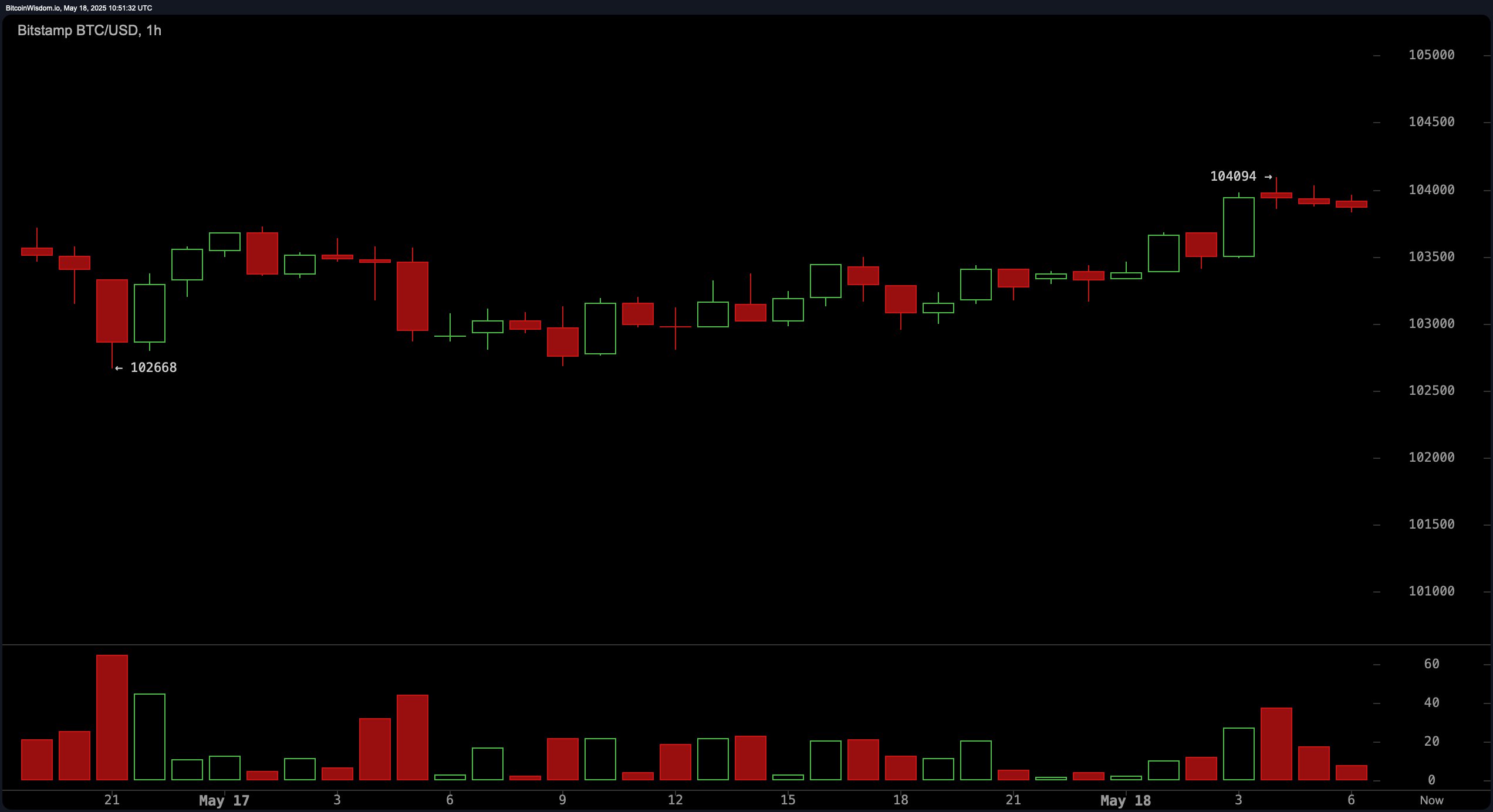

Bitcoin’s short-term outlook, as illustrated on the 1-hour chart, signals a gradual uptrend marked by consistently higher lows and highs since May 16. The key resistance lies at $104,094, while support is seen at $102,668. Small-bodied candlesticks near the upper range indicate market indecision, although a breakout above $104,100 on high volume may serve as a valid long entry point. On the downside, failure to breach this threshold and a drop below $103,000 could suggest a short-term bearish reversal. Volume tapering in this window highlights a potential slowdown or shift toward consolidation.

BTC/USD 1H chart via Bitstamp on May 18, 2025.

