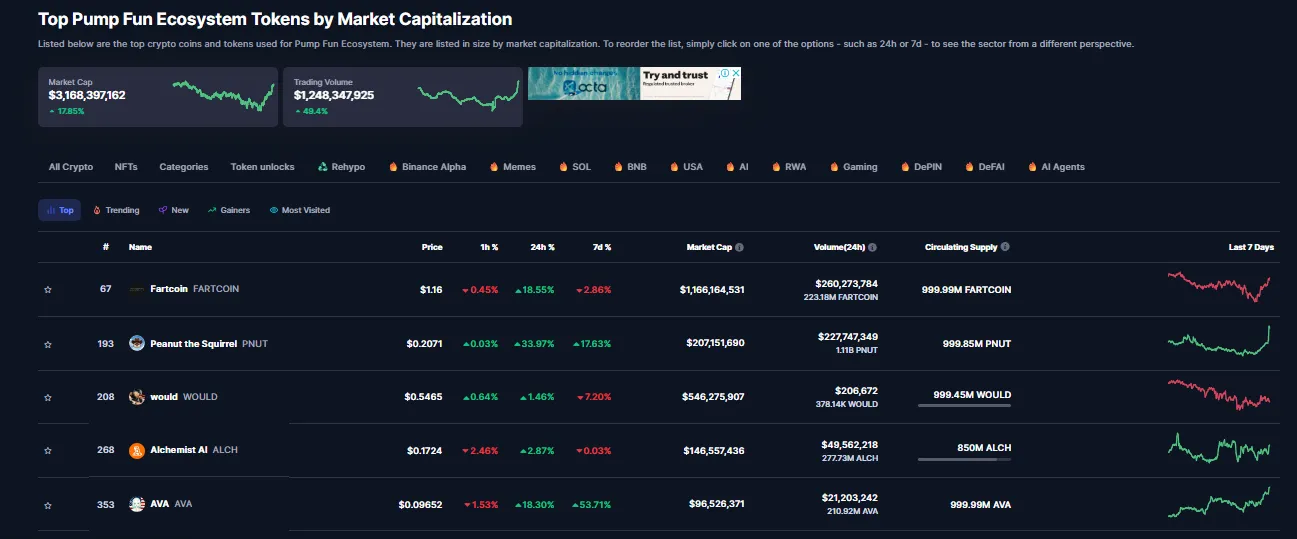

While Bitcoin has taken center stage, overshadowing Ethereum, meme coins are doing the same. Unfortunately, these meme coins are not launched on the Ethereum chain. One of the most successful meme coins of 2025, Fartcoin, with a market cap exceeding $1 billion, was launched on the Solana chain. The popular meme coin issuance platform PumpFun is also on Solana. You may not have noticed, but most of the hottest meme tokens created at the end of 2024 and in 2025 come from PumpFun.

Source: CoinMarketCap

Source: CoinMarketCap

Thus, Ethereum has clearly missed this wave of excitement. Additionally, discussions around decentralized finance (DeFi) have significantly decreased due to a lack of major innovations. Overall, Ethereum is not at the center of any significant trend—there's nothing to drive its price up.

Liquidity Flowing to Subnetworks

Ethereum's high gas fees have been a major barrier to its growth. Worse still, the Ethereum network is flooded with Layer-2 networks like Polygon, Optimism, Base, Linea, and Arbitrum. These Layer-2 networks compete with Ethereum for liquidity. With the presence of USDC, these networks can operate without needing much ETH. Not to mention that various activities can be conducted on these Layer-2 platforms, leading to a reduction in transactions through the Ethereum main chain. Therefore, if on-chain usage is high, the demand for ETH should theoretically rise, but that is not the case now.

Competing Networks

We have slightly touched on how competitors like Solana are undermining Ethereum's market dominance. The fact is, Solana offers a better experience for developers and users. Who wouldn't want a faster, cheaper, and more powerful chain? According to CoinGecko's report on Solana, the ongoing activity on the Solana chain reveals why it continues to attract more developers and retail investors. Here are some standout reasons:

Higher Performance and Scalability: Solana can process up to 3,000 transactions per second, theoretically even reaching 65,000 TPS. In any case, Ethereum's capacity of 15 transactions per second is completely incomparable. Given Solana's extremely low costs for processing large transactions, it’s clear why developers prefer it. Active and Supportive Ecosystem: The Solana ecosystem provides developers with a wealth of resources and tools, fostering its growth. The Solana ecosystem offers developer toolkits and funding opportunities, allowing new projects to emerge seamlessly. Similar to Solana, Avalanche is also growing in popularity and capability. The institutional adoption of these Layer-1 platforms will further weaken Ethereum's dominance. Hyperliquid and Tron have made progress in perpetual futures trading and the stablecoin market, respectively.

Limited Institutional Interest

While global companies, market giants, and nations continue to accumulate Bitcoin, the situation for Ethereum is starkly different. According to CoinGecko data, there are very few publicly traded companies holding Ethereum, with a total value of less than $500 million, while Bitcoin's figure exceeds $50 billion.

The crypto ETF market shows a significant gap between the demand for Bitcoin and Ethereum, with the latter failing to record high inflows like the former. ETF inflow data indicates that Bitcoin, with its first-mover advantage and widely accepted store of value function, has attracted substantial investments from large investors. While Ethereum has recorded billions in spot ETF inflows, its numbers still lag far behind Bitcoin.

Hope for Ethereum: Will It Make a Comeback?

Ethereum needs a wake-up call to regain market dominance, attract widespread investment, and achieve a surge in value. At the time of writing, Ethereum has just activated an upgrade. This is a positive development, but it does not address the challenges of asset and data bridging within the Ethereum Layer-2 ecosystem. Competitors like Solana still hold an advantage, as users can seamlessly switch between multiple decentralized applications (DApps). Nevertheless, this upgrade seems to have had a positive impact on Ethereum's price, which rose by 20% in the past 24 hours to reach $2,400. Will this top altcoin make a comeback this time? We must be patient and observe how much improvement the recent upgrade can bring to the Ethereum chain, and whether it is enough to get ETH back on track!

Article link: https://www.hellobtc.com/kp/du/05/5856.html

Source: https://s.c1ns.cn/DFboB

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。