Today's homework is a bit difficult. The price of $BTC fluctuated by over $2,000 over the weekend. Although it's not entirely certain, I personally estimate that it has a lot to do with Bessent's live interview with CNN. After Moody's downgraded the U.S. credit rating on Friday, Bessent, who replaced Yellen, had to come out to work because the downgrade mainly addressed the issue of U.S. debt, so Bessent's response was very direct.

The U.S. economy will continue to strengthen, and the growth rate of the U.S. GDP will continue to exceed the growth rate of debt, especially after Trump's new tariffs were introduced. More and more countries have started to offer the U.S. more favorable tariffs. After all, while Trump raised tariffs, he also increased U.S. revenue.

Bessent also emphasized that Trump's trip to the Middle East would bring in a commitment of $2 trillion in investments for the U.S., which will strengthen U.S. employment and innovation. Bessent's speech resonated with some investors over the weekend, and the low liquidity during the weekend led to $BTC entering a cycle of volatility. However, whether Bessent's speech will have a substantial effect, or if U.S. investors have already digested the negative impact of Moody's downgrade, will have to wait until Monday to see.

Looking back at Bitcoin's data, today's fluctuations did not bring about significant changes. Although the turnover rate saw a slight increase compared to Saturday, it still remains at a normal weekend level. Regardless of whether it was due to Bessent's speech, it indeed did not elicit much reaction from market investors. The price changes were driven by low liquidity, leading to sharp rises and falls, rather than a change in the narrative of BTC itself, nor were there any new positive or negative factors in the market.

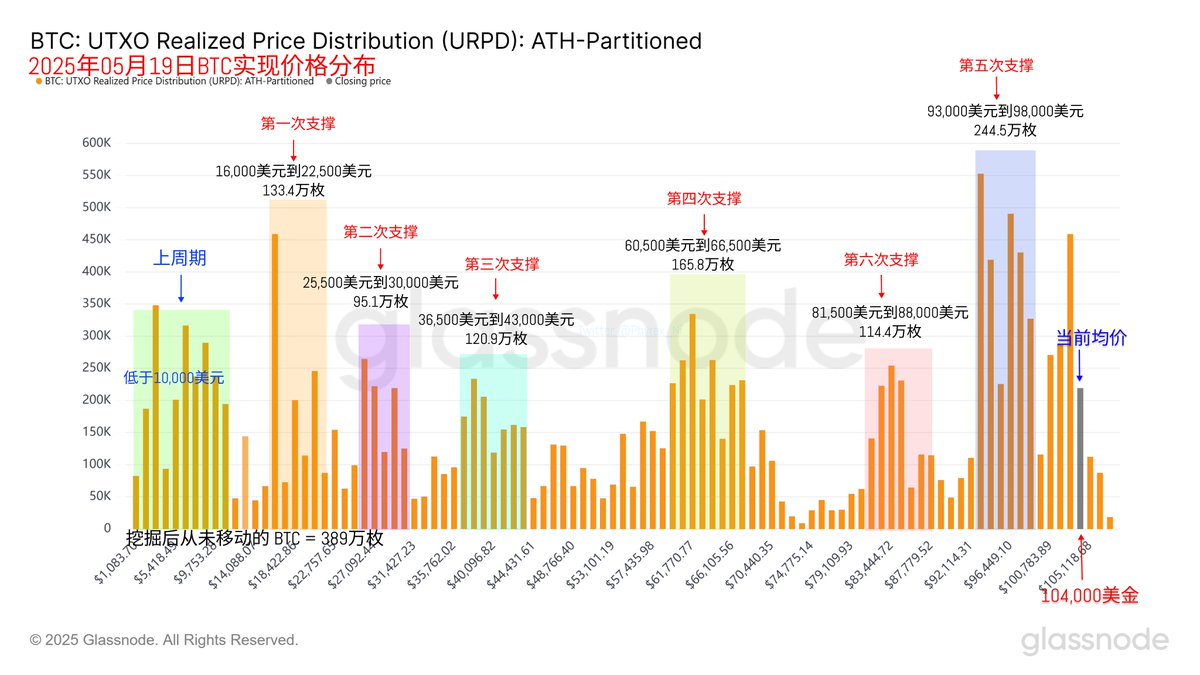

Since the turnover rate is still very low, there are no new changes to the current support levels. After a lot of back and forth, the $93,000 to $98,000 range remains the most solid support. The chips around $82,000 have mostly exited the market. I estimate that in about a week, this group of investors will have left, and those who remain are likely to become long-term holders.

Investors around the $102,000 mark are still primarily short-term investors. Even with a large accumulation of chips, it is difficult to form a support level in the short term.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。