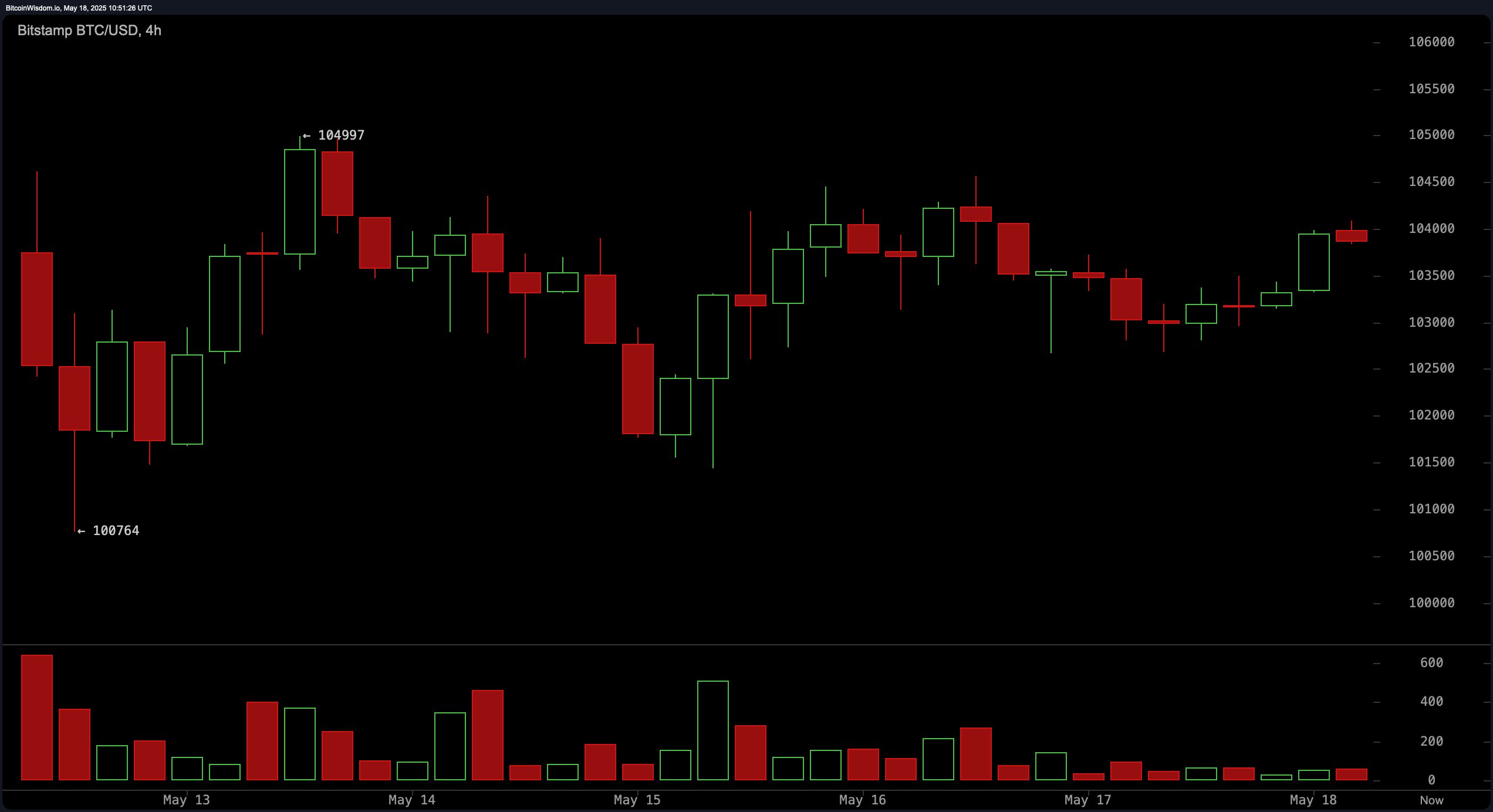

The 4-hour chart paints a picture of consolidation, with bitcoin moving laterally between $100,764 and $104,997. Both upper and lower boundaries have experienced failed breakouts, indicative of a tightly coiled market. No clear directional dominance is evident in trading volume, with compressed volatility supporting a wait-and-watch approach. Should the price break and maintain above the $105,000 level on strong buying volume, bullish continuation becomes more likely. A breach below $102,500, however, could open the door to a short-term decline toward $100,000.

BTC/USD 4H chart via Bitstamp on May 18, 2025.

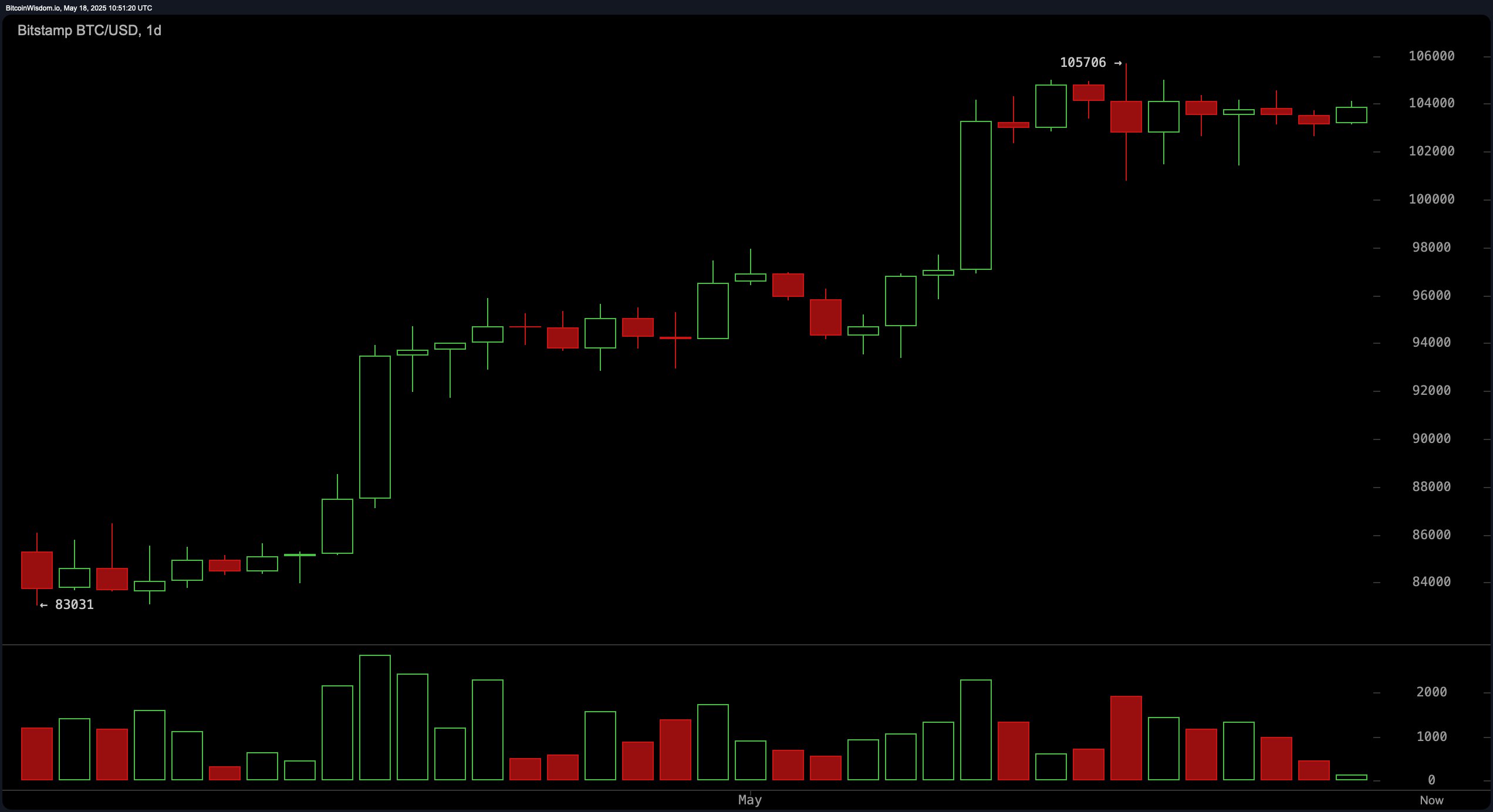

From a daily perspective, bitcoin retains a bullish trend, rising from April lows near $83,000 to a peak of $105,706. Despite this strong advance, current price action reflects healthy sideways movement, commonly near cycle tops. The volume profile shows a decline in recent activity, which may either precede a fresh breakout or signal buyer fatigue. A close above $105,706 with significant volume would affirm bullish strength, while a fall below $102,000 on rising volume may prompt deeper retracement toward the $98,000 to $100,000 range.

BTC/USD 1D chart via Bitstamp on May 18, 2025.

Turning to technical indicators, the oscillators provide mixed signals. The relative strength index (RSI) stands at 68, the Stochastic oscillator at 82, and the commodity channel index (CCI) at 67—all denoting neutral momentum. Similarly, the average directional index (ADX) and the Awesome oscillator also remain neutral. However, the momentum indicator and the moving average convergence divergence (MACD) both flash sell signals, hinting at short-term vulnerability within a broader bullish structure.

Moving averages reinforce the dominant upward trend. All key exponential moving averages (EMAs) and simple moving averages (SMAs) across 10, 20, 30, 50, 100, and 200 periods are in buy territory. For instance, the 10-period exponential moving average is at $102,699, and the 200-period simple moving average is at $92,624, both well below current prices. This alignment supports a continuation bias, provided key resistance levels are cleared with conviction.

Bull Verdict:

Bitcoin remains in a structurally bullish phase supported by a suite of strong buy signals across all major moving averages and a resilient price base near all-time highs. While consolidation is evident across timeframes, any breakout above $105,700 with volume would likely confirm a continuation of the prevailing uptrend, keeping long positions favored.

Bear Verdict:

Despite bitcoin’s impressive climb from April lows, warning signs are emerging in the form of mixed oscillator signals and declining volume near resistance. If price fails to breach $105,000 and breaks below $102,000 with momentum, it could initiate a deeper correction toward the $98,000 to $100,000 support band, making short setups increasingly viable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。